41 fidelity retirement budget worksheet

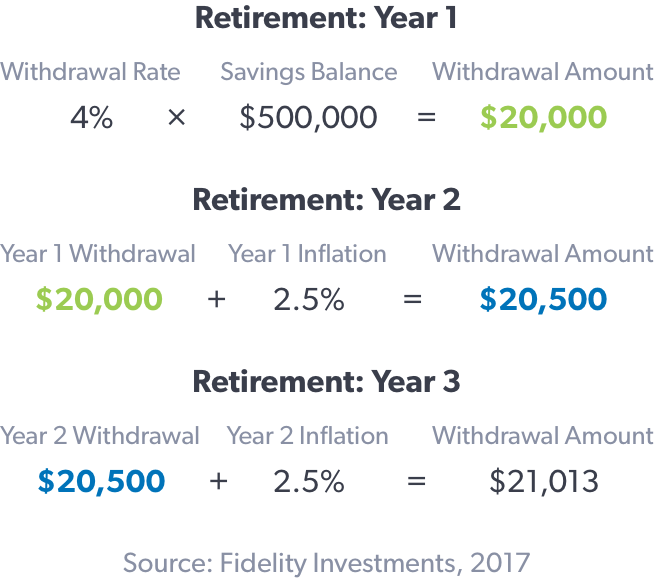

31/08/2021 · Limit withdrawals from retirement savings accounts to 4%–5% in your first year of retirement,then adjust for inflation in subsequent years. Consider consolidating accounts at a trusted provider. Making a budget may not be the first thing you look forward to in retirement, but it's one of the most important things to do to start your retirement on the right path.

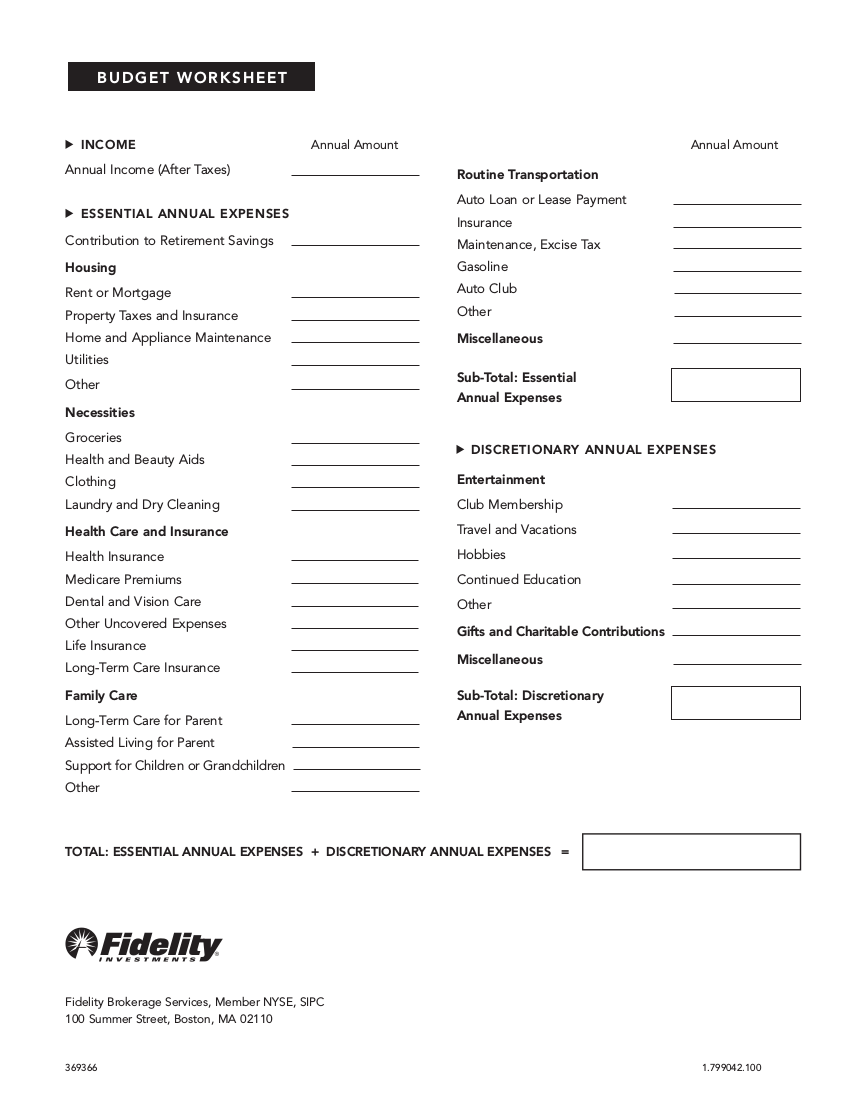

These tools from Fidelity will help you learn how to establish a budget and create a savings plan.

17/07/2021 · When thinking about how much you need to retire, it's important to remember the 80% rule. The 80% rule states that you'll need to replace 80% of your pre-retirement income. So, if you were making $100,000 pre-retirement, you need to be able to have about $80,000 coming in annually during retirement.

Fidelity retirement budget worksheet

Cell Division Meiosis Worksheet Answer Key; Disney Princess Coloring Pages Frozen Elsa And Anna; Dilations Worksheets; Traceable Worksheets; Math Worksheets For Grade 3 Addition; Fidelity Retirement Budget Worksheet; Classifying Matter Worksheet Key; 1st Grade Reading Worksheet; Super Teacher Worksheets Www Superteacherworksheets Com; Archives ...

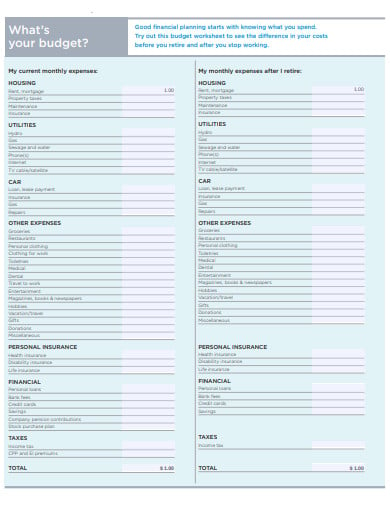

Extra expenses: You plan on traveling in retirement, so you budget an extra $500 per month ($6,000 per year) for travel. Housing: Your mortgage will be paid off, so you'll only need to pay taxes and insurance on your home. That might cut out $1,000 per month from your spending.

21/10/2021 · Fidelity offers $0 stock trades, 3,700-plus no-transaction-fee mutual funds and top-notch research and trading tools. Its zero-fee index funds ice the cake.

Fidelity retirement budget worksheet.

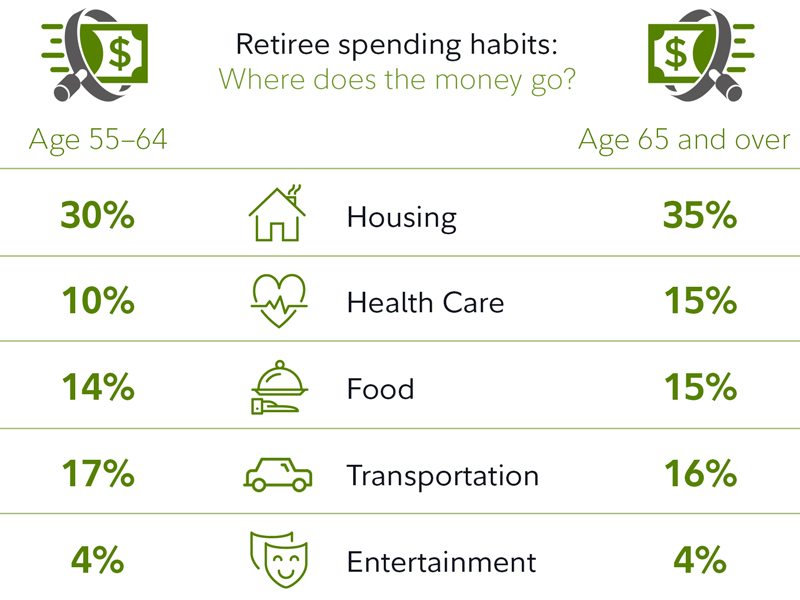

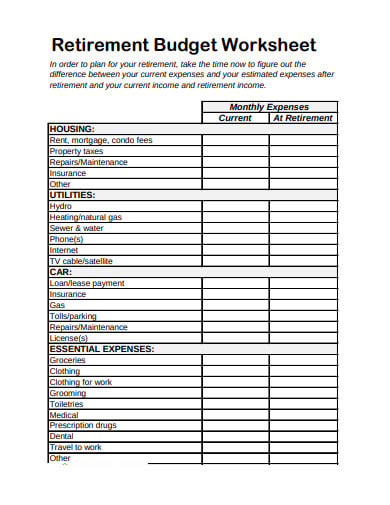

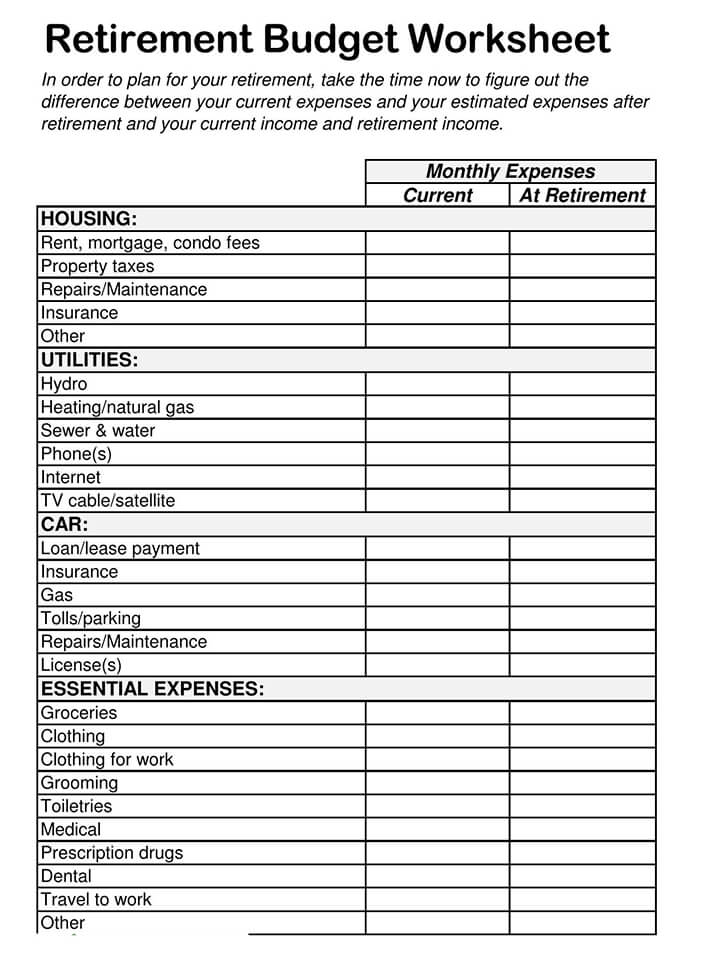

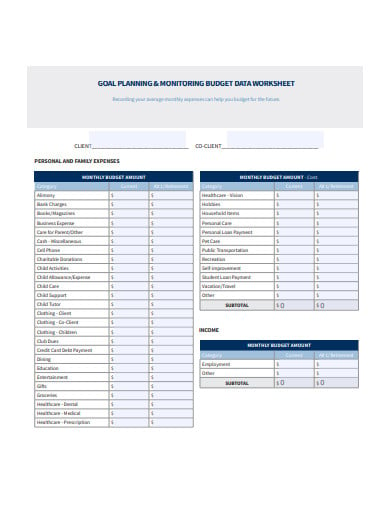

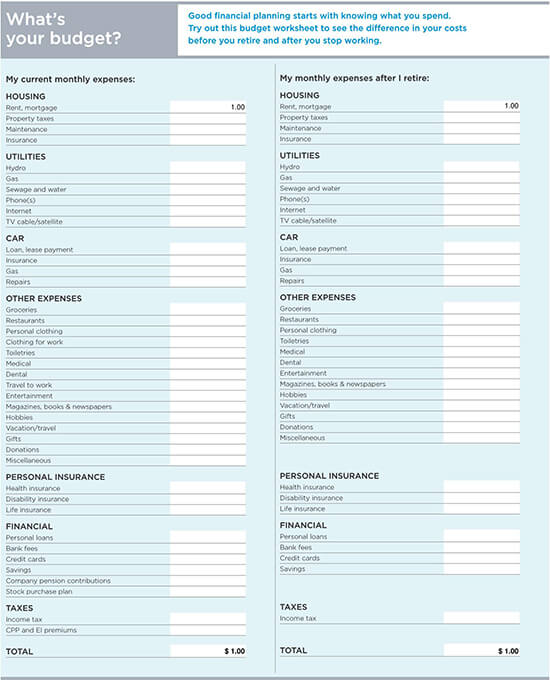

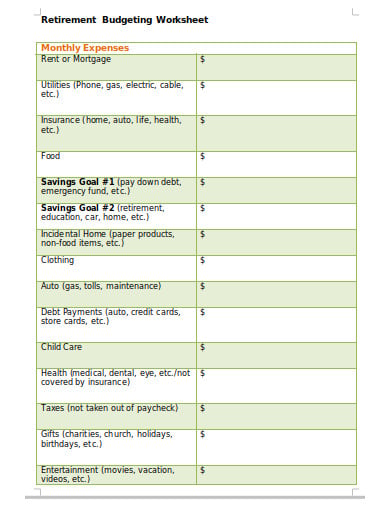

Create a Retirement Budget. You can start creating a retirement budget by looking at your household expenses over the past several years. Take notes of the amounts you spend for housing, transportation, food, medical expenses and incidental expenses such as cable subscriptions, gym memberships and cell phone plans.

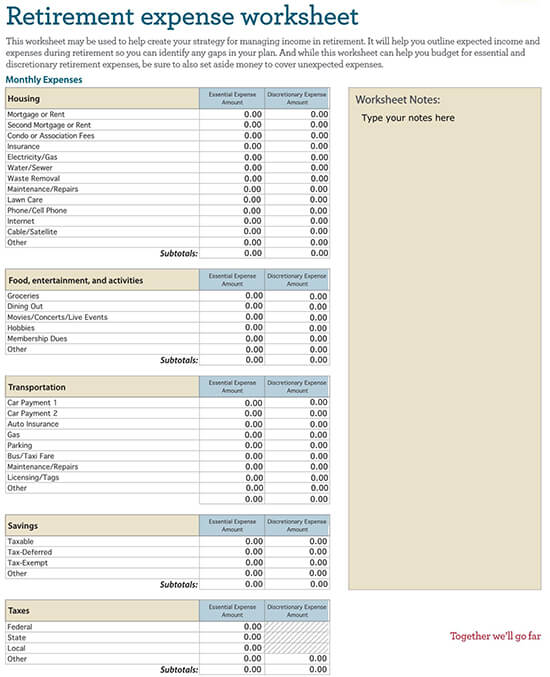

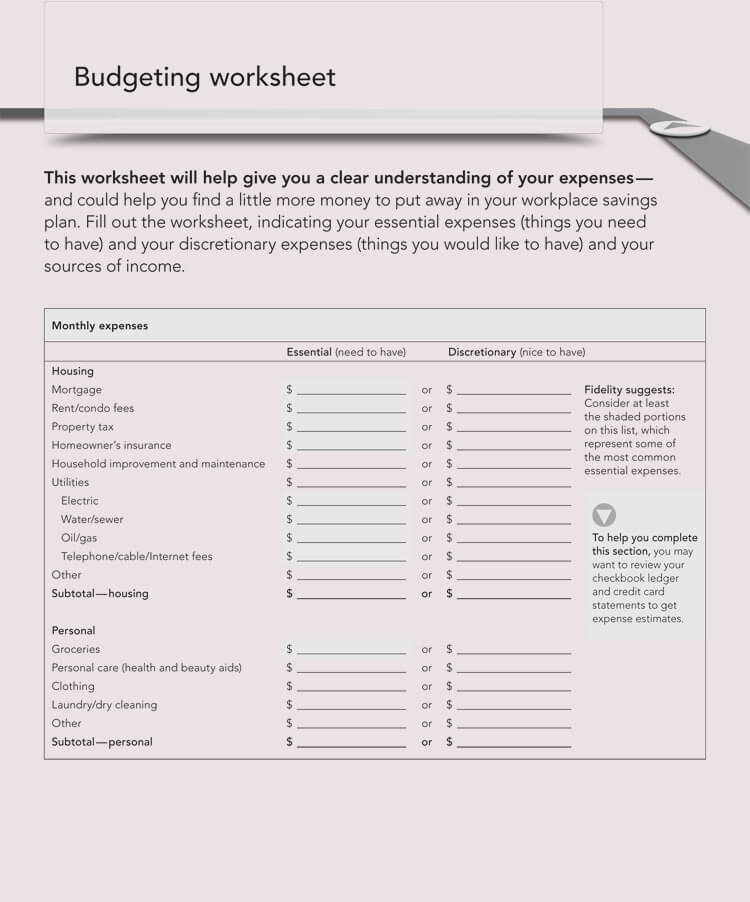

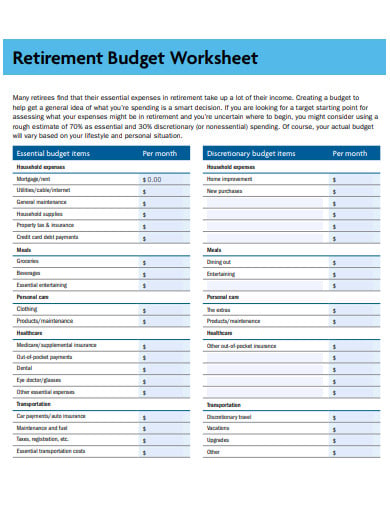

Budgeting worksheet This worksheet will help give you a clear understanding of your expenses — and could help you find a little more money to put away in your workplace savings plan. Fill out the worksheet, indicating your essential expenses (things you need to have) and your discretionary expenses (things you would like to have) and your

30/11/2018 · The CLARK Method and our free budget worksheet will put YOU in control of your money: “A lot of people look at being told to do a budget as if their life is being restricted. But the whole idea of budgeting is freeing because you’re getting your life under control, creating more choices and reducing anxiety,” money expert Clark Howard says.

27/09/2021 · If you’re wondering how much you need to retire, we like the way you’re thinking. You’re a step ahead of the game because, sadly, most people don’t even have a strategy for saving for retirement. They just lock in a certain age—maybe 65—and try to save as much as they can until then.

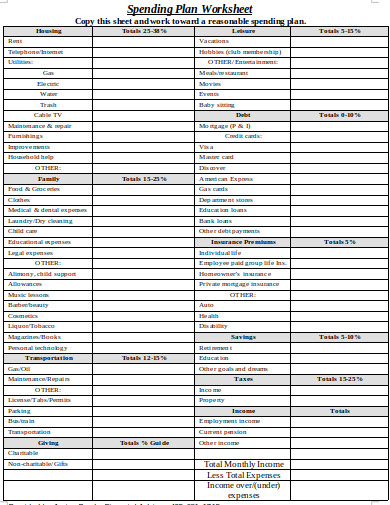

Use this budget worksheet to get control of your monthly living expenses. A good budget helps you reach your spending and savings goals. Work out a …

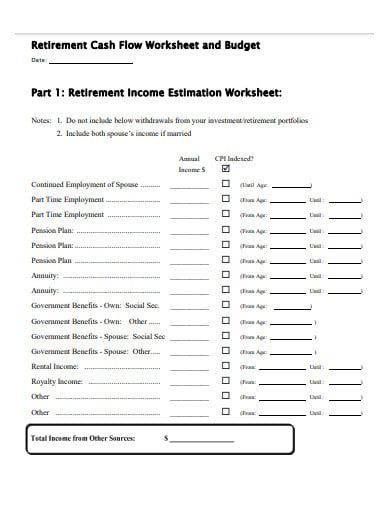

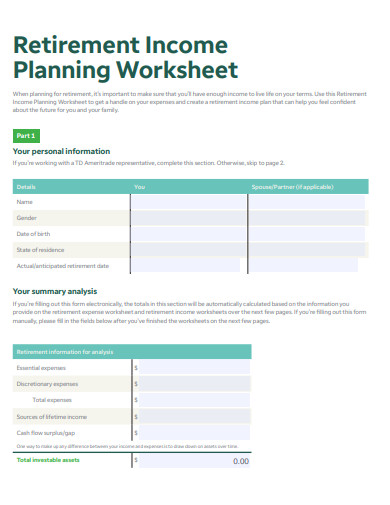

your inventory of retirement income sources and expenses. Please complete as much as you can before meeting with a Fidelity Representative.8 pages

Net worth calculator Budget calculator Budget worksheet Savings goal ... Fidelity's "private wealth management service," where you have an entire team of financial professionals working on ...

Rachel Hartman March 3, 2021. To create a retirement budget, you'll want to follow these steps: Start with an estimate of the income you will need. List your expected spending. Consider expenses ...

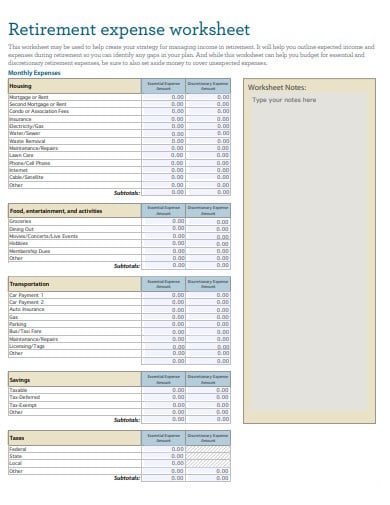

This retirement financial planning checklist template gives you a planning picture that you can use to plan the days after your retirement.This worksheet may be used to help create your strategy for managing income in retirement.Tracking personal finance expenses can be easy with this budget worksheet tracking expenses from fidelity.

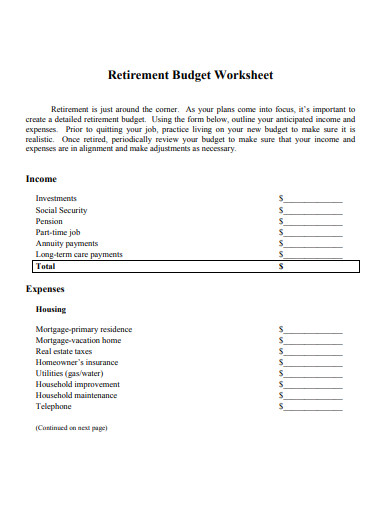

Plan your budget with this printable worksheet. Income, Annual Amount. Annual Income (after taxes). Essential Annual Expenses. Contribution to retirement ...

Personal Retirement Account RF's pension experts designed this account for new and existing retirees with lump sums of $100,000 or more wanting to safeguard or grow their money. The Account is a flexible term investment product, providing an attractive alternative to an annuity; however, it may not be suitable for all investors.

Fidelity estimates that on average a 65-year-old retired couple needs $300,000 to spend on health care over the course of retirement 3. For planning purposes, you may want to factor in an even higher number, because many people experience above-average expenses—often due to chronic illnesses, longevity, or long-term care costs.

Lcm 14 lcm 20 lcm 20 d. 6 and 10 e. Get 4th and 5th graders to solve these worksheets that carefully integrate fun and challenge at every step. Figure out the least common multiple with these lcm of polynomials worksheets. Lowest common multiple lcm of two numbers under 30.

The County offers eligible employees the ability to save for retirement on a tax-deferred basis through the 401(k) and 457 Plans. Tax-deferred means you don't pay income taxes on the amount you contribute to the Plans - or earnings on those contributions - until you withdraw those funds after you separate from service.

One way to get a great look at your household budget is to use a bullet journal for finances. It's a great way to pay off student loans, tackle credit card debt, boost retirement savings and create an emergency savings account. However, no matter what method you choose, sit down this month and start saving money with a long-term financial plan.

Annual Income (After Taxes). ESSENTIAL ANNUAL EXPENSES. Contribution to Retirement Savings. Housing. Rent or Mortgage. Property Taxes and Insurance.1 page

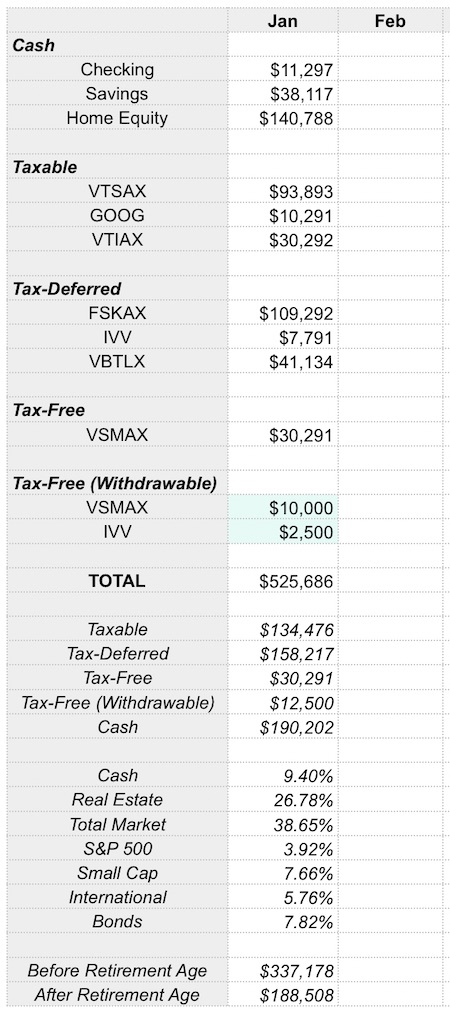

You will love this free investment tracking spreadsheet. See your portfolio value updated in real-time, and it makes rebalancing your investments a snap.

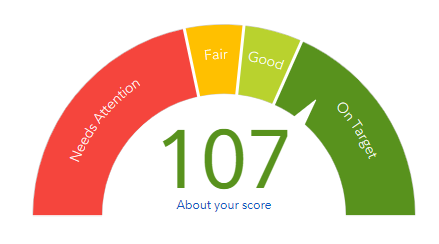

Fidelity Retirement Score Morningstar's Investment Policy Worksheet ... Alternatively, you can create a budget the old-fashioned way, using an Excel spreadsheet or other budget worksheet.

Fidelity suggests: Consider at least ... This worksheet will help give you a clear understanding of your expenses — ... Retirement savings contributions.4 pages

A retirement packet will be mailed to your home address and it will include your Personal Retirement Profile (PRP) and the Election Worksheet for you to complete. Schedule a meeting with your Senior Benefits Analyst if you need assistance understanding the PRP or to complete the election worksheet

5. Complete the application and buy the funds. Beginning May 30, 2016, mutual fund companies are required to give investors a copy of Fund Facts before they decide to purchase a conventional mutual fund. You'll have to provide some personal information, such as how much risk you are willing to take, and how much you know about investments.

Fidelity Retirement Budget Worksheet And Detailed Retirement Budget Worksheet If you want to create your own retirement expense worksheets, the first step is to gather the information you entered for your annual income and expenses. Include everything such as mortgage, rent, utilities, and taxes.

50/15/5 It's a simple rule of thumb. See how your actual savings and spending compares with our guidelines. 50% Essential Expenses 15% Retirement Savings 5% ...

The Women's Institute for a Secure Retirement ... Included in the guide is a budget worksheet that factors in many of the out-of-pocket costs of care. ... Fidelity shun net-zero alliance ...

The Bipartisan Budget Act of 2018, P.L. 115-123, ... To do this, use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed, whichever is appropriate for your plan's contribution rate, in chapter 6. ... Early retirement.

Retirement age must be higher than current age. 10. Fidelity Retirement Planner. The Fidelity Retirement Planner is a good tool with a variety of inputs that all update a single chart showing your accounts and any potential gap in what you need for a secure future. There are various data points to input.

Here, we present an overview of some of the best retirement-planning apps that are available now. 1. Retirement Planner App. This free Android app is a useful tool when you are in the midst of ...

See RMD requirements for your Fidelity retirement accounts Log In Required *Your workplace savings account may have different rules; you should contact your savings plan administrator to learn more. † The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020.

Retirement Planning Checklist Whether the day you stop working is a decade away or around the corner, these to-do items will help you retire on your own terms.

This spreadsheet takes basic inputs such as your current age or the age you want to retire. It also accounts for the total amount you have saved in tax-deferred, taxable, and tax-free accounts. You can get an estimate of the rate of return on your savings and your tax rate.

The $0-annual-fee Fidelity Rewards Visa Signature offers 2% back on every purchase, as long as you deposit those rewards into an eligible Fidelity account.

Fidelity retirement expense worksheet: free download. document library. On-line document store on 5y1.org | Download document for free. Find document.

This first step involves estimating anticipated expenses and taking an inventory of potential sources of income. You'll also want to collect information about ...7 pages

As stated earlier, a retirement planning worksheet can help to create a list of potential retirement savings choices. And track your progress and hit your money goals faster with the babysteps app. Chapter 13 lab from dna to protein synthesis worksheet answers. Fidelity retirement income planning worksheet. We tried to get some great references ...

Aug 31, 2021 — Try to match your essential expenses to guaranteed sources of income. Limit withdrawals from retirement savings accounts to 4%–5% in your first ...

The best retirement planning tools and software include: Betterment Retirement Savings Calculator. Charles Schwab Retirement Calculator. Chris Hogan's Retire Inspired Quotient Tool. Fidelity ...

Investment firms are required to provide annually to each client information about the performance of the investments they hold. These requirements result in greater transparency about your investments and help you understand whether you are on track to meet your goals.

A four-phase model for retirement consists of pre-retirement (age 50 to 62 or so), the early period of retirement (62 to 70), middle retirement (70 to 80), and late retirement (80 and up). Pre ...

The template has the following two worksheets that help you estimate your retirement financial plan: Retirement Budget and Budget for Inflation. The Retirement Budget worksheet maintains records of the earnings and spending on a weekly, bi-weekly, monthly, quarterly and annual bases. The spreadsheet helps you plan a secure and modest future.

0 Response to "41 fidelity retirement budget worksheet"

Post a Comment