43 qualified dividends and capital gain tax worksheet instructions

The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. Lines 1 7 are for ordinary income and qualified income. Per the form 1116 instructions if the qualified dividends and capital gain tax worksheet is generated and the taxpayer is not required to file schedule d an ...

When you have qualified dividends or capital gains, you do not use the tax table. Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. The program has already made this calculation for you.

View Chanika Justin_Capital Gains.pdf from ACCT 361 at Towson University. Qualified Dividends and Capital Gain Tax Worksheet (2019) • See Form 1040 instructions for line 12a to see if the taxpayer

Qualified dividends and capital gain tax worksheet instructions

Qualified dividends can be found in Box 1b. If you get a capital gain payout from your mutual fund investment, it will be reported in box 2a on your tax return. Boxes 4 and 14 on your tax return will show the amount of federal and state taxes withheld from your payouts, respectively.

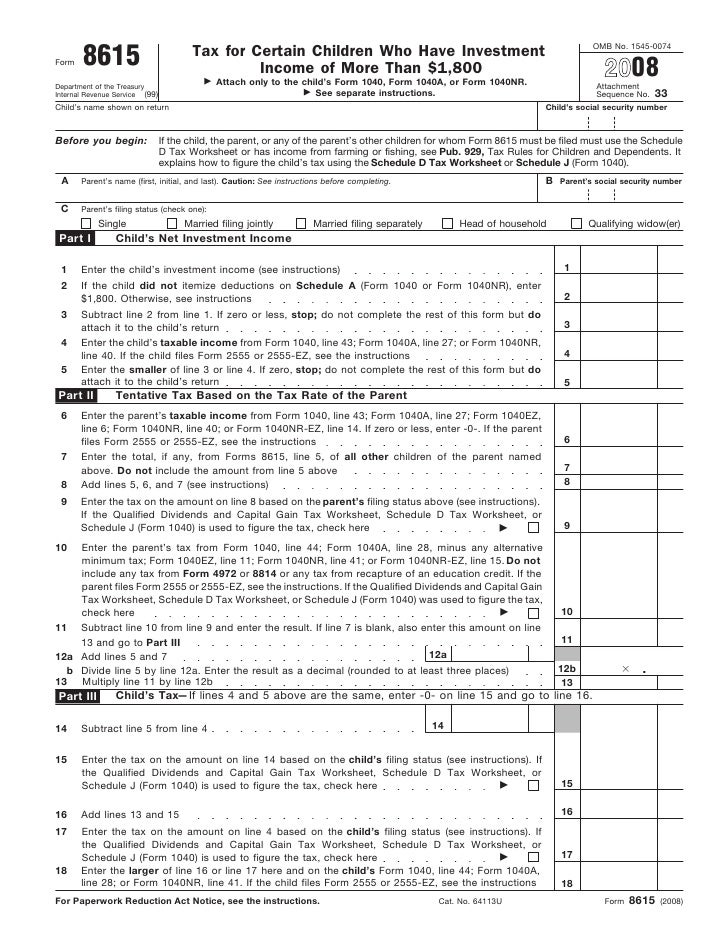

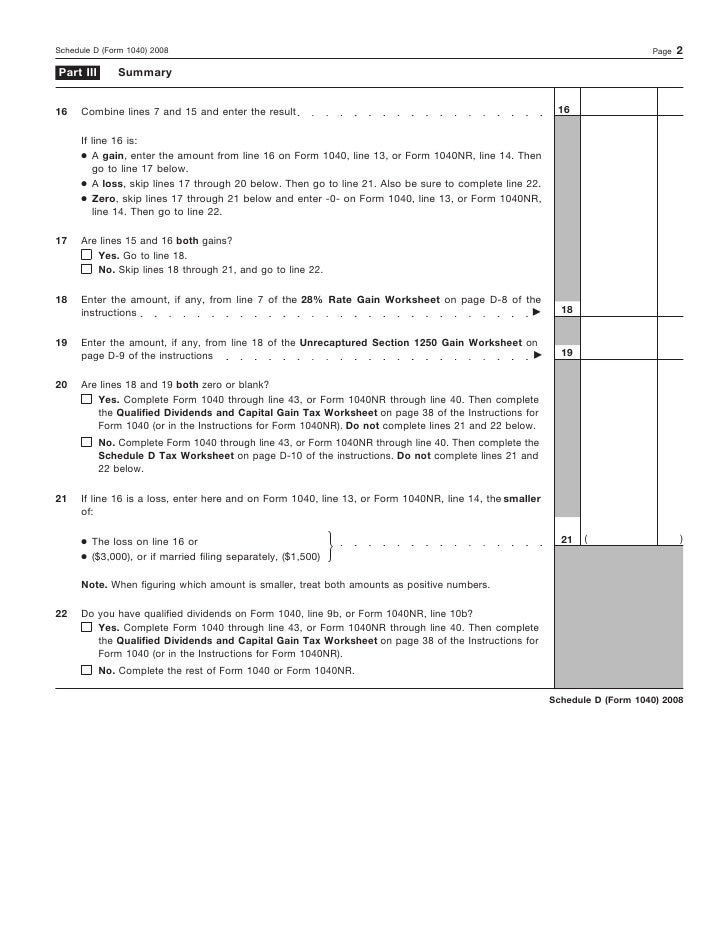

Then complete the Qualified Dividends and Capital Gain Tax Worksheet on page 38 of the Instructions for. Form 1040 (or in the Instructions for Form 1040NR).

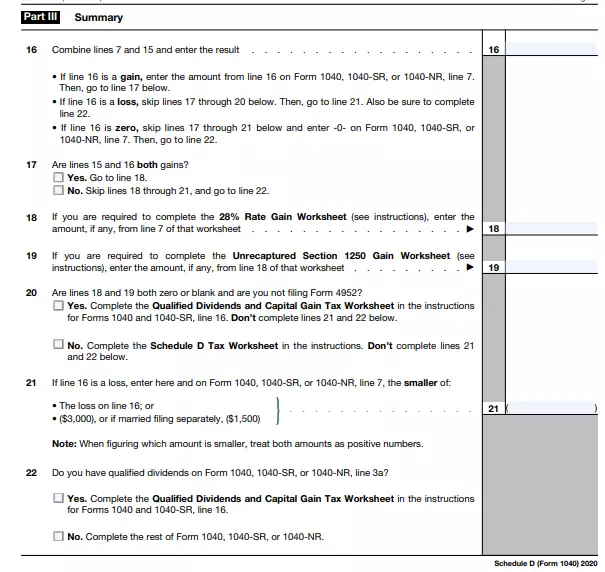

Exclusion of Gain on Qualified Small Business (QSB) Stock, later. If there is an amount in box 2d, in-clude that amount on line 4 of the 28% Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. If you received capital gain distribu-tions as a nominee (that is, they were paid to you but actually belong to some-one ...

Qualified dividends and capital gain tax worksheet instructions.

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

2013 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

In those instructions, there are two worksheets which together calculation your tax. First, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which separates your total qualified income (line 4) from your total ordinary income (line 5), so they can be taxed at their different rates.

Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

This is not just a problem with Turbotax, the flawed logic is in the IRS worksheet included in the 1040 instructions. I am attaching a hypothetical example of a completed worksheet. As noted in my question, the flaw occurs on line 18 where you subtract line 17 (effectively taxable income that is not qualified dividends or capital gains ) from the 15% bracket threshold (in the example, $479,000 ...

Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

Qualified dividends and the capital gain tax worksheet is a good way to estimate the capital gain taxes. Stick to the fast guide to do Form Instructions 1040 Schedule D steer clear of blunders along with furnish it in a timely manner.

long-term capital loss on Form 8949, but any gain is reported as ordinary income on Form 4797. • If qualified dividends that you re- ported on Form 1040, ...

[Using 2020 preliminary forms & data] I completed the "Qualified Dividends and Capital Gain Tax Worksheet" and saw that I had only $20,126 on line 9 which I think represents the amount of qual divds & CG's taxed at zero percent - and so there was room for more.

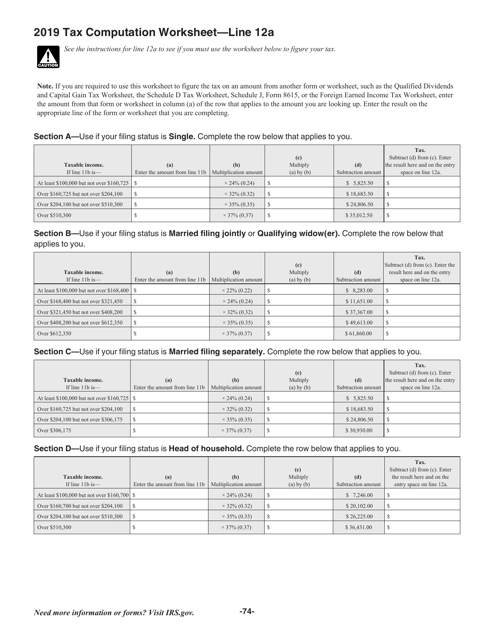

Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

According to the IRS Form 1040 instructions for line 44: Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

Unformatted text preview: Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax.• Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the ...

Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV.

Enter the amount from line 25 of the Qualified Dividends and Capital Gain Tax Worksheet on Form 8615, line 9, and check the box on that line. Don't attach this worksheet to the child's return." On page 6 of the instructions, under "Using the Qualified Dividends and Capital Gain Tax Worksheet for line 15 tax.," number 6 was revised. It now reads ...

If you receive federal Form 1099‑DIV, Dividends and Distributions, enter the amount of distributed capital gain dividends. Line 6 – 2019 California Capital Loss ...

Before completing this worksheet complete Form 1040 through line 10. The Tax Summary screen will then indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. Enter the amount from Form 1040 line 43. Fill in all of the requested fields they are marked in yellow.

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms ...

Oct 16, 2021 — As of this writing, qualified dividends are taxed as long-term capital gains. This means that if your highest income tax bracket is 15% or ...

these instructions r go to oIRS.gov/FreeFile. IRS Departmentofthe Treasury InternalRevenue Service IRS.gov is the fast, safe, and free way to prepare and e- le your taxes. See IRS.gov/FreeFile. See What s New in these instructions. THIS BOOKLET DOES NOT CONTAIN INSTRUCTIONS FOR ANY FORM 1040 SCHEDULES For the latest information about developments

Qualified dividends and capital gains. Per the Form 1116 instructions, if the Qualified Dividends and Capital Gain Tax Worksheet is generated and the taxpayer is not required to file Schedule D, an adjustment may need to be made to the foreign source qualified dividends and capital gain distributions.. If the taxpayer meets both of the following requirements, UltraTax CS will automatically ...

Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to Schedule D. Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip Schedule D entirely.

Tax Tables. You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

A guide to reporting Vanguard mutual fund dividends and capital gains distributions from your Form 1099-DIV on your federal income tax return.6 pages

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

Apr 16, 2021 — (3) Relationship (4) V if qualifies for (see instructions): ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the ...

Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records 2010 Form 1040—Line 44 Before you begin: See the instructions for line 44 on page 35 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

Find the 2016 Qualified Dividends And Capital Gain Tax Worksheet ... you want. Open it up using the cloud-based editor and begin editing. Fill the blank fields; involved parties names, addresses and phone numbers etc. Customize the template with smart fillable fields. Put the date and place your electronic signature.

Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

0 Response to "43 qualified dividends and capital gain tax worksheet instructions"

Post a Comment