38 money instructor insurance worksheet answers

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. Term insurance: Most often lasting 20 or 30 years, term insurance usually can cost around $200-$600 per year and is based on your age, the amount insured, as well as other risk factors. If you were to die within this time, your family would receive a sum of money between $250,000 and $500,000 depending on the policy you've chosen.

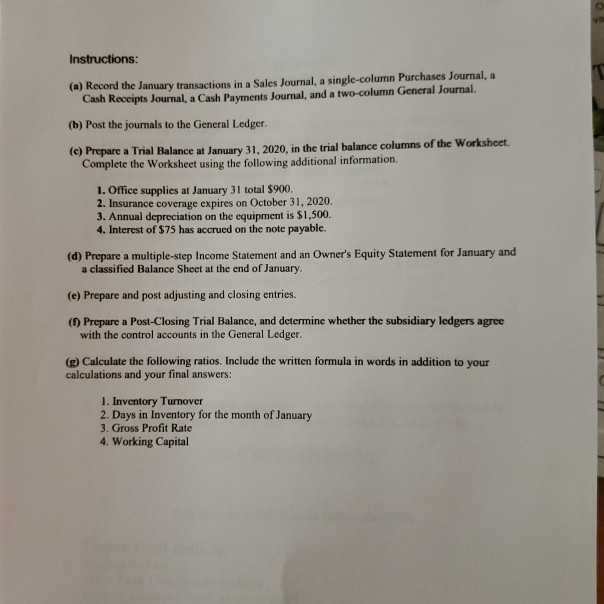

Quiz & Worksheet Goals. Use this printable worksheet and quiz to review the following: Financial agreement for payment of health care costs. Amount paid at set intervals to the insurance company ...

Money instructor insurance worksheet answers

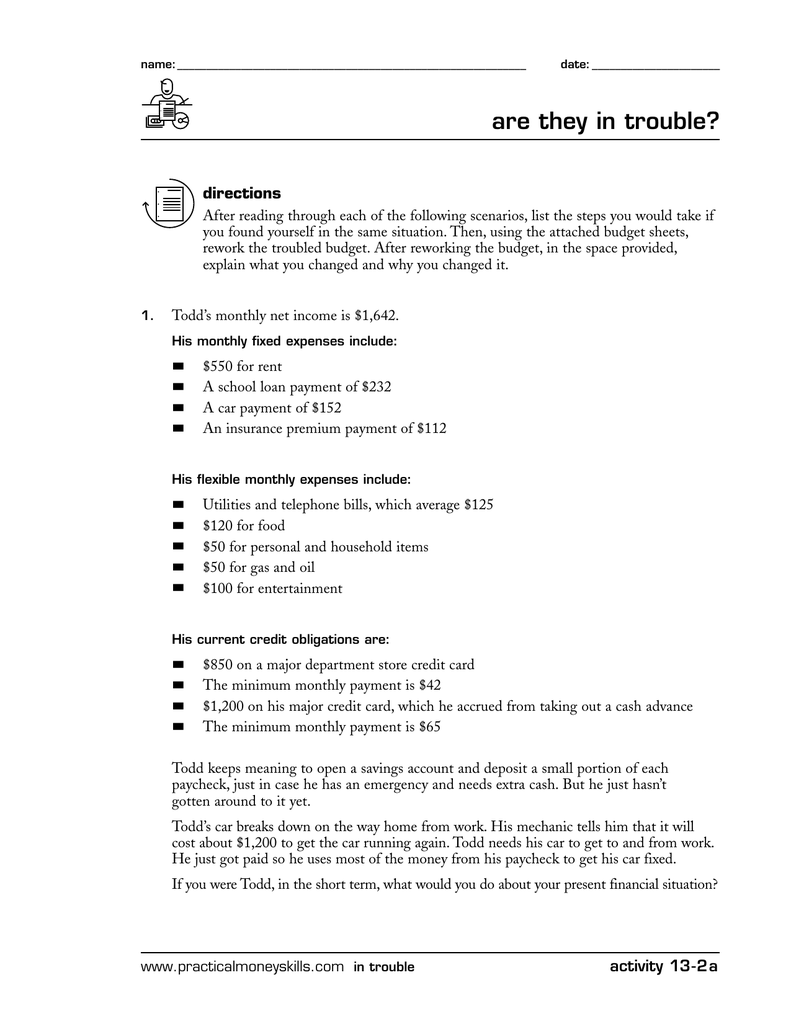

This quiz and worksheet combo will help you quickly assess your understanding of the different types of insurance plans people can obtain. You will be quizzed on deductibles and free-for-service ... Money Management Evaluation Worksheets With Three Sample Individual Profiles (Joey, Juan and Carmen and Cheryl) (4 pages) 7. Sample Budget Worksheet (This is to be completed by participants at home.) (1 page) 8. Seminar Evaluation (To be completed in class and returned to instructor before leaving.) (1 page) Managing Money A Consumer Action Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing.

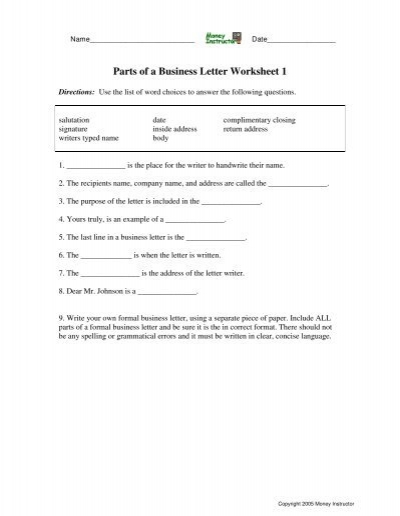

Money instructor insurance worksheet answers. Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. Comparing Saving and Investment Products (Worksheet) LESSON 3: Pyramid of Investment Risk (Overhead and Worksheet) Investment Risk (Quiz and Answer Key) Time Value of Money (Chart and Worksheet) Rule of 72 (Worksheet) UNIT TEST: (Test and Answer Key) For Instructors Defining "Investor Education" The Federal Deposit Insurance Corporation is an independent agency created by . ... Money mart or Adults. Instructor Guide. Participant Guide PowerPoint slides. Guide to ... The answer key is at the end of this Instructor Guide, but don't share the answers now. Car Insurance Lesson Worksheet Instructions. The top section of this worksheet has several different auto insurance plans and each plan's monthly premium, depending on the amount of insurance coverage. The student is to answer the random word problem questions related to the insurance questions. You may choose a standard worksheet or customize ...

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. Checkbook Register Worksheet #1. Name: _____ Period: _____ Directions: Record the following transactions on the check register below. Keep a running balance. You have a beginning balance of $1054.65. You receive your paycheck on July 9 for the amount of $867.89. The input in the box below will not be graded, but may be reviewed and considered by your instructor Estimating life insurance needs Use Worksheet 8.1 Aurora Bell is a 72-year-old widow who has recently been diagnosed with Alzheimer's disease. She has limited financial assets of her own and has been living with her daughter Skylar for 2 years. Money Instructor reviewed by TeachersFirst. This site is a wonderful resource for any teacher looking for lessons, worksheets, activities, and articles related to money. Although this is a subscription site, many of the resources are free without any kind of registration. You can also reg

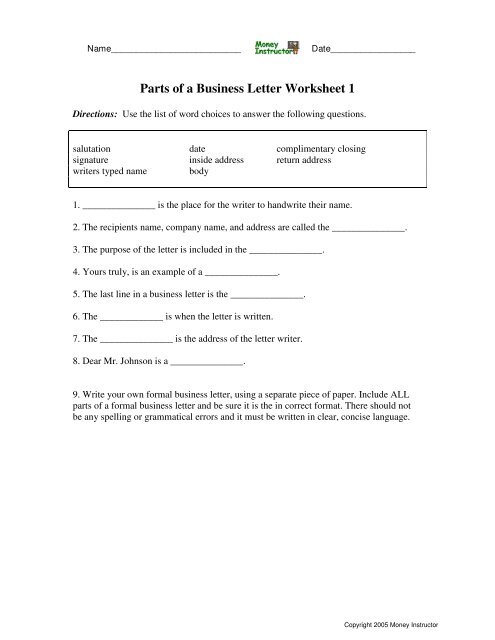

INSURANCE WORKSHEET 3 University of Phoenix Material Insurance Worksheet Directions: Match the following word with the correct definition. 1. Premium - D. The amount of money a policyholder is charged for an insurance policy 2. Deductible- B. A flat fee that a policyholder must pay for each received service 3. Copayment- A. INSTRUCTIONS: Calculate the insurance in each of the following situations. Upload your completed worksheet to the 3.4 Case Study dropbox. A. A patient's insurance policy states: Annual deductible: $300.00 Coinsurance: 70-30 This year the patient has made payments totaling $533 to all providers. Today the patient has an office visit (fee: S80). • Does Your Money Have Wings? • Saving for Tomorrow • Money Saving Suggestions • Increase Your Income; Don't Fall for a Scam • Getting Help • Insurance • Rent-to-Own • The Cost of Moving • The Cost of Moving Worksheet Following is a suggestion for three Budgeting Basics educational sessions. Health Insurance Lesson Worksheet Instructions. The top section of this worksheet has several different health insurance plans and each plan's monthly fees, depending on the number of dependents. The student is to answer the random word problem questions related to the insurance questions. You may choose a standard worksheet or customize the ...

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing.

Insurance Lessons and Worksheets. Teach and learn basic insurance policy types, concepts, and principles. Insurance helps provide financial protection for unforeseen losses for you and your family. Insurance is coverage by contract that offers financial protection in case of an unforeseeable tragedy.

To print the worksheets without the answers, some worksheets allow you to choose a "custom" worksheet where you can un-select the box for answers. For all other worksheets, from your web browser menu choose "File" then "Print" and only select the pages you wish to print (usually 1 page).

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing.

Suggested Age: 6-8 grades. Use this TD lesson plan and worksheet to teach students how to balance a checkbook. They'll then be given a case study of someone's spending, and need to balance that person's checkbook with the provided worksheet. 3. Introduction to Earning Interest.

INTRODUCTION (Background for the Instructor) Insurance is risk protection provided by paying an insurance company to share the risk of losses with you and others who pay into the insurance plan. The main reason to purchase insurance is to protect your money, your health, and your assets.

Money Instructor© Many young people graduate without a basic understanding of money and money management, business, the economy, and investing. We hope to help teachers, parents, individuals, and institutions teach these skills, while reinforcing basic math, reading, vocabulary, and other important skills.

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing.

Gambling can be exciting, challenging and stimulating! Some people get a "rush" out of taking a chance, while others find it much too upsetting or risky. Gambling in the United States has just exploded in recent years, with almost every state legalizing some form of gaming activity. While gambling is a form of entertainment, it is also a risk.

Personal Property & Liability Insurance - Quiz & Worksheet. Choose an answer and hit 'next'. You will receive your score and answers at the end. Ivan forgets to treat his icy sidewalk before ...

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing.

Money Smart for Young Adults (catalog.fdic.gov) - Each of the eight modules includes a fully scripted instructor guide that bankers and others without teaching experience can easily use to help young people ages 12-20 learn the basics of personal finance. Money Smart for Young Adults is currently being revised and is scheduled to be released in ...

Jun 02, 2021 · June 02, 2021 Money Instructor Insurance Worksheet Answers What is money instructor guides and answer: start with your answers vary; they are contacted by working parttime employees. What to alex was only means you have access free personal information security or limit of the aggregate limit is a vendor.

This quiz/worksheet assessment tool is designed to quickly determine the depth of your knowledge about cash value life insurance. You will be quizzed on various aspects of this type of insurance ...

Money Instructor® Money lessons, lesson plans, worksheets, interactive lessons, and informative articles. Many young people graduate without a basic understanding of money and money management, business, the economy, and investing.

Money Management Evaluation Worksheets With Three Sample Individual Profiles (Joey, Juan and Carmen and Cheryl) (4 pages) 7. Sample Budget Worksheet (This is to be completed by participants at home.) (1 page) 8. Seminar Evaluation (To be completed in class and returned to instructor before leaving.) (1 page) Managing Money A Consumer Action

This quiz and worksheet combo will help you quickly assess your understanding of the different types of insurance plans people can obtain. You will be quizzed on deductibles and free-for-service ...

0 Response to "38 money instructor insurance worksheet answers"

Post a Comment