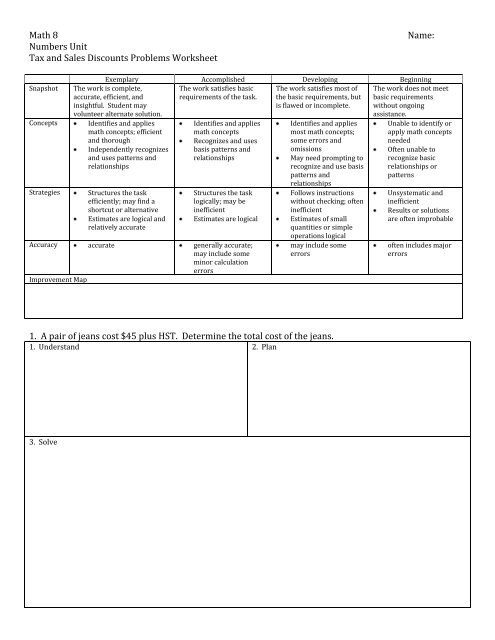

41 sales tax and discount worksheet

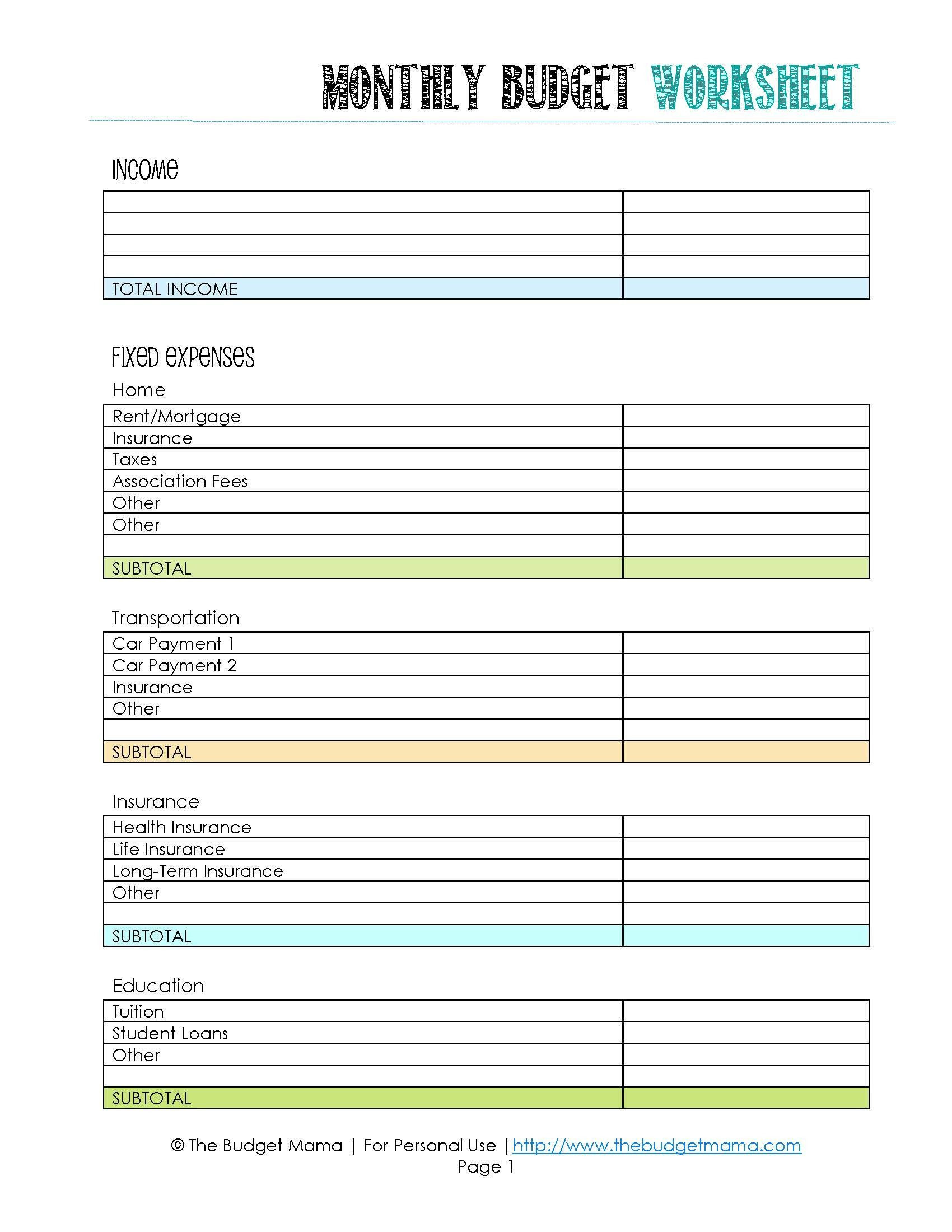

5) Sales tax is 6.5 % and you spend $58.50. a) How much money will you spend on tax? $3.80 b) How much money will you spend total? $62.30 6) A restaurant requires customers to pay a 15% tip for the server. Your family spends $45 on the meal. a) How much money do you need to pay the server? $6.75 b) How much money will you spend total? $51.75 Worksheets are Sales tax and discount work, Sales tax practice work, Sales tax and discount work, Tax tip and discount word problems, Name period date tax tip and discount word problems, Title word problems involving one variable class math, Percent increase and decrease word problems 4, Discount tax and tip.

Sales Tax and Discount Worksheet. Name:_____ Procedure: The rate is usually given as a percent. To find the discount, multiply the rate by the original price. To find the sale price, subtract the discount from original price. Now that we have a procedure, we can solve the problem above. Problem: In a video store, a DVD that sells for $15 is ...

Sales tax and discount worksheet

Sales Tax, Tip, Discounts, and Mark-up Word Problem Practice Worksheet by Kelsey Tucker 2 $1.00 PDF A ready to go worksheet that builds the students level of learning and understanding of sales tax, tip, discounts, and mark-up. Your students can use the percent key on their calculators or can review how to turn a percent into a decimal to multiply. charged if the sales tax is 7%?. 3. John and his family went out to eat at their favorite restaurant. The bill for the food was $65.00, and ...2 pages The discount will be apportioned according to the discount given at the item level. 6. Select the applicable GST ledgers. 7. Click A : Tax Analysis to view the tax details, and click F1 : Detailed to view the tax break-up. In the sales invoice, press Alt+P to print the invoice.

Sales tax and discount worksheet. 07/01/2022 · Effective January 1, 2014, all employee Wage Tax refund petitions require documentation to verify any time worked outside of Philadelphia. Employees who request a refund for travel should use our refunds date and location worksheet, and must provide a copy of their Telework Agreement. students to check t • • This worksheet works best to reinforce sales tax. • Make sure that students bubble in their answers for the front page (#1-7) and the back page (#8-14). The bubbles allow heir answers and results in a more confident student. In addition, it makes it a lot easier for you to do a quick Using the Tax, Tip, and Discount Activity worksheet, students determine total cost, including tax and tip. SE works with the pre-selected students who are most likely to succeed independently with the task. SE assigns a partner or groups of four to share their lists. Students create one list of items they can all agree on to purchase. entered on the ST-389 (local sales tax worksheet). 2. 3. 1. < > Item 7. Use this section to report the total of all sales and purchases subject to the state Sales Tax rate of 6%. Sales and purchases reported in this section include charges for meals, gift items, and additional guest charges (such as room service, amenities, phone charges, etc.).

17) The sales tax in Texas is 8.25% and an item costs $400. How much is the tax? $_____ 18) The price of a table at Best Buy is $220. If the sales tax is 6%, what is the final price of the table including tax? $_____ bit.ly/2Je5lo0 t discount points, and then subtract any refund of UFMIP. ... monthly mortgage insurance premiums, and any real estate tax deposits needed to establish the escrow account regardless whether the mortgagee refinancing the existing loan is also the servicing lender for that mortgage. Late Charges, Prepaids and Escrows: In determining the existing debt as part of the mortgage … Percent discount Worksheet. Search form. Search. To print this worksheet: click the "printer" icon in toolbar below. To save, click the "download" icon. PDF.js viewer. Thumbnails. Document Outline. Attachments. Deferred Tax Liability: 4,736,683 Step 2: Compute the Applicable Percentage: The applicable percentage is computed in the year of sale and is used for all subsequent years. = Aggregate face amount of obligations arising in a tax year and outstanding as of the close of such tax year from dispositions with sales price > $150,000 –

sales tax total amount article on sale watch calculator bicycle typewriter tennis racket turntable camera cassette deck original price $99.00 $59.90 $88.50 $84.95 percent discount 200/0 3310/0 sale price the witty raindrop said: $54.34 $84.15 $50.97 $89.20 $53.52 $50.97 $53.91 $65.36 $61.95 $92.40 $35.1c $61.95 $92.40 $45 $61.95 $53.52 $52 $54.34 Sales Tax and Discount Worksheet Percents: Combination of Discount and Sales Tax For each problem find the total cost. 1.) If the Mr. Bowen wants to buy a new set of golf clubs. The clubs he wants to buy is normally $540.00. They are on sale right now for 25% off the original price. Sales tax on the clubs will be 6%. To find the sale price, subtract the discount from original price. [$49 - $49(.40)]. Example. In a clothing store, a shirt that sells for $15 is marked “10% off ... 38. $7.00. $5.00. Bundle. Zip. This is a collection of 3 resources to help students practice and review finding tax, tips, and discounts. There are mazes, a paper chain, and a set of task cards. They have to find the tax, tips, and discounts and the total price after the tax, tip, or discount.

TAX UNIT PRICE LINE TOTAL Catering Invoice Sabrosa Empanadas & More 1202 Biscayne Bay Drive Orlando, FL 32804 Invoice #: 5690B Date: 05/15/16 Invoice #: 5690B Date: 05/15/16 Empanadas: Poblano & Cheese Empanadas: Spicy Sweet Potato SUBTOTAL TOTAL W/ TAX Empanadas: Buffalo Chicken Empanadas: Fig and Goat Cheese Sides: Black beans and rice …

Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ...

2. Answer : First round $68.50 to $70 and 8.5% to 8%. Convert the percent to decimal. The sales tax is about $6. 3. Answer : Convert the percent to decimal. Multiply 0.15 and 70.

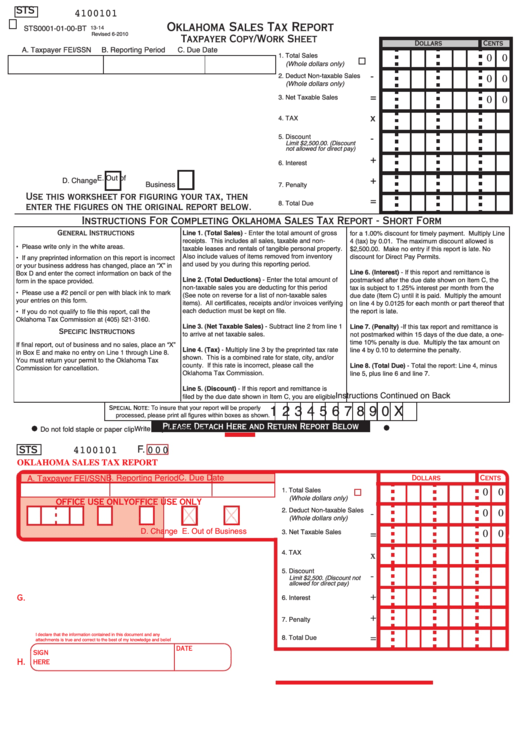

For paper filing, print out a copy of ND tax return for your record. Transfer the tax info to the official ND tax forms and mail them in. 1040Now tax forms can be used ONLY for record. OH. 01/2022 . 01/2022 . OK. 01/2022 01/2022 OR. 01/2022 01/2022

Sales tax and discount worksheet 7th grade answer key 5. Discount and sales tax worksheet with answer. Use a sales tax rate of 5. 010 x 1500 150 The sale price is calculated as follows. 1 In a department store a 40 dress is marked Save 25 What is the discount. Sales Tax and Discount Worksheet.

Sales Tax and Discount Worksheet. Name: a=p%(6). Procedure: ... To find the sale price, subtract the discount from original price.5 pages

Sales Tax And Discount - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are Name period date tax tip and discount word problems, Sale price sales tax total cost, Markup discount and tax, Sales tax and discount work, Calculating sales tax, , Percent word problems work 1, Taxes tips and sales.

Sum both sales tax discount amounts and enter on line 5 of this form. PART 2: USE TAX ON ITEMS PURCHASED FOR BUSINESS OR PERSONAL USE ; Line 7: Carry amount from line 9 of the Worksheet 5095. To determine use tax due from purchases and withdrawals, multiply the applicable tax base by 6%. PART 3: WITHHOLDING TAX ; Line 8:

If you’ve created a 2020 or later tax return and entered ATS data prior to the 2021.0.4 version, please refresh the tax return by opening the ATS schedule along with the related worksheet (Item 13, Item 20, Item 18, Item 24 category 4) where the data is transferred. This will update the return including the tax return print.

Discount and Sales Tax Worksheet The following items at Sam's Sports Palace are on sale. Find the amount of discount, sale price, sales tax, and total cost for each item. Use a sales tax rate of 5%. Tennis Racquet: $100 at 30% off Can of Tennis Balls: $4.00 at 25% off Basketball: $10.95 at 20% off Baseball Glove: $44.50 at 10% off

Sales Tax and Discount Worksheet -Math 6. In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

The student will be able to mentally calculate amount of discount, sale price, sales tax, and total cost for an item that is 10% off and 5% sales tax. 5. The student will be able to write in complete sentences how they mentally solved a discount and sales tax problem.

If you received a Form 1099-B (or substitute statement) reporting the sale or retirement of a market discount bond, enter code "D" for the transaction in column (f) of the appropriate Part of Form 8949 and complete this worksheet to figure the amount to enter in column (g).

Discount, Tax, and Tip Worksheet Name: _____ Discount: The amount saved and subtracted from the original price of an item to get the discounted price. Procedure: 1. The rate is usually given as a percent. 2. To find the discount, multiply the rate (as a decimal) by the original price. ... Sales Tax and Discount Worksheet Author: Justin Rysz

Practice the questions given in the worksheet on mark-ups and discounts involving sales tax. 1. Ashok purchased a washing with a marked price of $ 16500at a ...

You can scroll through the template options in Microsoft Word, or you can filter them to show the most relevant results first. To do so, click on the search bar in the upper right-hand corner and enter “invoice.” Look for a template that suits your business needs. Word offers templates for sales invoices, service invoices and more.

Discount. Type: None. Currency. USD $ Options. Get Link Print Receipt: Receipt Maker. Everyone knows what a receipt is — but often small businesses can get tripped up on how to write a receipt. Here is the why, what and how of writing receipts using Invoice Simple. Why use a receipt maker; What to put on a receipt; Why use our receipt maker; Receipt maker …

Sales Tax and Discount Worksheet 1) In a department store, a $40 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? 2) In a grocery store, a $12 case of soda is labeled, "Get a 20% discount." What is the discount? What is the sale price of the case of soda?

F p DMxa Xd8e L swqiZtch k iIGn8f Wi2n yiRt7e x RPQrMeb-mA2lfg Xeib 9rKaz.p Worksheet by Kuta Software LLC 9) Original price of a microphone: $20.00 Discount: 42%

Discount and Sales Tax. For Students 8th - 9th. In this Algebra I worksheet, students work with a family member to find the percent of discount and sales tax of three items that are on sale. The twopage worksheet contains fourquestions. Answers are not included.

Discount, Markup, and Sales Tax VOCABULARY: Discount: is the amount by which a regular price is reduced. Discount- the amount goes down Mark up- is the increase in the price Markup- the amount goes up Selling price- the amount the customer pays Sales tax- is an additional amount of money charged on certain goods and services.

16/10/2021 · Special discount offers may not be valid for mobile in-app purchases. ... #1 best-selling tax software: Based on aggregated sales data for all tax year 2020 TurboTax products. America’s #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for …

Discount and sales tax worksheet with answer. May 22, 2021 by suchit. Q.1 A furniture seller is giving a discount of 14 % on a sofa set. The marked price of the sofa set is 22000 Rs . Find the selling price of the sofa set after discount. Q.2 An Article with a marked price of 1500 Rs was sold to a customer for 1200 Rs.

Discount: 50% 14) Original price of a camera: $554.99 Discount: 48% 15) Original price of a CD: $17.00 Discount: 50% 16) Original price of a CD: $22.95 Discount: 10% 17) Original price of a book: $49.95 Tax: 3% 18) Original price of a book: $90.50 Tax: 4% 19) Original price of an MP3 player: $99.50 Tax: 4% 20) Original price of a microphone ...

See 14 Best Images of Sales Tax And Discount Worksheets. Inspiring Sales Tax and Discount Worksheets worksheet images. Sales Tax Math Problems Worksheets Percent Word Problems Worksheets Sales Tax Worksheets for Students 1 Square Graph Paper Similar Figures Proportions Worksheet

BlankRefer - create an anonymous link

PART 1: SALES AND USE TAX information. If filing a credit schedule with a monthly/ Line 1a: Enter the amount from Worksheet 5095, line 4A. quarterly return, calculate the allowable discount on sales Line 1b: Enter the amount from Worksheet 5095, line 4B. tax separate from the sales tax discount calculated on the credit schedule.

C Discount: $40 Sale Price $42. 4) If the sales tax rate is 7% in Concord, then how much would you pay for a coat that cost $120.00? Hint: Find 7% and add ...2 pages

The discount will be apportioned according to the discount given at the item level. 6. Select the applicable GST ledgers. 7. Click A : Tax Analysis to view the tax details, and click F1 : Detailed to view the tax break-up. In the sales invoice, press Alt+P to print the invoice.

charged if the sales tax is 7%?. 3. John and his family went out to eat at their favorite restaurant. The bill for the food was $65.00, and ...2 pages

Sales Tax, Tip, Discounts, and Mark-up Word Problem Practice Worksheet by Kelsey Tucker 2 $1.00 PDF A ready to go worksheet that builds the students level of learning and understanding of sales tax, tip, discounts, and mark-up. Your students can use the percent key on their calculators or can review how to turn a percent into a decimal to multiply.

0 Response to "41 sales tax and discount worksheet"

Post a Comment