43 clergy housing allowance worksheet

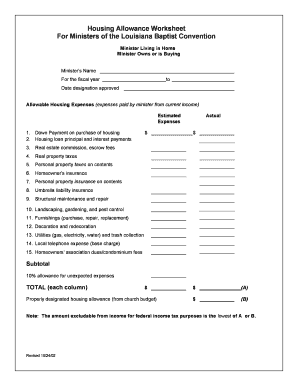

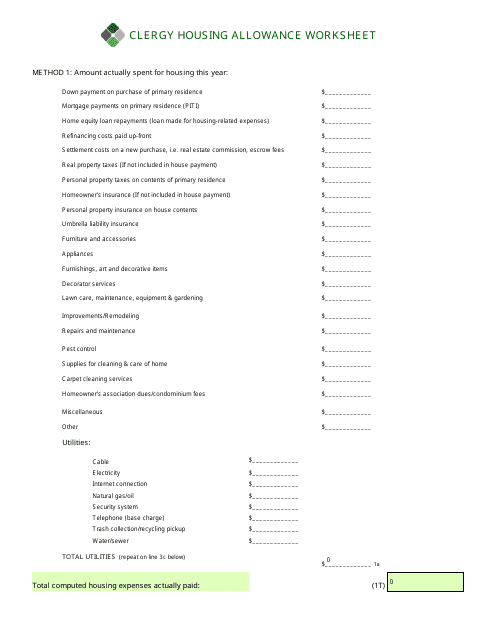

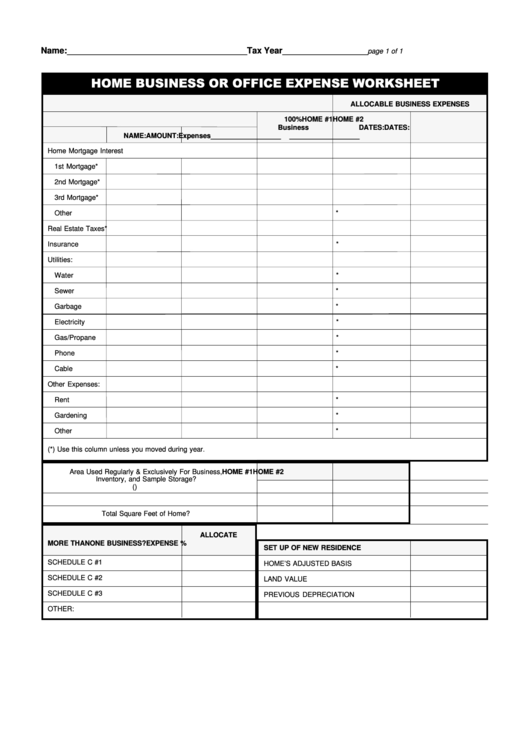

CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____. NOTE: This worksheet is provided for educational purposes only.1 page MINISTER'S HOUSING EXPENSES WORKSHEET ANNUAL HOUSING EXPENSES Rent (if a primary residence was ented for all or part of the year) $ ... MINISTER'S HOUSING ALLOWANCE In order to claim Minister's Housing Allowance exemptions for federal income tax purposes on your retirement distributions, you

HOUSING ALLOWANCE EXCLUSION WORKSHEET This worksheet is designed to help a retired clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of section 107 of the Code. Those provisions provide that "a minister of the gospel" may exclude a "housing allowance" from his or her gross income.

Clergy housing allowance worksheet

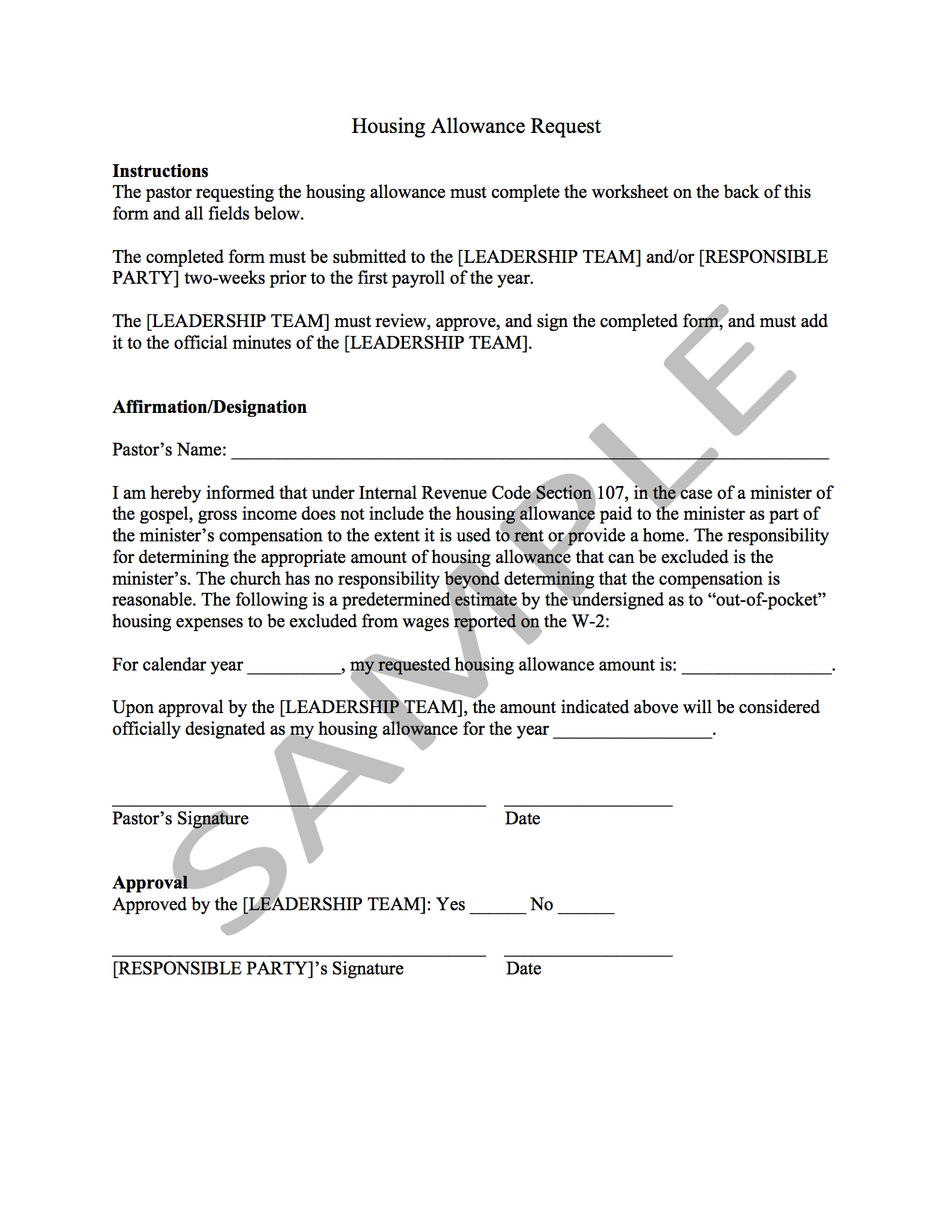

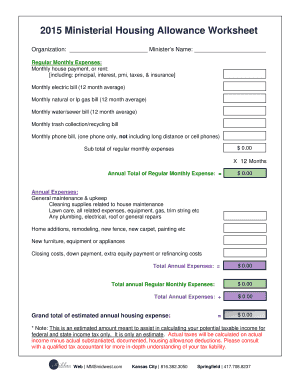

A minister who receives a housing allowance may exclude the allowance from gross income to the extent it is used to pay expenses in providing a home. A housing allowance is also available to a minister living in a parsonage to the extent he uses the allowance for his personally paid out-of-pocket costs not paid by the church. A. A housing allowance is a portion of clergy income that may be excluded from ... ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting ...7 pages Pastoral Housing Allowance for 2021 . Pastors: It is time again to make sure you update your housing allowance resolution. According to tax law, if you are planning to claim a housing allowance deduction (actually an 'exclusion') for the upcoming calendar year, your Session is required to designate the specific amount to be paid to you as housing allowance prior to the beginning of that ...

Clergy housing allowance worksheet. EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources www.clergytaxnet.com MMBB's Housing Allowance Worksheet Example Subject: Download MMBB's Housing Allowance Worksheet, which serves as an example only. This form in not intend to provide advice in any way and should be treated as such. Created Date: 3/5/2015 3:42:32 PM • A minister’s housing allowance is an exclusion for federal income taxes only. Ministers must add the nontaxable amount of their self-employment taxes on Schedule SE (unless exempt from self-employment taxes). RentData.org - Comprehensive Fair Market Rent Estimates By City, State and ZIP Code. Find the Rental Value of Your Home or Appartment.

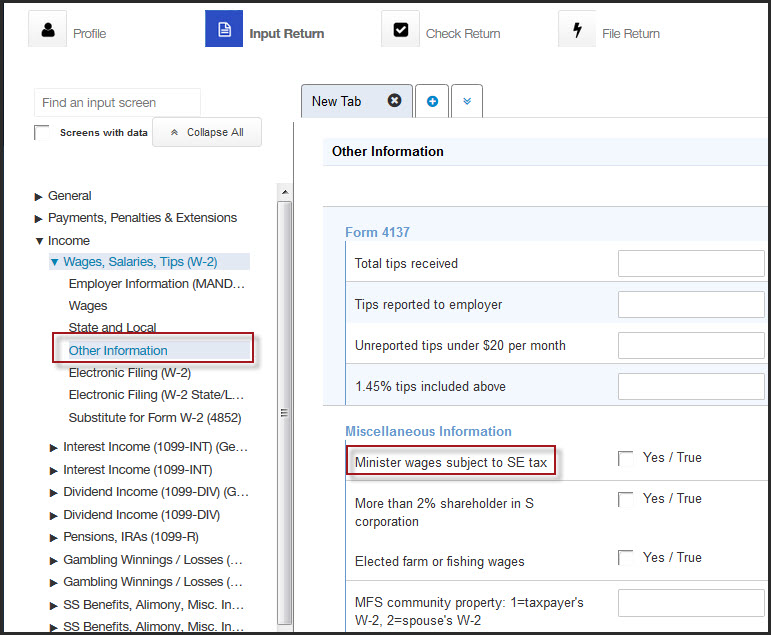

For more information on a minister's housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy. Therefore, the signNow web application is a must-have for completing and signing housing allowance worksheet on the go. In a matter of seconds, receive an electronic document with a legally-binding eSignature. Get pastors housing allowance worksheet signed right from your smartphone using these six tips: Housing Allowance Weddings & Funerals (see below) Speaking engagements Business Expense Reimbursement Liturgical work Direct reimbursement Auto Barter Set Amount Other Other Sales of Equipment and/or Machinery Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost Section 107 [Parsonage] Allowance · Model Parsonage Resolution · Parsonage Worksheet · Tax Excludable Clergy Parsonage Allowance Certification.

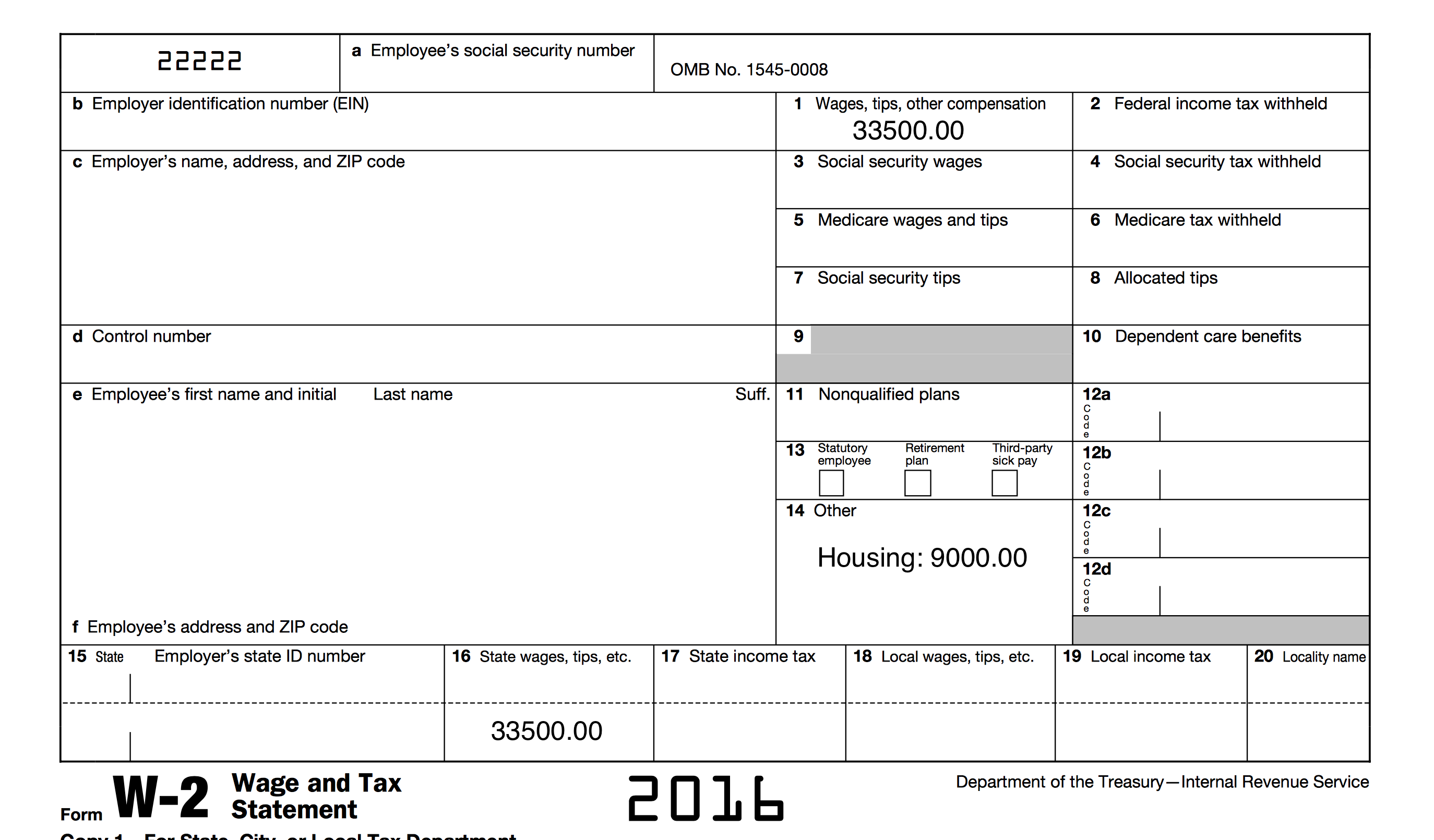

Below is a list of frequently asked questions from CBB participants related to the clergy/pastor house allowance. 1. Q. What is a Housing Allowance? A. A housing allowance is a portion of clergy income that may be excluded from income for federal income tax purposes (W-2 “ ox 1” wages) under Section 107 of the Internal Revenue ode. CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year: A minister's housing allowance is an exclusion for federal income taxes only. Housing Allowance is subject to Social Security (SECA) taxation and must be ... PARSONAGE or HOUSING ALLOWANCE NOTIFICATION BY THE CHURCH . Applied to Principal Residence Only! Date: Dear : This is to notify you of the action taken establishing your housing allowance at a meeting held on . A copy of the Resolution is attached. Under section 107 of the Internal Revenue Code, a minister of the gospel is allowed to

For more information on a minister's housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417 , Earnings for Clergy .

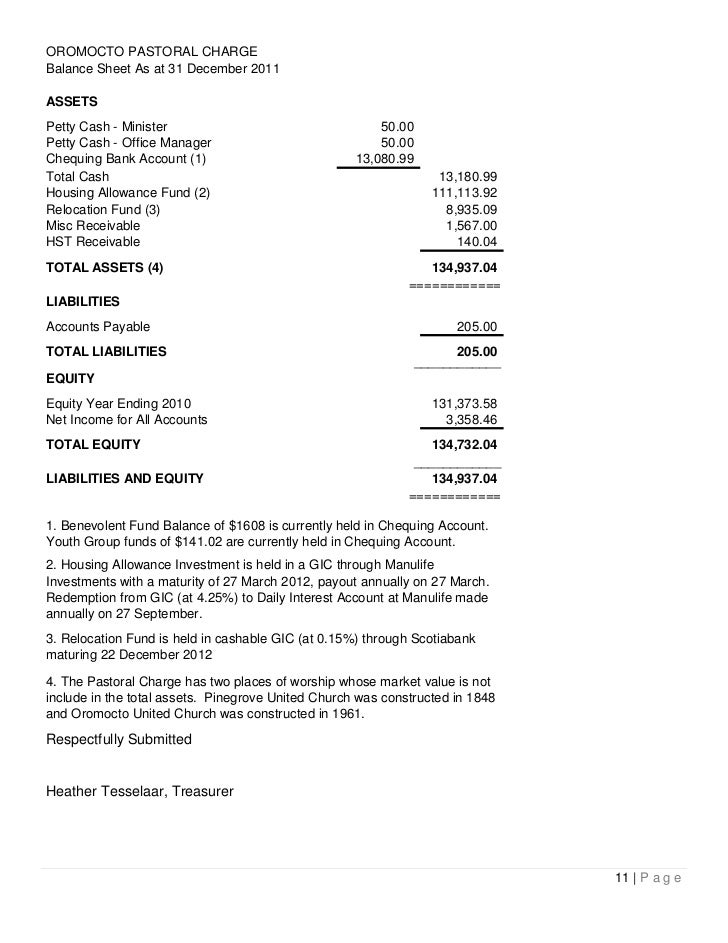

$10,000. In that case, at most $5,000 of the $10,000 housing allowance can be excluded from the pastor’s gross income in that calendar year. Q. Is the housing allowance also excluded from earnings subject to self-employment taxes? A. No. The housing allowance exclusion only applies for federalincome tax purposes. By law, clergy

Mellieha Heights Malta and the colourful houses built on the hills. A lovely part of this fascinating island in the Mediterranean.

CLERGY A minister can exclude from income only the smallest of: (a) The amount officially designated as a housing or parsonage allowance (b) The amount actually spent on qualified housing expenses (c) The fair rental value of a home or parsonage, including utilities, furnishings, etc.

To figure out your specific housing expenses when filing your annual tax return, download the free Ministers Housing Expenses Worksheet. It’s a great way to make sure you get the most out of your housing allowance each year. It’s important to know the IRS does place some limits on how much can be designated as clergy housing allowance.

A new apartment house with an inherent blur effect stands near the main train station in Linz, Austria.

2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses.

that the allowance 1) represents compensation for ministerial services, 2) is used to pay housing expenses, and 3) does not exceed the fair rental value of the home (furnished, plus utilities). The clergy housing allowance is subject to self-employment taxes, and most clergy pay these quarterly using IRS Form 1040 ES. Housing Expense Estimated ...

reflect the changing value of the housing provided. To obtain all allowable tax exemptions for "Ministers of Religion," the congregation should have a recorded resolution (prior to January 1 of the year it is to take effect), which authorizes the housing / utility/ or parsonage allowance in advance of any payment.

now, the clergy housing allowance continues." Ministry settings should continue to designate housing allowances for clergy. Formula: Value of median-priced house x 1% x 12 = Housing Allowance church's recommended housing allowance would be $100,000 times 1%, or $1,000 per month. ($12,000 per year).

Therefore, the signNow web application is a must-have for completing and signing clergy housing allowance worksheet on the go. In a matter of seconds, receive an electronic document with a legally-binding eSignature. Get clergy housing allowance worksheet 2021 signed right from your smartphone using these six tips:

HOUSING ALLOWANCE Q&As (FOR UNITED METHODIST CLERGY) 1. What is the housing allowance? When reporting gross income for federal income tax purposes, clergy can exclude a portion of their income designated by their church or salary paying unit as a "housing allowance" under Section 107 of the Internal Revenue Code (IRC).

Housing allowance for pastors worksheet. Download mmbb's housing allowance worksheet, which serves as an example only. Rpb will designate 100 percent of your distribution income as your potential housing allowance, but this does If you receive as part of your salary (for services as a minister) an amount officially designated (in advance of ...

CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE. The amount spent on housing reduces a qualifying ministers federal and state income tax burden. Income when filing your federal income tax return. This worksheet is provided for educational purposes only. 843 722 - 4075 E-Mail. This worksheet is designed to help a retired ...

Nov 04, 2021 · Housing Allowance. A licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation (a parsonage) or a housing allowance provided as compensation if it is used to rent or otherwise provide a home.

How a member of the clergy or religious worker figures net earnings from self-em-ployment. This publication also covers certain income tax rules of interest to ministers and members of a religious order. In the back of Pub. 517 is a set of work-sheets that you can use to figure the

Mar 15, 2019 · What is a housing allowance? A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister’s federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that:

How It Works. Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000.

2020 Minister Housing Allowance Worksheet Mortgage Payment *Real Estate Taxes *Homeowners Insurance Mortgage Down Payment & Closing Costs Rent Renter's Insurance HOA Dues/Condo Fees Home Maintenance & Repairs Utilities Furniture & Appliances Household Items Home Supplies Yard Service Yard Care Tools & Supplies Miscellaneous

Clergy housing allowance worksheet.It is time again to make sure you update your housing allowance resolution. According to tax law if you are planning to claim a housing allowance deduction actually an exclusion for the upcoming calendar year your Session is required to designate the specific amount to be paid to you as housing allowance prior to the beginning of that.

Dec 16, 2019 · The housing allowance for pastors is not and can never be a retroactive benefit. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Therefore, it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020.

Housing Exclusion Worksheet Minister Living in Home Minister Owns or Is Buying Minister's name:_____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title:

Pastoral Housing Allowance for 2021 . Pastors: It is time again to make sure you update your housing allowance resolution. According to tax law, if you are planning to claim a housing allowance deduction (actually an 'exclusion') for the upcoming calendar year, your Session is required to designate the specific amount to be paid to you as housing allowance prior to the beginning of that ...

A. A housing allowance is a portion of clergy income that may be excluded from ... ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting ...7 pages

A minister who receives a housing allowance may exclude the allowance from gross income to the extent it is used to pay expenses in providing a home. A housing allowance is also available to a minister living in a parsonage to the extent he uses the allowance for his personally paid out-of-pocket costs not paid by the church.

0 Response to "43 clergy housing allowance worksheet"

Post a Comment