43 Va Residual Income Calculation Worksheet

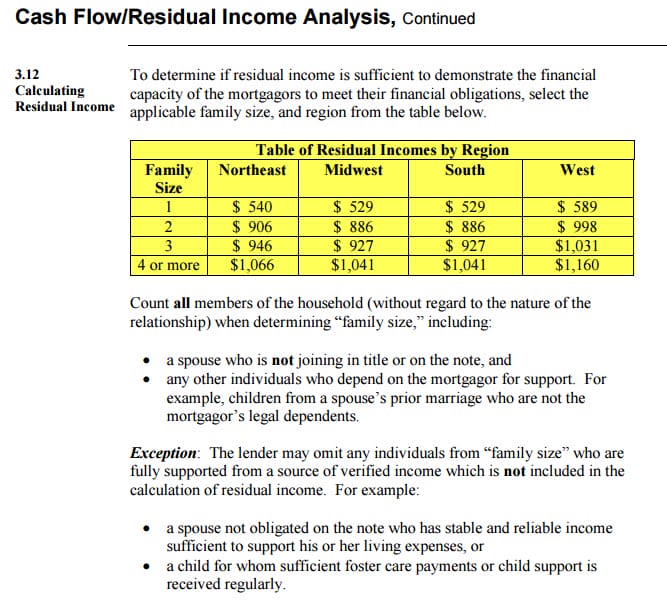

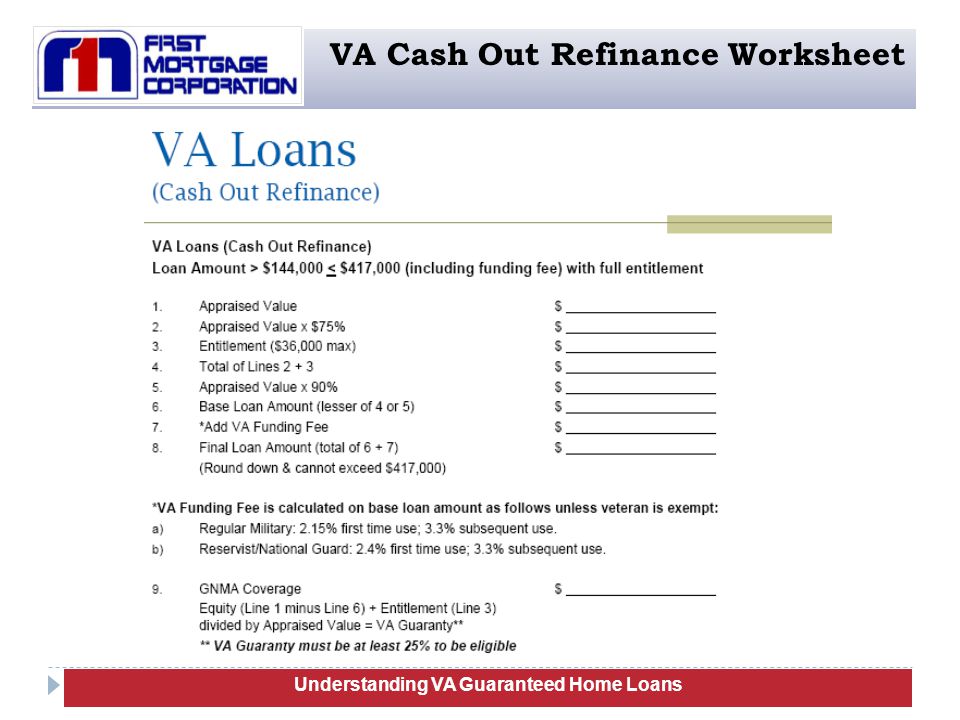

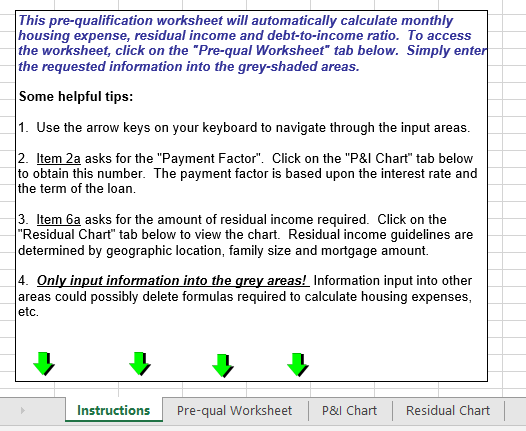

Section 2: Calculation of Loss (Compensation) | VCF 05/01/2021 · By law, the VCF can only compensate for losses caused by eligible conditions related to the events of September 11, 2001. In addition, the law requires the Special Master, in each case, to take account of the harm to the claimant, the facts of the claims, and the individual circumstances of the claimant. Our claim analysis therefore always begins with three essential … HECM FINANCIAL ASSESSMENT AND PROPERTY CHARGE GUIDE ... Cash Flow/Residual Income Analysis ..... 29 3.1 Purpose of the Cash Flow/ Residual Income Analysis ..... 29 3.2 Mortgagor Income ..... 29 3.3 General Income Requirements..... 29 3.4 Income from a Eligible Non-Borrowing Spouse ..... 30 3.5 Income from Other Non-Borrowing Household Members..... 30 3.6 Non-Taxable Income ..... 31 3.7 Employment-Related Income …

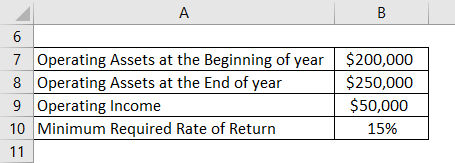

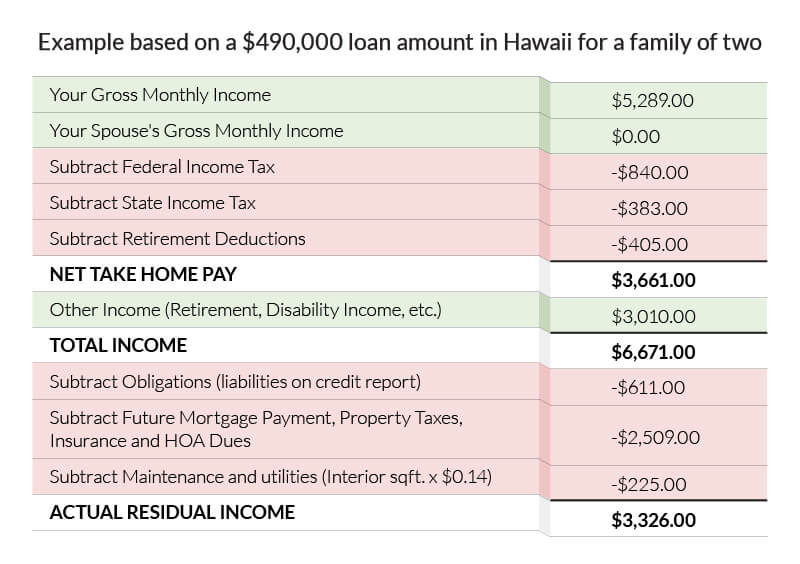

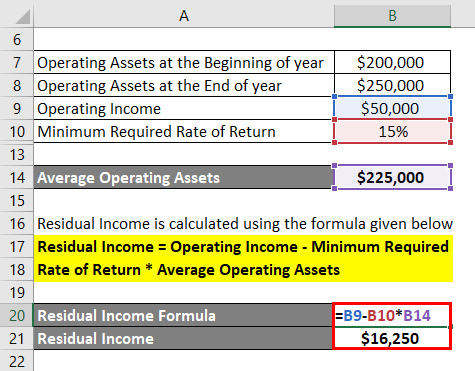

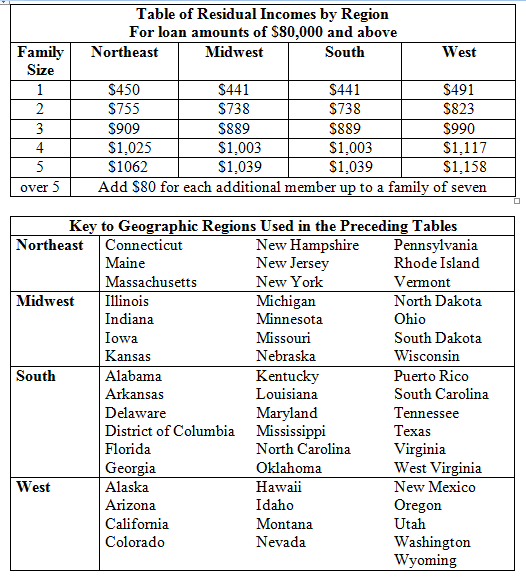

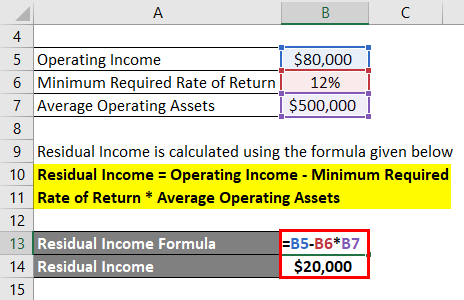

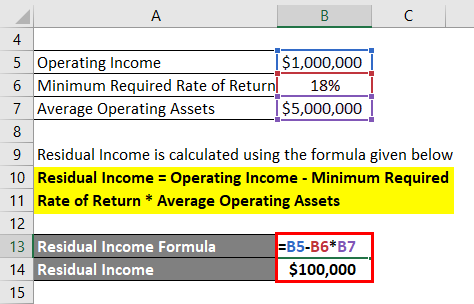

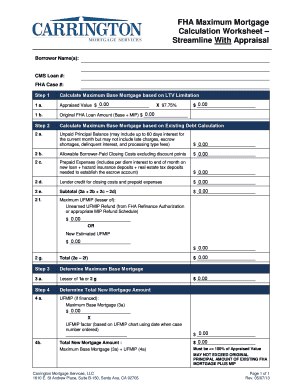

VA Residual Income Calculator - AnytimeEstimate.com VA Residual Income Calculator. Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck(s).

Va residual income calculation worksheet

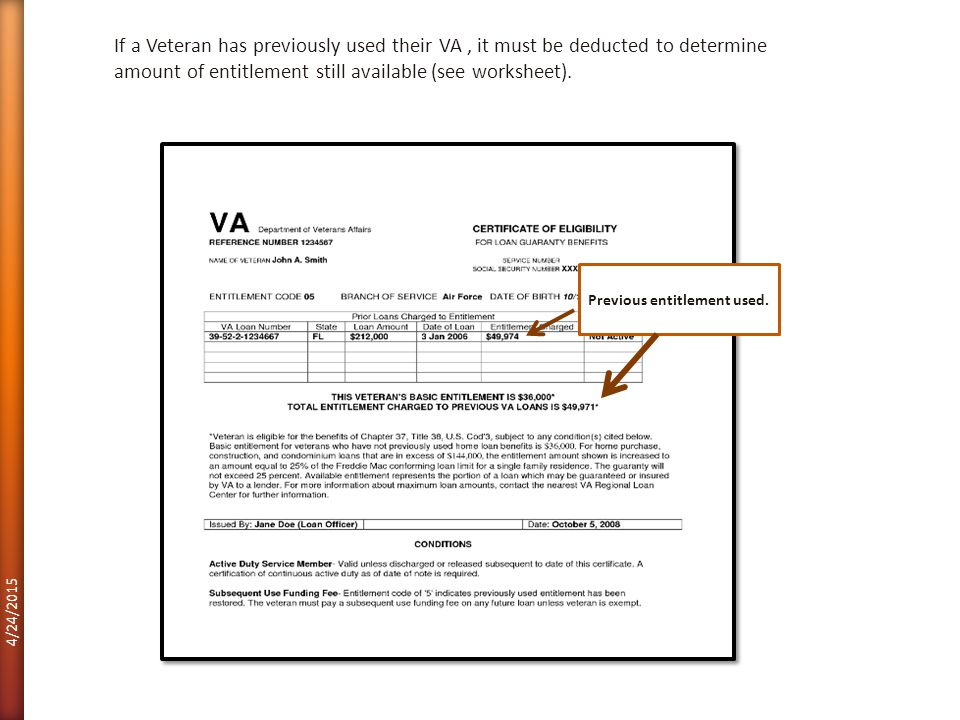

Updated Ability-To-Repay and Qualified Mortgage ... 25/09/2020 · This Regulatory Alert supersedes and replaces Regulatory Alert 14-RA-01 (January 2014), to clarify the points and fees limit for each loan amount threshold and types of charges included in the calculation. This Regulatory Alert also references updated guidance for implementing the requirements of the rule.Dear Board of Directors and Chief Executive Officer: Single-Family Homepage | Fannie Mae All other housing allowances should be entered as other income in Section V. For a VA loan, the dollar amount from the MCC should be entered in this field as a monthly amount. The amount of the MCC will be added to the residual income, subject to the $2000 annual ($167 monthly) limit. Format: Z(12).Z(2) What Is A Tangible Net Benefit? - Rocket Mortgage 27/01/2022 · VA loans have a tangible net benefit calculation that applies to many of their transactions. For the VA policy not to apply, a homeowner must have 10% equity or more. In all other rate/term (excluding VA streamlines, which we’ll get into below) and cash-out transactions, one of the following must happen to pass the test:

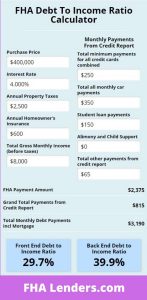

Va residual income calculation worksheet. Chapter 4 - Veterans Affairs Debt-to-Income Ratio VA’s debt-to-income ratio is a ratio of total monthly debt payments (housing expense, installment debts, and so on) to gross monthly income. It is a guide and, as an underwriting factor, it is secondary to the residual income. It should not automatically trigger approval or rejection of a loan. Instead, consider the ratio in conjunction with all other credit … Forms & Resources | Correspondent Division Manual Underwrite Residual Income Worksheet. i. Rate/Term Refinance Worksheet. i. Streamline Worksheet . i. HUD-VA 92900-A Uniform Residential Loan Application. i. Complete the HUD Addendum to the 1003 (Form HUD-92900-A) i. Order FHA Case Number. 203(k) Forms. CLICK ON THE DOCUMENT ICON TO VIEW THE FILE _____ i. Borrower's … Chapter 4 Credit UnderwritingOverview - Veterans Affairs b. Debt-to Income Ratio. VA’s debt-to-income ratio is a ratio of total monthly debt payments (housing expense, installment debts, and other obligations listed in section D of VA Form 26-6393, Loan Analysis, to gross monthly income. It is a guide and, as an underwriting factor, it is secondary to the residual income. It should not ... Single-Family Homepage | Fannie Mae *New income values are only supported by DU and should not be sent for FHA or VA loans. **Net Rental Income can be entered in the Income or REO segment. Please review the information on page 65, Net Rental Income. F3 = Military Hazard Pay 02 = Military Clothes Allowance 04 = Military Quarters Allowance 03 …

What Is A Tangible Net Benefit? - Rocket Mortgage 27/01/2022 · VA loans have a tangible net benefit calculation that applies to many of their transactions. For the VA policy not to apply, a homeowner must have 10% equity or more. In all other rate/term (excluding VA streamlines, which we’ll get into below) and cash-out transactions, one of the following must happen to pass the test: Single-Family Homepage | Fannie Mae All other housing allowances should be entered as other income in Section V. For a VA loan, the dollar amount from the MCC should be entered in this field as a monthly amount. The amount of the MCC will be added to the residual income, subject to the $2000 annual ($167 monthly) limit. Format: Z(12).Z(2) Updated Ability-To-Repay and Qualified Mortgage ... 25/09/2020 · This Regulatory Alert supersedes and replaces Regulatory Alert 14-RA-01 (January 2014), to clarify the points and fees limit for each loan amount threshold and types of charges included in the calculation. This Regulatory Alert also references updated guidance for implementing the requirements of the rule.Dear Board of Directors and Chief Executive Officer:

0 Response to "43 Va Residual Income Calculation Worksheet"

Post a Comment