40 medicare cost report worksheet a

Medicare Plan F | Why Boomers Prefer Plan F | Medicare ... Medicare Plan F cost varies by several factors. Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we find pricing around $130 to $140 a month for a female turning 65, but it’s always important to get quotes for Medicare Plan F cost in your area. FEGLI Calculator - U.S. Office of Personnel Management Enter the information below and click on the Calculate button to get a report on those choices. You may want to look at your paystub or the FEGLI code on a Notification of Personnel Action (SF 50) and model the actual FEGLI coverage you currently have. You can then change your choices to see what difference the change(s) would make on the ...

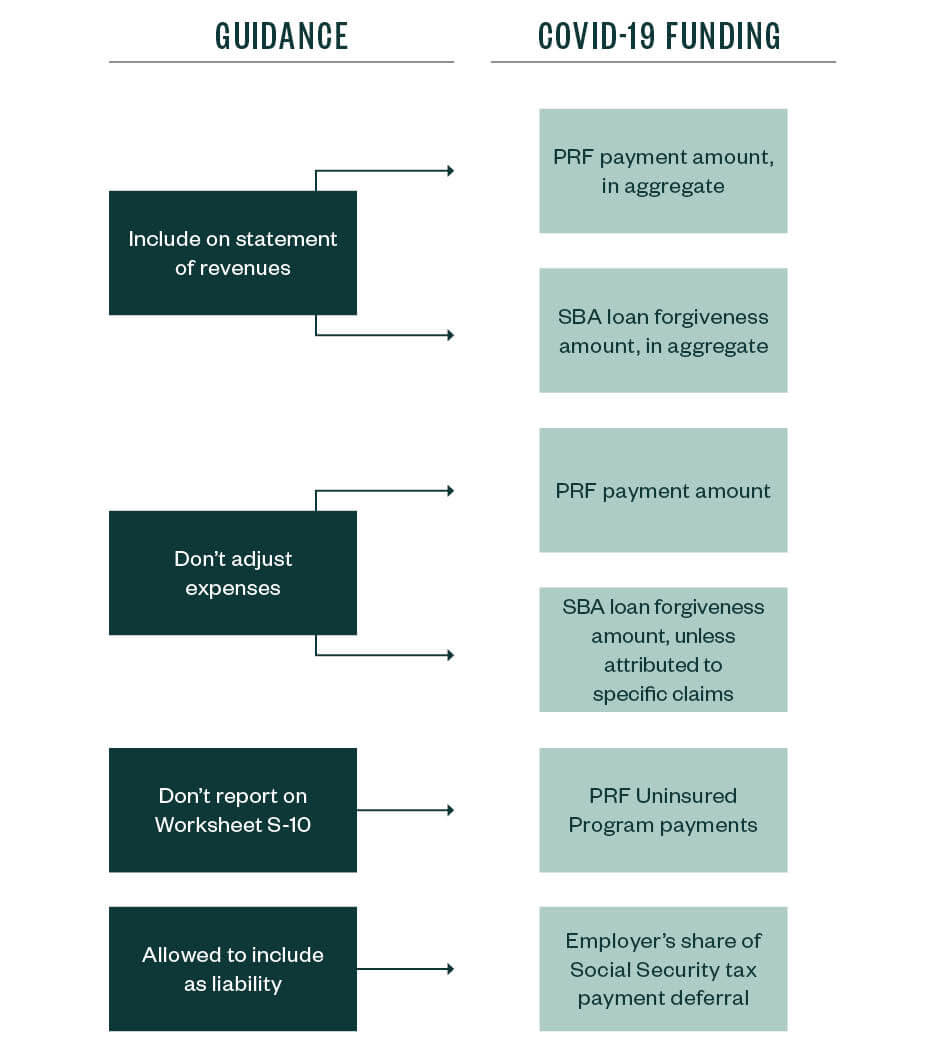

Reviews of Cost Report Worksheet S-10 | CMS Overview In the Fiscal Year (FY) 2018 Inpatient Prospective Payment System (IPPS) Final Rule, CMS finalized that uncompensated care data from the Medicare Cost Report Worksheet S-10 would be incorporated into Factor 3 of the Disproportionate Share Hospital Uncompensated Care Payment (DSH UCP). This payment methodology continued with the FY 2019 IPPS Final Rule, and was also proposed in the FY ...

Medicare cost report worksheet a

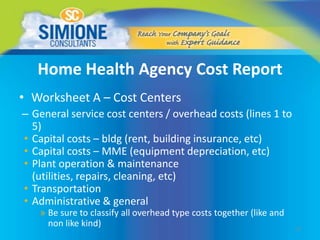

Instructions for Form 8889 (2021) | Internal Revenue Service Report health savings account (HSA) contributions (including those made on your behalf and employer contributions), Figure your HSA deduction, Report distributions from HSAs, and. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Additional information. See Pub. 969, Health Savings Accounts and Other Tax … PDF 3604. WORKSHEET S-2 - Cost Report Data 3604. WORKSHEET S-2 - HOSPITAL AND HOSPITAL HEALTH CARE COMPLEX ... and participates in the Medicare program or is a Federally controlled institution approved by CMS. ... for cost reporting periods beginning on or after July 1, 2002, Medicare swing-bed services will be PPTX Medicare Cost Report Basics - neohfma.org Medicare Cost Report Worksheets WS S Series - Settlement, questionnaire, statistics, days, discharges, wage index, and uncompensated care information WS A Series - Trial balance of expenses grouped by cost center WS B Series - Allocation of overhead expenses to routine, ancillary, and other departments

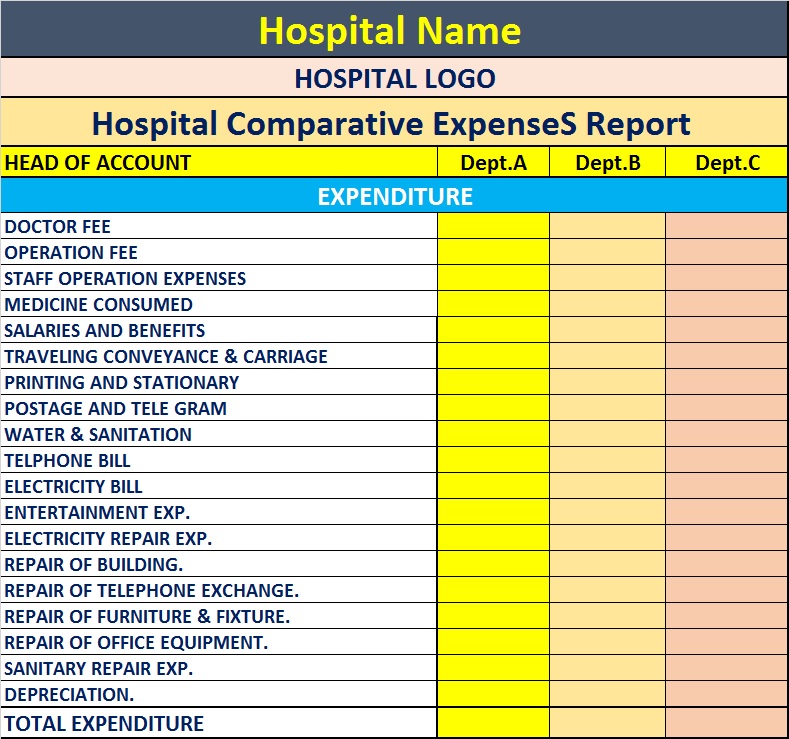

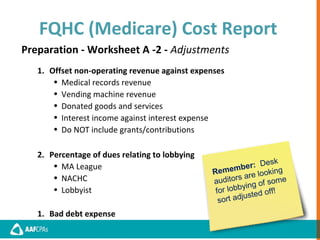

Medicare cost report worksheet a. PDF Cost Reporting 101: A Crash Course in the Basics Worksheet A-8: Adjustments to Expenses This worksheet provides for adjustments to remove nonallowable expenses and offset nonpatient care revenue Adjustments increase or decrease reimbursable costs Medicare assumes that nonpatient service revenue is equal to the cost of the service provided medicare.fcso.com This website provides information and news about the Medicare program for health care professionals only.All communication and issues regarding your Medicare benefits are handled directly by Medicare and not through this website. For the most comprehensive experience, we encourage you to visit Medicare.gov or call 1-800-MEDICARE. In the event your provider fails … PDF Medicare Cost Report Preparation - HFMA NJ Worksheet A Expenses Purpose: To determine Medicare allowable costs by cost center and to insure proper mapping of expenses to the appropriate cost center. If there are new departments, determine correct inclusion in a cost center based on department description. PDF Introduction to Medicare Cost Reports - ResDAC Medicare Cost Reports The worksheets collect the following types of information: ˗ Facility characteristics (ownership status, type of facility) ˗ Statistical ˗ Financial ˗ Cost ˗ Charge ˗ Wage Index information 6 . Medicare Cost Reports 7 Example of Hospital Form 2552-10, Worksheet S-3, Part I .

News | AHA - American Hospital Association 02/03/2022 · The American Hospital Association (AHA) is the national organization that represents and serves all types of hospitals, health care networks, and their patients and communities. Nearly 5,000 hospitals, health care systems, networks, other providers of care and 43,000 individual members come together to form the AHA. Our vision is of a society of healthy … Cost Report Data - Cost Report Data provides hospital ... 01/12/2020 · CostReportData.com provides online Medicare cost report data to healthcare financial and reimbursement professionals. Our database of more than 6,000 hospitals is built from Medicare cost report information obtained from the federal Centers for Medicare and Medicaid Services (CMS) for all reporting periods since 1996. Cost Report 201 - Worksheet A6 Reclassifications [PODCAST] As we continue exploring best practices for preparation of the Medicare Cost Report, I'm joined today by Andrew Kinnaman, a Reimbursement Manager on our reimbursement services team here at BESLER. And Andrew is going to be talking with us about Worksheet A6 reclassifications on the cost report. Andrew, welcome back to the show. Hospital 2552-2010 form | CMS - Centers for Medicare ... Hospital 2552-10 Cost Report Data files. The data included in this release contains cost reports with fiscal years beginning on or after May 1, 2010 . Hospital cost reports beginning before May 1, 2010 are reported on the old form 2552-96, and can be found in other data files on this site.

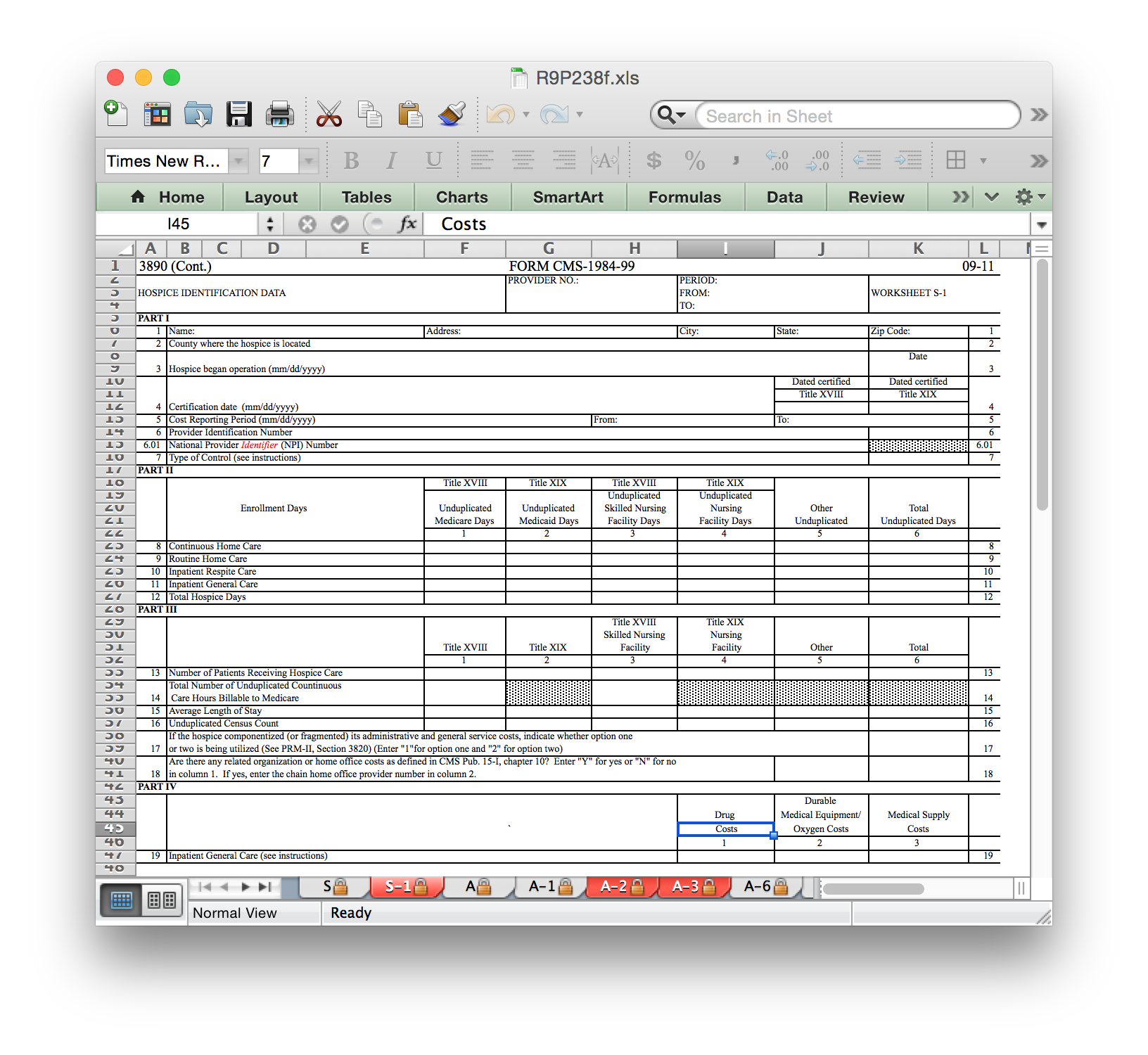

Medicare Cost Report 101 medicare cost report overview. 10/19/18 8 question ... •fully allocated costs from worksheet b, part i are divided by total charges on worksheet c to arrive at ccr for each ancillary cost center PDF Medicare - hhs.gov 4306. WORKSHEET S - HOSPICE COST AND DATA REPORT . 4306.1 Part I Cost Report Status- --This section is completed by the provider contractor as or indicated on the worksheet. Provider use only--The provider completes lines 1 through 4. Line 1 --In column 1, enter " Y" for yes if the cost report is electronically prepared (an ECR created PDF Medicare The CMHC cost report must be submitted to your Medicare administrative contractor (MAC) (hereafter referred to as contractor) electronically in accordance with 42 CFR 413.24(f)(4). The CMHC cost report provides for the determination of allowable costs which are reasonable and necessary and the calculation of an overall cost -to-charge ratio (CCR). Updates to Medicare's Cost Report Worksheet S-10 to ... Updates to Medicare's Cost Report Worksheet S-10 to Capture Uncompensated Care Data. This article is intended to provide additional guidance to 1886(d) hospitals by summarizing revisions and clarifications to the instructions for the Worksheet S-10 of the Medicare cost report. Download the Guidance Document

Publication 575 (2021), Pension and Annuity Income | Internal ... If you make this election, reduce the otherwise taxable amount of your pension or annuity by the amount excluded. The amount shown in box 2a of Form 1099-R doesn't reflect this exclusion. Report your total distributions on Form 1040, 1040-SR, or 1040-NR, line 5a. Report the taxable amount on Form 1040, 1040-SR, or 1040-NR, line 5b.

Worksheet Formats - Cost Report Data Worksheet formats are based on information supplied by the Centers for Medicare and Medicaid Services (CMS).Forms and instructions can be downloaded from the CMS website and are presented here as a convenient reference. * Worksheets which are not yet available on CostReportData.com have been marked with an asterisk. Please contact us if there is a specific sheet to be requested, as an addition ...

PDF Updates to Medicare's Cost Report Worksheet S-10 to ... revisions and clarifications to the instructions for the Worksheet S-10 of the Medicare cost report. The Worksheet S-10 data is used in the computation of Factor 3 in the calculation of the uncompensated care payment for 1886(d) hospitals under the Social Security Act (SSA) eligible to receive such payments.

PDF 2022 Medicare Costs.

PDF 3613. Worksheet A-8 - Adjustments to Expenses costs should include the cost of th e drugs Epoetin and Aranesp. Do not report the cost of these drugs claimed in any other cost center. These costs will be removed later on Worksheet B-2 (10/00). If the hospital is paying membership dues to an organization which perform lobbying and political

PDF Understanding the Medicare Cost Report - 340BPVP 03-18 FORM CMS-2552-10 4090 (Cont.) This report is required by law (42 USC 1395g; 42 CFR 413.20(b)). Failure to report can result in all interim FORM APPROVED payments made since the beginning of the cost reporting period being deemed overpayments (42 USC 1395g).

PDF Worksheet S-10 - Centers for Medicare & Medicaid Services parts of the cost report (e.g. cost-to-charge ratio, Medicare bad debts). These have material impacts on the Worksheet S-10 Line 30. When we amend the cost report on or before January 2, 2018 (which is a full re-submission of the cost report), are we permitted to adjust parts of the cost reports that flow through to S-10 (i.e. if we have ...

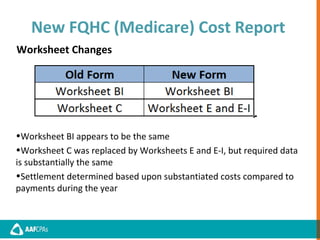

PDF Medicare The FQHC cost report must be submitted to the Medicare administrative contractor (hereafter referred to as contractor) electronically in accordance with 42 CFR 413.24f)(4).( Cost reports are due on or before the last day of the fifth month following the close of the period covered by the report. For cost reports ending on a day

PDF Medicare Cost Report, Form CMS-222-17, by revising existing edits, creating new edits, updating and references. Revisions include: • Worksheet S, Part I: • Revised the check box option to read "Electronically prepared cost report" and "Manually prepared cost report," on the worksheet and in the instructions.

PDF Cost Reporting - The Basics the RHC Cost Report Medicare Bad Debt ... appropriate cost centers Worksheet A-2: Used to include additional or exclude non-allowable costs Health Services Associates, Inc. Lab/X-ray/EKG Allocations Worksheet A-1 Lab, X-ray, EKG

Rates Information | Washington State Health Care Authority Employer's Payment for Health Care Benefits (Cockle Rates) PEBB Program rates State agencies, four-year higher education institutions, community and technical colleges and commodity commissions 2022 January-June 2021 July-December 2021 January - June 2020 July - December 2020 January - June 2019 July - December 2019 January - June 2018 July - December 2018 January - June 2017

Disproportionate Share Hospital (DSH) | CMS We provide a link to the final report and supplemental data in the downloads section below. Note to Providers: May 3, 2010: CMS published CMS Ruling "CMS-1498-R" pertaining to three Medicare Disproportionate Share Hospital (DSH) issues. Specifically, the Ruling addresses jurisdictionally proper pending appeals and open cost reports on the issues of Medicare non …

MLN006398 - Rural Health Clinic - Centers for Medicare ... their administration at 100% of reasonable cost. RHCs report these services on a separate cost report . worksheet. RHCs shouldn’t report these services on their RHC billing claims. Note: We updated the RHC cost report to reflect costs related to COVID-19 shots and COVID-19 monoclonal antibody products and their administration.

PPTX Medicare Cost Report Basics - neohfma.org Medicare Cost Report Worksheets WS S Series - Settlement, questionnaire, statistics, days, discharges, wage index, and uncompensated care information WS A Series - Trial balance of expenses grouped by cost center WS B Series - Allocation of overhead expenses to routine, ancillary, and other departments

PDF 3604. WORKSHEET S-2 - Cost Report Data 3604. WORKSHEET S-2 - HOSPITAL AND HOSPITAL HEALTH CARE COMPLEX ... and participates in the Medicare program or is a Federally controlled institution approved by CMS. ... for cost reporting periods beginning on or after July 1, 2002, Medicare swing-bed services will be

Instructions for Form 8889 (2021) | Internal Revenue Service Report health savings account (HSA) contributions (including those made on your behalf and employer contributions), Figure your HSA deduction, Report distributions from HSAs, and. Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Additional information. See Pub. 969, Health Savings Accounts and Other Tax …

![Medicare Cost Report Worksheet S-10 Explained [PODCAST]](https://i.ytimg.com/vi/Fxs7qsYS_oU/maxresdefault.jpg)

0 Response to "40 medicare cost report worksheet a"

Post a Comment