42 schedule d tax worksheet 2014

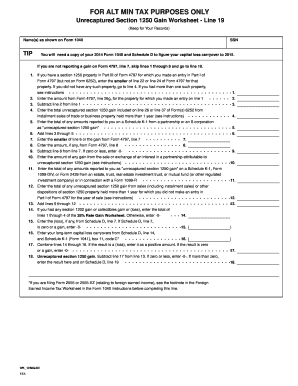

Form 6251 - Alternative Minimum Tax - Individuals (2014 ... Form 6251 (2014) Page 2. Part III. Tax Computation Using Maximum Capital Gains Rates. Complete Part III only if you are required to do so by line 31 or by the Foreign Earned Income Tax Worksheet in the instructions. 36. Enter the amount from Form 6251, line 30. If you are filing Form 2555 or 2555-EZ, enter the amount from. How to Fill Out a Schedule D Tax Worksheet | Finance - Zacks Schedule D contains different worksheets that you may need to complete, including the Capital Loss Carryover Worksheet, 28% Rate Gain Worksheet and Unrecaptured Section 1250 Gain Worksheet. Each of...

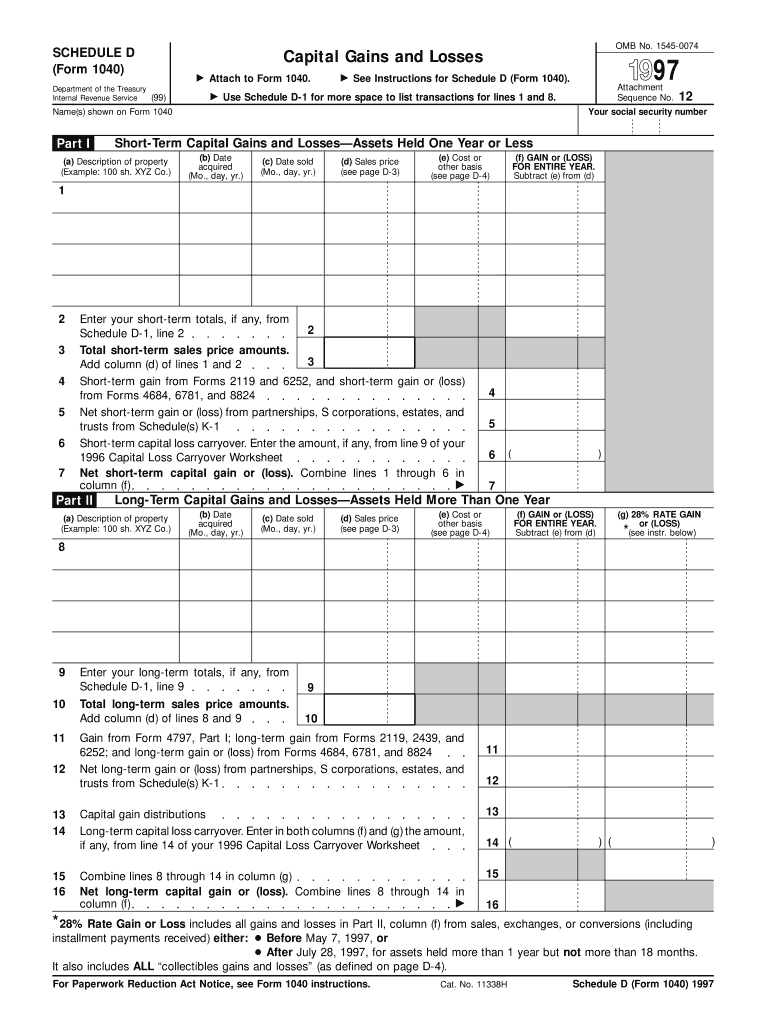

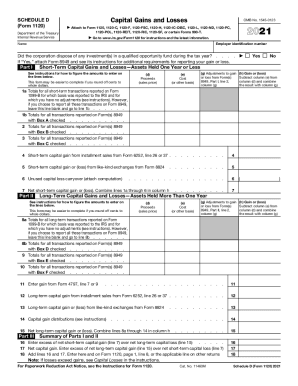

Prior Year Products - IRS tax forms 2020. Form 1040 (Schedule D) Capital Gains and Losses. 2019. Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses. 2019. Form 1040 (Schedule D) Capital Gains and Losses.

Schedule d tax worksheet 2014

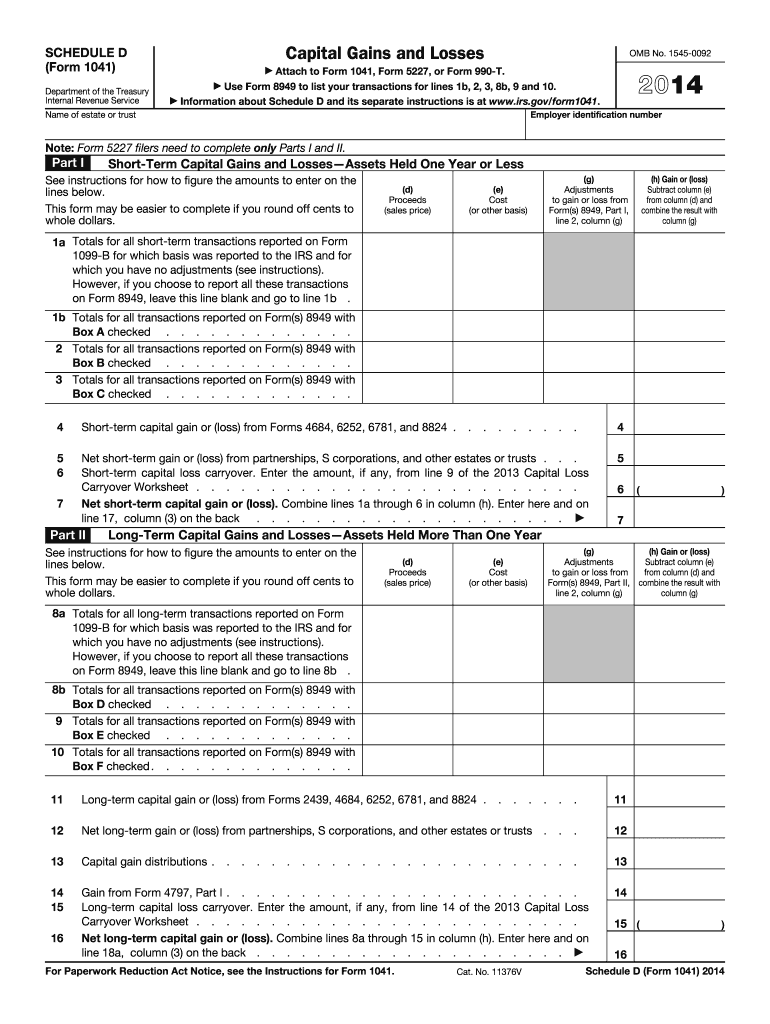

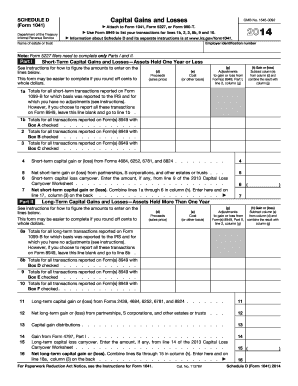

PDF 2014 Net Profit Tax Worksheets - Phila WORKSHEETS D, E, K and EXTENSION 2014 NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return. WORKSHEET D: ALLOCATION OF BUSINESS INCOME & RECEIPTS TAX CREDIT FOR PARTNERSHIPS, ETC., WITH CORPORATE MEMBERS (THIS SCHEDULE IS TO BE USED ONLY BY PARTNERSHIPS, JOINT VENTURES AND ASSOCIATIONS Changes to the 1040 Schedule D Will Make the 2014 Filing ... For the 2014 filing season, direct reporting on Schedule D is allowed. Taxpayers will be able to combine qualifying transactions and report the totals directly on Schedule D. If they choose to report in this manner, they do not need to include these transactions on Form 8949. › instructions › i1041sdInstructions for Schedule D (Form 1041) (2021) - IRS tax forms Dec 31, 2020 · Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if Schedule D, line 20 is a loss and (a) the loss on Schedule D, line 19, col. (3) is more than $3,000 or (b) Form 1041, page 1, line 23 is a loss.

Schedule d tax worksheet 2014. 2016 Form 568 Limited Liability Company Tax Booklet Instructions for Schedule IW, LLC Income Worksheet 14 Instructions for Schedule K (568) and Schedule K-1 (568) 18 Federal/State Line References Chart 23. Form 568 . 25. Schedule IW, Limited Liability Company Income Worksheet . 31. Schedule K-1 (568) 33. Schedule EO (568) 37 Instructions for Schedule EO (568) 38. Schedule D (568) 39 Instructions for Schedule D … Schedule D - Viewing Tax Worksheet - TaxAct Click the Forms button in the top left corner Expand the Federal folder, and then expand the Worksheets folder Scroll down and double click Schedule D Tax Worksheet - Tax Worksheet - Line 20 Click on the pink Printer Icon above the worksheet to print. You are able to choose if you wish to send the output to a printer or a PDF document. Instructions for Schedule D (Form 1120-S ... - IRS tax forms 31.12.2020 · Enter the amount from line 28 of Form 1120 on line 17 of Schedule D. Attach to Schedule D the Form 1120 computation or other worksheet used to figure taxable income. For corporations figuring the built-in gains tax for separate groups of assets, taxable income must be apportioned to each group of assets in proportion to the net recognized built-in gain for each … Untitled 65 2014 estimated tax payments and amount applied from 2013 return ... Information about Schedule D and its separate instructions is at ...64 pages

2014 Business Income & Receipts Tax (BIRT) forms ... Instructions for filing the 2014 Business Income and Receipts Tax and Net Profits Tax. Use this form to file 2014 Business Income & Receipts Tax (BIRT). This form includes Schedules B, C-1, D, A, and E. Use this form to file 2014 Business Income & Receipts Tax (BIRT) if 100% of your business was conducted in Philadelphia. Illinois Schedule ICR (Illinois Tax Credits) - 2021 ... 4c d Enter the county and property number of another adjoining lot, if included in Line 4a. 4d e E nter the portion of your tax bill that is deductible as a business expense on U.S. income tax forms or schedules, even if you did not take the federal deduction. f Subtract Line 4e from Line 4a. g Multiply Line 4f by 5% (.05). 5 Compare Lines 3 and 4g, and enter the lesser amount here. 6 … PDF 2014 Instruction 1040 - TAX TABLE - IRS tax forms Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only. PDF Optional Worksheet for Calculating Call Report Applicable ... Section in Washington, D.C. (800-688-FDIC). Alternative minimum tax - This optional worksheet is designed to assist in the calculation of an institution's applicable income taxes under the regular tax system. Some institutions may be subject to higher income taxes under the alternative minimum tax (AMT) system.

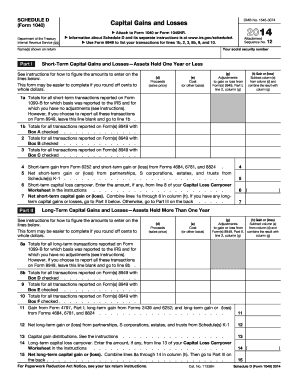

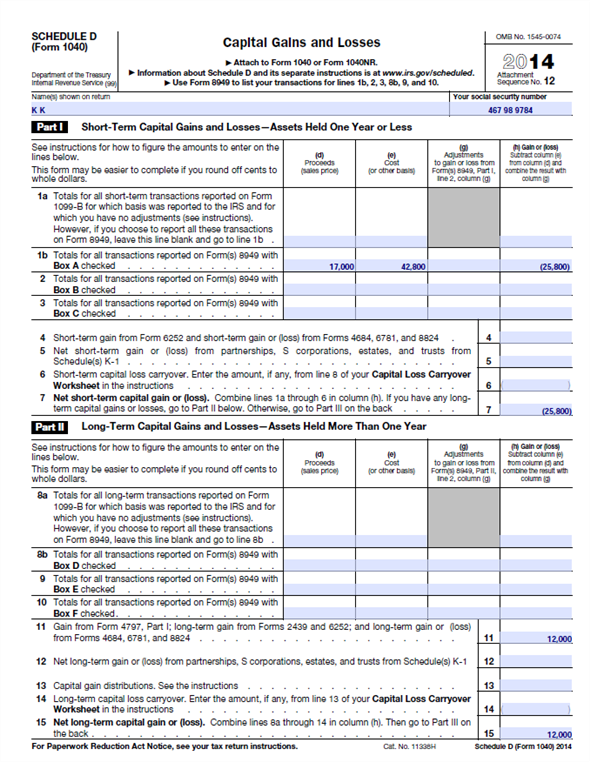

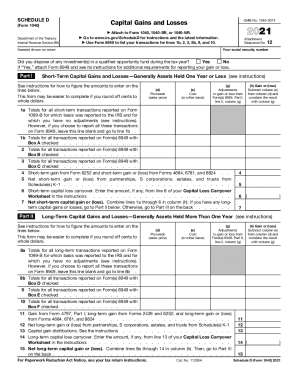

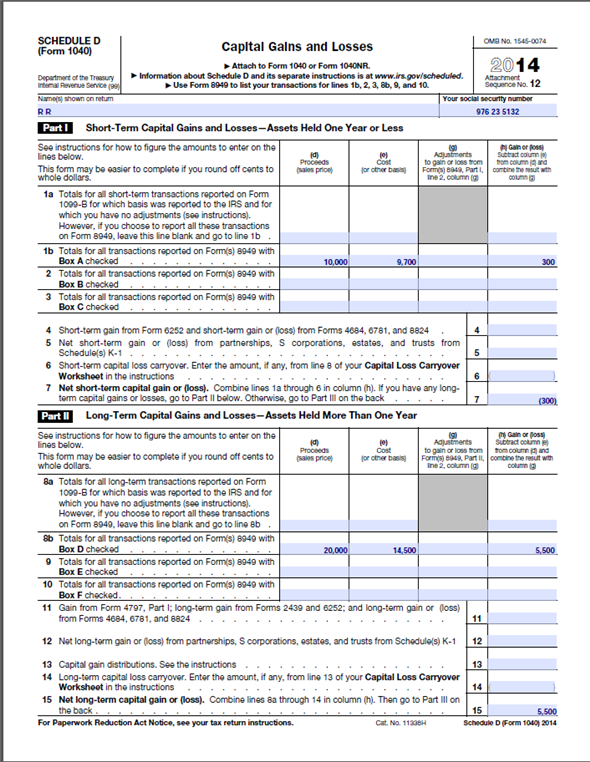

Federal 1040 (Schedule D) (Capital Gains and Losses ... More about the Federal 1040 (Schedule D) Individual Income Tax TY 2021 We last updated the Capital Gains and Losses in January 2022, so this is the latest version of 1040 (Schedule D) , fully updated for tax year 2021. Schedule D Tax Worksheet - ttlc.intuit.com Schedule D Tax Worksheet. Line 44 of the Schedule D Tax Worksheet (page D-17) is computed using the 2019 Tax Computation Worksheet. The 2019 Tax Computation Worksheet can be found on page 253 of IRS publication 17. **Say "Thanks" by clicking the thumb icon in a post. 2014 Instructions for Schedule D - Capital Gains and Losses 2014 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949, Federal 1041 (Schedule D) (Capital Gains and Losses ... More about the Federal 1041 (Schedule D) Corporate Income Tax TY 2021 We last updated the Capital Gains and Losses in January 2022, so this is the latest version of 1041 (Schedule D) , fully updated for tax year 2021.

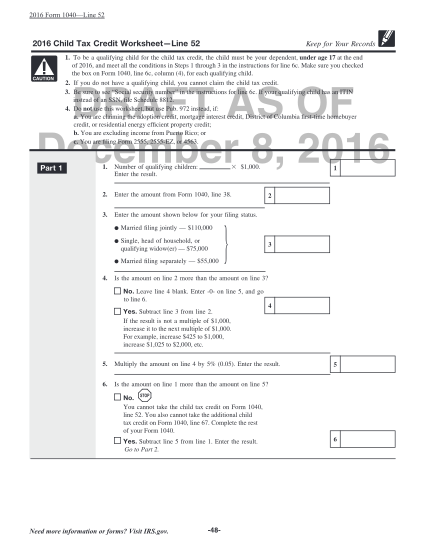

2014 Qualified Dividends and Capital Gain Tax Worksheet ... 2014 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

2021 Schedule D Form and Instructions (Form 1040) The IRS Schedule D form and instructions booklet are generally published in December of each year. If published, the 2021 tax year PDF file will display, the prior tax year 2020 if not. Last year, many of the federal income tax forms were published late in December, with instructions booklet following in early January due to last minute ...

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box

Schedule D - Viewing Tax Worksheet - TaxAct If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D, according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. To view the tax calculation on the Schedule D Tax Worksheet which will show the calculation of the tax which ...

10 of the Schedule D Tax Worksheet as refigured for the ... 10 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555 or Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 14 of the Schedule D Tax Worksheet in the instructions for Schedule D (Form 1040), whichever applies (as figured for the regular tax).

North Carolina Form D-400 Instructions | eSmart Tax 01.01.2012 · Tax Rate Schedule. Use the Tax Rate Schedule on Page 30 to calculate your tax if your taxable income is $68,000 or more. Enter the amount on Line 18. Line 19 - Tax Credits. See Page 16 for information about tax credits. Complete Form D-400TC, Individual Tax Credits, if you are entitled to one or more of the credits. Line 21 - Consumer Use Tax

1040 (2021) | Internal Revenue Service - IRS tax forms Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for ...

Reproducible Copies of Federal Tax Forms and Instructions United States. Internal Revenue Service · 2014 · Income taxWas age 18 at the end of 2014 and did not have earned income that was more ... 19 of Schedule D is more than zero , use the Schedule D Tax Worksheet in the ...

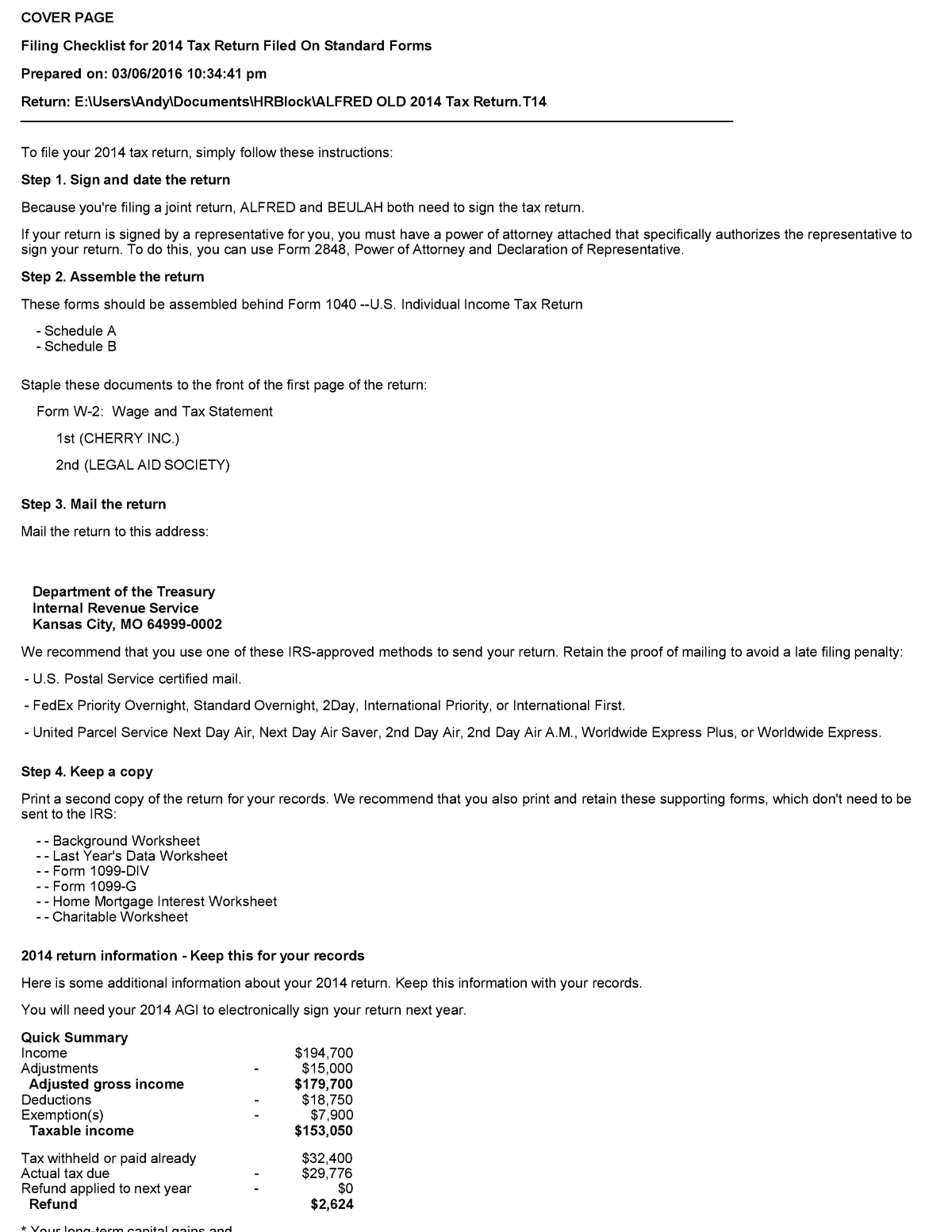

Use Excel to File Your 2014 Form 1040 and Related ... The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss.

Schedule D Tax Worksheet 2015 - worksheet Schedule d tax worksheet 2015. Complete form 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d. Before completing this worksheet complete form 1040 through line 43. 2015 tax computation worksheet. Tax computation worksheet form 1040 instructions html. This form may be easier to complete if you round off cents to whole dollars.

› pub › irs-pdf2021 Schedule K-1 (Form 1041) - IRS tax forms Schedule K-1 (Form 1041) 2021 Beneficiary’s Share of Income, Deductions, Credits, etc. Department of the Treasury Internal Revenue Service See back of form and instructions. OMB No. 1545-0092 . 661117 . Final K-1. Amended K-1For calendar year 2021, or tax year beginning / ending / / Part I Information About the Estate or Trust . A

IRS 1040 - Schedule D 2019 - Fill and Sign Printable ... schedule d worksheet rating ... Tax form 1040 Schedule D is used to report capital gains for the purpose of income tax. A capital gain is any profit made from the sale of an investment for more than the purchase price. ... 2014 IRS 1040 - Schedule D. 2013 IRS 1040 - Schedule D. 2012 IRS 1040 - Schedule D. 2011 IRS 1040 - Schedule D. 2010 IRS ...

Schedule K-1 (Form 1065) - Tax Exempt Income, Non ... This article focuses solely on the entry of the Tax Exempt Income, Non-Deductible Expenses, Distributions and Other Information.Learn more. These items are found on Box 18, Box 19 and Box 20 of the Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc.

How to Complete a Schedule D Form (with Pictures) - wikiHow Write your totals from Form 8949 on Schedule D. On Schedule D, you will have to fill out a section for short term and long term gains and losses. Here, you'll be transferring the total gain/loss for each asset you determined when filling out Form 8949. In both Section 1 and 2, the first lines on Schedule D regard your values from Form 8949.

Schedule D - Viewing Tax Worksheet Expand the Federal folder and then expand the Worksheets folder Scroll down and click Schedule D Tax Worksheet - Tax Worksheet - Line 20 Click Print and then click the worksheet name and the worksheet will appear in a PDF read-only format.

2019 Partnership Tax Booklet | California Forms ... For taxable years beginning on or after January 1, 2014, the IRS allows partnerships with at least $10 million but less than $50 million in total assets at tax year end to file Schedule M-1 (Form 1065) in place of Schedule M-3 (Form 1065), Parts II and III. However, Schedule M-3 (Form 1065), Part I, is required for these partnerships.

2021 Instructions for Schedule D (2021) - IRS tax forms Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

PDF 2014 z *149980110002 - Washington, D.C. 2014 SCHEDULE H WORKSHEET P3 Homeowner and Renter Property Tax Credit Revised 11/2014 *149980130002* z z z 2014 SCHEDULE H PAGE 3 Last name and SSN Federal Adjusted Gross Income of the tax fi ling unit (see instructions) - Report the AGI of every member of your tax fi ling unit, including income subject to federal but not DC income tax.

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Schedule D Tax Worksheet: in the instructions. Don't: complete lines 21 and 22 below. 21 : If line 16 is a loss, enter here and on Form 1040, 1040-SR, or 1040-NR, line 7, the ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR ...

PDF Capital Gains and Losses - IRS tax forms Schedule D Tax Worksheet: in the instructions. Do not: complete lines 21 and 22 below. 21 : If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, line 14, the : smaller : of: ... 2014 Form 1040 (Schedule D) Author: SE:W:CAR:MP Subject: Capital Gains and Losses

› instructions › i1041sdInstructions for Schedule D (Form 1041) (2021) - IRS tax forms Dec 31, 2020 · Use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if Schedule D, line 20 is a loss and (a) the loss on Schedule D, line 19, col. (3) is more than $3,000 or (b) Form 1041, page 1, line 23 is a loss.

Changes to the 1040 Schedule D Will Make the 2014 Filing ... For the 2014 filing season, direct reporting on Schedule D is allowed. Taxpayers will be able to combine qualifying transactions and report the totals directly on Schedule D. If they choose to report in this manner, they do not need to include these transactions on Form 8949.

PDF 2014 Net Profit Tax Worksheets - Phila WORKSHEETS D, E, K and EXTENSION 2014 NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return. WORKSHEET D: ALLOCATION OF BUSINESS INCOME & RECEIPTS TAX CREDIT FOR PARTNERSHIPS, ETC., WITH CORPORATE MEMBERS (THIS SCHEDULE IS TO BE USED ONLY BY PARTNERSHIPS, JOINT VENTURES AND ASSOCIATIONS

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

0 Response to "42 schedule d tax worksheet 2014"

Post a Comment