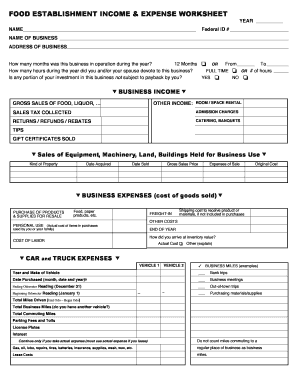

43 self employed business expenses worksheet

Self-Employed Business Expenses Worksheet Self-Employed Business Expenses Worksheet. Self-employment provides one with a lot of freedom; therefore, you may end up spending more than you are gaining. The business expense report will enable you to know how much you are paying by including all the expenses... LLC Income & Expense Tracking (& the difference from...) - YouTube Автор подсказки: Business Finance Coach. amandarussell.mba. Get the BUSINESS SPREADSHEET TEMPLATE.

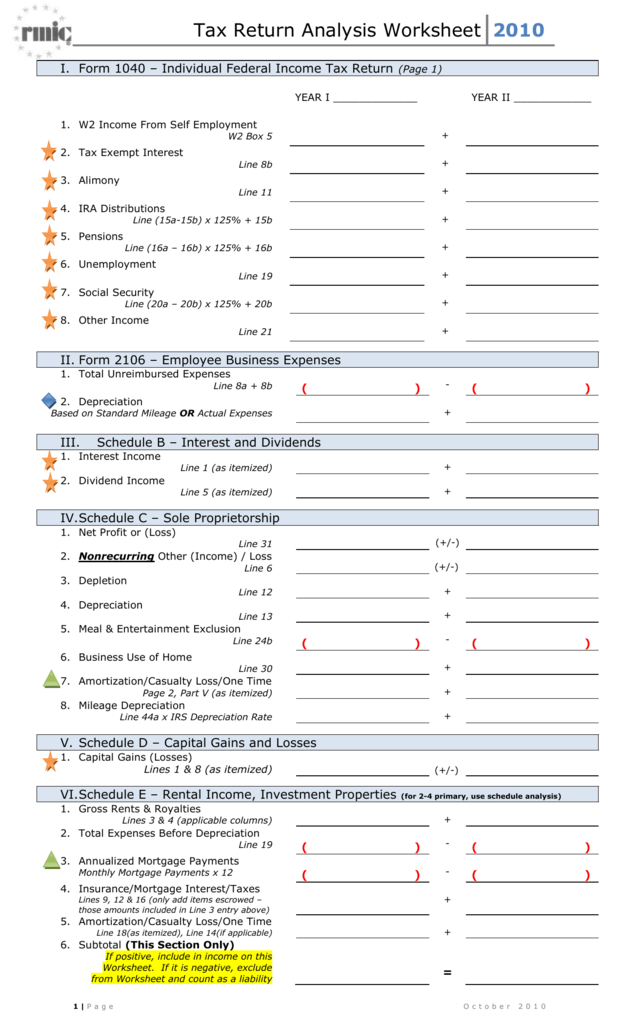

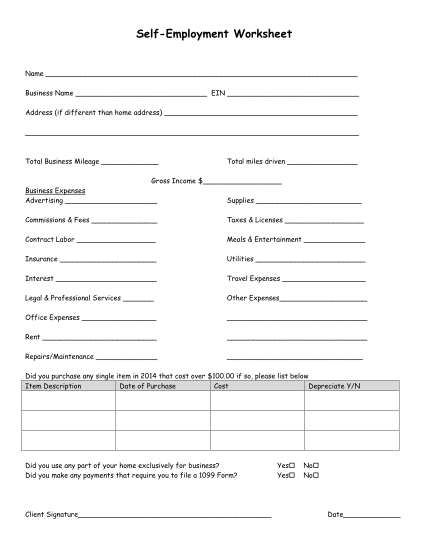

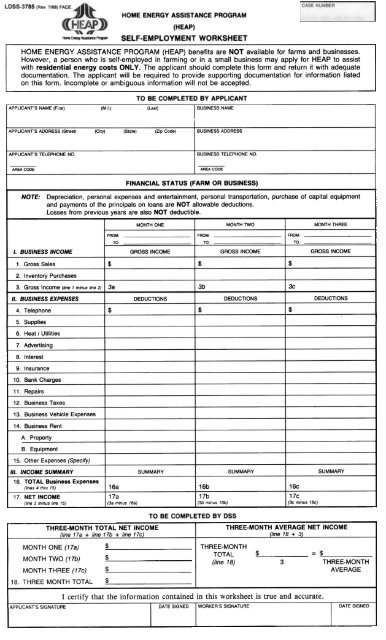

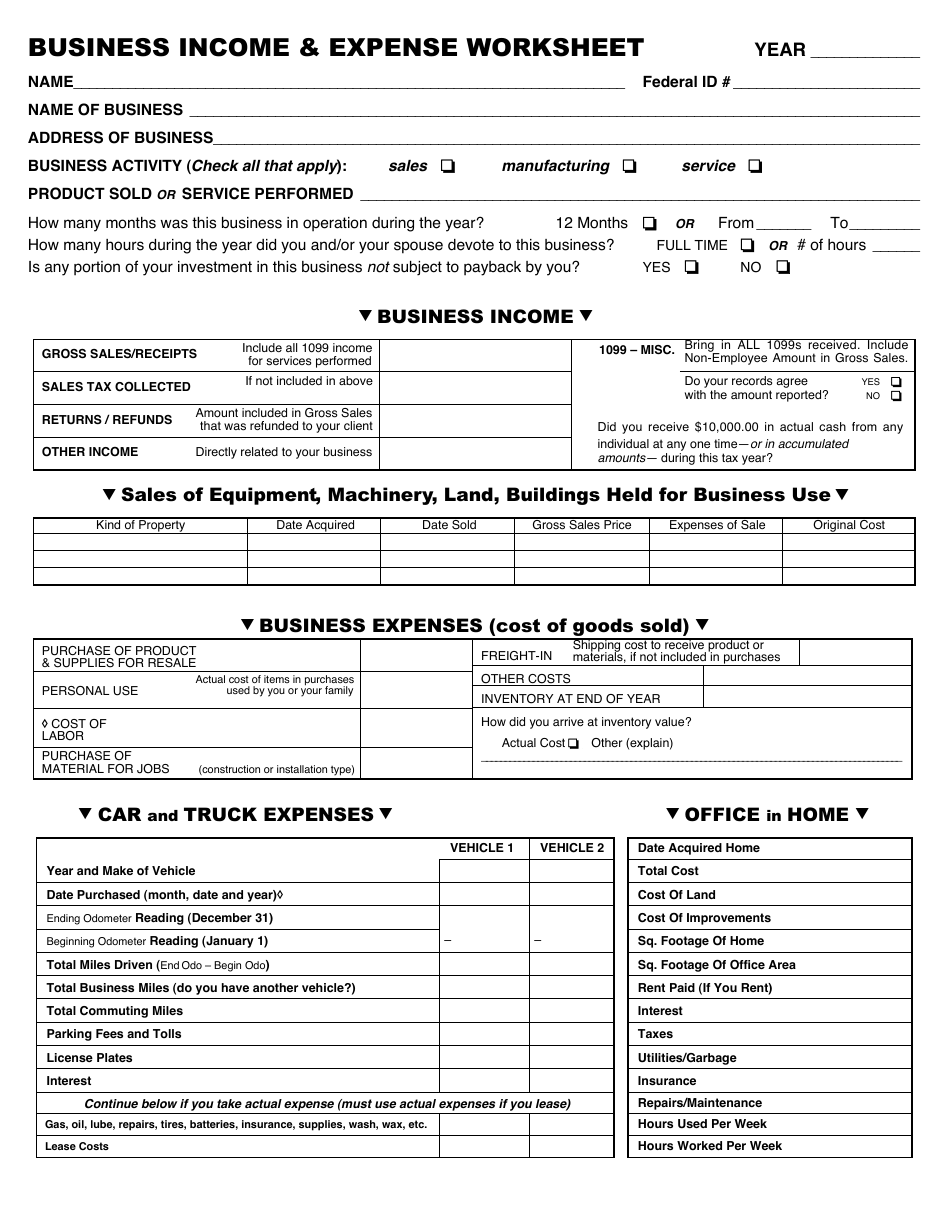

Self-Employed Business Expenses bSchedule Cb Worksheet for Self-Employment Worksheet - Hawkins Accounting Inc. Selfemployment worksheet name business name ein address (if different than home address) total business mileage total miles driven gross income $ business expenses advertising supplies commissions & fees taxes & licenses contract...

Self employed business expenses worksheet

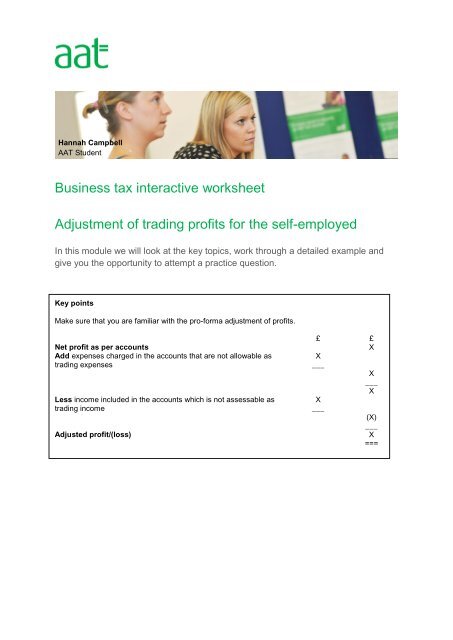

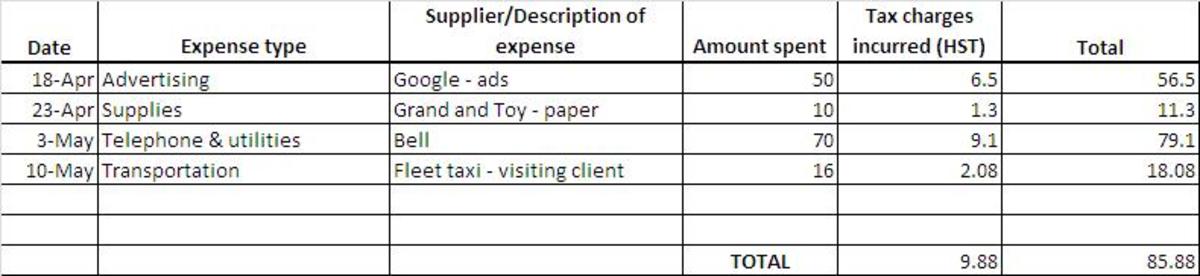

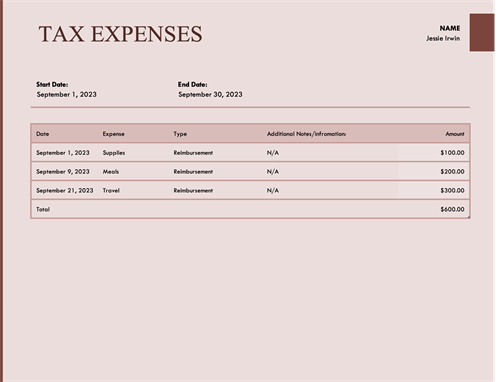

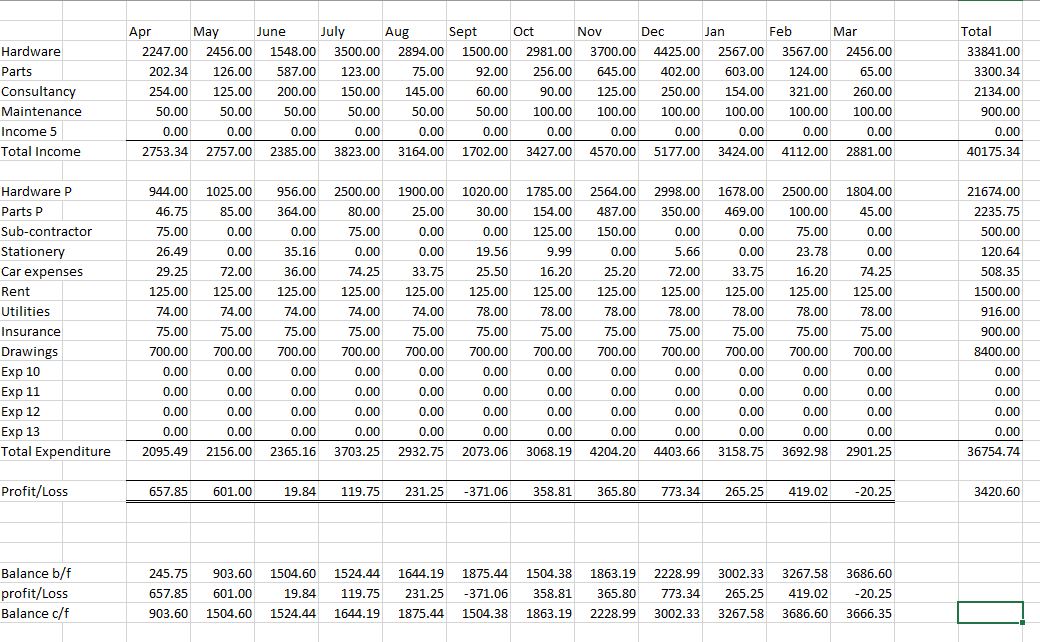

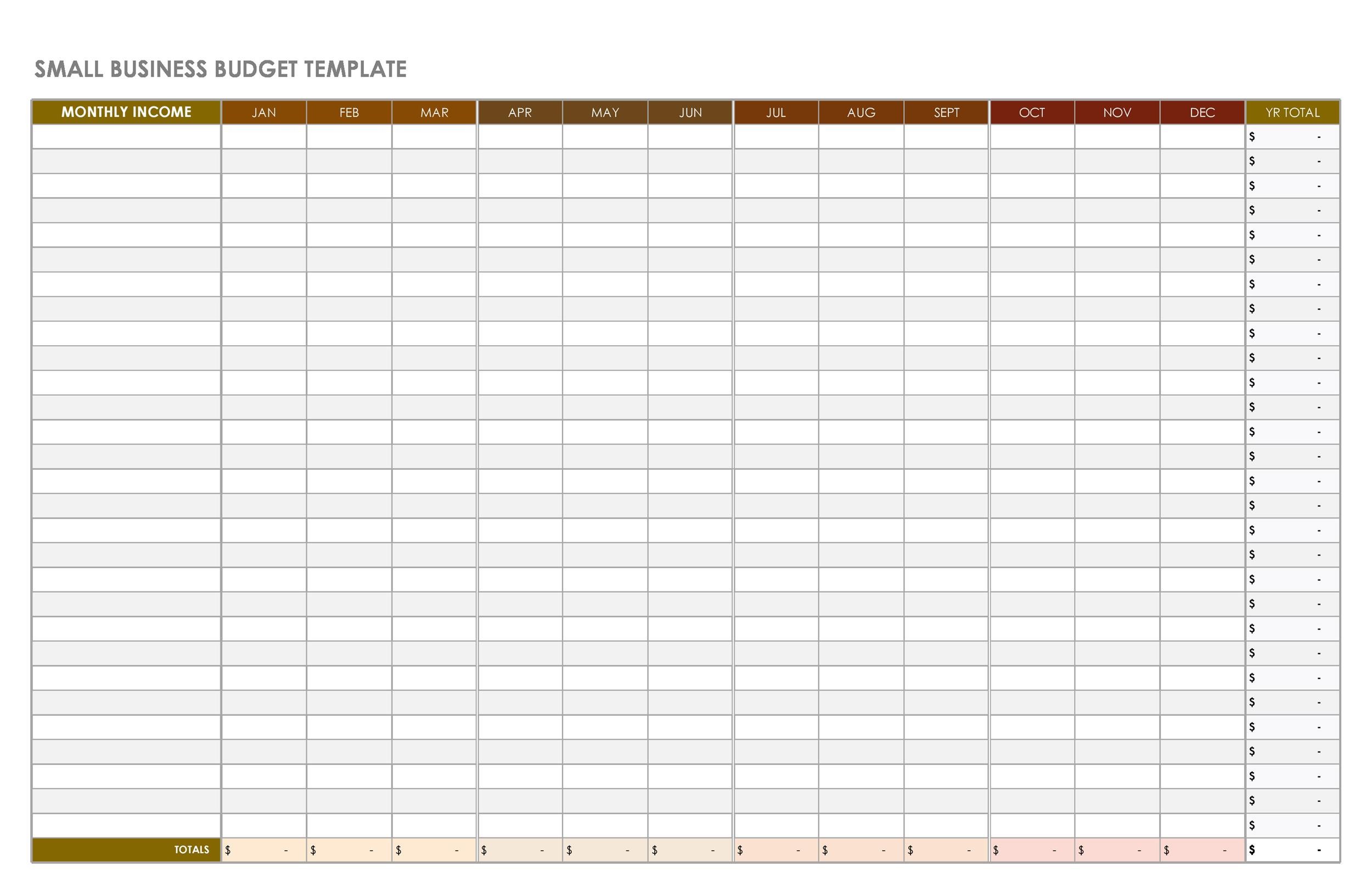

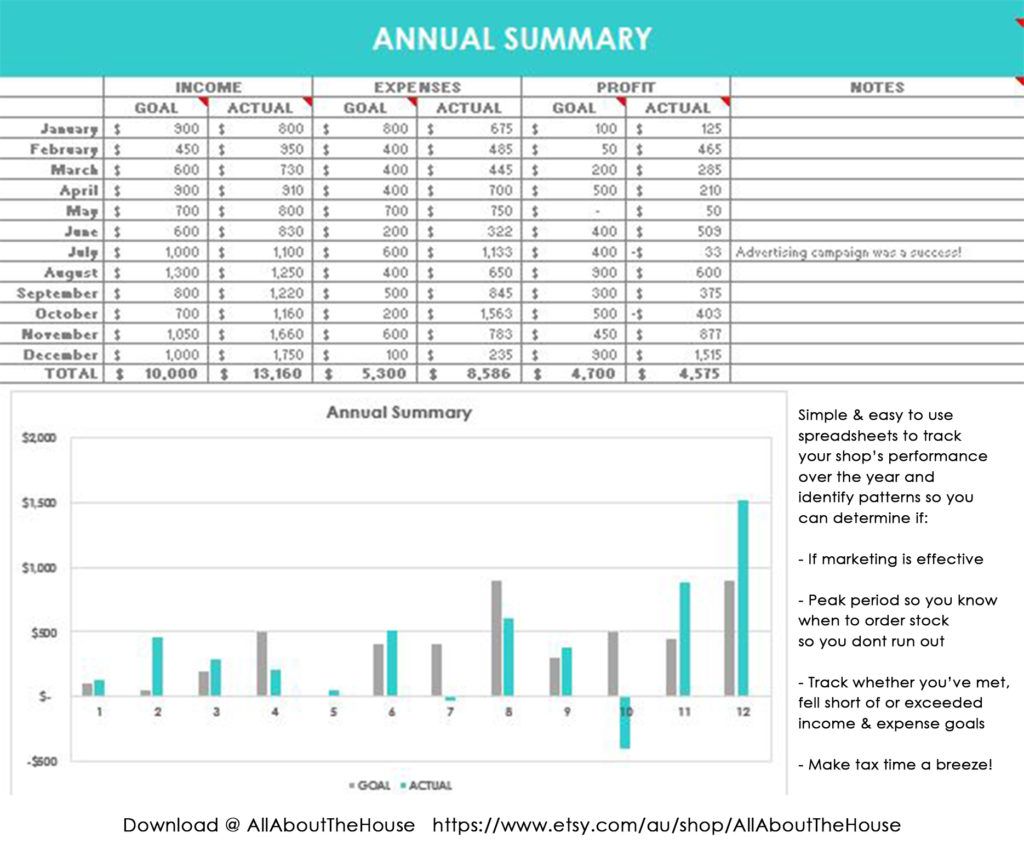

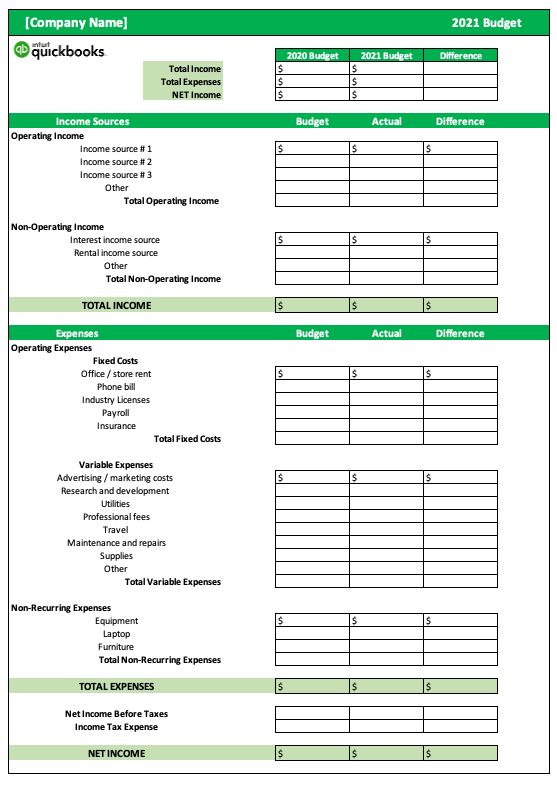

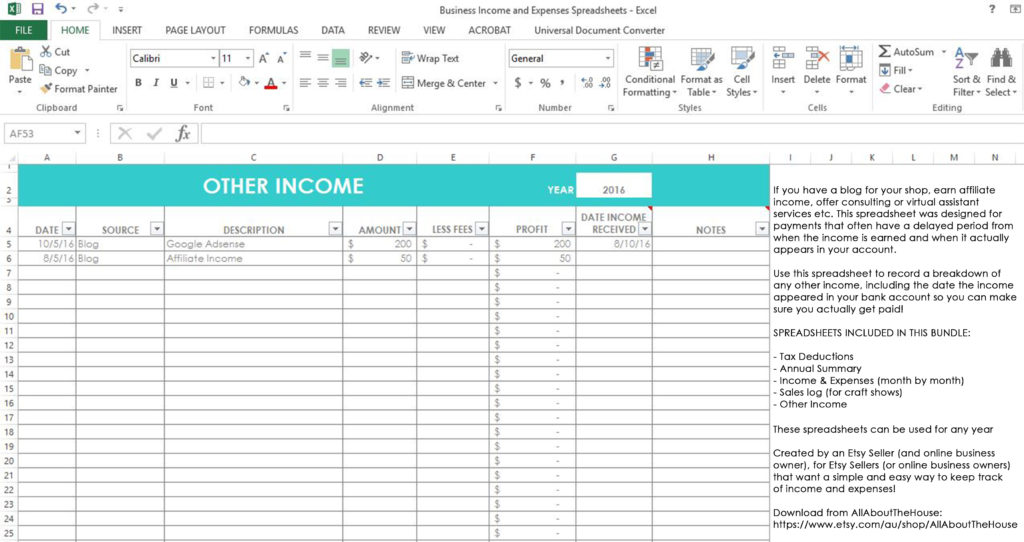

(Schedule C) Self-Employed Business Expenses Worksheet ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business.2 pages › files › 109128408Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, Free Excel Bookkeeping Templates | 3. Expense Form Template Small businesses starting up can take full advantage of Excel until they are in a position to afford bookkeeping software. The excel cash book is the simplest and easiest way to start recording and tracking your business income and expenses and bank balance, for your day to day bank accounts.

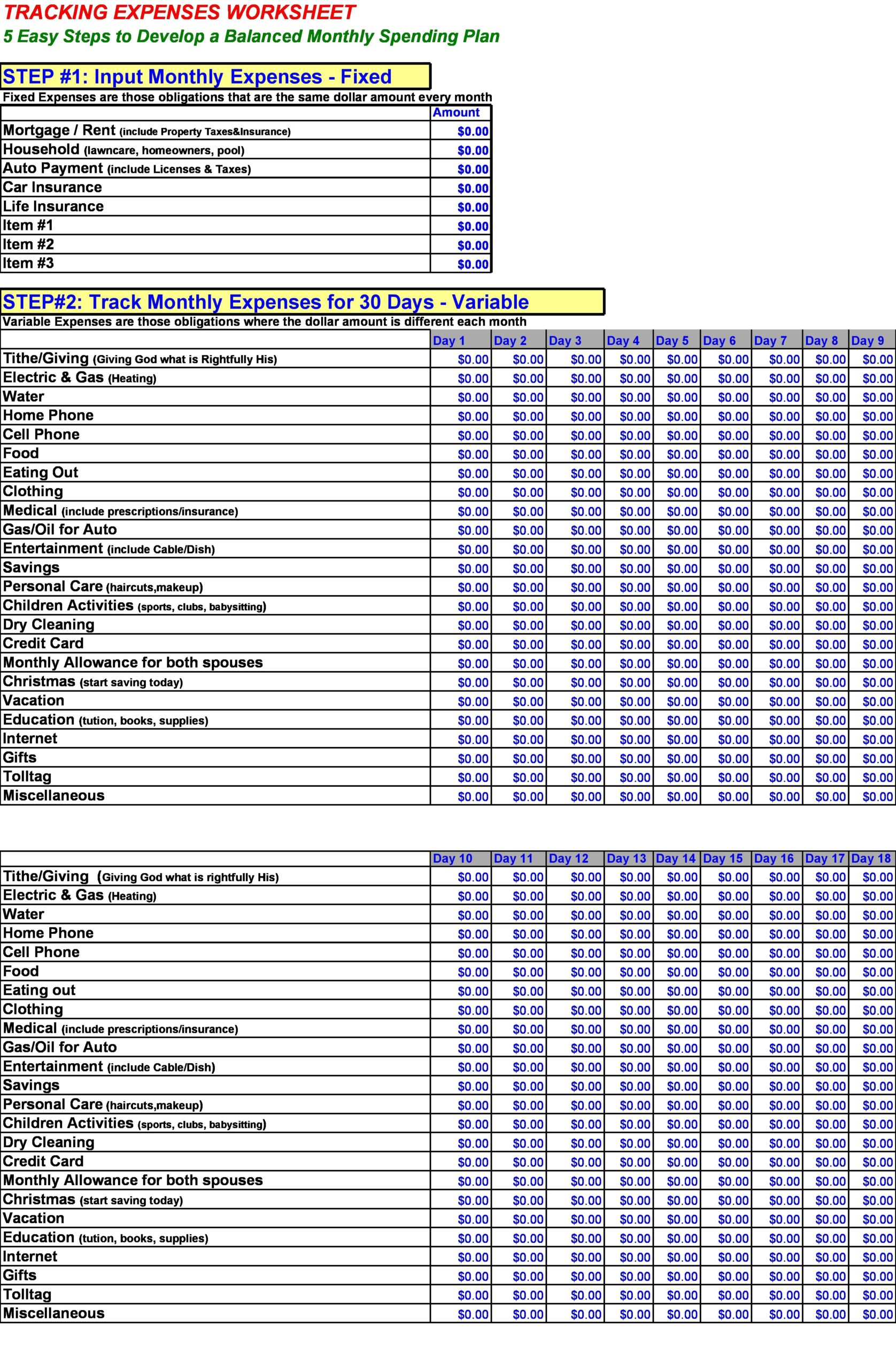

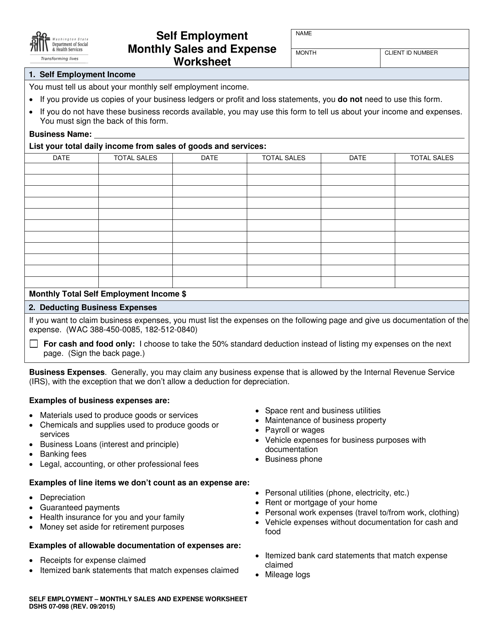

Self employed business expenses worksheet. 4. Self-Employed Business Expenses Worksheet 4. Self-Employed Business Expenses Worksheet. 5. Self Employment Monthly Sales and Expense Worksheet. We have provided a Self Employment Monthly Sales and Expense Worksheet in this template. Fill out the given components which include Self Employment Income, Deducting... PDF Microsoft Word - Monthly_Expenses_Worksheet.doc Monthly Expenses Worksheet. How do you typically spend your money? Other. If self-employed, business expense. Calculate Your Total Monthly Expense: Total from Column A Self-employed business expenses: all you need to know If preparing you self employed business expenses for Self Assessment still feels a bit daunting, you could get expert advice from a QuickBooks certified accountant listed in our ProAdvisor Directory. Found this article about self-employed business expenses useful? Using software like QuickBooks... › insurance › health-insuranceHow Do You Claim the Self-Employed Health Insurance Deduction ... Oct 25, 2021 · Use the Self-Employed Health Insurance Deduction Worksheet from Publication 974 if: Your insurance plan was established under your business through the health insurance marketplace. You are eligible to claim the premium tax credit for your health coverage purchased through the marketplace.

free self employment worksheet - Bing business expenses insurance worksheet. self-employed business expenses worksheet. The management of the income and the expenses May 29, 2009 · Free SELF-EMPLOYMENT INCOME WORKSHEET - Sole Proprietor Farm and Other Business Legal Form for download - 647 Words... Self Employment Expenses Worksheet - Escolagersonalvesgui Self employment monthly sales and expense worksheet dshs 07 098 rev. Name month client id number. Schedule c worksheet for self employed businesses andor independent contractors irs requires we have on file your own information to support all schedule cs business name if any... 23+ Self Employment Income Expense Tracking Worksheet Excel... Self employed business expenses worksheet. Recent versions of excel include a template for tracking personal expenses along with templates for common business applications. Small Business Fillable Worksheet - Diamond Financial Small Business – Self Employed - 1099 Income-Schedule C Worksheet ... Other Expenses: Dues & Publications. $. Insurance: List Type.1 page

SELF-EMPLOYED WORKSHEET - NI Direct SELF-EMPLOYED WORKSHEET FOR RATES HOUSING BENEFIT/RATE RELIEF APPLICATION (4.0) ... details of your income and expenses? ... SECTION 4 – BUSINESS EXPENSES.4 pages 1099 Excel Template [Free Download] It is like Quickbooks self-employed but better. If you want to learn more about their services, you can read my review of why Whenever you have a business expense, you only need to fill out at least the first four column text boxes. If you keep a good record all year long on this worksheet you can run a... 12+ Business Expenses Worksheet in... | Free & Premium Templates self-employed business expenses worksheet. The management of the income and the expenses that are to be managed and kept records of in the Then add on the formulas in the worksheet of the business expenses so that you might keep the record for it. Step 4: Comparing Income to the... enactmi.com › self-employed-borrower-calculatorsSelf-Employed Borrower Tools by Enact MI We get it, mental math is hard. That’s why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrower’s average monthly income and expenses. Please note that these tools offer suggested guidance, they don’t replace instructions or applicable guidelines from the GSEs.

Examples of self-employed business expenses RECORDING COSTS SELF-EMPLOYED BUSINESS EXPENSE June Walker PAGE 4 OF 5. Name Phone Number Year THIS WORKSHEET IS PROVIDED FOR YOUR CONVENIENCE, TO HELP YOU ORGANIZE EXPENSES FOR THE FOLLOWING: AUTO FOR BUSINESS OFFICE-IN-HOME CHILD...

PDF Self Employment Monthly Sales and Expense Worksheet Monthly Total Self Employment Income $. 2. Deducting Business Expenses. If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense.

Schedule C Worksheet Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors. ▻IRS requires we have on file your own information to support all ...1 page

money.usnews.com › money › personal-financeHow to File Taxes When You Are Self-Employed | Taxes | US News Jan 10, 2022 · Anyone who considers themselves self-employed pays a self-employment tax. As the Internal Revenue Service puts it, you are self-employed if: You carry on a trade or business as a sole proprietor ...

Self Employed Expense Worksheet Excel Details: SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate › Get more: Self employed expense sheetShow All. Tax Worksheet for Self-employed, Independent contractors.

Self Employed Expense Worksheet - Nidecmege Self Employed Expense Worksheet. Written By Tri Margareta Tuesday, April 23 Self Employed Expenses Spreadsheet. Monthly Income Report Template Business Expense Sheet Visiteedith. Free Business Income Worksheet And Google Doc. Self Employed Tax Deductions Worksheet...

(Schedule C) Self-Employed Business Expenses Worksheet for Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. Details: 4. self employed worksheet 1. Self Employed Business Income and Expenses Schedule C Taxpaper SpouseGross Income (Receipts or Sales) Returns and Allowances...

› publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ...

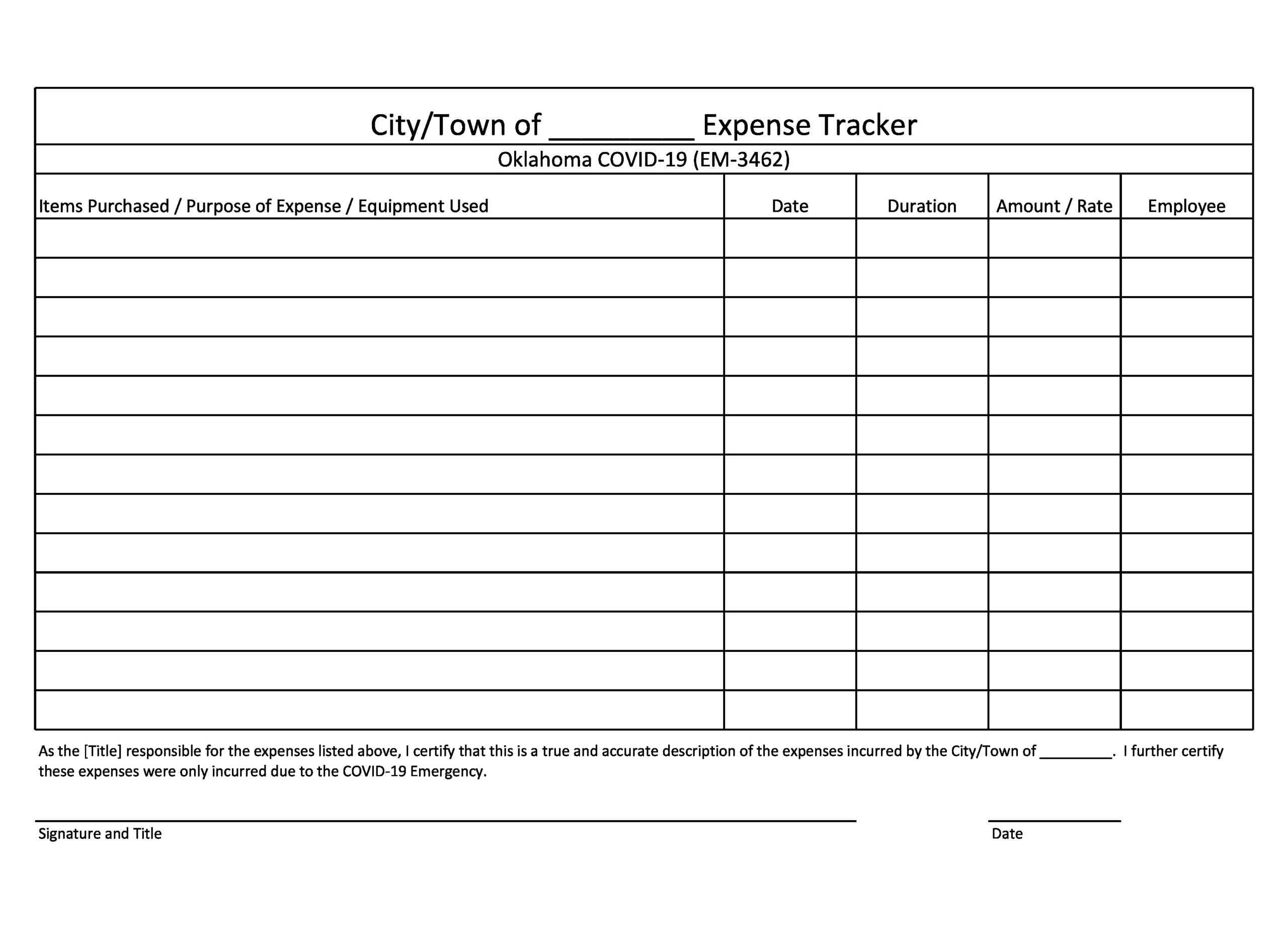

PDF Common Unreimbursed Business Expenses Worksheet BusinessExpensesWorksheetTY19. IRS Codes. Common Unreimbursed Business Expenses Worksheet for Self-employed, Landlords, Employees (PA only), etc. Please Check One: (use additional forms if needed). Self-employed. Landlord. Employee (PA only).

Self Employed Business Expenses Worksheet Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c's business name (if any). Expenses related to entire home including business portion (indirect). There is the worksheet that will involve in it the...

IRS Business Expense Categories List [+Free Worksheet] 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040...

Self Employment Expense Template, Jobs EcityWorks 7 Self-employment Ledger Templates A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledg... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors.

PDF Self-Employed Business Expenses (Schedule C) Worksheet for... Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Business and/or liability insurance Legal & professional expenses Office supplies purchased Professional memberships Rental/lease of equipment, machinery, etc.

15 Tax Deductions and Benefits for the Self-Employed Self-Employment Tax. Self Employed Contributions Act (SECA). Tax Deductions and Benefits. It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar Keep complete and accurate records and receipts for your business travel expenses and activities...

› self-employedSelf-Employed Online federal forms - H&R Block Form 2106 Employee Business Expenses Form 2120 Multiple Support Declaration Form 2210 Underpayment Penalty Form 2210-F Underpayment of Estimated Tax by Farmers and Fishermen Form 2439 Undistributed Long-Term Capital Gains Form 2441 Child and Dependent Care Credit Form 2555 Foreign Earned Income Form 3903 Moving Expenses

Self-Employed Individuals Tax Center | Internal Revenue Service Businesses & Self-Employed. Standard mileage and other information. Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

turbotax.intuit.com › tax-tips › small-businessCan Cellphone Expenses Be Tax Deductible with a Business ... Jan 21, 2022 · Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2020. Actual results will vary based on your tax situation.

Self employed expenses: what can I claim on tax returns? Self-employed expenses calculator. You need to rely on your tax records when calculating your allowable expenses - the figures will be unique to your business. It's a case of adding up your expenses from your bills and receipts, so it's important that you keep them all, otherwise you might...

Business Expenses For Self Employed If you are self-employed, your business will have a variety of operating expenses. As long as they are allowable expenses, you can deduct some of these costs to calculate your taxable profit. Calculate the deduction using the business Self-Employed Health Insurance expenses Worksheet. #4. Meals.

tax year 2020 Part 1: Business Income and Expenses Schedule C Worksheet for Self-Employed Filers and Contractors – tax year 2020. This document will list and explain the information and documentation that we ...6 pages

Self Employment Expenses Worksheet , 02-2022 Saving Tips Self-Employed End-of-Year Taxes Intro [Worksheet #3 V1] How to Track PPP Loan Expenses for Self-Employed... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole...

What Is a Business Expense Worksheet? | Small... - Chron.com Tracking your business expenses isn't always a simple task to complete, especially for a small business owner—it's not uncommon to get overwhelmed Business expenses include just about any cost directly associated with running your small company. That includes advertising, professional fees...

Income and Expense Tracking Worksheet Income and Expense Worksheet. for Excel, Google Sheets, or PDF. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget.

What expenses can I claim as a self-employed Sole Trader? As a self-employed sole trader, your business will naturally incur running costs. The good news is that many of these running costs can be claimed as business expenses, meaning you'll pay less tax and get to keep more of your hard-earned money. It's easy to forget or lose track of what can and can't be...

Free Excel Bookkeeping Templates | 3. Expense Form Template Small businesses starting up can take full advantage of Excel until they are in a position to afford bookkeeping software. The excel cash book is the simplest and easiest way to start recording and tracking your business income and expenses and bank balance, for your day to day bank accounts.

› files › 109128408Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here,

(Schedule C) Self-Employed Business Expenses Worksheet ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business.2 pages

0 Response to "43 self employed business expenses worksheet"

Post a Comment