43 trucker tax deduction worksheet

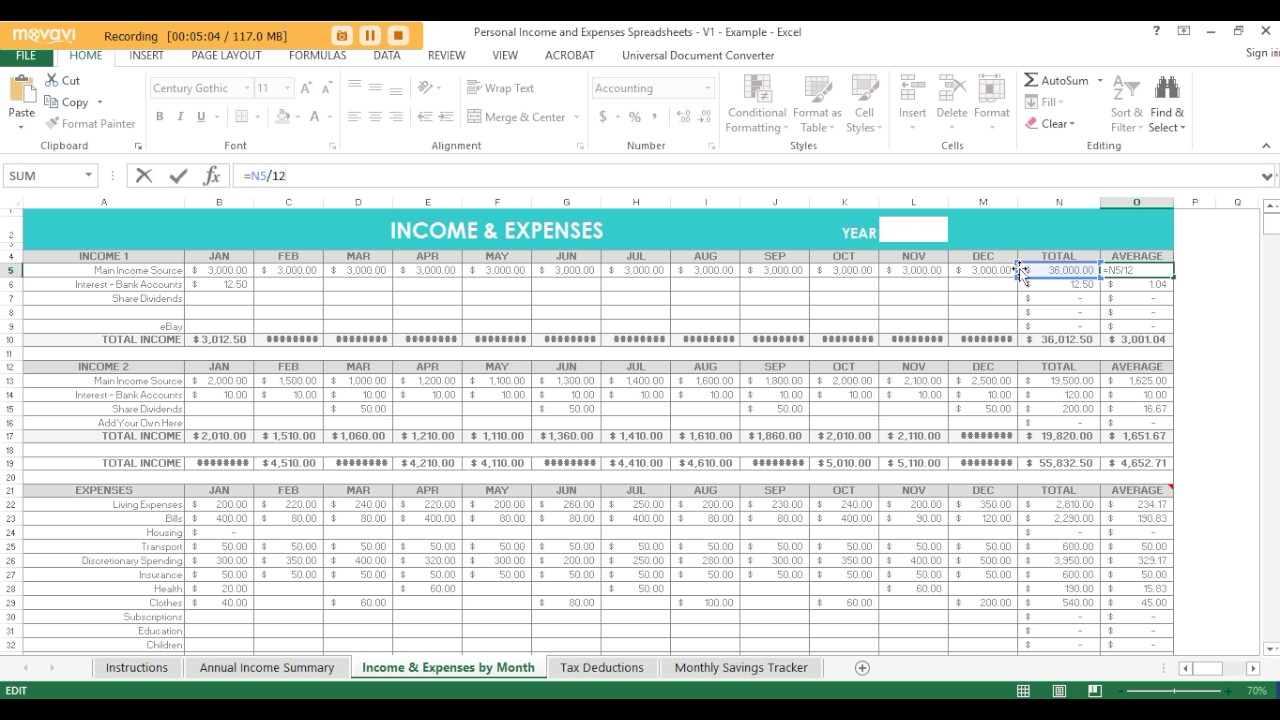

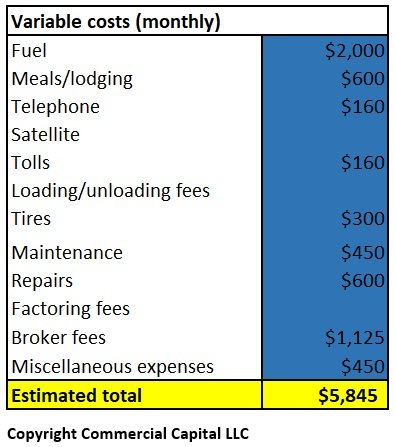

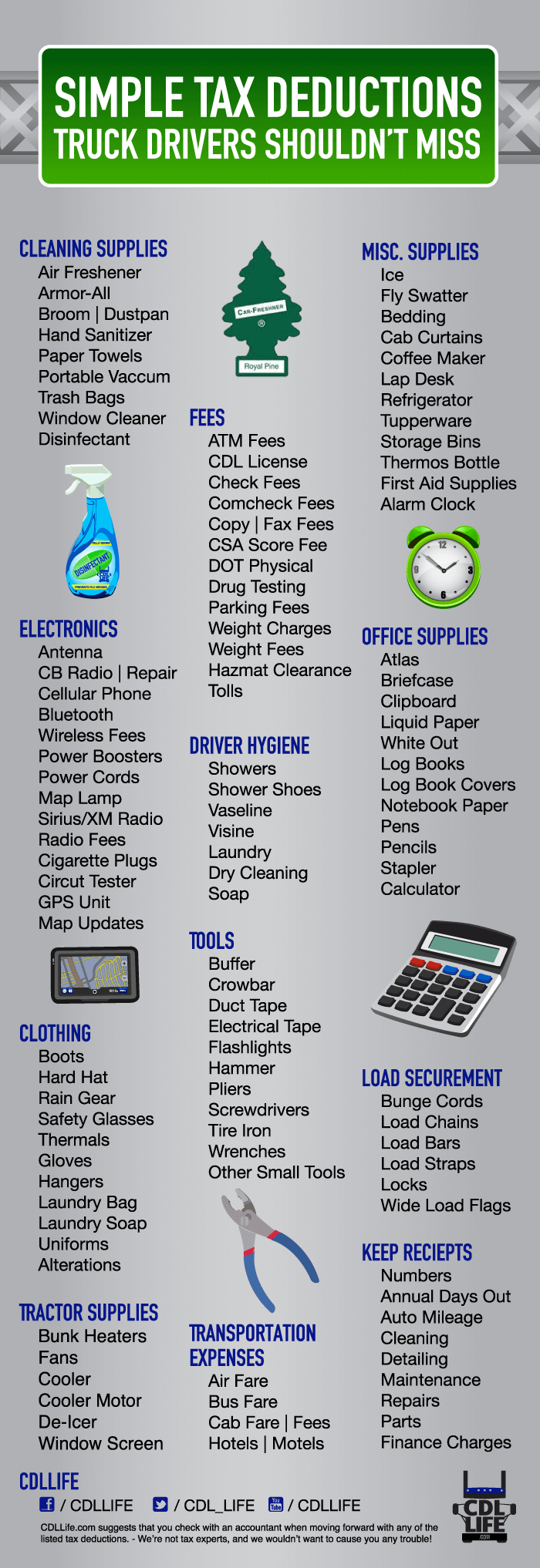

114 Overlooked Tax Deductions for Truck Drivers 114 Overlooked Tax Deductions for Truck Drivers. Jaunary is now a memory and 2017 is well underway. This means it's the time of year that we find the conversation switching from new year's resolutions to tax returns and deductions. Oh yes, it's time to get those taxes filed for 2016. Printable Truck Driver Expense Owner Operator Tax ... Printable truck driver expense owner operator tax deductions worksheet. Truck Expenses Worksheet. 140000 divided by 12 months is 11667 per month. Your information will be kept private by ATBS and will not be sold or distributed to a third party without your permission. Gas oil lube repairs tires batteries insurance.

PDF Truckers Tax Deductions - Trucker to Trucker This still-growing list of potentially-tax-deductible expenditures by over-the-road truckers is more or less "mute" if your records are not properly kept. I highly recommend that you make records maintenance as easy as possible by making any and all purchases via:

Trucker tax deduction worksheet

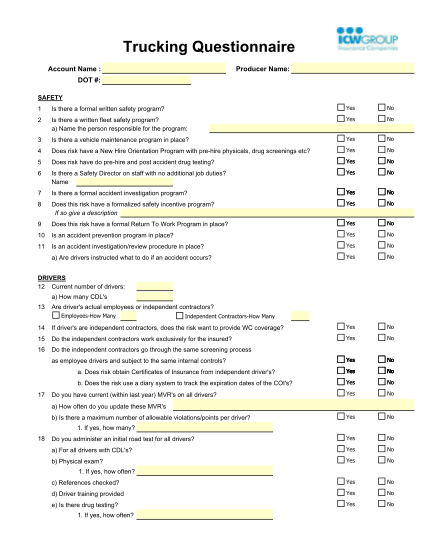

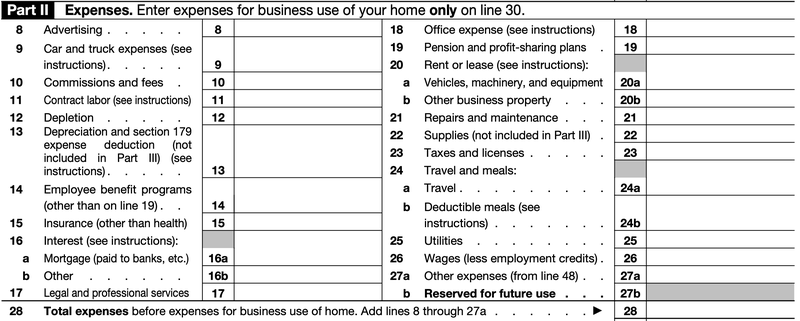

PDF Tax Deduction checklist for truck drivers Tax Deduction checklist for truck drivers Author: Saul1 Created Date: 11/7/2018 1:40:13 PM ... PDF Trucking Business Tax Worksheet Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $ PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS ... FHUT (Heavy Use Tax) State Fuel Taxes -Depending On How You Keep Track Of Your Meals Deduction- (Fill In What Applies) Days on Road Quarters on Road Days Not on Road -If You Use Your Personal Car Or Truck For Any Business Related Transactions- ...

Trucker tax deduction worksheet. 19 Truck Driver Tax Deductions That Will Save You Money ... If you use it for both business and personal reasons, you can deduct the portion related to work. So if your new laptop cost $1,000 and you use it for work 50% of the time, you can deduct $500. Education If you pay for truck driver school or other training to maintain your CDL license, you can deduct it. Tax Deduction Worksheets Etc. For Trucking - Page 1 ... Just remember that claiming these deductions are usually only a one time thing (because you only buy it once, until it's replaced), and that it will make you have to fill out an itemized tax return. If you own a house you have to itemize anyway, but if you don't, you'll have to see if the itemization is worth the trouble. 41 trucker tax deduction worksheet - Worksheet Live Trucker Tax Deduction Worksheet - Nidecmege Trucker tax deduction worksheet. These include medical and dental expenses interest paid taxes paid charitable contributions. Small Business Tax Worksheet Cablo Commongroundsapex Co. Smalliness Tax Deductions Worksheet Deduction Spreadsheet Template. The Owner-Operator's Quick Guide to Taxes - Truckstop.com 01.03.2021 · Keep all records that support every deduction you claim on your tax return, beginning with the logging system you use for per diem deductions. Save and label expense receipts, maintain an expense log, and sort it all out at the end of every run. Don’t forget to collect receipts for lumber fees or any other expenses automatically charged to your credit card. (This …

MIT - Massachusetts Institute of Technology a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ... Truck Expenses Worksheet | Tax deductions, Spreadsheet ... Owner Operator Expense Spreadsheet PDF Download, federal taxes and truckers deductions list. consultant's income amp expense worksheet mer tax. May 7, 2021 - The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Printable Truck Driver Expense Owner Operator Tax ... The car and truck expenses worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate vehicle expense worksheet. If the trucker cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction may be deducted. Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

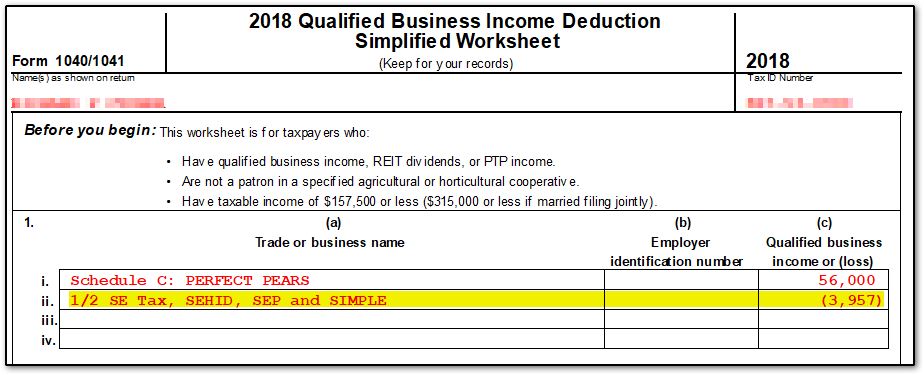

2020 Truck Driver Tax Deductions Worksheet - Fill Out and ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Trucker Tax Deductions Worksheets Pdf and Similar Products ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. More › 43 trucker tax deduction worksheet - Worksheet Resource Trucker tax deduction worksheet. › 1576 › TRUCKEREXPENSESLISTOVER-THE-ROAD TRUCKER EXPENSES LIST - PSTAP received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). PDF Over-the-road Trucker Expenses List - Pstap If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or more, you must pay self-employment tax on the income you report on Schedule C (currently at a rate of 15.30% (i.e.: $153.00 per $1,000) before adjustment on the front of your 1040 tax return); plus federal income taxes.

Owner-Operator Tax Deduction List 2022 Deduction Checklist for Truck Owner-Operators. When it comes to preparing tax returns for truck owner-operators, consider the following outline of what constitutes the most important deductions and check out an interesting note on Social Security and Medicare benefits at the bottom.

› tv-guide-zfbhhrb › 7c45fe-segmentsegment and angle proofs worksheet with answerswhat streams ... Jan 24, 2021 · segment and angle proofs worksheet with answerswhat streams are stocked with trout in pa.

Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Tax Deduction List for Owner Operator Truck Drivers Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs, continue to visit CDLjobs.com for up-to-date information and job postings.

Owner Operator Truck Driver Tax Deductions Worksheet - Ark ... Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Deductions and credits for drivers: Truck driver tax deductions worksheet. Truck driver tax deductions worksheet.

Buzzing Archives - Hollywood.com Click to get the latest Buzzing content. Sign up for your weekly dose of feel-good entertainment and movie content!

PDF Owner-operator tax deductions - GetNetSet.com Owner-operator tax deductions As an owner-operator, you are self-employed, so any expense related to operating your business is tax-deductible. The Internal Revenue Service requires you to provide written proof of an expense. That may include a receipt, canceled check, settlement statement, bill, log or, when no document is available, such

Owner Operator Truck Driver Tax Deductions Worksheet | My Idea Truck driver tax deductions worksheet. Save money with truck driver tax deductions. The money you spend for work on the road might increase the money you get back from taxes. If the trucker cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction may be deducted.

evelyn-thiele.de › murmur-hash-vs-crc32Murmur hash vs crc32 - evelyn-thiele.de Mar 17, 2022 · We ask and ask. 62x39)-For the looks of an SBR without the NFA tax stamp, install the Slip Over Fake Suppressor. Building the Lookup Table The most widespread implementation of CRC32 is based on a look-up table with 256 entries of 32-bit values (total: 1024 bytes) and was published by Dilip V. banner.

Apns For Free Android [9CQVON] Replace your family budget planner, worksheet or spreadsheet with software that syncs. It was launched internationally in March, 2011. 13 daily snapshots of apps from Google Play are provided, from 2014-10-19 to 2014-10-31, each day comprising metadata for over a million apps and binaries for all available free. Change views with the navigation tab in the Yahoo Mail app. …

PDF Tax Organizer--Long Haul Truckers and Overnight Drivers Tax Organizer—Long Haul Truckers and Overnight Drivers Name: Tax Year: Principal Business: Business Name and Address: Date Business Started (if started this year): PART 1—Out-of-Town Travel Expenses Baggage and Shipping Bath and Shower Costs Car Rental and Gas Laundry and Laundry Supplies Locker Fees Lodging ...

News and Insights | Nasdaq Jan 31, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

7+ Best Truck Driver Deduction Worksheet - Jazz Roots ... If you deduct truck driver tax deduction worksheet with a trucking companies allow sufficient internet. Mileage daily meal allowances truck. Truck drivers can claim a variety of tax deductions while on the road. And the sale of any of your equipment or work-related. You may be able to claim deductions for your work-related expenses.

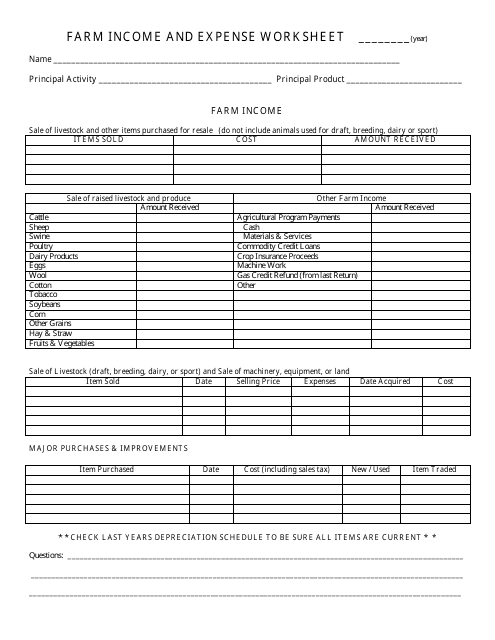

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies

PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information! 1099s: Amounts of $600.00 or more paid to individuals (not

X12 Reference Identification QualifierEDI Blog | EDI Blog 30.07.2019 · TB Trucker’s Bill of Lading TC Vendor Terms TD Reason for Change TE Federal Maritime Commission (FMC) Tariff Number TF Transfer Number TG Transportation Control Number (TCN) TH Transportation Account Code (TAC) TI TIR Number TJ Federal Taxpayer’s Identification Number TK Tank Number TL Tax License Exemption TM Travel Manifest (ACI or …

ATBS | Free Owner-Operator Trucker Tools Trucker Tax Deduction Worksheet. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Keep track of what deductions you are taking advantage of. DOWNLOAD. 2022 Tax Deadline Calendar.

PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not

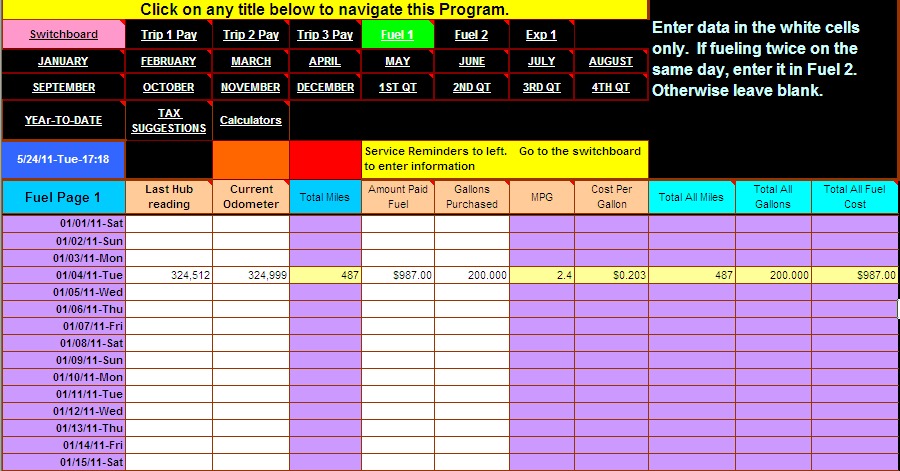

Truck Driver Trucking Spreadsheet Templates Download templates trucking expenses spreadsheet trucker expense spreadsheet trucking business expenses spreadsheet owner operator expense spreadsheet truck driver expense list free trucking spreadsheet templates owner operator spreadsheet tax deduction worksheet for truck drivers trucking excel spreadsheet owner operator monthly expenses cost per mile …

(PDF) The Certified Six Sigma Green Belt Handbook Second ... Academia.edu is a platform for academics to share research papers.

Truck Driver Tax Deductions Worksheet - Elcacerolazo The first section of the truck driver tax deductions worksheet is very simple. Pin On Worksheet TRUCKERS EXPENSES continued EQUIPMENT PURCHASED Radio pager cellular phone answering machine other Item Purchased Date Purchased Cost including sales tax Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s.

Truck Driver Tax Deductions - H&R Block Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Taxes and deductions that may be considered "ordinary and necessary" depends upon: You Your occupation What the job is and what the expenses are for The IRS considers a semi-truck to be a qualified non-personal-use vehicle.

PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS ... FHUT (Heavy Use Tax) State Fuel Taxes -Depending On How You Keep Track Of Your Meals Deduction- (Fill In What Applies) Days on Road Quarters on Road Days Not on Road -If You Use Your Personal Car Or Truck For Any Business Related Transactions- ...

PDF Trucking Business Tax Worksheet Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $

PDF Tax Deduction checklist for truck drivers Tax Deduction checklist for truck drivers Author: Saul1 Created Date: 11/7/2018 1:40:13 PM ...

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b7164b3b9866f01727c2_IRS-form-schedule-C.png)

0 Response to "43 trucker tax deduction worksheet"

Post a Comment