39 daycare income and expense worksheet

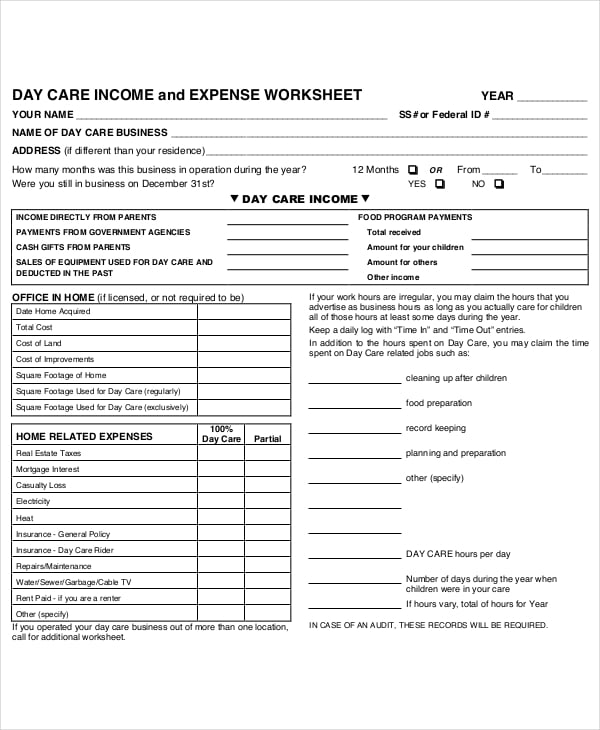

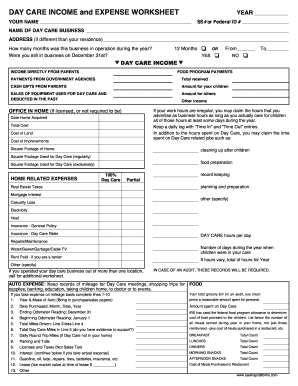

Daycare Income and Expense Worksheet Form - Fill Out and ... Get and Sign Daycare Income and Expense Worksheet Form Use a daycare income and expense worksheet template to make your document workflow more streamlined. Show details How it works Open form follow the instructions Easily sign the form with your finger Send filled & signed form or save Rate form 4.6 Satisfied 40 votes PDF DAY CARE INCOME and EXPENSE WORKSHEET YEAR If you take expense on mileage basis complete lines 1-10Your total grocery bill (in an audit, you must- 1. Year & Make of Auto (Bring in purchase/sales papers)prove a reasonable amount spent for personal. 2. Date Purchased: Month, Date, Year Amount spent on Day Care 3.

PDF CHILD/ELDERLY CARE INCOME and EXPENSE WORKSHEET TAX YEAR ... ARKED Enterprises Revised 12/2019 Page 1 of 2 CHILD/ELDERLY CARE INCOME and EXPENSE WORKSHEET (Use separate worksheet for each business) TAX YEAR_____ Taxpayer's Name: _____ Business Location: _____ You must prove your business exist, please check all that apply [ ]Business Cards/Stationary [ ]Business License [ ]Social Media/Website [ ]Appointment Book [ ]Other

Daycare income and expense worksheet

Home Daycare Budget, Tracking Expenses for Your Business Whether you do your home daycare budget expense tracking on paper or computer, setting up a spreadsheet is the best plan. You can use graph paper or lined notebook paper to set up columns if you like to make your expense spreadsheet with paper and pencil. Or using google docs or excel is a great way to make one on the computer. PDF DAY CARE PROVIDERS WORKSHEET - LSTAX.com 100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water, Daycare in your home - Canada.ca Deduct, remit and report payroll deductions. Keeping daycare records. What you need to keep and for how long. Making payments for individuals. How to pay your income taxes owing, make payment arrangements, and send in instalment payments. Collecting goods and services tax/harmonized sales tax on your daycare services. Interest and penalties.

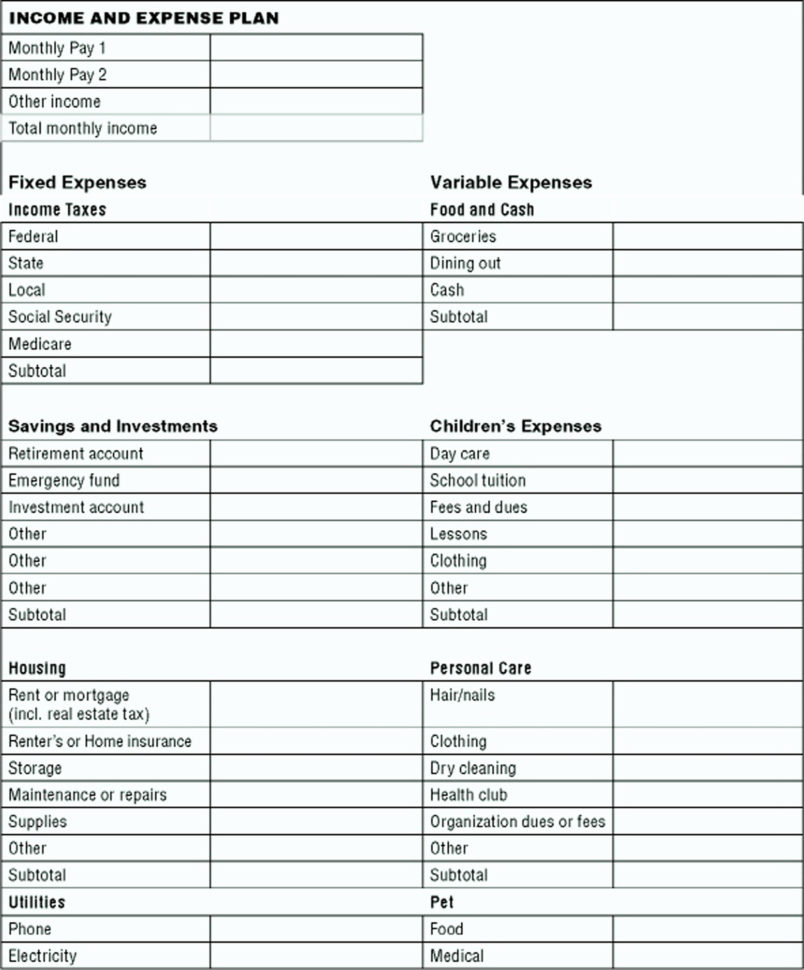

Daycare income and expense worksheet. How to Create a Budget in 6 Simple Steps - Better Money Habits If you’re a freelancer, gig worker, contractor or are self-employed, make sure to keep detailed notes of your contracts and pay in order to help manage irregular income. Step 2: Track your spending Once you know how much money you have coming in, the next step is to figure out where it’s going. Free Income Expenditure Statement Report Template - Excel TMP Jun 10, 2016 · Sample of Income Expenditure Statement Report Template. It as well as has an Income, expense & Savings line chart. Start by downloading the template & recording your income & expenses into the spreadsheet. The first sheet is the Personal Budget sheet that records the details of the entire sources of income & the amount got through every source. 10+ Day Care Budget Templates - PDF | Free & Premium Templates This template gives you a simple but effective day care budget which covers all details regarding the revenue, operating expenses and expenditure for the complete year. The sample daycare budget template can be used as a perfect reference document. Make use of the framework while making your own day care budget. 5. PDF Child Support Guidelines - Shared Parenting Worksheet ... 16. Net Work Related Child Care (from Appendix IX-E Worksheet) +$ 17. Child's Share of Health Insurance Premium +$ 18. Unreimbursed Health Care Expenses over $250 per child per year +$ 19. Court-Approved Extraordinary Expenses +$ 20. Total Supplemental Expenses (L16 + L17 + L18 + L19) $ 21.

Daycare Business Plan and Financial Model Template Sources and uses statement is a part of our daycare income and expense worksheet. It shows the company's stakeholders where all the fund sources for a company come from. This statement also shows how the company uses these funds. Daycare Valuation Our Daycare Cash Flow Projection In Excel has two integrated valuation methods. The Annual Cost Of Pet Ownership: Can You Afford A Pet? 05-04-2022 · The Texas Society of CPAs has a PDF version of a pet budget worksheet you can use to help you estimate pet ownership costs. While the page is geared at parents teaching kids the costs involved in pet ownership, the actual worksheet is universal and could be useful in trying to determine what your actual pet ownership costs might be. Daycare Expense Worksheet - atmTheBottomLine Daycare Expense Worksheet | Print | Email . Below are forms and worksheets to help you keep track of your expenses: Daycare Expense Worksheet (.xls) Daycare Expense Worksheet (.pdf) Daycare Expenses Spreadsheet (.xls) Publication 587 (2021), Business Use of Your Home ... For daycare facilities not used exclusively for business, enter the decimal amount from the Daycare Facility Worksheet; otherwise, enter 1.0: 3b. _____ c. Multiply line 3a by line 3b and enter result to 2 decimal places: 3c. _____ 4. Multiply line 2 by line 3c: 4. _____ 5. Allowable expenses using the simplified method.

Flexible Spending Account (FSA) | Chard Snyder Employees give information about their daycare provider (name, address and tax ID number, or social security number if an individual) on Form 2441 or Schedule 2 of their income tax return. Employees cannot take both the Dependent Daycare FSA deduction and an income tax return deduction for the same expense. PDF DAY CARE PROVIDERS WORKSHEET - LSTAX.com to prepare two business returns based upon income and expenses per each location. Call the office to discuss this. 4. Meals - Do not assume the days and meals served, count them. If audited and you guessed wrong, your whole meal deduction could be disallowed. 5. 100% Day Care Use-Notice the left side of Page 2 of the daycare PDF Daycare Income and Expense Worksheet - SunCrest DESCRIPTION DATE PURCHASED COST + SALES TAX DAYCARE USE % Date Amount % VEHICLE EXPENSES NOTES: 1. Make, Model and Year of Auto 2. Purchase Date (mm/dd/yy) 3. Beginning Odometer Reading - Jan 1 4. Ending Odometer Reading - Dec 31 5. Total Miles Driven(Personal & Business) 6. Total Business Miles 7. Easy Budgeting Tool - The Savings Spot - RBC Royal Bank Other Monthly Income (e.g. Investment Income) Monthly Expenses - Fixed Housing Costs (e.g. mortgages, rent, condo/maintenance fees, property taxes, lawn care and supplies, snow removal, renovations, cleaning and supplies, etc)

Publication 503 (2021), Child and Dependent Care Expenses ... Worksheet for 2020 expenses paid in 2021. ... during the year. (However, see Rule for student-spouse or spouse not able to care for self under You Must Have Earned Income, later.) Work-Related Expense Test. You must pay child and dependent care expenses so you ... Dean pays a daycare provider to care for Nicole to allow him to work.

About Publication 587, Business Use of Your ... - IRS tax forms Feb 03, 2022 · Publication 587 explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. This publication explains how to figure and claim the deduction for business use of your home.

Instructions for Form 8829 (2021) | Internal Revenue Service When completing line 2 of this worksheet for Form 8829, enter your adjusted gross income excluding the gross income and deductions attributable to the business use of the home. Do not use this worksheet to figure the amount to enter on line 8d of Schedule A. Step 2.

Printable Forms Available: Day Care Income and Expense ... Printable Forms Available: Day Care Income and Expense Worksheet. To make tax preparation a little easier for our clients, we have placed some popular forms on our website. Our clients who are daycare providers will find the Day Care Income and Expense Worksheet invaluable for recording their business expenses for the year.

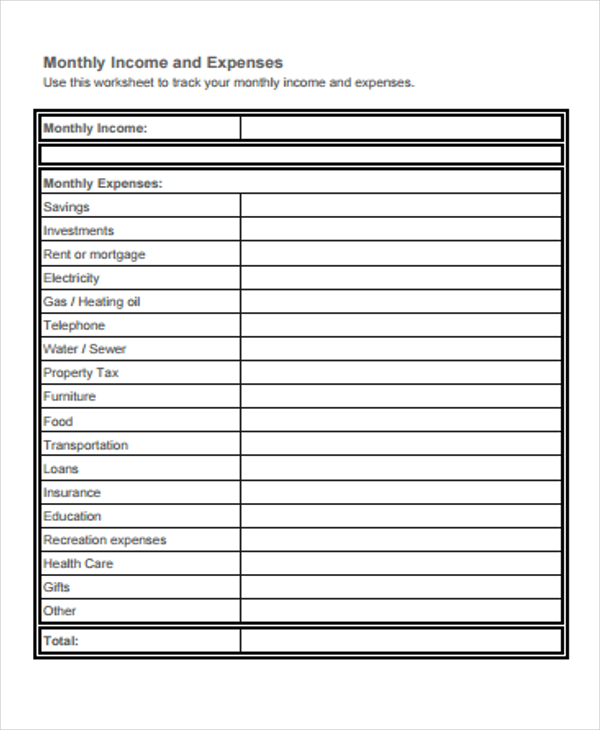

Monthly Expense Tracker, Calculator & Spending Planner ... This monthly personal expense tracker for Excel functions as a worksheet, spreadsheet, calculator and spending planner for both individuals and households. Excel Expense Tracker If you prefer to write expenses down as they happen or want to carry a little booklet with you, then you can download and print our easy-to-use Monthly Expense Tracker PDF.

Daycare Expense Spreadsheet Google Spreadshee daycare expense spreadsheet. home daycare expense ...

PDF Day Care Income and Expense Worksheet DAY CARE INCOME AND EXPENSE WORKSHEET . ... DAY CARE INCOME . Gross income from day care $ _____ Federal food reimbursement $ _____ OFFICE IN HOME - IF LICENSED ... AUTO EXPENSE . Keep records of mileage for day care meetings, shopping for supplies, groceries, or to events, etc.

Family Child Care Net Income Worksheet - Tom Copeland's ... Tom Copeland's Taking Care of Business The Nation's Leading Expert on the Business of Family Child Care

Daycare Expenses List (Sample Budget Template Included ... Calculating your income. Figuring total expenses. Learning how to complete a budget template. The first step to completing a daycare expense list is recognizing what entities are considered your income and your expenses. Calculating Your Income. Income can be divided into 3 categories: daycare tuition, administrative fees, and grants and/or ...

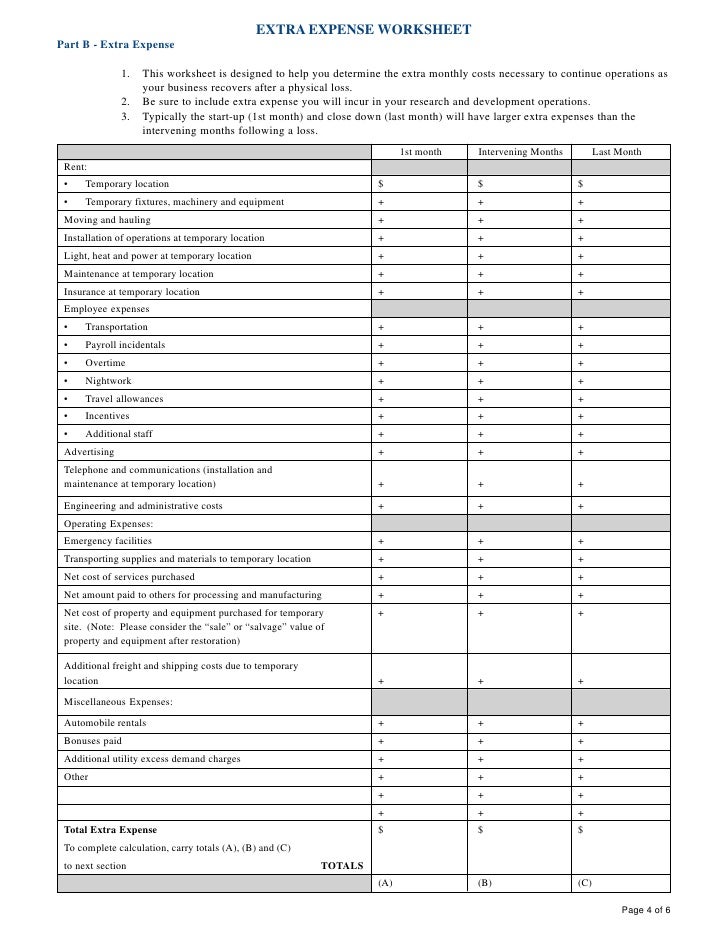

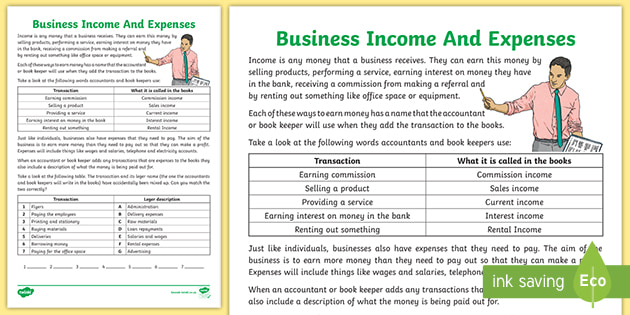

Income And Expenses And Profit Worksheets - Learny Kids Income And Expenses And Profit. Displaying top 8 worksheets found for - Income And Expenses And Profit. Some of the worksheets for this concept are Business income and expense summary month year, Day care income and expense work year, Truckers income expense work, Simplified business income and extra expense work, Mechanic auto body income ...

Daycare Record Keeping - Pride Tax Preparation First off, I strongly recommend reading Tom Copeland's books, especially the Family Child Care Record-Keeping Guide The more detailed records you record, the better. The Redleaf Calendar-Keeper 2022 or the software KidKare are two great ways of doing that. To help you prepare your information for your tax return AND to thoroughly understand your daycare tax return (either if you do your tax ...

PDF Family Child Care Net Income Worksheet income to determine if they are eligible for the Tier I Food Program reimbursement rate. The worksheet should not be used by providers to fill out their IRS Schedule C tax form. The calculation of yearly net income involves many other business expenses not listed on this worksheet.

DAY CARE INCOME and EXPENSE WORKSHEET - MER Tax If you take expense on mileage basis complete lines 1-10 Your total grocery bill (in an audit, you must- 1. Year & Make of Auto (Bring in purchase/sales papers) prove a reasonable amount spent for personal. 2. Date Purchased: Month, Date, Year Amount spent on Day Care 3.

Daycare Income And Expense Worksheet - Fill and Sign ... Ensure the details you add to the Daycare Income And Expense Worksheet is updated and accurate. Include the date to the sample with the Date option. Select the Sign tool and make an electronic signature. You can find 3 available choices; typing, drawing, or capturing one. Make sure that each area has been filled in properly.

Home Daycare Record Keeping - Little Sprouts Learning For printable income and expense worksheets, click on the highlighted links below. Home Daycare Income Worksheet Home Daycare Expense Worksheet Record keeping software If you like to use technology to help you, you can make excel spreadsheets to keep your records on. I like to do this because it's personalized exactly how I want it.

8+ Income & Expense Worksheet Templates - PDF, DOC | Free ... Open your spreadsheet or worksheet application. Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Once you do that, click on the "Available Templates" option and choose "Blank Workbook". You can include both your income and expense spreadsheets in the same workbook.

0 Response to "39 daycare income and expense worksheet"

Post a Comment