40 chapter 7 federal income tax worksheet answers

SOLVED:Use this tax computation worksheet to answer ... Use this tax computation worksheet to answer Exercises 11-14. table can't copy Calculate the tax for each of the taxable incomes of a head of house-hold taxpayer. a. $ 400, 000 b. $ 108, 962 c. $ 201, 102 d. $ 106, 000 Answer a. $ 115, 409.00 b. $ 22, 303.00 c. $ 48, 926.66 d. $ 21, 562.50 View Answer Discussion You must be signed in to discuss. Community Development Block Grant (CDBG) - Mass.gov Jul 02, 2021 · CDBG Substantial Amendment #3 - Federal CARES Act Update 7/02/2021 . CDBG Substantial Amendment #2 - Federal CARES Act Update 9/11/20. CDBG Substantial Amendment - Federal CARES Act Update 4/30/20. DHCD announced a NOFA on 5/15/20 through CommBuys for State CDBG-CV funds. The NOFA and additional documents are attached below.

PDF 2021 Publication 17 - IRS tax forms Chapter 2. Filing Status. Chapter 3. Dependents. Chapter 4. Tax Withholding and Estimated Tax. Part Two. Income and Adjustments to Income. Chapter 5. Wages, Salaries, and Other Earnings. Chapter 6. Interest Income. Chapter 7. Social Security and Equivalent Railroad Retirement Benefits. Chapter 8. Other Income. Chapter 9.

Chapter 7 federal income tax worksheet answers

Chapter 7 Federal Income Tax Worksheet Answers - Worksheet ... 21 Gallery of Chapter 7 Federal Income Tax Worksheet AnswersOur Federal Income Tax Plan Worksheet AnswersSection 2 1 Federal Income Tax Worksheet AnswersLesson 2.1 Federal Income Taxes Worksheet AnswersLesson 2.3 Federal Income Taxes Worksheet AnswersChapter 13 Lab From Dna To Protein Synthesis Worksheet AnswersMonthly Retirement Planning ... Chapter 7, Income Taxes Video Solutions, Financial Algebra ... Problem 9. Use the tax computation worksheet for a head of household taxpayer. Let x represent the taxpayer's taxable income and y represent the tax. Express each line of the worksheet as a linear equation in y = m x + b form. Use interval notation to define the income range on which each of your equations is defined. Federal Publication 17 (Your Federal Income Tax Guide ... Your Federal Income Tax Guide 2021 Publication 17 Department of the Treasury Your Federal Income Tax For Individuals Publication 17 Catalog Number 10311G For use in preparing 2021 Returns Internal Revenue Service TAX GUIDE 2021 Get forms and other information faster and easier at: • IRS.gov (English) • IRS.gov/Spanish (Español) Dec 16, 2021 • IRS.gov/Chinese (中文) • IRS.gov/Korean ...

Chapter 7 federal income tax worksheet answers. Income Tax Worksheets Teaching ... - Teachers Pay Teachers This income tax preparation learning module is for high school age students. It takes around 60 minutes to complete. Items needed to for the module instruction include: 1. "2013 Income Tax" PowerPoint slide for instructions (free) 2. Read the "Chapter 9 Taxes--Income Tax Preparation Exercise--SI.doc ($6.00) 3. PDF Chapter 14: Taxes and Government Spending Section 1 •A proportional tax is a tax for which the percentage of income paid in taxes remains the same at all income levels. •A regressive tax is a tax for which the percentage of income paid in taxes decreases as income increases. -A sales tax is regressive because higher income households spend a lower proportion of their incomes Chapter 7 - Bankruptcy Basics | United States Courts Notes The "current monthly income" received by the debtor is a defined term in the Bankruptcy Code and means the average monthly income received over the six calendar months before commencement of the bankruptcy case, including regular contributions to household expenses from nondebtors and including income from the debtor's spouse if the petition is a joint petition, but not including social ... PDF THE PROGRESSIVE ERA - EPHShdfavela He lowered tariff duties and introduced a graduated income tax, made possible by the 16th Amendment. He created the Federal Reserve System to control the nation's money supply. To control the unfair practices of big business, he passed the Clayton Anti-trust Act, creating the Federal Trade Commission. L.

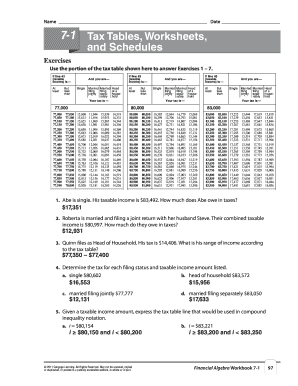

Federal-Module-2-Study answers.pdf - Chapter 5: Earned ... Federal-Module-2-Study answers.pdf - Chapter 5: Earned Income Credit Chapter Description Upon completion of this chapter, students will have a working ... Determine how to complete Schedule EIC and where to put the information from the appropriate worksheet on Form 1040. 7) ... The credit amount is added to federal income tax withheld. hello,i need the answers for Chapter 7 | Chegg.com In computing the federal income taxes to be withheld, the wage-bracket tables in Tax Table B at the back of the book were used. Each payday, $8 was deducted from the earnings of the two plant workers for union dues (Bonno and Ryan). Payroll check numbers were assigned beginning with check no. 672. PDF CHAPTER IIncome Taxesncome Taxes 7-1 Tax Tables, Worksheets, and Schedules329 And you are At least If line 43 (taxable income) is Single Married filing jointly * Married filing sepa- rately Head of a house- hold But less than Your tax is — 51,000 51,000 51,0509,100 6,851 9,100 7,819 51,050 51,1009,113 6,859 9,113 7,831 51,100 51,1509,125 6,866 9,125 7,844 Quiz & Worksheet - Federal Income Tax Returns | Study.com 1. In which section do you write down the taxes that were withheld from your paychecks? Refund Other Taxes Payments Tax and Credits 2. Which Filing Status do you choose if you are divorced with no...

PDF 7-1 Tax Tables, Worksheets, and Schedules Given a taxable income amount, express the tax table line that would be used in compound inequality notation. a. i = $80,154 b. i = $83,221 Financial Algebra Workbook 7-1 Tax Tables, Worksheets, and Schedules 7-1 $17,351 $12,931 $77,350 - $77,400 $16,553 $15,956 $12,131 $17,633 PDF Chapter 2 - Net Income He claims 1 allowance on his federal taxes. He makes $32,000 per year and is paid weekly. a. What is his weekly salary? 32000 / 52 = $615.38 b. What is his federal income tax per week? $70.00 c. What is his annual state income tax? 1. Exemptions = 1500 + 700 = $2200 2. Taxable Income = 32000 - 2200 = $29800 3. Income Tax = 29800 x 0.035 = $1,043 d. PDF Official Form 122A-2 - United States Courts Official Form 122A-2 Chapter 7 Means Test Calculation page2 Part 2: Calculate Your Deductions from Your Income The Internal Revenue Service (IRS) issues National and Local Standards for certain expense amounts. Use these amounts to answer the questions in lines 6-15. What is Chapter 7 Bankruptcy & Should I File? - Upsolve Chapter 7 bankruptcy is a powerful legal tool in the United States that allows you to totally erase many debts, including credit card debt, medical debt, car loans, and payday loans. Experts estimate that over 39 million Americans have filed for bankruptcy. [ 1] It's more common than most people think.

income tax chapter 7 Flashcards and Study Sets | Quizlet Income Tax - Chapter 7 1. How are the terms basis, adjusted ba… 2. What is meant by the terms realized… 3. How can the gain from the sale of pr… Proceeds are FMV ... gain and loss = Act realized (Proceeds) - Ad… Realized is what you calculate and recognized is what you put… 1. ordinary income ... 2. Capital assets... 3. Trade or business 80 Terms

Solved Refer to your course textbook! Chapter 7 ... Chapter 7 - Cumulative Problem #59 - Jane Smith Requirements You are required to prepare all necessary 2015 forms and schedules using the PDF forms provided at the IRS website. DO NOT USE TAX SOFTWARE Show detailed calculations for partial credit and receipt of useful feedback. Attach your tax return as a PDF file Attach your

Chapter 7: Federal Income Tax Flashcards | Quizlet Chapter 7: Federal Income Tax STUDY Flashcards Learn Write Spell Test PLAY Match Gravity Created by gerite1025 Terms in this set (35) revenue Money collected by the government from various sources is known as ______. progressive A tax that increases in proportion to increase in income is known as a _____ tax. taxable

› forms › 20192019 Fiduciary Income 541 Tax Booklet | FTB.ca.gov Jan 01, 2015 · Complete the Use Tax Worksheet or use the Use Tax Lookup Table on page 12 to calculate the amount due. Extensions to File. If the fiduciary requests an extension to file its income tax return, wait until the fiduciary files its tax return to report the purchases subject to use tax and make your use tax payment. Interest, Penalties and Fees.

7 3 Income Statements Worksheet Answers - Fill Online, Printable, Fillable, Blank | PDFfiller

PDF What You'll Learn Section 2-1 Section 2-2 Section 2-3 ... What amount will be withheld from Garza's pay for FIT? STEPS: 1. Find the income range from the table. (It's 420-430.) 2. Find the column for 2 allowances. 3. The amount of income to be withheld is $15. Lance Han's gross pay for this week is $460.00. He is married and claims 1 allowance. What amount will be withheld from Han's pay for FIT?

Publication 17 (2013), Your Federal Income Tax | Reading worksheets, Worksheets, Worksheets free

PDF COMPREHENSIVE TAX COURSE - The Income Tax School the appropriate worksheet on Form 1040. 7) Discuss circumstances when the IRS would disallow the Earned Income Credit. 8) Examine IRS due diligence requirements. 9) Recognize when special rules apply to a taxpayer claiming Earned Income Credit. Chapter 6: Tax Credits 1) Examine rules for claiming the child tax credit (CTC), the credit for other

› publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... Refunds received after 2021 and after your income tax return is filed. If anyone receives a refund after 2021 of qualified education expenses paid on behalf of a student in 2021 and the refund is paid after you file an income tax return for 2021, you may need to repay some or all of the credit. See Credit recapture next.

State of Oregon: Businesses - Corporate Activity Tax FAQ Estimated payments, which can be calculated using the estimated payment worksheet on page 5 of the CAT return instructions, are due for the previous quarter on or before the last day of the 4 th, 7 th, and 10 th months of the tax year, and on the last day of the first month immediately following the end of the tax year.

Publication 505 (2022), Tax Withholding and Estimated Tax ... Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022

Chapter 2: Net Income - Mr. Adelmann's Fantastic Math Class Chapter 2: Net Income. Section 1: Federal Income Tax. Class Presentation: Federal Income Tax. Class Activity: Fed. Income Tax Worksheet and Tax Table. Section 2: State Income Tax. Class Presentation: State Income Tax. Class Activity: State Income Tax Worksheet.

Exemptions in Chapter 7 Bankruptcy - Nolo Here's how it works. Suppose your car is worth $10,000, and your state allows you to exempt $5,000 in vehicle equity. Your outstanding car loan is $5,000. The trustee must pay the lender $5,000, leaving equity of $5,000. Because the bankruptcy exemption would protect all vehicle equity, the bankruptcy trustee would not sell the car.

income analysis worksheet - Edit, Fill, Print & Download Best Online Forms in Word & PDF | cash ...

Lesson 2.3 Federal Income Taxes Worksheet Answers ... Chapter 7 Federal Income Tax Worksheet Answers. Our Federal Income Tax Plan Worksheet Answers. Section 2 1 Federal Income Tax Worksheet Answers. ... Chapter 13 Lab From Dna To Protein Synthesis Worksheet Answers. Monthly Retirement Planning Worksheet Chapter 8 Answers. Federal Income Tax Ez Form.

0 Response to "40 chapter 7 federal income tax worksheet answers"

Post a Comment