40 truck driver expenses worksheet

27 Elegant Truck Driver Expenses Worksheet ... 27 elegant truck driver expenses worksheet incharlottesville com beautiful tax deduction spreadsheet excel unique trucking cost per mile for everyone ... Sample spreadsheet for business expenses. Excel spreadsheet template for customer database. Framing takeoff spreadsheet. Tax Deductions for Truck Drivers - Jackson Hewitt Meal Allowance. Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US. The special standard meal allowance is ...

PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST Non-Deductible Expenses Short List on Business Return (1) Expenses that were reimbursed by your employer(…ask your tax pro whether you are obligated to claim such reimbursements for business-related expenses in whole or in part…especially items like reimbursed fines or penalties paid by you but reimbursed back to you byemployer).

Truck driver expenses worksheet

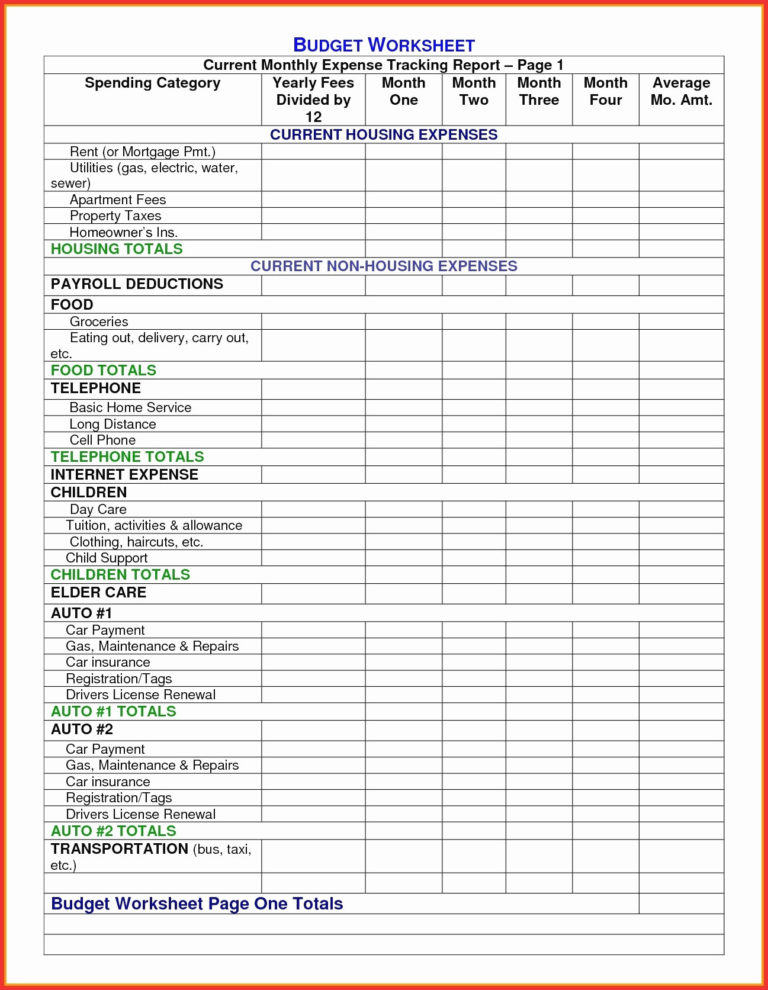

1 Wicked Trucking Expenses Spreadsheet Excel ~ Ginasbakery Free templates trucking expenses spreadsheet spreadsheets cost per mile 972. In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report. PDF Trucker'S Income & Expense Worksheet Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees Complete List Of Owner Operator Expenses For Trucking ... A single fill up of two 150 gallon tanks can run over $1,400. In the current market, fuel prices can also spike very quickly as well as have wide cost variations from state to state. Your fuel costs can easily rise to the tens of thousands of dollars depending on your hauls and mileage.

Truck driver expenses worksheet. What You Need to Know About Truck Driver Tax Deductions ... If you're a self-employed driver, on the other hand, you can deduct expenses related to your work. As an owner/operator, you should receive a 1099-NEC at year-end from any customer that paid you more than $600 during the year. PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) ... Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions- Fuel & Oil Expenses Showers On The Road Tolls & Scales Fees Truck Insurance Repairs & Maintenance ... 2020 Truck Driver Tax Deductions Worksheet - Fill Online ... Fax Email Add Annotation Share Comments and Help with trucking expenses spreadsheet meals: Include the cost of the meals in the employee cost column of the W-2. In other words, you are only allowed to deduct the employee meal meal expenses if you are the person who actually paid for the meal. Free Templates Trucking Expenses Spreadsheet ... - Golagoon Format : jpg/jpeg. The common feature among the spreadsheets templates is that they save time and effort and also they make the work and other calculations easier. Planning out things and fast access to data and other information are made very easy when using spreadsheet templates. But most of these templates are unique according to the purpose.

Tax Deduction List for Owner Operator Truck Drivers Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs, continue to visit CDLjobs.com for up-to-date information and job postings. Cost Per Mile - OOIDA The $1.06 per mile cost, at 50,000 miles, represents a vehicle cost of $53,000 and a "Driver Income" of $22,174. The final $0.69 per mile cost for 130,000 miles, represents a vehicle cost of $89,000 and a "Driver Income " of $38,422. This decrease of cost per mile with each additional mile is a characteristic small business truckers ... PDF Over-the-road Trucker Expenses List - Pstap When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks). PDF Trucking Business Tax Worksheet - tnttaxserviceaz.com Trucking Business Tax Worksheet Name of Business: Taxpayer Name: Tax Payer SS#: Gross Income (provide any 1099's) *A $ Number of Miles Logged Bank Service Charges $ Telephone, Pager $ Computer Expense $ Tractor Rental $ Fuel Expense $ Tolls $

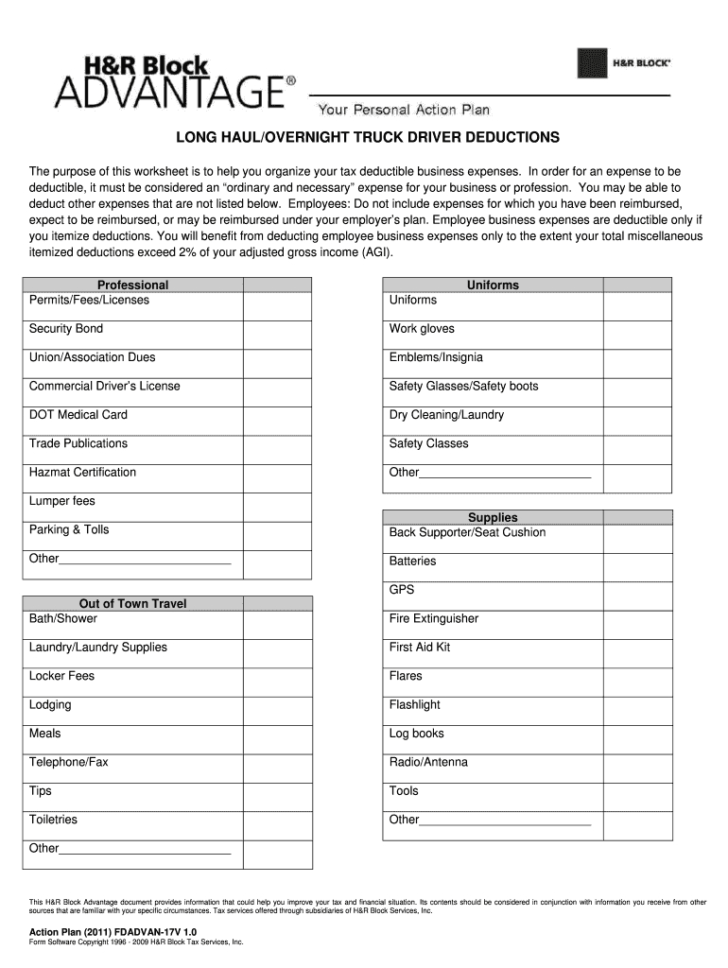

PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! OFFICE EXPENSE:postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING:Employees only "RENT/LEASE:Truck lease Machinery and equipment # Other bus. property, locker fees "REPAIRS & MAINTENANCE:Truck, equipment, etc. SUPPLIES:Maps, safety supplies Small tools PDF Tax Organizer--Long Haul Truckers and Overnight Drivers PART 1—Out-of-Town Travel Expenses Baggage and Shipping Bath and Shower Costs Car Rental and Gas Laundry and Laundry Supplies Locker Fees Lodging Meals (Actual Cost) Parking and Tolls Taxi, Commuter Bus and Shuttles Telephone and Fax Tips Toiletries Transportation—Airfare, Bus and Train Other: PART 2—Owner/Operator Truck Expenses Truck Driver Tax Deductions - HR Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep ... Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep allowed/allowable-1 is too large. I have tried all of this and it does not work. There is no drop down menu to override it and I did not put in a depreciation value. Turbotax did and it still says it is too high. I traded in an older car for a new car for my business.

Solved: Car & Truck Expenses Worksheet: Cost must be enter... Car & Truck Expenses Worksheet: Cost must be entered. When the program asks for the cost of the vehicle, it is asking for how much you paid for it when you purchased it. That number would only be known to you. View solution in original post. 1.

Truck Expenses Worksheet | Tax deductions, Spreadsheet ... Truck Expenses Worksheet The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?)

PDF o n O o õ o o õ o o (.0 o o o o o o o CD õ ... - Emshwiller Created Date: 1/25/2017 2:53:15 PM

2020 Truck Driver Tax Deductions Worksheet - Fill Out and ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

PDF Car and Truck Expense Deduction Reminders Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, "Travel, Entertainment, Gift, and Car Expenses." However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ...

Tax Deductions for Truck Drivers - Support Truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are some of the tax deductions available. However, local truck drivers typically cannot deduct travel expenses.

19 Truck Driver Tax Deductions That Will Save You Money ... These expenses include any specialized items you buy to help safely carry your loads. Examples include chains, locks, straps, and even wide-load flags. Tools and equipment If you're like most truckers, you probably carry a tool kit in your truck. Things like hammers, wrenches, pliers, tire irons, and even electrical tape are all deductible.

0 Response to "40 truck driver expenses worksheet"

Post a Comment