42 credit card comparison worksheet

Compare 25+ Cash Back Credit Cards in This Free Spreadsheet Get the spreadsheet and compare cash back rewards for yourself. Compare cash back offers from over 25 credit cards in this Google spreadsheet. Things to keep in mind: The data is current as of March 28, 2019. We will update the spreadsheet with new cards and offers every quarter. Use this spreadsheet as a place to begin. Side by Side Credit Card Comparison - NerdWallet Our card comparison tool identifies the things each card is great for, such as rewards, balance transfers or bad credit. In general, there are three types of credit cards: Cards that earn rewards...

Credit Card Payment Amortization Schedule: Printable ... Effective Ways to Pay Off Credit Card Debt Faster. Guide published by Jose Abuyuan on January 13, 2020. If you have credit card debt, you're one of thousands of Americans struggling to clear their balance. The Federal Reserve Bank states that the total credit card debt reached $1.088 in October 2019. That's an increase of 8.8 percent from ...

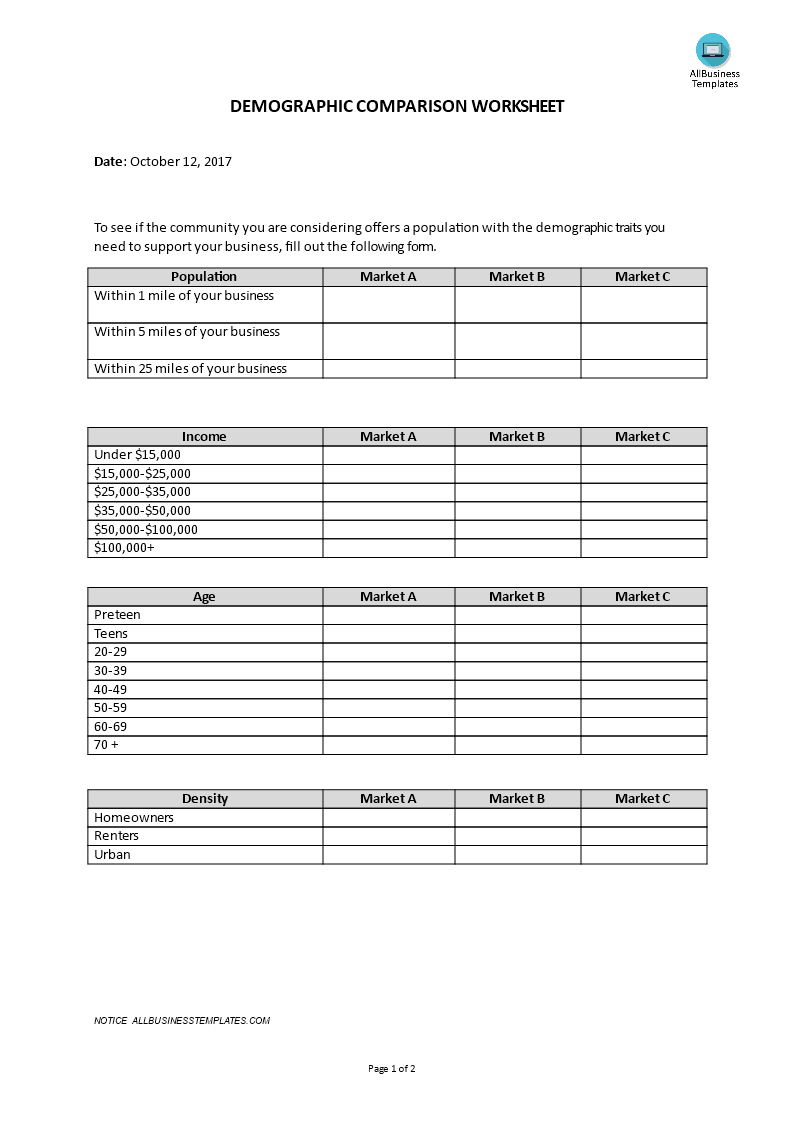

Credit card comparison worksheet

Credit Card Debt Payoff Spreadsheet | Excel Templates Let's say you have a total credit card debt of $6,000, spread over 3 credit cards. You owe $2,000 on each credit card. Credit card A has a fixed rate of 12 percent. Card B has a fixed rate of 14 percent, and Card C. has a fixed rate of 18 percent. If you paid credit card A at a rate of $100 per month, it would take you 23 months to retire ... Why A Credit Card Comparison Worksheet Is So Important ... A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees. Your Credit Card - EconEdLink Select a credit card that fits your preference and explain why you chose the card you did. Assessment 1. Assign the credit card worksheet. This worksheet is rigorous and may take two days for the students to complete. 2. Check the students' answers and reteach on an individual basis. Subjects: Economics, Mathematics, Personal Finance

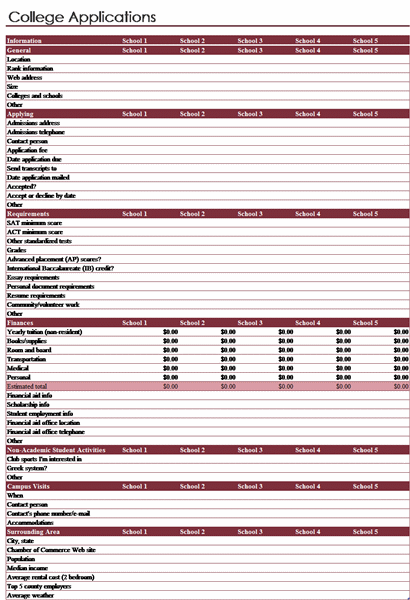

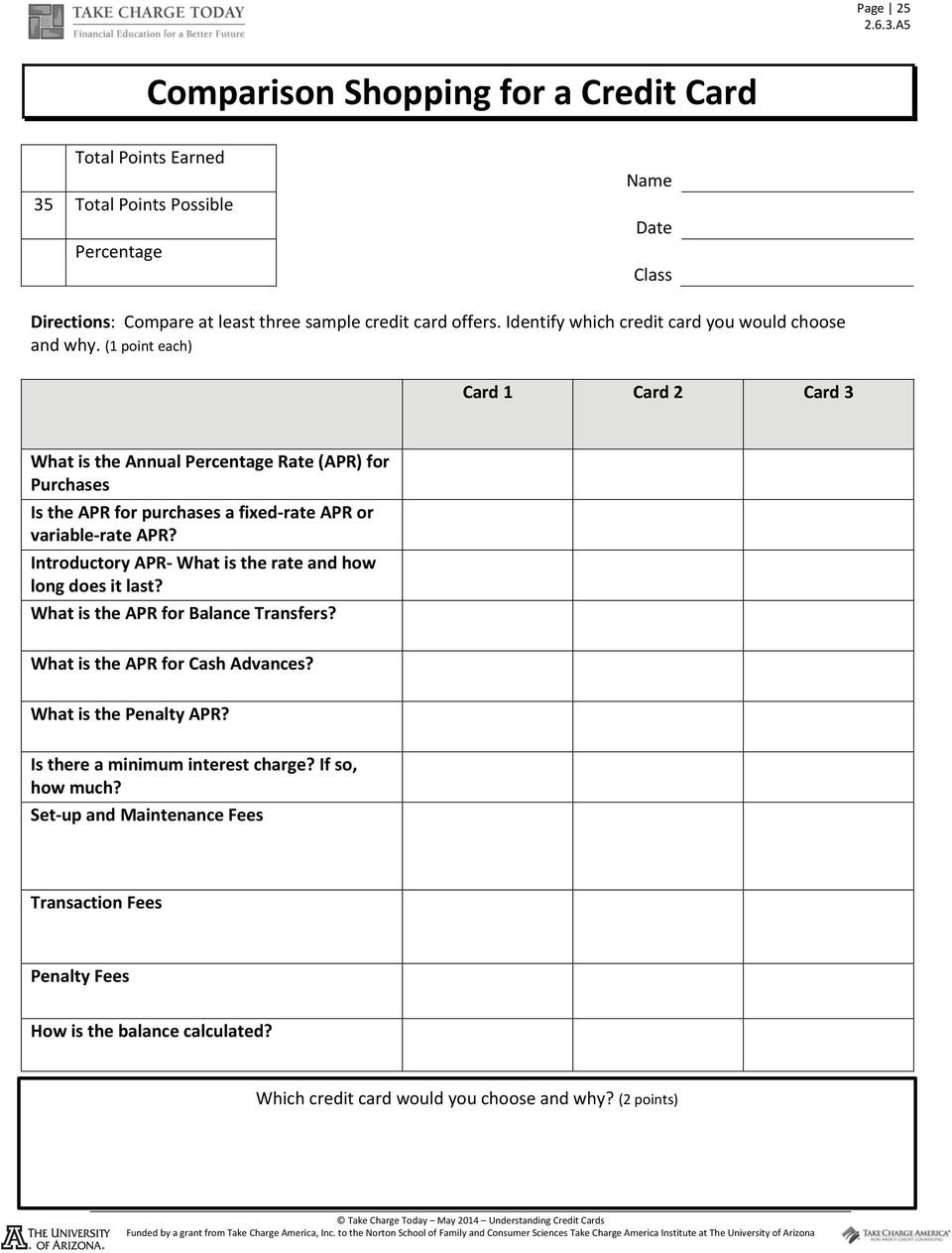

Credit card comparison worksheet. Credit card comparison worksheet (XLS) Credit Card 1 Credit Card 2 Credit Card 3 Fees Annual Late Payment Cash Advance Maximum Credit Limit Grace Period Type of Card Secured Regular Premium Issuer Purchases Cash Advances Late Payment Penalty APR for: Fixed or Variable APR Rewards Cash Back Points Frequent Flyer Miles Rebates Other Balance Consolidation Inactivity Credit cards: Find the Right Card For You at Creditcards.com Check out CardMatch™ Helpful calculations If math isn't your strong suit, we can help you find calculations with almost zero effort. Just type in a few details and we'll calculate how long it'll take to pay off your card, or how much a balance transfer could help you save. Discover savings now Read our top card reviews Let's start learning Credit Card Comparison Worksheet - SlideShare Credit Card Comparison Worksheet 1. Find three different credit card applications. 2. Compare. Próximo SlideShare. SlideShare ... Credit and Credit Card Lesson Plans, Consumer Credit ... CREDIT AND Credit Cards Lessons and Worksheets. This section includes lessons on consumer credit cards, credit, and paying interest. Learn about credit with an introduction to credit cards, reading a credit card statement, and advanced lessons regarding incorrect credit card transactions.

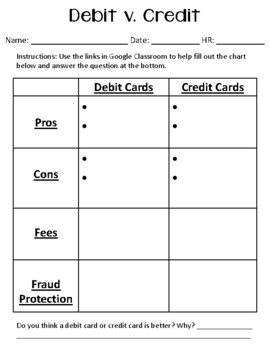

Loans and credit. Perecntage worksheet. | Teaching Resources This is a good functional worksheet which requires students to answer questions about loan and credit card repayments, it brings in percentages and division and would really help to develop financial awareness. This would be a good resource to use when studying percentages at GCSE. Thank you for sharing. Credit Card Comparison Flashcards | Quizlet Credit Card Comparison Flashcards | Quizlet Credit Card Comparison STUDY Flashcards Learn Write Spell TestNew stuff! PLAY Match Gravity Interest Rate Click card to see definition 👆 The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. At an interest rate of 10%, a borrower would pay $110 for $100 borrowed. PDF Credit Card Comparison Shopping Worksheet Publisher Credit Card Comparison Shopping Worksheet. Things to consider when choosing a credit card: • If you're going to pay the bill in fullevery month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer grace period so you don't get hit with a finance charge. • If you're going to carry a balance, you want the lowest possible interest rate and a low introductory rate. Credit Card Comparison Worksheet - SlideShare 24 Aug 2020 — Credit Card Comparison Worksheet 1. Find three different credit card applications. 2. Compare. Next SlideShares. SlideShare ...

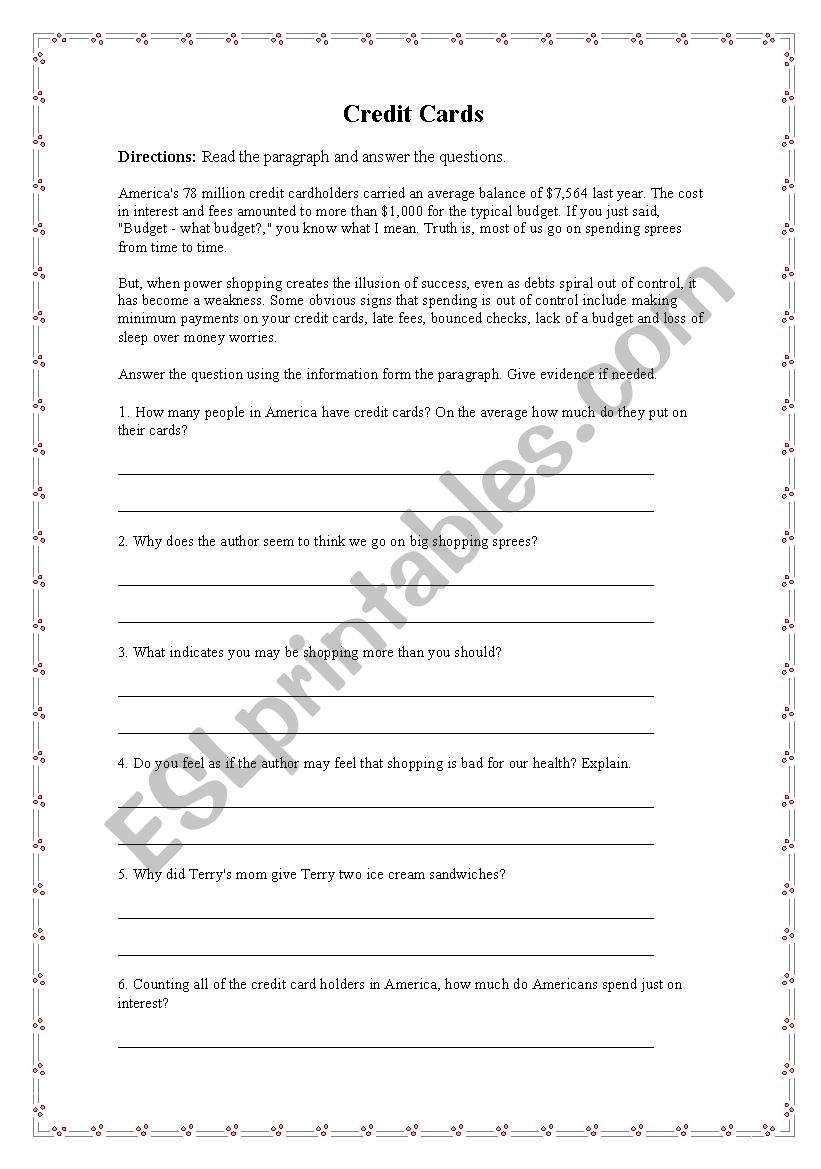

Free Financial Literacy Lesson Plans for High School Teachers Lesson Seven: Credit. In today's world, credit is integrated into everyday life. From renting a car to reserving an airline ticket or hotel room, credit cards have become a necessary convenience. However, using credit wisely is critical to building a solid credit history and maintaining fiscal fitness. PDF Consumer.gov Lesson Plan: Using Credit compare *credit card credit history *credit limit credit reporting company credit union deal debit card debt deposit earn everyday expensive *fee furniture ... prepaid cards. Preview Vocabulary. Use the worksheet version that is most appropriate for your learners. Edit the handout to include only the words you need or want to emphasize. 41 Credit Card Comparison Worksheet - Worksheet Was Here Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit.2 pages Compare Credit Cards: Compare & Apply Online Instantly 11-02-2022 · Compare credit cards from all the major credit card companies and quickly find the best credit card for your needs. PDF Lesson Five Credit Cards - Practical Money Skills credit cards student activity 5-3b Marie just used her new credit card to buy a bike for $400. Her budget allows her to pay no more than $25 each month on her credit card. Marie has decided not to use the credit card again until the bike is paid off. The credit card she used has an Annual Percentage Rate of 21%.

Credit Card Worksheet - Ms. Scharf's Website Credit Card Worksheet Go to to compare credit cards (bankrate.com>credit cards>find the best card for you). Fill out the chart below to help you decide which credit card is best for you. Credit Card #1 Credit Card #2 Credit Card #3 Name & Type of Card Phone Number Category (student, low rate, no fee, etc.) Introductory APR

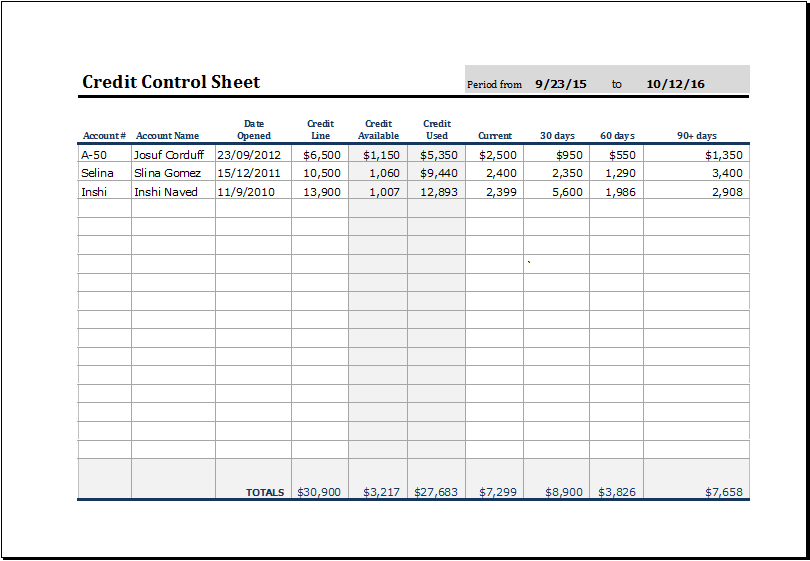

Credit Card Tracking Spreadsheet with Bill Tracker Spreadsheet Credit Card Tracking Awesome ...

PDF CREDIT CARD COMPARISON - Finance in the Classroom CREDIT CARD COMPARISON. Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit Card information: . Store Cards and Pay Day Lenders search individually on internet. Type of Credit & Company APR (%) Annual Fee Other Fees Balance Transfer Finance Charge Grace Period Other.

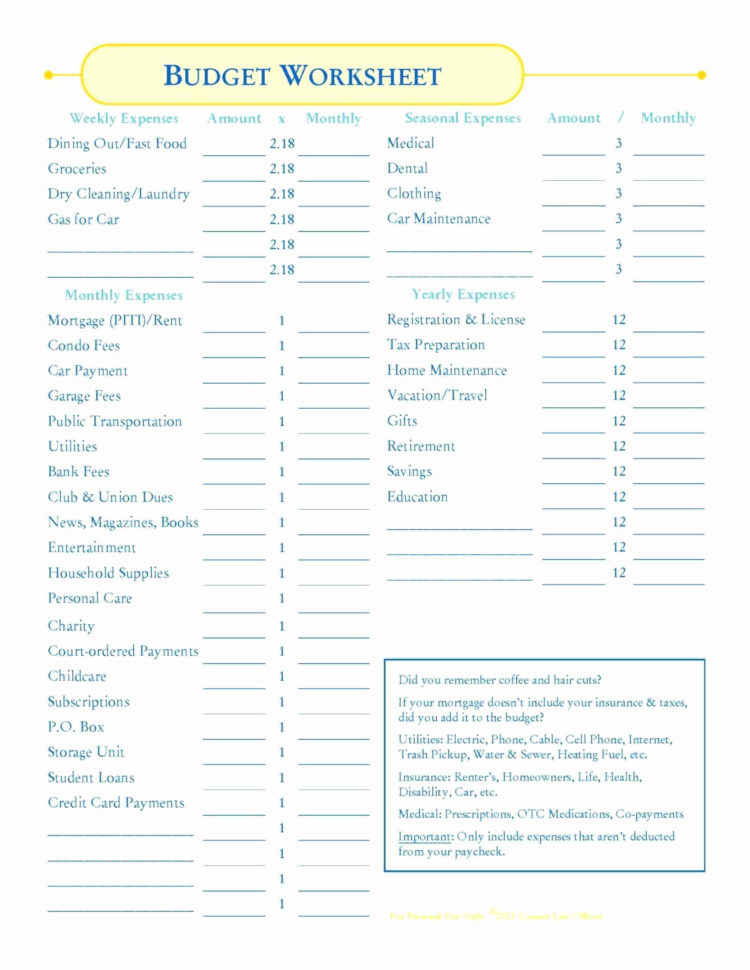

The Best Free Debt-Reduction Spreadsheets The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet. 1. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid.

PDF Comparison Shopping for a Credit Card - Weebly Directions : Compare at least three sample credit card offers. Identify which credit card you would choose and why. Card 1 Capital One® VentureOne® Rewards Credit Card Card 2 Quicksilver From Capital One Card 3 Discover It What is the Annual Percentage Rate (APR) for Purchases 0% 0% 0%

PDF Introducing the Credit Card - Credit Cards | Compare The ... A: 16 B: 17 C: 18 D: 19 E: A credit card number can be 16 to 19 digits long. 4. What happens after the expiration date on a credit card? A: The card no longer works B: The cardholder has to get a new card C: The card blows up D: Both A and B 5. How many numbers are in a CVV code? A: 1 B: 2 C: 3 D: 4 E: 3 or 4 5 Introducing the Credit Card

11 Steps to pay off and debt | Credit card payoff plan, Paying off credit cards, Budgeting finances

Compare Credit Cards - Credit Card Comparison Calculator Our credit card comparison calculator will handle all the time-consuming calculations and show you the long-term costs of using each card thus giving you the information you need to make a wise decision. Related: Why you need a wealth plan, not a financial plan. Terms & Definitions For Comparing Credit Cards

Teacher Printables - FITC - Finance in the Classroom A spin-free guide to reading the fine print on credit car offers and agreements. 10-12 Grades Credit Card Comparison (pdf) Practice choosing the right credit card for you! Credit Masquerade Activity (pdf) Credit Scores: The SATs of Adulthood (pdf) Learn About Your Offer (pdf) Understand Your Credit Card Offer Understand Your Statement (pdf)

The Ultimate Spreadsheet To Track Credit Card Churning ... Credit Card Rewards and churning Excel spreadsheet The spreadsheet I created focuses specifically on credit card bonuses and churning. As I've written before, it's not about spending money on the credit card, as much as it is about pocketing the sign on bonuses when it comes to abundant and free travel. The spreadsheet is simple, yet effective.

33 Comparison Shopping For A Credit Card Worksheet Answers - Notutahituq Worksheet Information

PDF Choosing a Credit Card Extension Activity for Credit ... ii. search credit card selector tool in the search engine (top right hand corner) iii. click on the search result credit card selector tool 6. Demonstrate to students how to use the FCAC Credit Card Selector Tool to compare credit cards: i. select province on left side of the screen (Alberta) ii. select general use and student under card type iii.

Credit Card Comparison Finance In The Classroom - US Legal ... Fill out each fillable field. Make sure the information you add to the Finance In The Classroom Credit Card Comparison Worksheet Answer Key is up-to-date and accurate. Include the date to the record using the Date function. Click on the Sign icon and make a signature. You can use 3 available options; typing, drawing, or uploading one.

Compare Credit Cards: Compare & Apply Online Instantly Secured Credit Card → Min Deposit of $200 One-Time Fees → $0 Regular APR → 22.74% (V) Annual Fee $0 Monthly Fee $0 Minimum Credit Limited History Apply Now Show Details Chase Freedom Unlimited® 693 Reviews Purchase Intro APR → 0% for 15 months Transfer Intro APR →

Copy_of_Credit_Card_Comparison_Worksheet.docx - Credit Card ... Credit Card Comparison Worksheet American Express Platinum Card APR (Fixed or Varied) 15.88% to 22.99% variable Introductory APR APR Cash Advances Grace Period/Paying. Interest Annual Fee Cash Advance Fee Balance Transfer Fee Late Payment Fee Returned Payment Fee Rewards. Savings Account Required (minimum for that account)

4 Credit Card Comparison Charts (Rewards, Fees, Rates ... Capital One VentureOne Rewards Credit Card AIR MILES RATING ★★★★★ 4.9 OVERALL RATING 4.8/5.0 $0 annual fee and no foreign transaction fees Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel Earn unlimited 1.25X miles on every purchase, every day

Your Credit Card - EconEdLink Select a credit card that fits your preference and explain why you chose the card you did. Assessment 1. Assign the credit card worksheet. This worksheet is rigorous and may take two days for the students to complete. 2. Check the students' answers and reteach on an individual basis. Subjects: Economics, Mathematics, Personal Finance

Why A Credit Card Comparison Worksheet Is So Important ... A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees.

0 Response to "42 credit card comparison worksheet"

Post a Comment