45 life insurance needs analysis worksheet

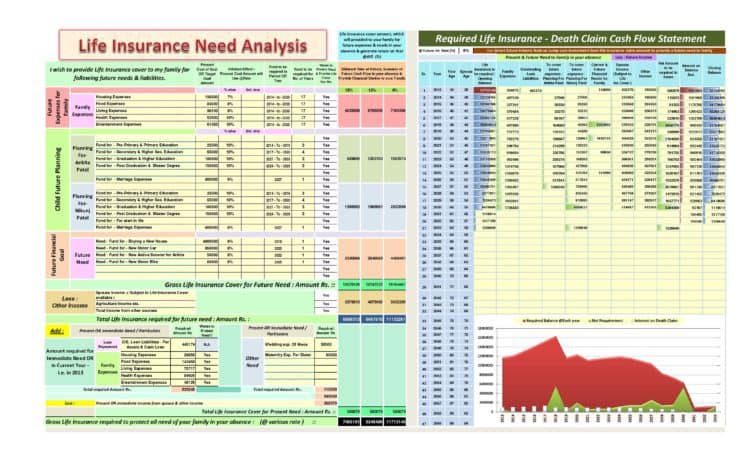

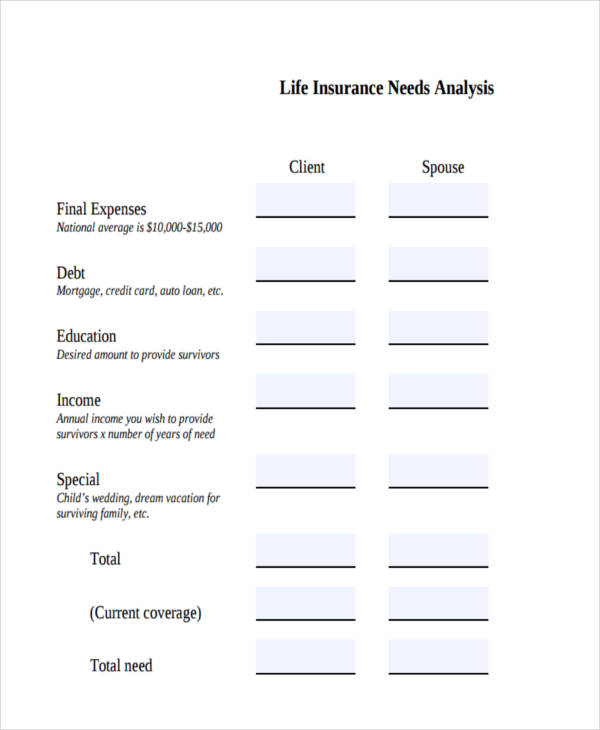

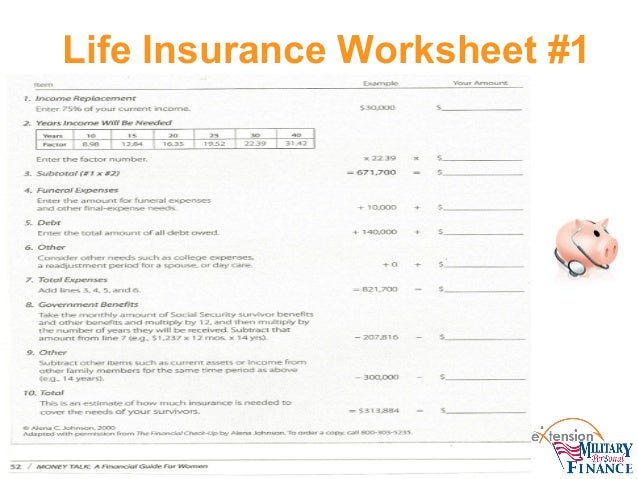

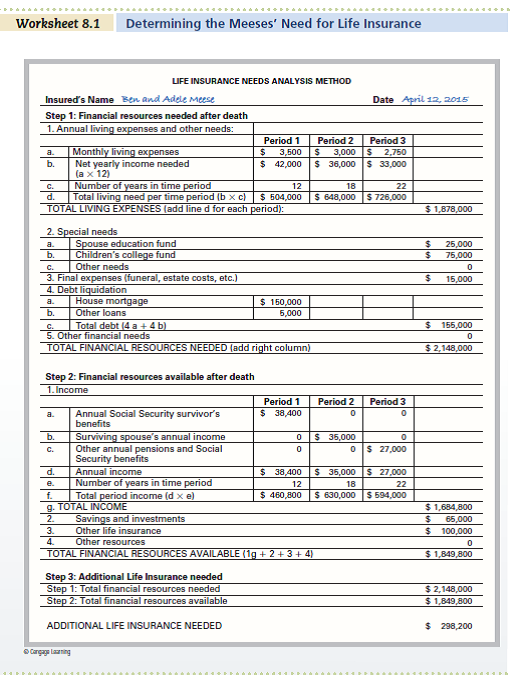

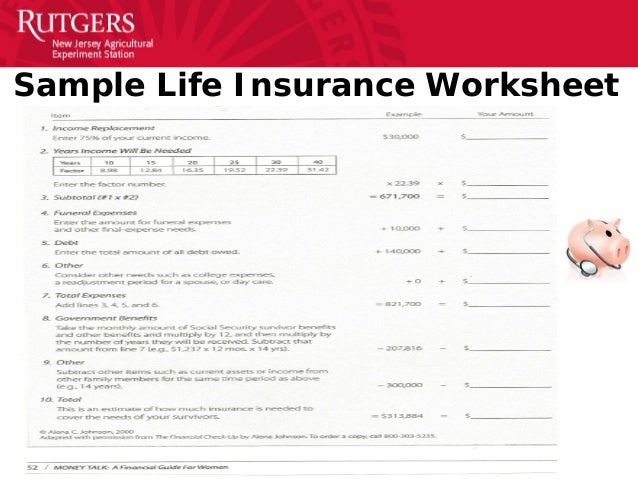

PDF Life Insurance Needs Analysis - n.b5z.net Life Insurance Needs Analysis Client Name: Date: Agent Name/Approved Title: This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs 1. Annual income your family would need if you die today Enter a number that's typically 10%-80% of total income. worksheet 8.1 - LIFE INSURANCE NEEDS ANALYSIS METHOD ... This preview shows page 1 - 2 out of 2 pages. View full document LIFE INSURANCE NEEDS ANALYSIS METHOD Insured's Name Step 1: Financial resources needed after death 1. Annual living expenses and other nee Period 1 Period 2 a. Monthly living expenses $ $ b. $ - $ - c. Number of years in time pe d.

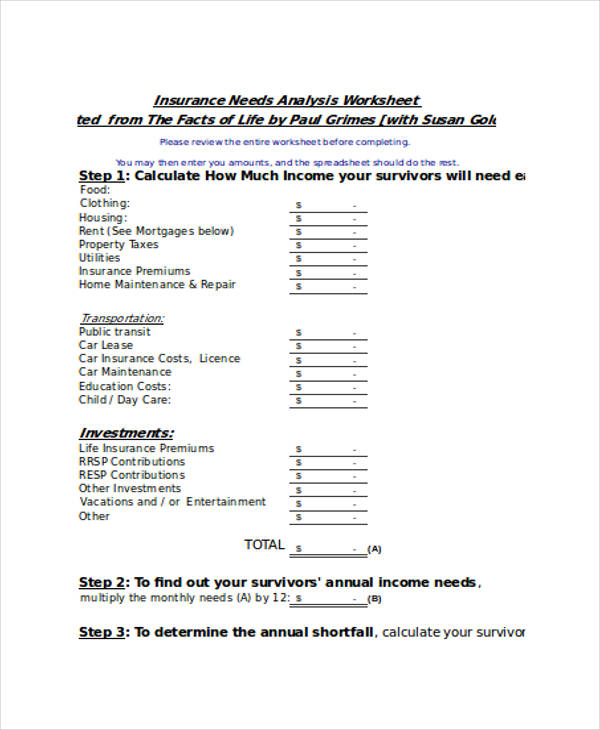

Life Insurance Needs Analysis Worksheet - Pruneyardinn Life Insurance Needs Analysis Worksheet (LNAW) helps to analyze the life-insurance requirements of a person. This worksheet helps to analyze and calculate all the various aspects of life assurance policy required by an applicant, including premium, contributions, discount, death benefit, and other financial matters.

Life insurance needs analysis worksheet

XLSX Wealth Link Financial Services TOTAL LIFE INSURANCE NEEDS I currently own life insurance form all sources equal to My net need for life insurance as of today is At this time I have decided to purchase additional coverage of ` HOUSEHOLD LIABILITIES: LEGACY NEEDS AND WANTS: (E) (F) This needs analysis demonstrates a life insurance need of (A+B+C-E) = INSURERIGHT Life insurance worksheet - CIBC COMPLETING THE WORKSHEET 1. Burial costs may range from $3,000 to $15,000.1 Your advisor can help estimate additional fees. 2. Total fees, including cost of living, may range from $10,000 to $20,000 per year, per child.2 3. Typically, the percentage of annual income your family will need if you die is 60% to 75% of your total family income PDF Life Insurance Needs Analysis Worksheet LIFE INSURANCE NEEDS ANALYSIS WORKSHEET Aatif Akhtar Broker-Agent CA DOI Lic. #0K77816 Cell: 818-448-0246 (Direct) Office: 818-217-4816 Fax: 818-670-7887 Email: info@coverlineinsurance.com I believe Life insurance is the greatest preventer of poverty... I would strongly suggest getting your life insured before you become

Life insurance needs analysis worksheet. PDF Life Insurance Needs Analysis - harvardfinancialeducators.com LIFE INSURANCE NEEDS ANALYSIS Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000 Subtotal $8,000 1-9 Months Probate Expenses $2,000 Estate Taxes Mortgage Pay-Off $50,000 Subtotal $52,000 Beyond 9 Months Emergency Fund $10,000 College Funding $100,000 How to determine eligibility | Washington State Health Care ... If you work a season of less than nine months, you are not eligible for the employer contribution during the off season, but may continue any combination of medical, dental, life and AD&D insurance when you are between periods of eligibility and not eligible for the employer contribution by self-paying for benefits for a maximum of 12 months. MOM Format – Minutes of Meeting Excel Template [Free Download] Jan 17, 2014 · You can protect your worksheet in Meeting Minutes Template Excel,so that others can’t modify it; When to use MOM – Meeting Minutes Template Excel: Generally after every project initiation meeting. Once you complete your meeting with your client, it is quite possible that you forget many points which you have discussed and raised with your ... Quiz & Worksheet - Life Insurance Needs Analysis | Study.com Personal Life Insurance Needs Analysis. Worksheet. 1. What are some things to keep in mind when deciding how much life insurance to have? Mortgage, Auto Loans, Funeral Expenses. Vacations, Build ...

PDF Easy Disability Insurance Needs Analysis - My Family Life ... Easy Disability Insurance Needs Analysis Determine Total Disability Insurance Needs Enter Numbers Below Monthly Expenses Monthly Amounts (1) Rent or Mortgage (2) Children's Daycare (3) Food (4) Debt Repayment/Student Loans (5) Utilities (6) Medical / Dental Insurance (7) Homeowners/Auto Insurance (8) Other Insurance Premiums (Life, etc) (9) Gas ... Why is System Analysis Important? - Study.com Jan 21, 2022 · System analysis is the process of evaluating needs to determine the design of new systems, as well as troubleshoot problems in existing systems. Explore an overview of system analysis to ... Generic-Life-Insurance-Needs-Analysis-Worksheet.xlsx ... LIFE INSURANCE NEEDS ANALYSIS WORKSHEET 1 Client Data Client Name Age Annual Income Primary Spouse Number of Family Members HOUSEHOLD LIABILITIES: Mortgage Balance Car Loans Lines of Credit Credit Cards Final Expenses Emergency Fund SUB TOTAL $0 (A) LEGACY NEEDS AND WANTS: Education Fund Legacy Fund for Children Charitable Bequest Other SUB TOTAL $0 (B) Version 2014-10 What percentage of your ... PDF Life Insurance Needs Analysis Worksheet Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H I J CURRENT CASH NEEDS Factor 0.008744 0.005964 Key to H

Life Insurance Needs Analysis Worksheet - Calculators This calculator will help you determine what your life insurance needs are. First enter potential funeral costs and estate taxes. Then include amounts needed for non-mortgage debt, emergency expenses, and college funds. Then enter annual living expenses, your spouse's annual income after taxes, and annual Social Security benefits. What Is the 50/20/30 Budget Rule? How It Works - Investopedia Mar 05, 2022 · The 50-20-30 (or 50-30-20) budget rule is an intuitive and simple plan to help people reach their financial goals. The rule states that you should spend up to 50% of your after-tax income on needs ... PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date A life insurance needs analysis is a first step toward ... Fortunately, those questions can be answered with a life insurance needs analysis, a tool that helps people figure out how much coverage they should have. Agents conduct these analyses over the phone or in person, and they usually take no more than 5 to 10 minutes.

PDF Calculating your life insurance needs in 3 easy steps… - BMO A + B - C = Your Life Insurance Needs $ Client Signature: Date: Advisor Signature: Date: I understand that the values illustrated in this life insurance analysis are based on financial information that I have provided and my understanding of my future financial needs in the event of my death. The illustrated insurance coverage is subject to

ASEC Educating the public about all aspects of financial security through a coalition of major public- and private-sector partners.

Coursework Hero - We provide solutions to students Please Use Our Service If You’re: Wishing for a unique insight into a subject matter for your subsequent individual research; Looking to expand your knowledge on a particular subject matter;

Life Insurance Needs Calculator - Life Happens Life Insurance Needs Calculator - Life Happens Life Insurance Needs Calculator Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. This is an estimate only. For a complete assessment, contact a qualified insurance professional. Question 1 of 7

PDF Term Life - rdvfs.com.au Insurance Needs Analysis Worksheet - Term Life Term Life Pays out a Lump Sum in the event of your death, or being told you have less than 12 months to live Lump Sum Needs Client 1 Client 2 Clear Mortgage $ $ Clear Investment debt(s) $ $ Clear other debt(s) $ $ Funeral costs $ $ Other $ $ A. Total $ $

Life Insurance Needs Calculator for Excel | Excel Templates The calculator asks: Details about burial expenses Number of years you need to pay from your income Annual income that the survivor will need Number of survivors The amount you have in savings The amount you have invested Details about the expenses you want to be refunded

How Much Life Insurance Do I Need? - State Farm A simple way to determine the amount of life insurance needed is to multiply your current income by 10 to 15. Is my current life insurance coverage enough? Some people who have life insurance through work may assume that will be plenty for their family to live on - and that may be correct depending on your life stage.

Rates information | Washington State Health Care Authority Jan 01, 2020 · State agency and higher education institution rates State agencies, four-year higher education institutions, community and technical colleges and commodity commissions 2022 January-June 2021 July-December 2021 January - June 2020 July - December 2020 January - June 2019 July - December 2019 January - June 2018 July - December 2018 January - June 2017 July - December 2017

Get Our Image of Life Insurance Needs Analysis Template for Free | Meeting agenda template ...

PDF Life Insurance Needs Analysis Fact Finder Life Insurance Needs Analysis Fact Finder. Income Needs. 1. Family Income Need $ (60-80% of total family income) 2. Income Available to Family $ (Spouse earnings, Social Security etc.) 3. Years Family Income Needed (Number of years —10,15,20,25,30,35,40,45,50) Expenses: 4. Funeral & Emergency Fund $

PDF How much Life Insurance Do you need??? Life Insurance Do you need??? Life Insurance Needs Analysis for: _____ As a provider for your family, your loved ones have a life that would not be the quality it is without you. It's especially important to protect your family's quality of life to guard against the time you are no longer there to provide for them.

PDF Life Insurance Needs Worksheet - Independent Benefit Solutions Get a general sense of how much life insurance you need to protect your family. Before buying life insurance, it makes sense to consult with an insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 1. Total annual income your family would need if you died today

Life Insurance Needs Worksheet Form - Fill Out and Sign ... How to create an eSignature for the life insurance needs worksheet Speed up your business's document workflow by creating the professional online forms and legally-binding electronic signatures. The way to create an electronic signature for a PDF in the online mode The way to create an electronic signature for a PDF in Chrome

PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H I J

PDF A Short Version of A Financial Needs Analysis A SHORT VERSION OF A FINANCIAL NEEDS ANALYSIS [C] Calculating Capital Needs. Find difference. between [3] and [4]. If income needs exceed available income, proceed to Step [C]. Multiply. monthly income shortfall [B] by 12 to determine annual shortfall. ... Life insurance (including employer-provided) Outstanding uninsured debts (mortgages if not

PDF Easy Life Insurance Needs Analysis Total Additional Life Insurance Needs $0 Applicant print name: Sign name: Date: As Surviving Spouse or Beneficiary, I understand that any changes to my estimated life insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than ...

0 Response to "45 life insurance needs analysis worksheet"

Post a Comment