39 funding 401ks and roth iras worksheet

PDF Mr. Powell's Classes - Home 401(k), 403(b), 457 When it comes to IRAs, everyone with an income is eligible The maximum annual contribution for income earners is as of 2008. Remember: IRA is not a type of It is the tax treatment on virtually any type at a bank. of investment. The Roth IRA is an The Roth IRA has more -tax IRA that grows tax Higher at retirement. PDF Roth vs. Traditional 401(k) Worksheet - Morningstar An increasing number of 401(k) plans are offering a Roth option. The key differences are as follows: Traditional 401(k) p Pretax contributions p Tax-deferred compounding p Taxed upon withdrawal in ...

PDF NAME: DATE: Funding 401(k)s and Roth IRAs Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth Þrst (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

Funding 401ks and roth iras worksheet

Roth IRAs | Internal Revenue Service - IRS tax forms Roth IRAs. A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth IRA after you reach age 70 ½. You can leave amounts in your Roth ... Funding 401(k) and Roth IRAs (1).pdf - NA ME: DAT E Funding 401(k)sand Roth IRAsDirectionsComplete the investment chart based on the facts given for each ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts

Funding 401ks and roth iras worksheet. What Is a Roth IRA? Everything You Need to Know - Insider Roth IRAs are a type of individual retirement account in which you pay taxes now rather than later. This allows for tax-free growth and withdrawals. ... Roth IRA vs. 401(k) A 401(k) is another ... One Participant 401k Plans | Internal Revenue Service Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 (k) plan contributions. See also Calculating Your Own Retirement Plan Contribution. Testing in a one-participant 401 (k) plan PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money. Retirement Plan FAQs Regarding Contributions - S Corporation No. Contributions to a retirement plan can only be made from compensation, which, in the case of a self-employed individual, is earned income. Distributions you receive as a shareholder of an S corporation do not constitute earned income for retirement plan purposes (see IRC Sections 401 (c) (1) and 1402 (a) (2) ). 401 (k) Plan Contributions.

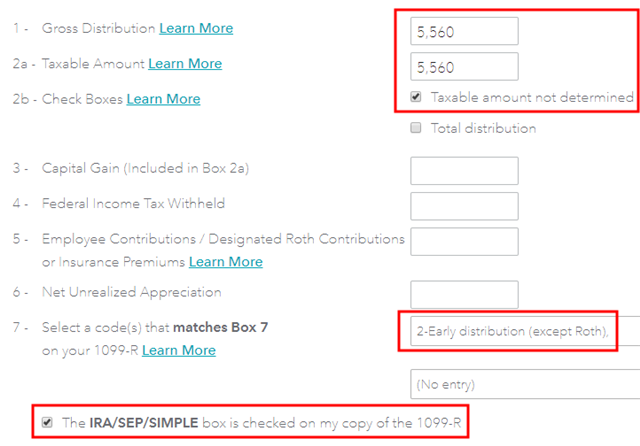

401(k) to Roth IRA Conversion: Rules & Regulations - Investopedia So, when you roll over a traditional 401 (k) to a Roth IRA, you'll owe income taxes on that money in the year when you make the switch. The total amount transferred will be taxed at your ... Roth IRAs and 401(k)s: Answers to Readers' Questions - WSJ These accounts include the Roth variety of individual retirement account and also the Roth type of company-sponsored 401(k) savings plan. Subscribe Sign In Continue reading your article with Funding 401(k)s & Roth IRAs Chart.docx - Course Hero Funding 401 (k)s & Roth IRAs Directions: Complete the investment chart based on the facts given for each situation. All of the people are following good sound advice and investing 15% (change to .15 to multiply by their annual salary to come up with their Total Annual Investment) of their annual household income for retirement. Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME Finance, Household income in the United States, Individual Retirement Account, Roth IRA Report Students who viewed this also studied Funding 401 (k)s & Roth IRAs Chart.docx 1 Act-Ch12-L03-S.pdf 2 Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx 1 Funding_401K_s_and_IRA_s.png 1 Activity_Funding_A_401k_And_Roth_IRA.pdf 2

Copy of Funding 401(k)s and Roth IRAs - Course Hero Funding 401(k)s and Roth IRAs Directions: Complete the investment chart based on the facts given for. ... Complete Funding 401ks and Roth IRAs Worksheet.jpg. 401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k) Is Your 401(k) Enough for Retirement? | RamseySolutions.com The contribution limit for Roth IRAs in 2021 and 2022 is $6,000 per individual, and it increases to $7,000 if you're 50 or older. 2 It's possible that you might not reach 15% of your income in your Roth IRA. If that happens, go back to your 401(k) and invest the remainder to take advantage of your 401(k)'s tax deferral. Amount of Roth IRA Contributions That You Can Make For 2021 Amount of your reduced Roth IRA contribution. If the amount you can contribute must be reduced, figure your reduced contribution limit as follows. Start with your modified AGI. $125,000 for all other individuals. Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing a separate return and ...

Roth IRA vs. 401K: How to choose | Stash The annual cap on 401 (k) contributions is significantly higher than the Roth IRA limit. For 2022: Employees can contribute up to $20,500 Employees over 50 can contribute an extra $6,500 With the employer match, contributions cannot exceed $61,000, or $67,500 for employees over age 50

Funding_A_401k_And_Roth_IR... NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the. ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 - Free Gold ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Roth IRA Contribution Rules: The 2022 Guide - Investopedia Key Takeaways. Only earned income can be contributed to a Roth individual retirement account (IRA). 2. Most people can contribute up to $6,000 to a Roth IRA in 2021 and 2022. If you are age 50 or ...

Solved Activity: Funding 401(k)s and Roth IRAs Objective: | Chegg.com Activity: Funding 401 (k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of ...

Retirement Plan Forms and Publications | Internal Revenue Service Designated Roth Accounts Under 401(k), 403(b) or Governmental 457(b) Plans: PDF PDF: Publication 4531: 401(k) Plan Checklist: PDF PDF: Publication 4546: 403(b) Plan Checklist: PDF PDF: Publication 4587. Payroll Deduction IRAs for Small Businesses. PDF PDF: Web: Publication 4674. Automatic Enrollment 401(k) Plans for Small Businesses. PDF PDF ...

Funding 401K And Roth Ira Worksheet - Free Gold IRA Rollover Guide ... Funding 401K And Roth Ira Worksheet Overview Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Funding 401ks and Roth Iras Worksheet - Semesprit Funding 401ks and Roth Iras Worksheet with Preschool Printable Worksheets Free Super Teacher Workshee Download by size: Handphone Tablet Desktop (Original Size) Your 401k is all about saving money. It provides a good amount of income, if you were to hold onto it until retirement.

Roth IRA vs. 401(k): Which Is Better for You? | RamseySolutions.com That's right: tax-free. That means once you turn 59 1/2, you can withdraw money from your account, and you won't owe a penny in taxes! Advantages of a Roth IRA. Here are some advantages a Roth IRA has over a 401 (k): Tax-free growth. Unlike a 401 (k), you contribute to a Roth IRA with after-tax money.

Act-Ch12-L03-S.pdf - Funding 401(k)s and Roth IRAs ... Funding 401(k)s and Roth IRAs CHAPTER 12, LESSON 3 DATE NAMES DIRECTIONS Complete the investment ... Complete Funding 401ks and Roth IRAs Worksheet.jpg.

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET Copy of Funding 401 (k)'s and Roth IRA's - WORKSHEET - Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual | Course Hero Copy of Funding 401 (k)'s and Roth IRA's - WORKSHEET -... School New Life Academy, Woodbury Course Title MATH 12345 Uploaded By ConstableScorpionPerson2954 Pages 2 Ratings 75% (4)

Forms & Applications | Charles Schwab Find the forms you need in one convenient place. Open an account, roll over an IRA, and more.

0 Response to "39 funding 401ks and roth iras worksheet"

Post a Comment