39 non cash charitable contributions donations worksheet

PDF 2021 Charitable Contributions Noncash FMV Guide - Tax Happens Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pic-tures for proof the items were in good or better condition at the time they were donated. Recordkeeping Rules for Charitable Contributions 6+ Popular Non Cash Donation Worksheet - Mate Template Design Non Cash Charitable Contributions Donations Worksheet 2017. Goodwill Donation Excel Spreadsheet Template. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. The Donation Form Templates can help you procure the details about the amount and property youve donated in charity hospitals and foundations.

Donation Calculator Therefore, the ideal way to use this spreadsheet is by laptop or desktop computer. Entering Data Enter the number of items you donate in the Qty columns. Also, your totals will reset when you do. However, if when you enter a quantity field, you get an error. Simply change the quantity to 0 (zero). Exporting

Non cash charitable contributions donations worksheet

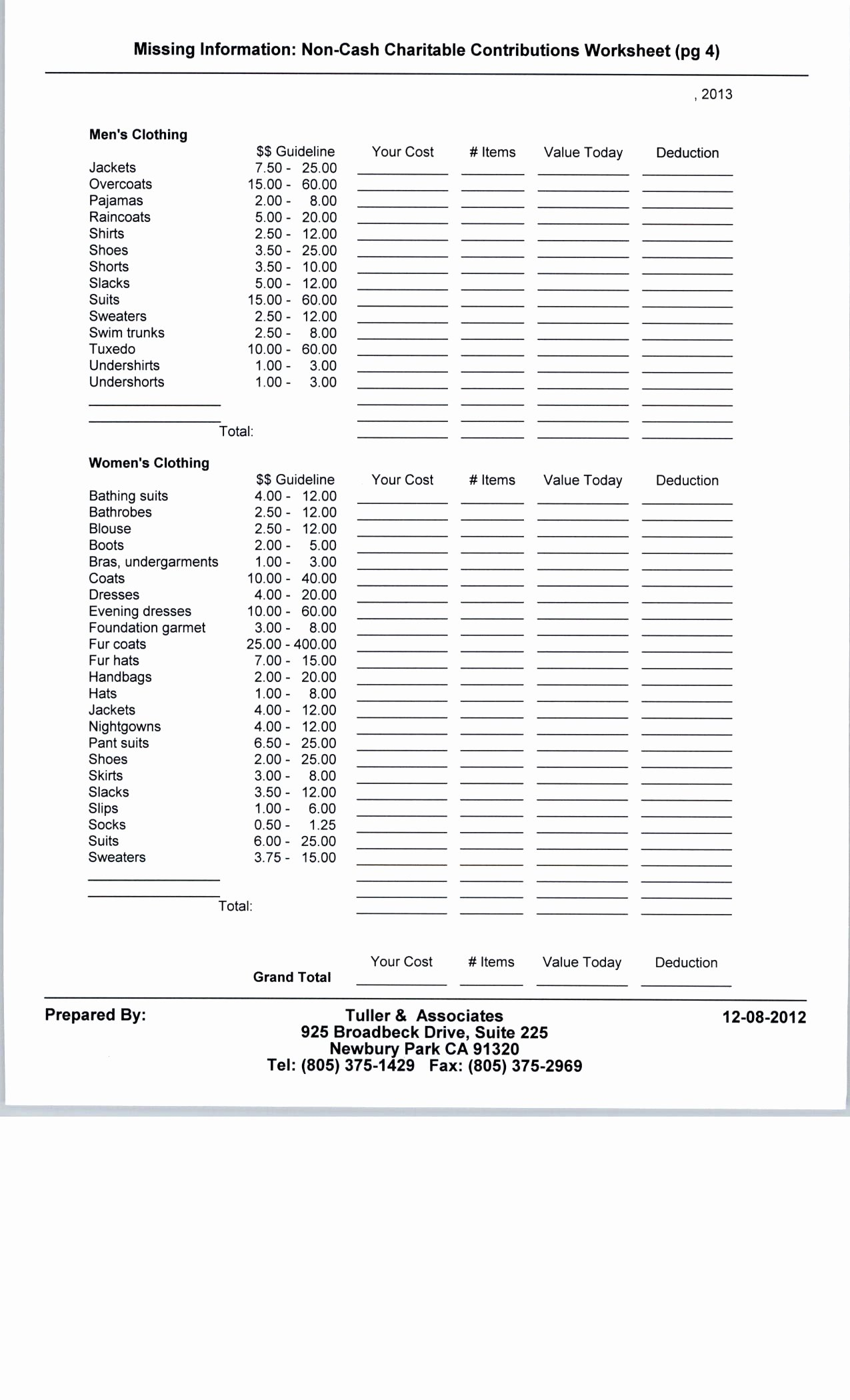

PDF Missing Information: Non-Cash Charitable Contributions Worksheet (pg 5) no later than the filing date of your return. With the exception of publicly traded securities, most donations over $5,000 require a written appraisal. Charity name/address: Date of donation: ... Non-Cash Charitable Contributions Worksheet (pg 5) Prepared By: Kerry M. Kerstetter, CPA 01-21-2004 11802 Deer Road Harrison AR 72601-6550 Donation Value Guide 2021 Spreadsheet - signNow There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity. XLS Noncash charitable deductions worksheet. - LSTAX.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

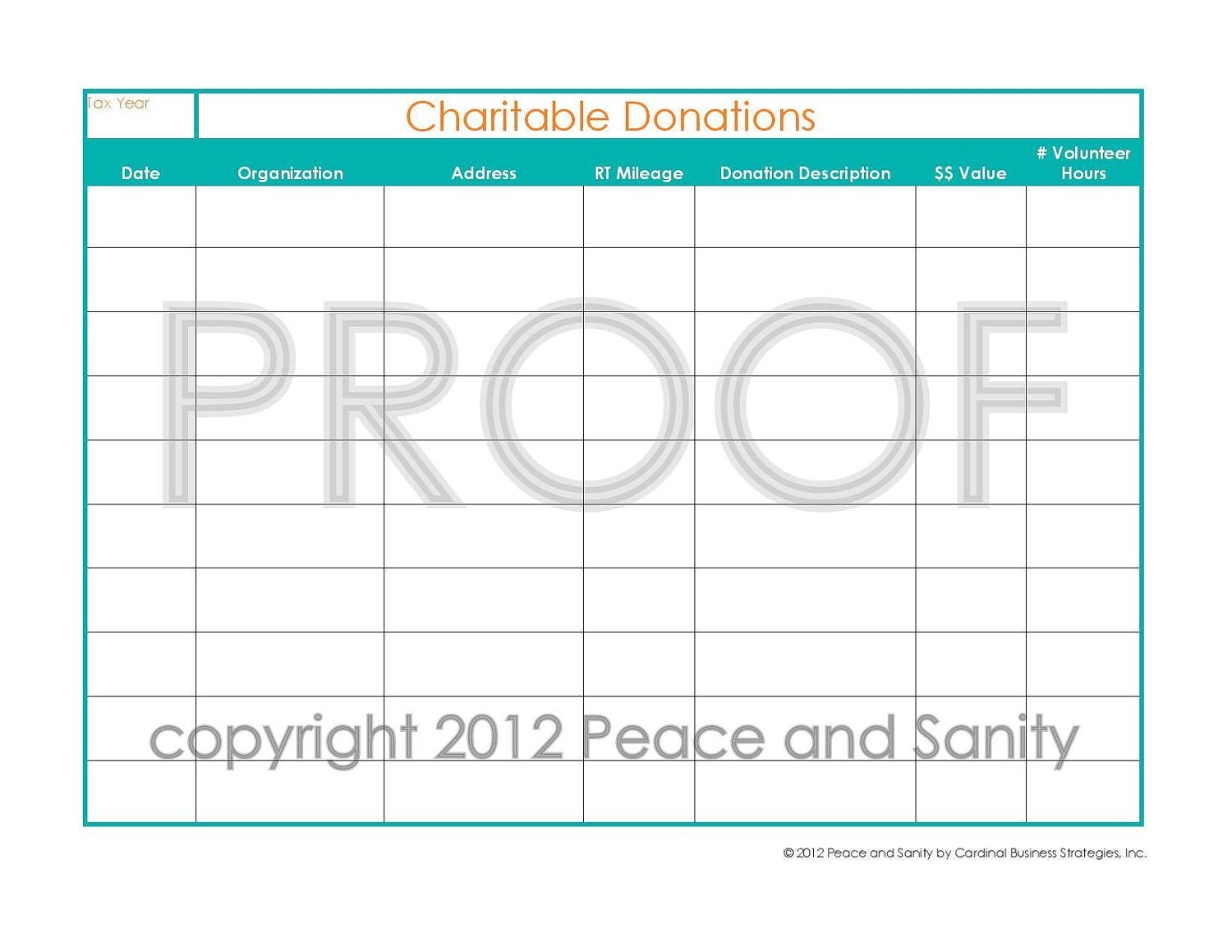

Non cash charitable contributions donations worksheet. XLS Noncash charitable deductions worksheet. - imgix NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING PDF Welcome | M. Greenwald Associates LLP EXPENSE WORKSHEET FOR NON-CASH CONTRIBUTIONS Drapes CLIENT NAME In order for us to maximize deductions please complete the work sheet TAX YEAR You can save tax dollars when you maximize your non-cash charitable deductions. The IRS allows you to deduct the Fair Market Value (FMV) — that is, the price the item would sell for in a thrift shop. The PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00 Tax Tip: Deducting Non-Cash Charitable Donations for 2021 A clothing or household item for which a taxpayer claims a deduction of over $500 does not have to meet this standard if the taxpayer includes a qualified appraisal of the item with their tax return. Donations of property totaling over $5,000 annually always require an appraisal. However, appraisals have to meet strict paperwork requirements ...

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. PDF Non-cash Charitable Contributions / Donations Worksheet Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. XLSX atslsmo.com NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Revised March 22, 2007 WHAT IS YOUR ORIGINAL COST ... Notes (optional Better than Good. Please fill out each column. YOU MUST COMPLETE A SEPARATE WORKSHEET FOR EVERY SINGLE DONATION SLIP. EXAMPLE: IF YOU HAVE A DONATION SLIP FROM GOODWILL ON FEBRUARY 2nd AND ANOTHER ... non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data.

PDF Missing Information: Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00 Publication 526 (2021), Charitable Contributions - IRS tax forms Noncash Contributions Out-of-Pocket Expenses How To Report Reporting expenses for student living with you. Noncash contributions. Total deduction over $500. Deduction over $5,000. Vehicle donations. Clothing and household items not in good used condition. Qualified appraisal. Qualified appraiser. Easement on building in historic district. About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments PDF NON-CASH CHARITABLE CONTRIBUTION WORKSHEET - Holberton Tax non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x =

Goodwill Donation Sheet Worksheets - Learny Kids You can & download or print using the browser document reader options. 1. VALUATION GUIDE FOR GOODWILL DONORS 2. Goodwill Donated Goods Value Guide 3. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 4. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 5. The Salvation Army Valuation Guide for Donated Items ... 6.

Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ...

PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services missing information: non-cash charitable contributions worksheet (pg 2) furniture bed (twin) bed (king, queen, full) carriage chair (upholstered) chest china cabinet clothes closet coffee table convertible sofa crib (w/mattress) desk dining room set dresser w/ mirror end tables floor lamps folding beds hi riser high chair kitchen cabinet kitchen …

PDF 2020 Charitable Contributions Noncash FMV Guide - DHA CPAs Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions

Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form While other platforms allow you only to download the Donation Value Guide Spreadsheet for further printing, filling, and scanning, we give you a complete and simple service for preparing it online. First of all, when you select Get Form, you get numerous features for efficient document preparing and eSigning. Next, it is possible to select your ...

How to Estimate the Cost Basis on Non-Cash Charitable Deductions Charitable Contributions 2017. Because the standard deduction for 2017 is $6,370 for singles and $12,700 for married couples filing jointly, more taxpayers will itemize in 2017 than for the following tax year. For many, this may prove the last year they itemize deductions at least until the TCJA expires in 2026. 00:00 00:00.

XLS Noncash charitable deductions worksheet. - LSTAX.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the

0 Response to "39 non cash charitable contributions donations worksheet"

Post a Comment