40 flood insurance coverage worksheet

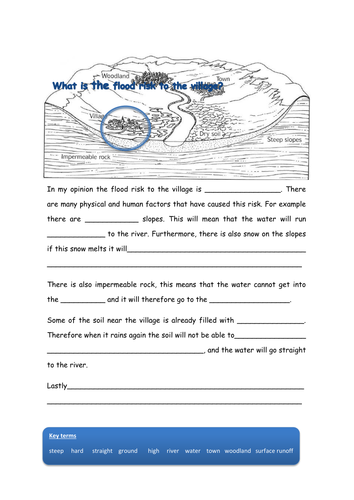

FloodSmart | What Does Flood Insurance Cover? Flood insurance covers losses directly caused by flooding. In simple terms, a flood is an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties. For example, damage caused by a sewer backup is covered if the backup is a direct result of flooding. Minimum Flood Coverage Calculator | Bankers Online Dan Persfull, of The Peoples State Bank has provided a quick way to calculate the minimum amount of flood insurance needed for flood requirements. This spreadsheet requires three input values: 1. Loan Balance 2. Property Value 3. Property Type The result is the minimum amount of required coverage and up to five buildings may be entered at once.

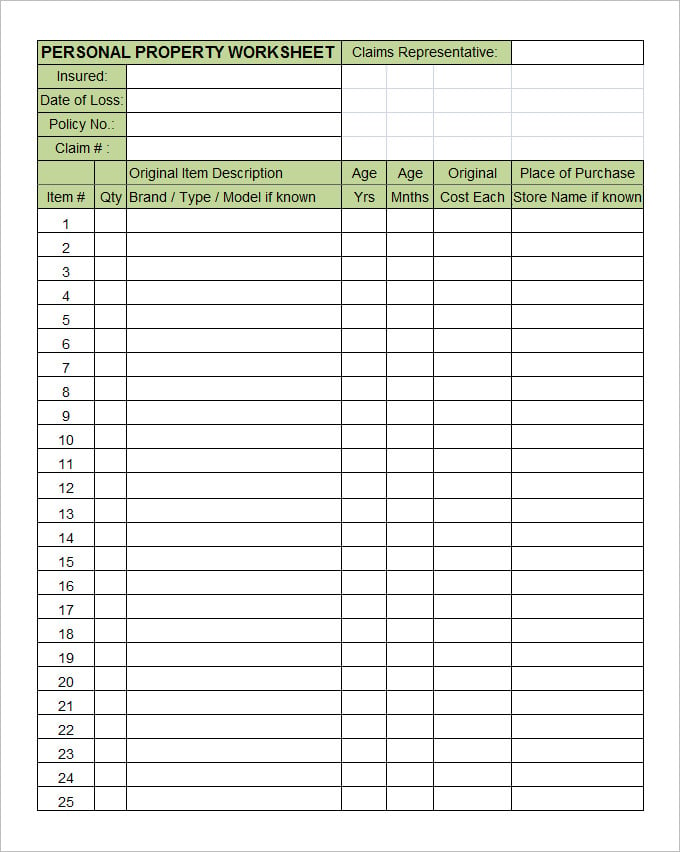

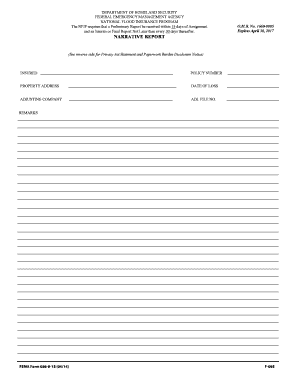

National Flood Insurance Program Claim Forms for ... May 05, 2021 · Building Property Worksheet (MUST DOWNLOAD) This form can be filled out online. FEMA Form 206-FY-21-107: Policyholders use this form provide specifications of the damaged building(s) and a detailed repair estimate, which includes an inventory of the of flood-damaged building property showing the quantity, description, actual cash value and amount of loss.

Flood insurance coverage worksheet

The National Flood Insurance Program | FloodSmart | NFIPServices ... This page contains links to information about the National Flood Insurance Program's (NFIP) Write Your Own Program, including a link to a list of property and casualty insurance companies that can write and service the Standard Flood Insurance Policy (SFIP). Participating Insurance Companies and Subsidiaries; WYO Company Arrangements PDF Flood Insurance Accepting Private Flood Insurance § Biggert-Waters Act requires lenders to accept private flood insurance policies as satisfaction of the mandatory purchase requirement if the coverage provided by the private policy satisfies the standards specified in the Act, subject to an implementing rule. § Flood Insurance Coverage Calculator | Fannie Mae This calculator tool is designed to assist lenders in determining the minimum flood insurance coverage required by Fannie Mae. The tool can be used for 1- to 4-unit properties, PUDs, detached condominiums, attached condominiums, and co-ops. Refer to the Selling Guide and other resources for complete requirements and more information.

Flood insurance coverage worksheet. B7-3-07, Flood Insurance Coverage Requirements (12/15/2021) For a property under construction or renovation, the flood insurance coverage must be in an amount equal to the "as is" value of the property. The coverage must be increased, if necessary, following completion of the renovation work to ensure that the coverage meets Fannie Mae's standard coverage requirements. Online Bankers Training - Private Flood Insurance Checklist Private Flood Insurance Checklist Back in August, we added sample Private Flood Insurance Procedures to the free Lending Tools page of our website. These sample procedures were designed to give you a starting point or framework to help you develop procedures for your institution. We encourage you to take these procedures and tweak as needed. PDF Flood Insurance Processing Center PO Box 2057 Kalispell, MT 59903 Phone ... Policy Number: _____ Insured Name: _____ Property Address: _____ ENCLOSURE/PROPER VENTING WORKSHEET . The National Flood Insurance Program (NFIP) requires the following information for all elevated buildings that have an enclosure, basement or crawlspace. If the structure has multiple enclosures, a separate worksheet should be completed for ... Auto Insurance Worksheet - rmiia.org Subtract the ones you may not need and you gain some control over the cost. Use the following worksheet to help you and your insurance agent select the best auto insurance policy for you. Answering these questions for yourself on an annual basis can help you keep your policy up-to-date. 1. Who are the drivers in my household?

DOCX OMB No. 2506-0177 - HUD Flood insurance is required. Provide a copy of the flood insurance policy declaration or a paid receipt for the current annual flood insurance premium and a copy of the application for flood insurance. Continue to the Worksheet Summary. ☐ Yes, less than one year has passed since FEMA notification of Special Flood Hazards. XLSX Welcome - Sterling Compliance LLC CALCULATING FLOOD INSURANCE COVERAGE | A STEP-BY-STEP WORKSHEET TRANSACTION DETAILS STEP 1: Document the Details of the Transaction Application or Account Number Applicant or Borrower Name(s) Collateral Address Primary Purpose of Subject Property Number of Residential Structures on Property Number of Detached Structures on Property Flood Insurance Calculation Worksheet - Fill and Sign Printable ... Get the Flood Insurance Calculation Worksheet you need. Open it up with online editor and begin altering. Fill out the blank areas; involved parties names, places of residence and numbers etc. Customize the template with smart fillable areas. Put the day/time and place your e-signature. Click Done after twice-examining everything. PDF NFIP Specific Rating Guidelines, April 2021 - FloodSmart $1,000 for coverage up to $100,000, and $1,250 for coverage over $100,000, based on whether the building is Pre- or Post-FIRM. 2. Before a specific rate can be quoted for a risk, the underwriter must have the following: • Complete NFIP Flood Insurance Application. • Complete Elevation Certificate . iii April 1, 2021

PDF All Banker Tools | Bankers Online Exception Tracking Spreadsheet (TicklerTrax™) Downloaded by more than 1,000 bankers. Free Excel spreadsheet to help you track missing and expiring documents for credit and loans, deposits, trusts, and more. Visualize your exception data in interactive charts and graphs. Provided by bank technology vendor, AccuSystems. Download TicklerTrax for free. Quiz & Worksheet - Flood Insurance Overview | Study.com The National Flood Insurance Program Worksheet Print Worksheet 1. Which of the following is the definition of a flood zone? Any area that has flooded in the last five years Any area within 5 miles... Flood Insurance Calculation Worksheet - Compliance Resource The Flood Insurance Calculation Worksheet helps add up the proper amount of required flood insurance. It provides space for the applicant/borrower and loan/application information, space to document the amount of required insurance using the calculation as well as space to document who completed the form and the date the form was completed. Auto Insurance Glossary of Terms - rmiia.org This coverage is for when you damage someone else's property with your vehicle. Usually it's someone's car, but it can apply to other property such as buildings, utility poles, fences and garage doors. Rate. This is the cost of a unit of insurance (usually $1,000 worth). Insurance is based on the history of loss experience for similar risks.

National Flood Insurance Program (NFIP) Worksheet -Coverage includes Building Property up to $250,000 -All the policies are in SFHA, average premium per policy is $734/year How many claims have been paid in the community? What is the total amount of paid claims? How many of the claims were for substantial damage? -27 claims have been paid totaling $540,000 in the last 5

How to Calculate Flood Insurance Requirements - Financial Web The replacement value of a home constitutes the amount of flood insurance coverage that is required. For example, a homeowner with a mortgage amount of $200,000 would acquire a flood insurance policy for $200,000. Pretty simple. A mortgage holder with a mortgage of $200,000 who put down $50,000 toward the purchase price of the home would have ...

PDF INSURANCE POLICY INFORMATION - FloodSmart Open for Business Worksheet Insurance Coverage Discussion Form Use this form to discuss your insurance coverage with your agent. Having adequate coverage now will help you recover more rapidly from a catastrophe. Insurance Agent: _____

DOCX Flood Insurance - Worksheet - HUD Exchange Provide a copy of the flood insurance policy declaration or a paid receipt for the current annual flood insurance premium and a copy of the application for flood insurance. Continue to the Worksheet Summary. ☐Yes, less than one year has passed since FEMA notification of Special Flood Hazards.

Attachment 2. Flood Insurance Worksheet Provide a copy of the flood insurance policy declaration or a paid receipt for the current annual flood insurance premium and a copy of the application for flood insurance . Continue to the Worksheet Summary. ☐Yes, less than one year has passed since FEMA notification of Special Flood Hazards.

PDF Flood Worksheet - victorinsuranceus.com Flood Worksheet FLOOD WORKSHEET 1 of 3 This information is required for quotation and application preparation purposes only. The insured must prepay the full annual premium. The effective date of coverage will be 30 days following the receipt of the completed application and prepaid premium to Fidelity National Insurance Company.

PDF Flood Insurance The bank has a blanket insurance policy in place from a private insurance company. Why does the bank still need the borrower to get a flood insurance policy to comply with the flood insurance regulation? • Flood insurance regulations are designed to protect the property owner's interest. When a customer buys a flood insurance policy, or ...

How to Calculate Business Income for Insurance | The Hartford The information contained on this page should not be construed as specific legal, HR, financial, or insurance advice and is not a guarantee of coverage. In the event of a loss or claim, coverage determinations will be subject to the policy language, and any potential claim payment will be determined following a claim investigation.

Flood Insurance Manuals and Handbooks | FEMA.gov Claims Manual This manual improves clarity of flood insurance claims guidance to NFIP Write Your Own (WYO) companies, flood vendors, flood adjusters and examiners, so that policyholders experience consistency and reliability of service. Effective Oct. 1, 2021 A table of changes is available here. Previous Manuals Effective May 1, 2020

Forms Flood - Insurance Claims Documents & Forms - Claims Pages Cause of Loss and Subrogation Report FEMA Form 086-0-16 (04/17) The adjuster uses this form to identify potentially responsible third parties and their actions that may have caused worsened flood damage. This includes looking at foundation grading and adequacy of sewer lines. PDF Forms - Flood Catastrophe Subrogation Property.

Understanding Business Income Coverage | Travelers Insurance Kate’s Bagel Shop is a Travelers customer. The shop’s insurance policy provides Property coverage and Business Income coverage (including Extra Expense and up to 30 days of Extended Business Income coverage). A fire causes extensive damage to the shop’s interior and cooking equipment.

Flood Insurance - How does flood insurance work Flood insurance coverage limits. The NFIP lets you insure your house for up to $250,000 and your personal property (contents) for up to $100,000. If you rent, you can buy up to $100,000 in coverage for your belongings. For non-residential property, you can buy up to $500,000 of coverage for the building and contents.

FEMA We would like to show you a description here but the site won’t allow us.

Flood Insurance | FEMA.gov The National Flood Insurance Program (NFIP) is managed by the FEMA and is delivered to the public by a network of more than 50 insurance companies and the NFIP Direct. Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Most homeowners insurance does not cover flood damage.

XLSX Welcome - Sterling Compliance LLC CALCULATING FLOOD INSURANCE COVERAGE FOR CONDOMINIUMS RCBAP Coverage Amount Replacement Cost Value RCBAP Coverage Calculation (# units * $250,000) Number of Units covered under RCBAP Required Minimum Coverage Amount Lesser of RCBAP Coverage and RCV Coverage REMINDER: The maximum allowable contents coverage is the actual cash value (ACV) of the

Business Income Insurance Coverage: Calculating How Much Your ... Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below:

Flood Insurance - HUD Exchange A FEMA Flood Insurance Rate Map (FIRM) showing that the project is located in a Special Flood Hazard Area along with a copy of the flood insurance policy declaration or a paid receipt for the current annual flood insurance premium and a copy of the application for flood insurance in the review View Flood Insurance - Worksheet.

0 Response to "40 flood insurance coverage worksheet"

Post a Comment