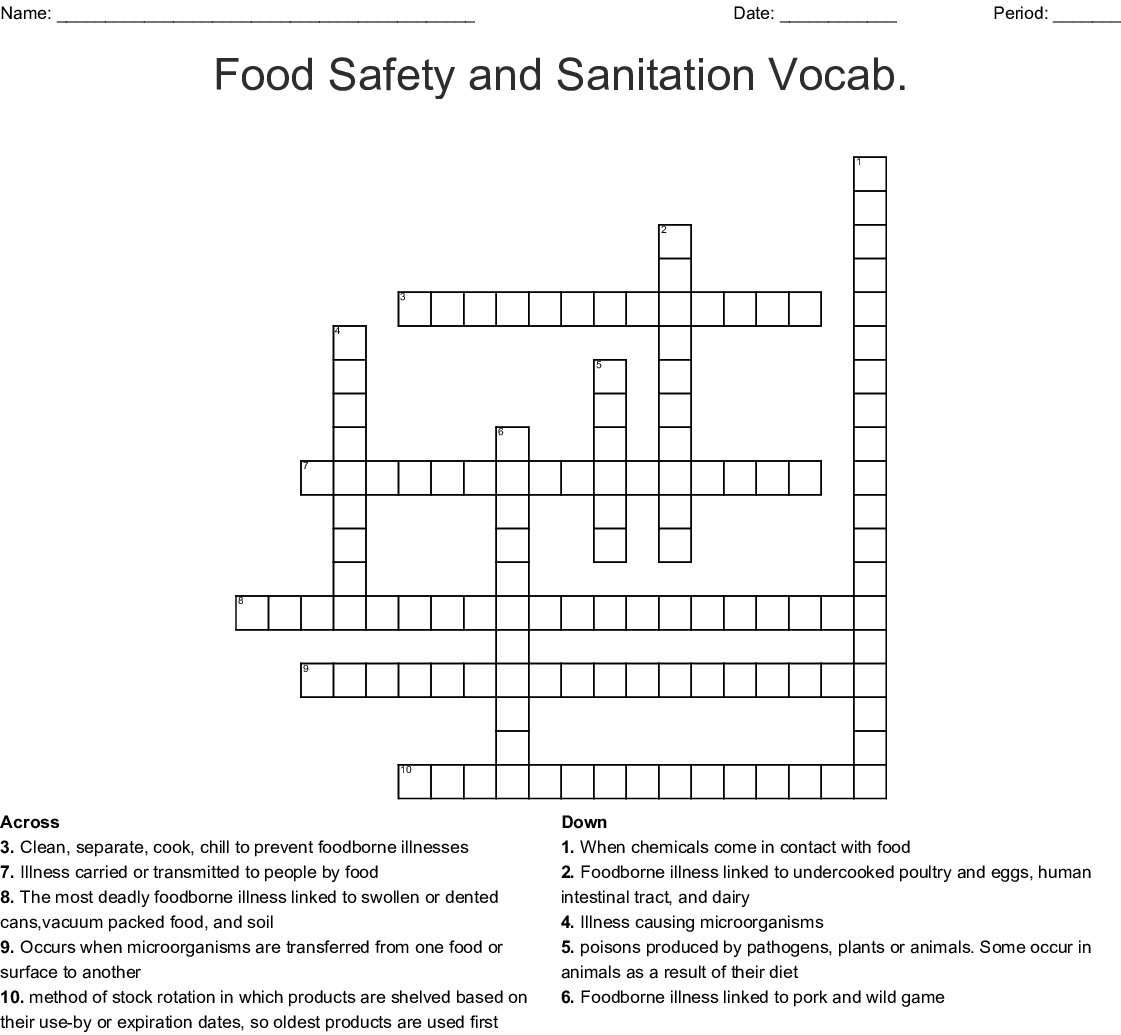

40 understanding your paycheck worksheet

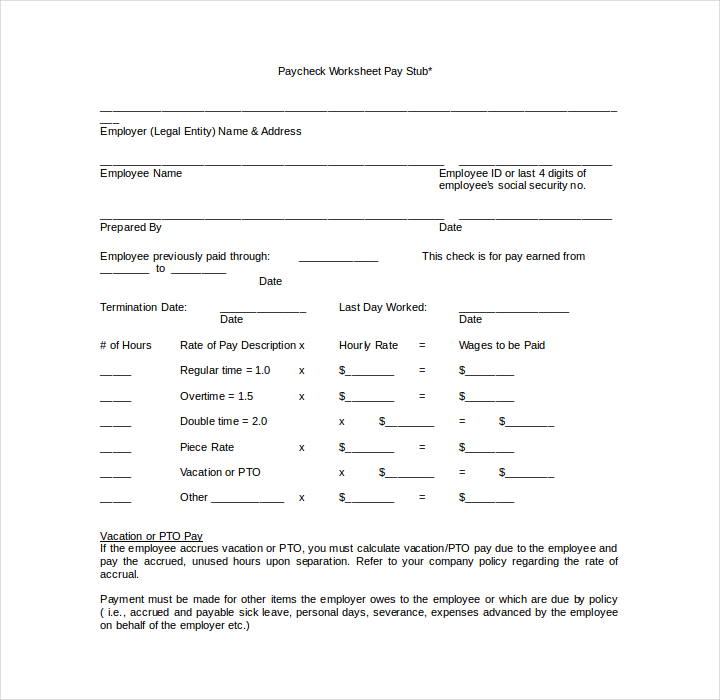

Grade 6 Mathematics - Lowndes County School District Mar 23, 2020 · with the topics your students have covered. ... Understanding Ratios 1 Understanding Ratio Concepts .....3 2 Using Equivalent Ratios .....4 Understanding Rates ... 8 Kendra gets a paycheck of $300 after 5 days of work. At this rate, how much does she get paid for working 24 days? How to Read a Pay Stub With Lesson Plans | PayStubs 365 Below you'll find some common entries on paychecks that will help you master the process of how to read a pay stub. 1. Pay Period: The pay period is the date range covered on the pay stub. You might be paid weekly, biweekly, or monthly, depending on your company's payment policy.

PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ...

Understanding your paycheck worksheet

PDF Understanding Your Paycheck - Georgia CTAE Top 10 Tips for (1) Understanding Your Paycheck 1. Examine your gross pay. 2. Study the types of deductions. 3. Identify federal income tax deductions. 4. Identify Social Security deductions. 5. Identify state income tax deductions. 6. Identify local income tax deductions. 7. Identify retirement deductions. 8. Identify insurance deductions. 9. 1040 (2021) | Internal Revenue Service Don’t include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2021, or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if … How Much Is Typically Taken Out of a Paycheck for Taxes? Dec 05, 2018 · Understanding exactly how much in taxes is taken out of your paycheck can help lessen the shock. ... number of withholding allowances claimed by the worker and whether an additional amount should be withheld from each paycheck. Form W-4 includes a worksheet to help employees determine the correct amount of allowances for their financial situation.

Understanding your paycheck worksheet. PDF Understanding Your Paycheck - Biz Kid$ Understanding Your Paycheck LESSON LEVEL Grades 4-6 KEY TOPICS Entrepreneurship Taxes Deductions LEARNING OBJECTIVES 1. Identify paycheck deduc- tions. 2. Learn the purpose of taxes. 3. Understand the difference between an employee and a contractor. 4. Learn financial terms. EPISODE SYNOPSIS What's on your pay stub? PDF Understanding taxes and your paycheck § Understanding taxes and your paycheck (worksheet) cfpb_building_block_activities_understanding-taxes-paycheck_worksheet.pdf. Exploring key financial concepts. When you get your first paycheck, the terms and amounts on the pay stub may not always be easy to understand. You may wonder why your take-home pay is different from what you expected, PDF Reading a Pay Stub Worksheet - Mrs. Yeschick Class Assignments To help you better understand the difference between gross income, net income, and some common payroll deductions, analyze the pay stub for Jonathan. Then answer the following questions: 1. Who is Jonathan's employer? _____ 2. What is the length of the pay period Jonathan just worked? _____ 3. How many total hours did Jonathan work during ... How to Read a Pay Stub | Understanding Your Pay Stub - OppU May 26, 2022 · The information contained herein is provided for free and is to be used for educational and informational purposes only. We are not a credit repair organization as defined under federal or state law and we do not provide “credit repair” services or advice or assistance regarding “rebuilding” or “improving” your credit.

Understanding Your Paycheck Worksheets - Learny Kids some of the worksheets for this concept are understanding taxes and your paycheck, understanding taxes and your paycheck, its your paycheck lesson 2 w is for wages w 4 and w 2, understanding your paycheck, nothing but net understanding your take home pay, understanding it managing it making it work for you, my paycheck, teen years and adulthood … Understanding Your Paycheck | Biz Kids Lesson Plan | Lesson 125 ... Understanding Your Paycheck. Students receive a sample earnings statement and break down the different categories of information. Students then break into groups of four and play the 'Paycheck Mystery Word Game'. ... The Biz Kid$ use a modern American pay stub to explain all the deductions on your paycheck. From social security to workman's ... PDF Understanding taxes and your paycheck 1.People often confuse a paycheck and a pay stub. A pay stub is what you use to get your money. True (T) False (F) Example or explanation for your choice 2.People often confuse gross income and net income. Net income is what you actually take home after deductions. True (T) False (F) Example or explanation for your choice II TT WT Understanding Your Paycheck Worksheet Answers ... - Image Rollins Understanding your paycheck can take some time. This episode helps you understand how to read your paycheck. Whether you're moving state and . It can be a big shock when teens receive their first paychecks and realize. Source: thumbor.forbes.com Identify paycheck learn the purpose of understand the difference .

Schwab MoneyWise We all want financial freedom. It's just a matter of figuring out how to get there. Schwab Moneywise ® can help you budget, save, and invest your money, manage debt, and achieve your life goals. Best of all, it's free and available to everyone from Charles Schwab Foundation.We're glad you're here. PDF Directions: Using the pay check stub above, answer the following questions. 1. deductions (n): money that is subtracted or taken out from your pay 2. federal taxes (n): a percentage of an employee's wages that goes to the federal government 3. gross pay (n): the amount of money in an employee's paycheck before any deductions have been taken out 4. net pay (n): the amount of money left in an employee's paycheck ... Understanding you paycheck stub worksheet Live worksheets > English. Understanding you paycheck stub. Definitions of the basic parts of a paycheck stub - pay and deductions. ID: 342213. Language: English. School subject: Career Education. Grade/level: Middle School - High School. Age: 12+. Main content: Paycheck terms. PDF CFPB Building Block Activities Understanding Paycheck Deductions Handout Understanding paycheck deductions What you earn (based on your wages or salary) is called your gross income. Employers withhold (or deduct) some of their employees' pay in order to cover . payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits. The amount of money you

Workplace Basics: Understanding Your Pay, Benefits, and Paycheck Earnings vs. net pay. When you view your pay stub, you'll find two notable figures: your earnings (or gross pay) and your net pay.Your earnings is the amount of money you make based on your pay rate.After a number of taxes and deductions are applied, you're left with your net pay, or the money that's available to you on your paycheck.. Upon your initial payment, you might be surprised at the ...

PPT Understanding Your Paycheck almost 31% of an individual's paycheck is deducted taxes are the largest expense most individuals will have therefore, it is important to understand the systematic deductions u.s. tax system operates on an ongoing payment system taxes are immediately paid on income earned paying employees three methods employers may use to pay employees: …

Understanding Your Paycheck Teaching Resources | TpT Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill out a paystub.

PDF Understanding Your Paycheck Lesson Plan 1 13 1 Revised March 09 Final Directions: Answer the following questions to help provide the information for the paycheck. Hint: A way to double check your work is to add your deductions and your net income. If they do not equal your gross income, then you need to recalculate. Joe works the same amount of hours each month.

PDF Understanding Your Paycheck Lesson Plan 1.13 Gross pay 2. $_____ (answer to #1) x .062= 3. $_____ Social Security deduction Calculate Joe's Medicare deduction, which is 1.45% of his gross pay. Gross pay 4. $_____ (answer to #1) x .0145= 5. $ _____Medicare deduction Add all of Joe's deductions together to figure out the total amount taken out of each paycheck.

11 Best Budget Templates & Tools That Will Change Your Life May 19, 2022 · Our free template is both printable as a budget worksheet and digitally like a spreadsheet that will auto calculate for you. ... Personal capital is great for understanding your monthly spending, cash flow, investments, retirement, and net worth. ... 7 Easy Steps That Will Make You Stop Living Paycheck to Paycheck. 11 Best Budget Planners ...

Understanding Your Paycheck Flashcards | Quizlet The amount required by law for employers to withhold from earned wages to pay taxes/The amount of money deducted depends on the amount earned and information provided on the Form W-4 Largest deduction withheld from an employee's gross income

Understanding Your Paycheck Worksheet Answer Key All groups and messages ... ...

0 Response to "40 understanding your paycheck worksheet"

Post a Comment