39 sale of rental property worksheet

Publication 527 (2020), Residential Rental Property Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange (a like-kind or section 1031 exchange) of one piece of rental property you own for a similar piece of rental property, even if you have used the rental property for personal purposes. About Form 4797, Sales of Business Property Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets. The disposition of capital assets not reported on Schedule D. The gain or loss for partners and S corporation shareholders from certain section 179 property dispositions by

How to Figure Capital Gains on the Sale of Rental Property The IRS lets you pull all of your sale-related expenses out of the price first to calculate what it calls the amount realized. For instance, if you sold the house for $179,000, paid a 6.5 percent commission of $11,635 and paid $3,250 in closing costs, your amount realized would be $164,115.

Sale of rental property worksheet

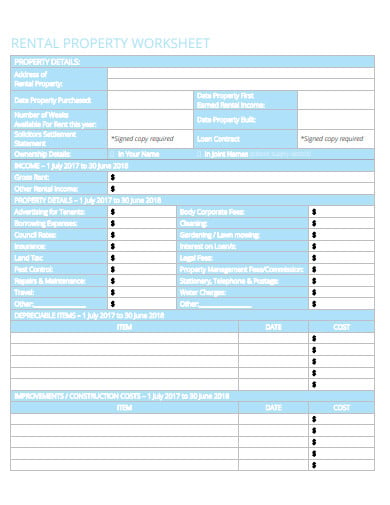

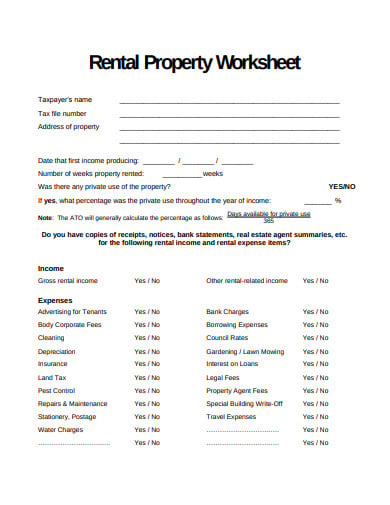

How Are Capital Gains Calculated On Sale Of Rental Property Your total gain is simply your sale price less your adjusted tax basis. Capital gain in this scenario: $400,000 - $300,000 = $100,000. Depreciation is taxed at 25%, and capital gains are taxed based on your tax bracket. Long-term gains typically end up being taxed at either 15% or 20%, depending on your income for the year. Solved: Sale of rental asset worksheet - Intuit You would report the sale of an individual asset in You can report the sale in the Assets / Depreciation interview of the Business Income and Expenses > Rental Properties and Royalties section. If you sell the entire rental property, you will report the sale in the same interview. For additional guidance, see: I sold my rental property. PDF Rental Property Worksheet Completing Form T776, Statement of Real Estate Rentals Income Rental expenses you can deduct Motor vehicle expenses Keeping records Guide: T4036 Rental Income Other CRA Publications and Guides for Taxpayers And the Koroll & Company website is a great resource for tax information!

Sale of rental property worksheet. Rental Property Calculator | Zillow Rental Manager Aug 13, 2021 · The amount of money earned from the rental property is considered the total investment gain or profit. Here are the typical gains that may come out of a rental property investment: Rent: A tenant’s regular monthly payment to a landlord for the use of the property or land. Rent is generally the primary source of income on a rental property. Publication 537 (2021), Installment Sales | Internal Revenue Service An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. The rules for installment sales don’t apply if you elect not to use the installment method (see Electing Out of the Installment Method , later) or the transaction is one for which the installment method may not apply. What is the Sale of Main Home Worksheet? - Support What is the Sale of Main Home Worksheet? If you sell your main home during the tax year, you should report the gain or loss on the return. You may qualify to exclude all or a portion of the gain on the sale of your main home. Complete the information required and the program will calculate the taxable portion for you. Rental Property is ... Preventing a Tax Hit When Selling Rental Property For a married couple filing jointly with a taxable income of $280,000 and capital gains of $100,000, taxes on the profits from the sale of a rental property would amount to $15,000. Fortunately,...

Do You Have to Pay Capital Gains Tax on a Home Sale? 02/03/2022 · According to the Housing Assistance Tax Act of 2008, a rental property converted to a primary residence can only have the capital gains exclusion during the term in which the property was used as ... PDF Rental Property Worksheet - WCG CPAs Rental Property Worksheet Please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Please download, open in Adobe, complete and securely upload the PDF to your client portal. Please do not email this worksheet since it contains sensitive information. You can access your client portal here- Solved: Sale of Rental Property - Intuit on the worksheet for the rental property, there will be a quickzoom link to the asset entry worksheets that contain the details of the assets. the sale info is entered in the assets entry worksheet - starting with line 20. the sales price and closing costs need to be allocated between the land and building. disposal of the activity changes the … Taxes You Need to Pay When Selling Rental Real Estate | Nolo Viola calculates her taxable gain on the property by subtracting her adjusted basis from the sales price: $300,000 - $170,000 = $130,000. As you can see, when you sell your property, you effectively give back the depreciation deductions you took on it. Since they reduce your adjusted basis, they increase your taxable gain.

Worksheet: Calculate Capital Gains - Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. How Much Tax Do You Pay When You Sell a Rental Property? In this example we'll adjust the basis to determine the amount of taxes owed when selling a rental property using the following assumptions: Purchase price = $150,000 Sale price = $200,000 Land value = $15,000 Closing costs including inspection, appraisal, recording, and owner's title insurance = $1,500 Assessment for street repaving = $2,500 PDF Capital Gain Worksheet - efirstbank1031.com Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) Less depreciation taken during ownership ( (4) 2022 Rental Property Analysis Spreadsheet [Free Template] Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value.

Disposal of Rental Property and Sale of Home - TaxAct Finish answering the interview questions about the rental property After you have entered the disposition of the rental home, you will want to fill out the Schedule D Home Sale Worksheet. To access this worksheet: Click on the Federal tab. On smaller devices, click the menu icon in the upper left-hand corner, then select Federal.

How to Calculate Capital Gains Tax on Rental Property Capital Gains. Capital Gains Tax. = Selling Price of Rental Property - Adjusted Cost Basis. = (Capital Gains x Tax Rate) + (Depreciation x 25%) Tax Rate: The tax rate can vary from 0% to 39.6% depending on two factors - Your income bracket and whether it is considered as a short or long term capital gains. Tax Bracket.

18+ Property Sale Agreement Templates in PDF A property sale agreement is a document or a contract between the seller and the buyer for the sale of a property. There exists the agreed terms and conditions related to the sale/purchase of the particular property. There are various property sale agreements.If you need to make any, then you can refer to the agreement templates and design the agreement.

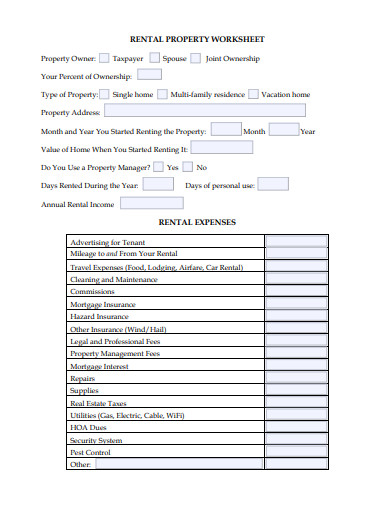

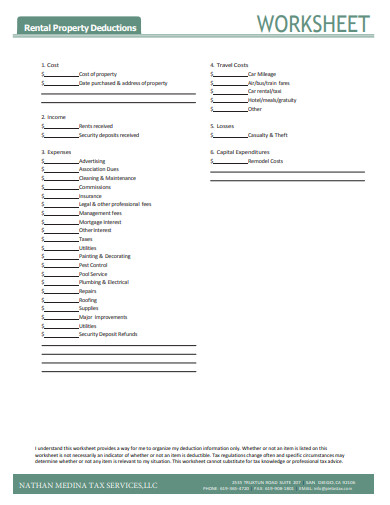

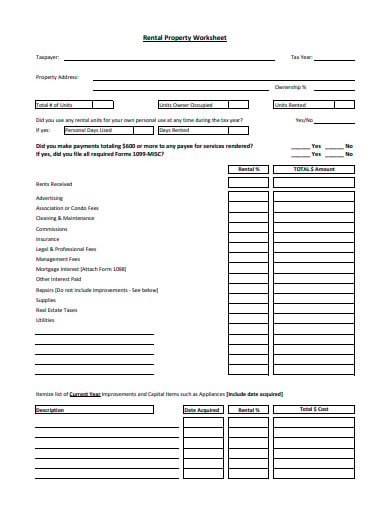

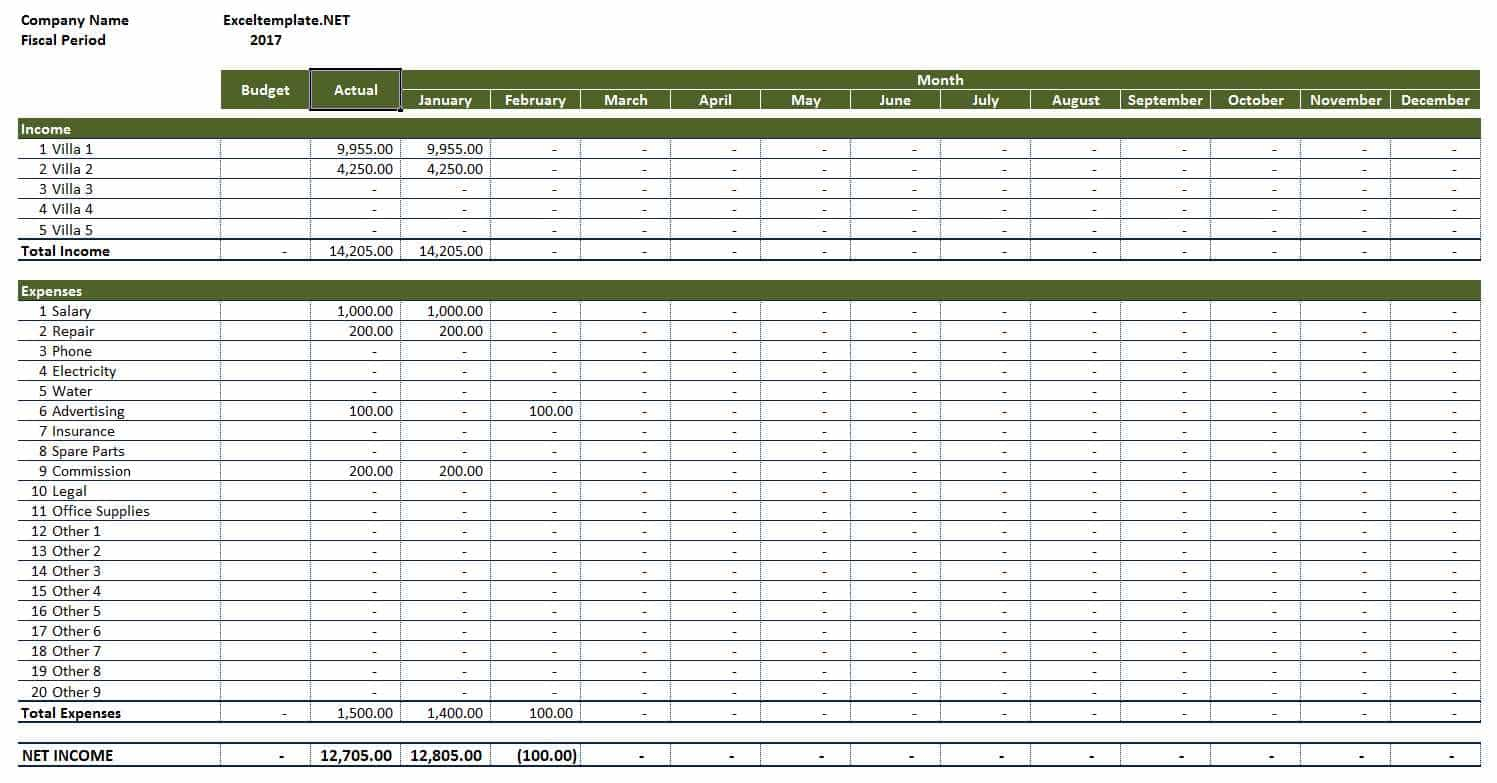

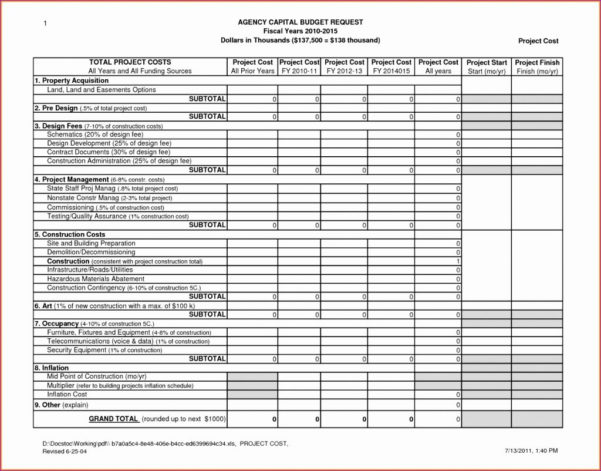

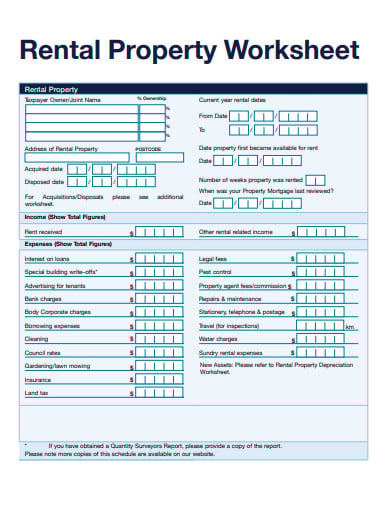

18+ Rental Property Worksheet Templates in PDF 5 Steps to Create the Rental Property Worksheet Step 1: Create the Rental Property Spreadsheet You need to create the Rental Property Spreadsheet where you can insert in the detail of the property that is owned by you. The property details like the income and the expenditure.

How to Report a Sale of a Rental Home | Sapling Compare the resulting number with the sale price. If the sale price is more, you have a capital gain. If it's less, you have a capital loss. Sale of Rental Property: IRS Form 4797 The Internal Revenue Service considers rental property to be business property, so you can't just report the gain or loss on your Form 1040.

Calculating Gain on Sale of Rental Property - AAOA 1. First, determine your selling costs. There is a great tip about accounting for all selling costs and you can read it here: Assuming you sold a property for $200K and you paid 6% commission ($12K) plus other closing costs that added to $6K, your selling costs are $18K (Selling Costs) = $12K (Commission) + $6K (Closing costs) 2.

Solved: Sale of rental property :dispostion of asset prose ... - Intuit I just want to know if I followed all the steps of selling the rental property. 1) I disposed the property in the asset worksheet section- the asset is linked to schedule E. 2) in schedule E worksheet, I put an X in Complete Taxable disposition. ( what's the purpose of putting X) does it prevent schedule E to show up in next yeat tax return.

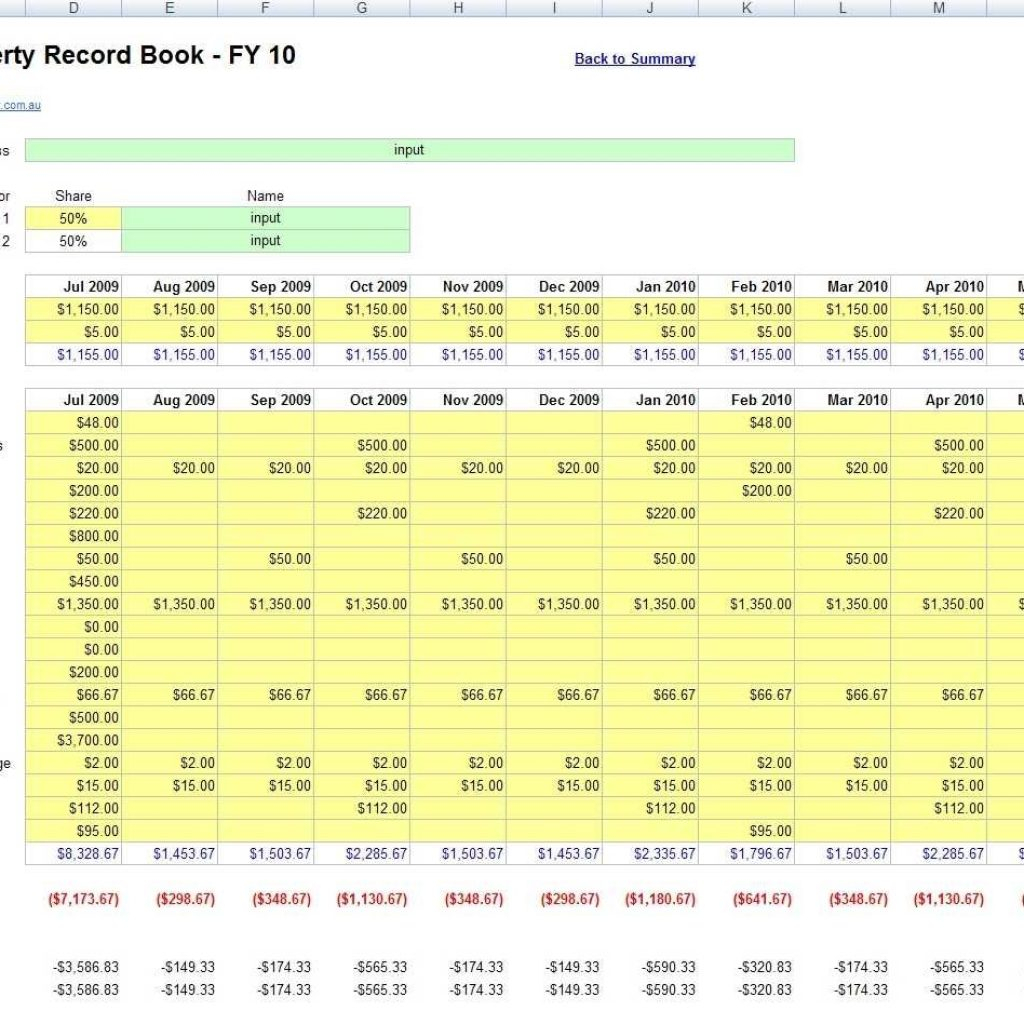

Cash Flow Analysis Worksheet for Rental Property 18/08/2021 · Download a rental property analysis worksheet for Microsoft Excel® | Updated 8/18/2021. This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization ...

PDF Property Sale Worksheet - LG Taxes Online rated property taxes, etc. Disclosure I(We) verify that the information provided in this Property Sale Worksheet s accurate and complete. I(We) i understand it is my(our) responsibility to include any and all information concerning income, deductions and other information necessary for the preparation of my (our) personal income tax return.

11+ Investment Property Worksheet Templates in PDF | Excel Tax Financial Rental Investment Property Worksheet. 9. Residential Investment Property Worksheet Template. 10. Accounting Investment Property Worksheet Template. 11. Investment Property Evaluation Worksheet Template. 12. Residential Investment Property Calculation Worksheet.

PDF 2021 Publication 527 - IRS tax forms Sale of main home used as rental prop- erty. For information on how to figure and re- port any gain or loss from the sale or other dis- position of your main home that you also used as rental property, see Pub. 523. Tax-free exchange of rental property oc- casionally used for personal purposes.

Capital Gains Tax: What to Know When Selling Rental Property Maintaining rental properties is a great way to earn passive income. Furthermore, many rental property owners choose to sell their properties, usually making a profit in the process. While selling a rental property can earn serious gains, sellers must understand how capital gains taxes will affect their sale.

Home Sale Exclusion From Capital Gains Tax - The Balance 10/03/2022 · How Does the Home Sale Exclusion Work? Your capital gain—or loss—is the difference between the sales price and your basis in the property, which is what you paid for it plus certain qualifying costs. You would have a gain of $200,000 if you purchased your home for $150,000 and you were to sell it for $350,000.

MARYLAND Application for Certificate of FORM Full or Partial … address(es) for the property as listed with the State Department of Assessments and Taxation (SDAT), including county. If the property does not have a street address, provide the full property account ID numbers used by SDAT to identify the property. Enter the date of closing for the sale or transfer of the property.

Free Property Sale Agreement Template & FAQs | Rocket Lawyer This document will define the obligations of both parties when a piece of property is being sold and will get you one step closer to selling or buying property. Property Sale Agreements will generally include details concerning the total purchase price of the property, closing costs, title requirements, and warranties.

Free Rental Income and Expense Worksheet | Zillow Rental … Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category.

Selling a Rental Property? 4 Crucial Points to Consider A residential rental property is depreciated over a period of 27.5 years on a straight line basis; basically, take the original cost divided by 27.5, and that is the annual depreciation amount. "I...

0 Response to "39 sale of rental property worksheet"

Post a Comment