43 income tax worksheet excel

Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax ... - Google This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Search this site Income Tax Calculator for Financial Year 2021-22 in Excel 1. Mainly useful for the salaried Employees having income includes: a . Income from Salary / Pension b. Income from Interest (Other Sources). (Bifurcation w.r.t. Interest from Savings Bank Account, FD Interest etc., NSC Accrued Interest) c. You can input Capital Gain on Shares, Dividend Income, TDS deducted by others etc 2.

Download Excel based - Income Tax Calculator for FY 2020-21 [AY 2021-22] This excel-based Income tax calculator can be used for computing income tax on income from salary, pension, gifts, fixed deposit, and bank interest and you will get the result accordingly to your tax regime selection. Highlights of Changes in FY 2020-21 in Income Tax

Income tax worksheet excel

Tax Return Worksheets and Templates - Newtown Tax Services Tax Return Worksheets and Templates - Newtown Tax Services Organising Your Tax Return We Use Online Tax Return Questionnaires Save Paper by uploading your electronic information to our Secure Portal in a questionnaire before you visit us. We'll email you a link to our Online Questionnaire after you call to book a meeting. Free 1099 Template Excel (With Step-By-Step Instructions!) How to Use this 1099 Template. There are 6 basic steps to using this 1099 Template. Step 1. Enter all expenses on the "All Business Expenses" tab of the free template. Step 2. Identify the total amount of each expense type by using the filter option on the "All Business Expenses" tab. Step 3. How to Do Taxes in Excel - Free Template Included Select OK. With the same data highlighted, click on the Data ribbon and click Subtotal. In the pop up window, select Category under "At each change in". Under "Use function" select Sum, and under "Add subtotal to", select Transaction amount. Also make sure the check box "Summary below data" is checked. Click OK.

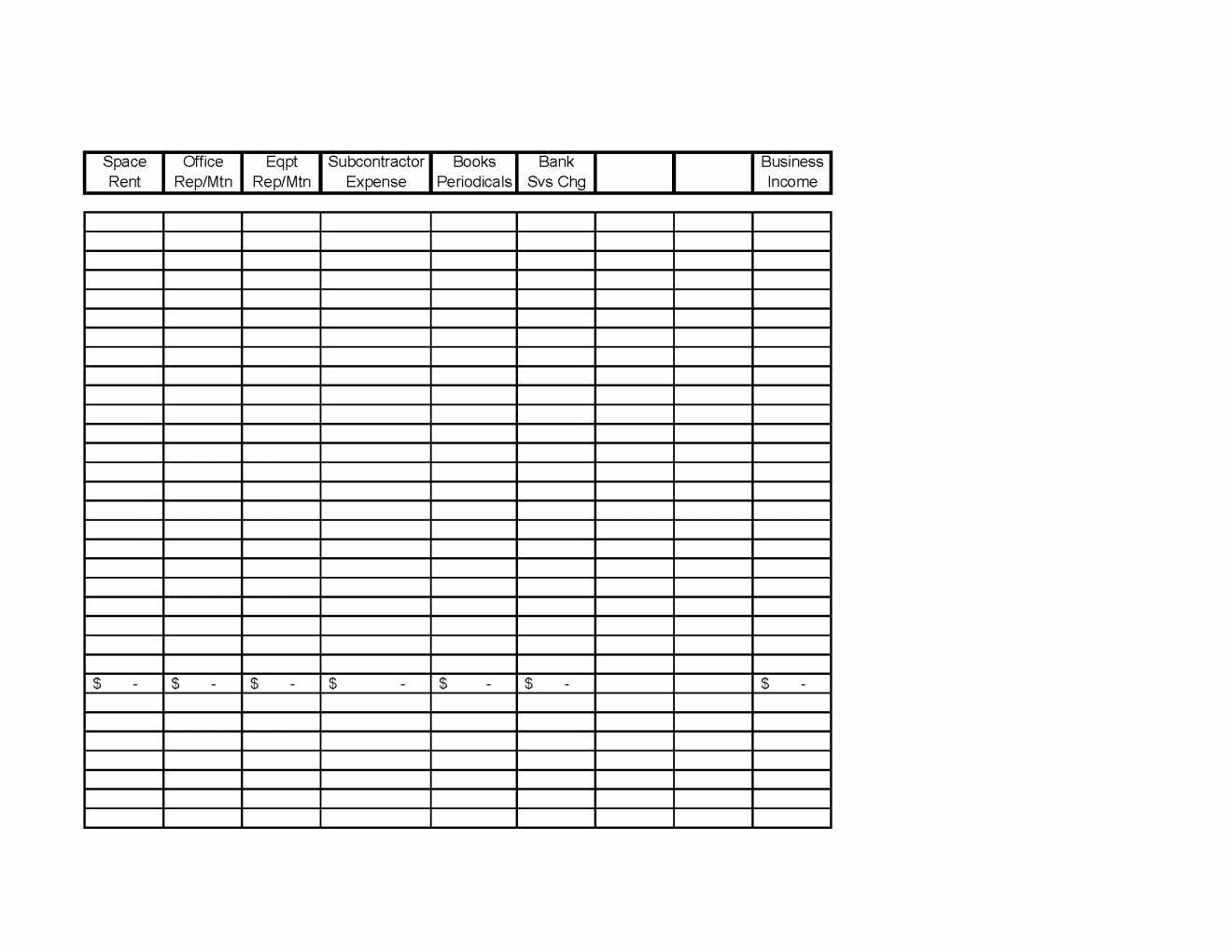

Income tax worksheet excel. Income Statement Template for Excel - Vertex42.com This income statement template was designed for the small-business owner and contains two example income statements, each on a separate worksheet tab (see the screenshots).The first is a simple single-step income statement with all revenues and expenses lumped together.. The second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income. 2022 Federal Excel 1040ES Estimated Tax Workbook The 2022 Version of the Federal Excel 1040ES workbook to help small business owners estimate their income taxes. With this workbook, you can take more control of your estimated taxes. The product features include: Input worksheet to set up your estimated tax computations. Dashboard summary worksheet to track your estimated tax position. 8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... Open your spreadsheet or worksheet application Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Once you do that, click on the "Available Templates" option and choose "Blank Workbook". You can include both your income and expense spreadsheets in the same workbook. Downloadable tax organizer worksheets This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. business.pdf

Income tax calculating formula in Excel - javatpoint It is a simple way to calculate income tax and easy to understand. Step 1: Open the Excel worksheet that contains the income details of someone. We have this income dataset: Step 2: As we want to calculate the taxable income and tax. So, create two rows: one for the taxable value and another for the tax. Free Rental Income and Expense Worksheet | Zillow Rental Manager To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category. Income Tax Formula - Excel University If we assume a taxable income of $50,000, we need to write a formula that basically performs the following math: =5081.25+ ( (50000-36900)*.25) We can use VLOOKUP to obtain all of the related values from the tax table based on the taxable income. The basic syntax of the VLOOKUP function follows: Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator

How to calculate income tax in Excel? - ExtendOffice Actually, you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in Excel. Please do as follows. 1. In the tax table, right click the first data row and select Insert from the context menu to add a blank row. See screenshot: 2. Income Tax Calculator Excel : AY 2021-22 - Karvitt Download Excel file to Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New Regimes (Tax Provisions & Tax Rates) for AY 2021-22 (FY 2020-21). Save your calculations on your computer for future reference. Download Income Tax Calculator AY 2021-22 | 2022-23 in Excel Excel formula: Income tax bracket calculation | Exceljet Summary. To calculate total income tax based on multiple tax brackets, you can use VLOOKUP and a rate table structured as shown in the example. The formula in G5 is: = VLOOKUP( inc, rates,3,1) + ( inc - VLOOKUP( inc, rates,1,1)) * VLOOKUP( inc, rates,2,1) where "inc" (G4) and "rates" (B5:D11) are named ranges, and column D is a helper column ... Estimated Income Tax Spreadsheet - Mike Sandrik Now the spreadsheet can calculate your effective tax rate based on the estimated amount of income you expect to make. The tax rates calculated depend on the tax tables on the right side of the sheet, which define the income tax brackets. You'll need to update the data in yellow each year for the new brackets and for your filing status.

Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax The sheet will take this and automatically calculate your total tax deduction in Column E. (Leave the business-use percentage column blank for a purchase, and you'll get your gross expense amount counted as your total tax deduction.) Making sure your deduction amount is correct

Download Free Federal Income Tax Templates In Excel Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. All excel templates are free to download and use.

Computation Of Income Tax In Excel - Excel Skills Calculates income tax based on variable monthly remuneration. All income tax calculations are automated. Includes medical tax credits, UIF & pension deductions. Calculate monthly net salary & tax on annual bonus. Easy to update tax rates & other variables for new tax years. Use for multiple tax years.

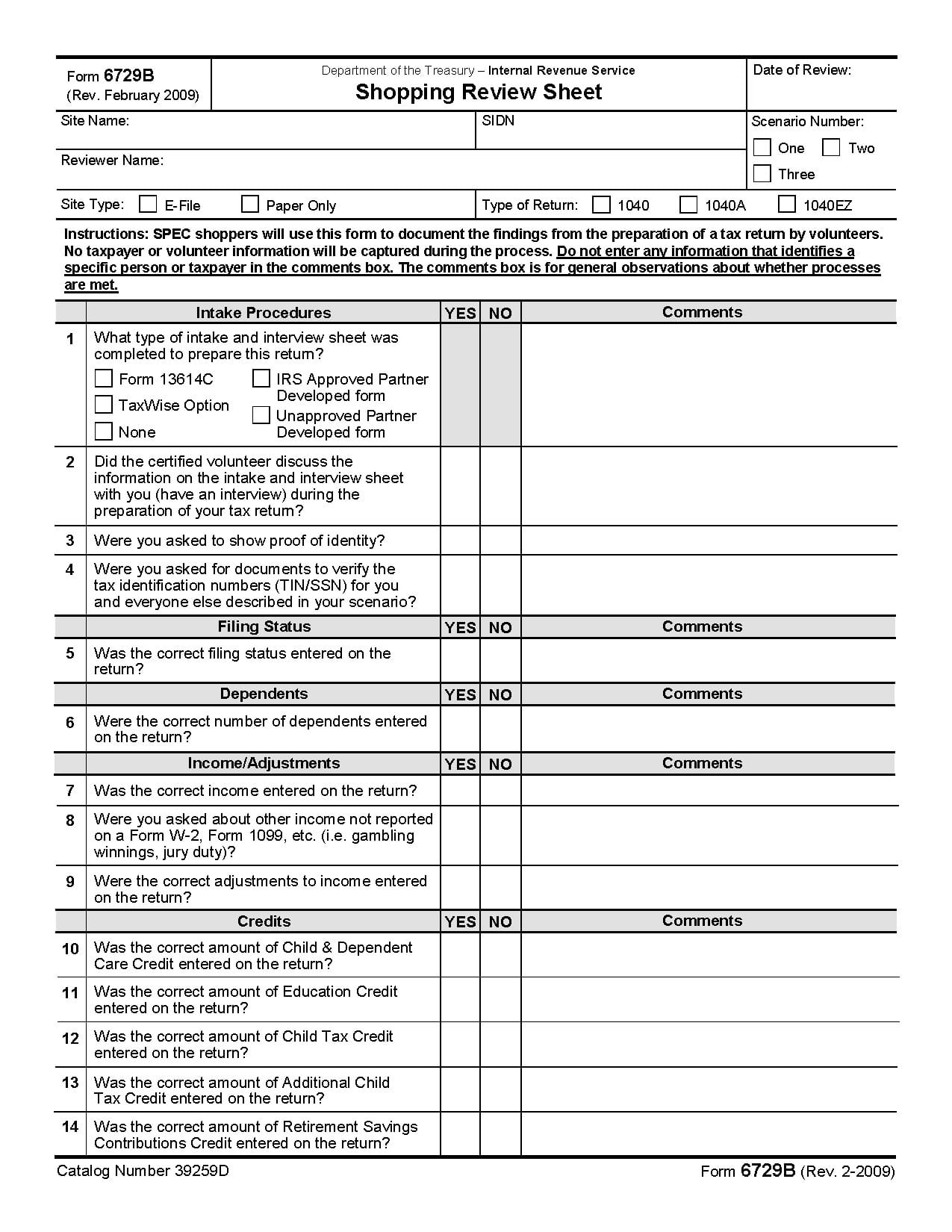

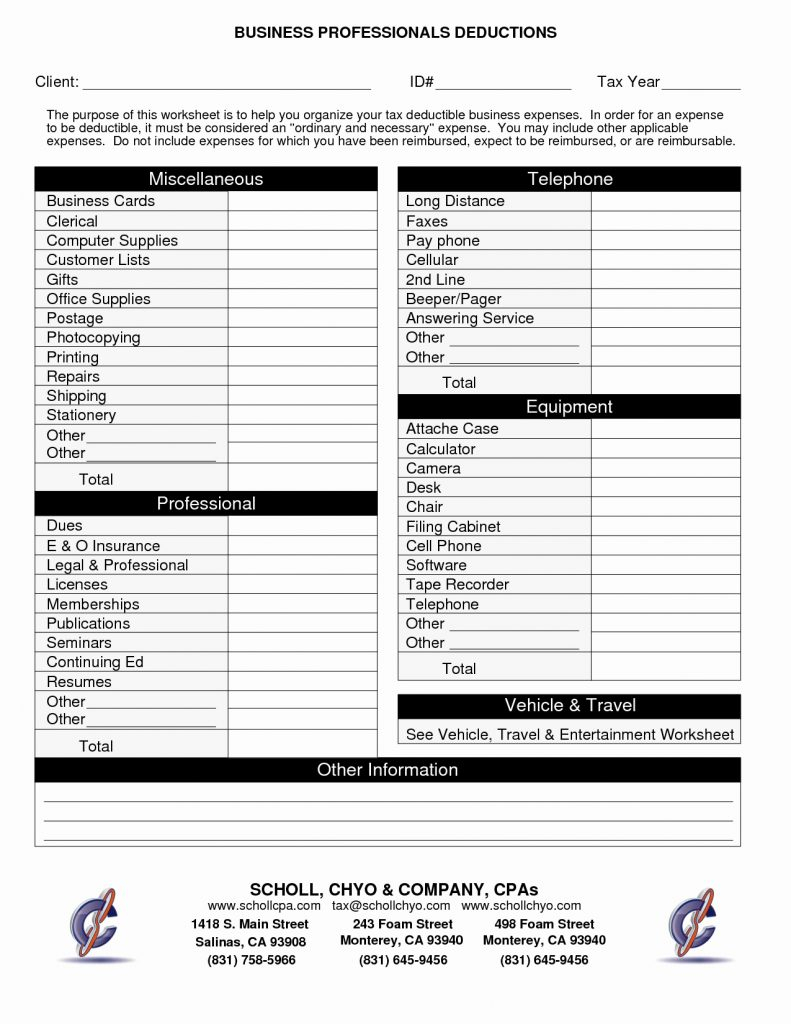

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

Worksheet Free Tax Excel Free Weekly Payroll Tax Worksheet - Excel Spreadsheet File In this free Excel 2013 tutorial, learn how to create formulas and charts, use functions, format cells, and do more with your spreadsheets o Add a surcharge based on the type of delivery by looking up the surcharge from the range A14:C17 on the Delivery Calculator worksheet and the type of delivery specified in cell B27 Open the Tax ...

Income Tax Withholding Assistant for Employers Save a copy of the spreadsheet with the employee's name in the file name. Each pay period, open each employee's Tax Withholding Assistant spreadsheet and enter the wage or salary amount for that period. The spreadsheet will then display the correct amount of federal income tax to withhold.

Income Tax Planning Spreadsheets - Taxvisor.com The tax planner spreadsheets allow you to perform on-the-fly tax planning with minimal effort. Most people will be able to model their federal and state taxes in a matter of minutes. This is no hoax and no joke: you will be able to plan for your taxes in less time and at significantly less cost than you have ever been able to in the past.

Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) Download Income Tax Calculator Excel India (FY 2021-22) How to Calculate Income Tax in India? In case you want to calculate your income tax without using the Income Tax India calculator, it's not very difficult. You need to follow following steps using the below example. Amit is salaried employee with following salary structure.

Estimated Tax Worksheet Estimated Payments Needed:by:JointTPSP. 90% of estimated total tax ( 66 2/3% for farmers and fishermen) 0. Enter 100% of 2021 's income tax ( Check if 2021 's AGI was > $ 150 K) Choose which to use... Smaller of above or ... Use 100 % of 2021 's amount from the line above. Use 100% of the 2022 estimated total tax.

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download] How to estimate your taxes using Excel Excel Formula to Calculate Tax Federal Tax: =VLOOKUP (TaxableIncome,FederalTaxTable,4) + (TaxableIncome - VLOOKUP (TaxableIncome,FederalTaxTable,1)) * VLOOKUP (TaxableIncome,FederalTaxTable,3)

How to Do Taxes in Excel - Free Template Included Select OK. With the same data highlighted, click on the Data ribbon and click Subtotal. In the pop up window, select Category under "At each change in". Under "Use function" select Sum, and under "Add subtotal to", select Transaction amount. Also make sure the check box "Summary below data" is checked. Click OK.

Free 1099 Template Excel (With Step-By-Step Instructions!) How to Use this 1099 Template. There are 6 basic steps to using this 1099 Template. Step 1. Enter all expenses on the "All Business Expenses" tab of the free template. Step 2. Identify the total amount of each expense type by using the filter option on the "All Business Expenses" tab. Step 3.

Tax Return Worksheets and Templates - Newtown Tax Services Tax Return Worksheets and Templates - Newtown Tax Services Organising Your Tax Return We Use Online Tax Return Questionnaires Save Paper by uploading your electronic information to our Secure Portal in a questionnaire before you visit us. We'll email you a link to our Online Questionnaire after you call to book a meeting.

0 Response to "43 income tax worksheet excel"

Post a Comment