45 nc 4 allowance worksheet

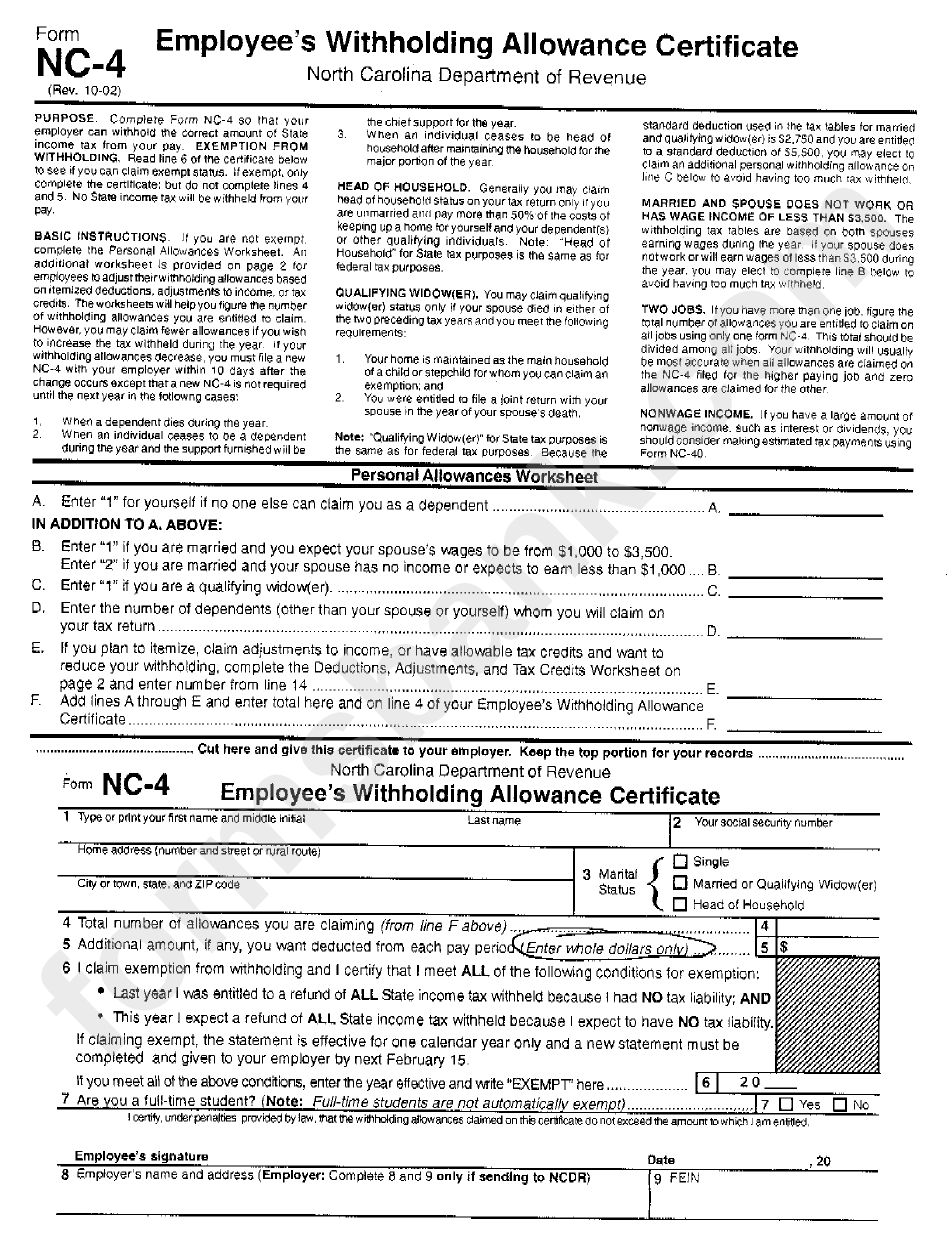

NC-4 Employee's Withholding - University of Colorado NC-4 Allowance Worksheet Answer all of the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $15,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income? Nonresident Alien Employee's Withholding Allowance Certificate - NCDOR Complete Form NC-4 NRA, Nonresident Alien Employee's Withholding Allowance Certificate, so that your employer can withhold the correct amount of State income tax from your pay. Files NC-4 NRA_Final.pdf PDF • 456.23 KB - December 17, 2021

PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

Nc 4 allowance worksheet

PDF NC-4 - iCIMS NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status PDF How to fill out the NC-4 - One Source Payroll Items needed to fill out NC-4 Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. PDF NC-4 Employee's Withholding - Westfield Insurance Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. BASIC INSTRUCTIONS. Complete the Personal Allowances Worksheet on Page 2. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

Nc 4 allowance worksheet. PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er) PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). PDF NC-4 NRA Nonresident Alien Employee's Withholding Allowance Certificate 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars) 3..00.00 PDF NC-4 Employee's Withholding - rssed.org If line 3 or line 4 above applies to you, enter the year effective and write "EXEMPT" here 1. Total number of allowances you are claiming (From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2.

Form Nc 4 ≡ Fill Out Printable PDF Forms Online NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). PDF NC-4 Employee's Withholding Allowance Certificate - Galactic, Inc NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er) PDF NC-4 Web Employee's Withholding Allowance Certificate Allowance Certificate NC-4 Web 2-15 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2.Additional amount, if any, withheld from each pay period (Enter whole dollars) Single Head of Household Married or Qualifying Widow(er) Marital Status Withholding Tax Forms and Instructions | NCDOR Business Registration Application for Income Tax Withholding,Sales and Use Tax, and Machinery and Equipment Tax. Register Online. NC-3. Annual Withholding Reconciliation ( Instructions) eNC3. NC-3X. Amended Annual Withholding Reconciliation. eNC3 eNC3. NC-5501.

PDF Form NC-4 Instructions for Completing Form NC-4 Web Employee's ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits. Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. NC-4-Web.pdf. PDF • 429.87 KB - January 04, 2021 Withholding, Individual Income Tax. Categorization and Details. Forms. Document Entity Terms. Withholding. Individual Income Tax. Document Organization. files. Date Published: Last Updated: January 4, 2021. PDF NC-4 NRA Nonresident Alien Employee's Withholding Allowance Certificate 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars) 3..00.00 Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Appointments are recommended and walk-ins are first come, first serve.

NC-4 Department of Revenue Employee's Withholding Allowance Certificate ... NC-4 Department of Revenue Employee's Withholding Allowance Certificate. PDF • 488.48 KB - February 22, 2022 Share this page: Facebook; Twitter; Email; How can we make this page better for you? Back to top. Contact. North Carolina Office of State Human Resources.

PDF c; sides of paper. NC-4 Allowance Worksheet Answer all of the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $13,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income?

Nc 4 Form Online - Printable Blank PDF Online PDF editor permits you to help make changes to your Nc 4 Form Online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently. ... nc-4 allowance worksheet. nc w-4. nc 4 employee withholding form. ncdor nc 4. nc withholding form nc 4. Popular Nc 4 Online Forms.

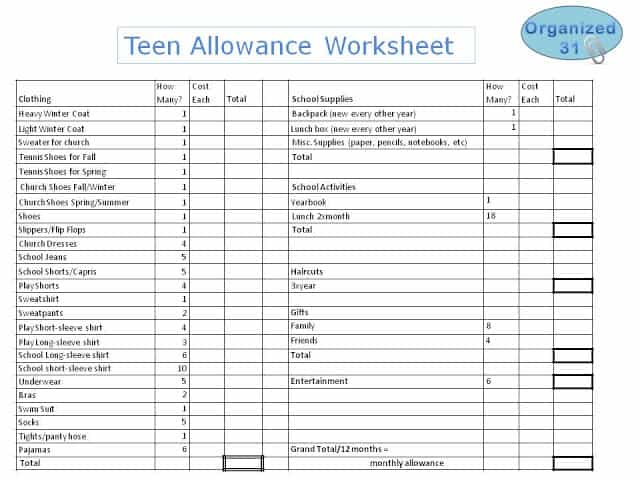

PDF How to fill out the NC-4 EZ - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Please fill out header Be sure to fill in Marital Status Header 3 Line 1 of NC-4 EZ Enter zero (0) or the number of allowances from the table on the next slide. 4

Nc 4 Allowance Worksheet Form - signNow Use a nc 4 allowance worksheet template to make your document workflow more streamlined. Show details How it works Open the nc4 allowance worksheet and follow the instructions Easily sign the nc 4 form 2022 printable with your finger Send filled & signed nc 4 form or save Rate the nc 4 form 2020 printable 4.8 Satisfied 45 votes

How to Complete your NC Withholding Allowance Form (NC-4) Starting a new job or need to change the amount of withholding from your paycheck? The NC-4 video will help you fill out the NC-4 form to make sure you are h...

PDF NC-4 Employee's Withholding 9-16 Allowance Certificate NC-4 NC-4 Allowance Worksheet Answer allof the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $11,249? Yes o No o 2. Will you have adjustments or deductions from income from Page 3, Schedule 2? Yes o No o 3.

PDF NC-4 NRA Web Nonresident Alien Employee's Withholding Allowance Certificate NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o Noo 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o Noo 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3?

PDF Employee's Withholding Allowance Certificate NC-4 North Carolina ... Form Employee's Withholding Allowance Certificate NC-4 Web 11-01 ... Personal Allowances Worksheet Form NC-4 If claiming exempt, the statement is effective for one calendar year only and a new statement must be completed and given to your employer by next February 15.

PDF NC-4 Employee's Withholding - Westfield Insurance Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. BASIC INSTRUCTIONS. Complete the Personal Allowances Worksheet on Page 2. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

PDF How to fill out the NC-4 - One Source Payroll Items needed to fill out NC-4 Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents.

PDF NC-4 - iCIMS NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

![Children Education Allowance Form Word [qvndx93qgj4x]](https://idoc.pub/img/crop/300x300/qvndx93qgj4x.jpg)

0 Response to "45 nc 4 allowance worksheet"

Post a Comment