39 cancellation of debt worksheet

Entering canceled debt in ProSeries - Intuit Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental Instructions for Form 982 (12/2021) | Internal Revenue Service If your main home is sold for $700,000 and $300,000 of debt is discharged, only $100,000 of the debt discharged can be excluded (the $300,000 that was discharged minus the $200,000 of nonqualified debt). The remaining $200,000 of nonqualified debt may qualify in whole or in part for one of the other exclusions, such as the insolvency exclusion.

› taxtopics › tc431Topic No. 431 Canceled Debt – Is It Taxable or Not? In general, you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return as "other income" if the debt is a nonbusiness debt, or on an applicable schedule ...

Cancellation of debt worksheet

PDF Cancellation of debt 5/26/2016 4 Foreclosure Worksheet #1 Figuring Cancellation of Debt Income The amount on line 3 will generally equal the amount shown in box 2 of Form 1099‐C. This amount is taxable unless you meet one of the exceptions Enter it on line 21, Other Income, of your Form 1040 Foreclosure Worksheet # 2 Figuring Gain from Foreclosure PDF Cancellation of Debt Insolvency Worksheet - RH Tax Services Cancellation of Debt ... Worksheet by: William Roos, EA, roos@bigsky.net Revised 11-27-12 NOTE: Do not use a spouse's separately owned assets in computing the taxpayer's insolvency. If any assets or liabilities are separately owned, use a separate worksheet for each spouse. Cancellation of Debt - Intuit Form 1099-C (Cancellation of Debt), fill out accordingly; Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason) Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion)

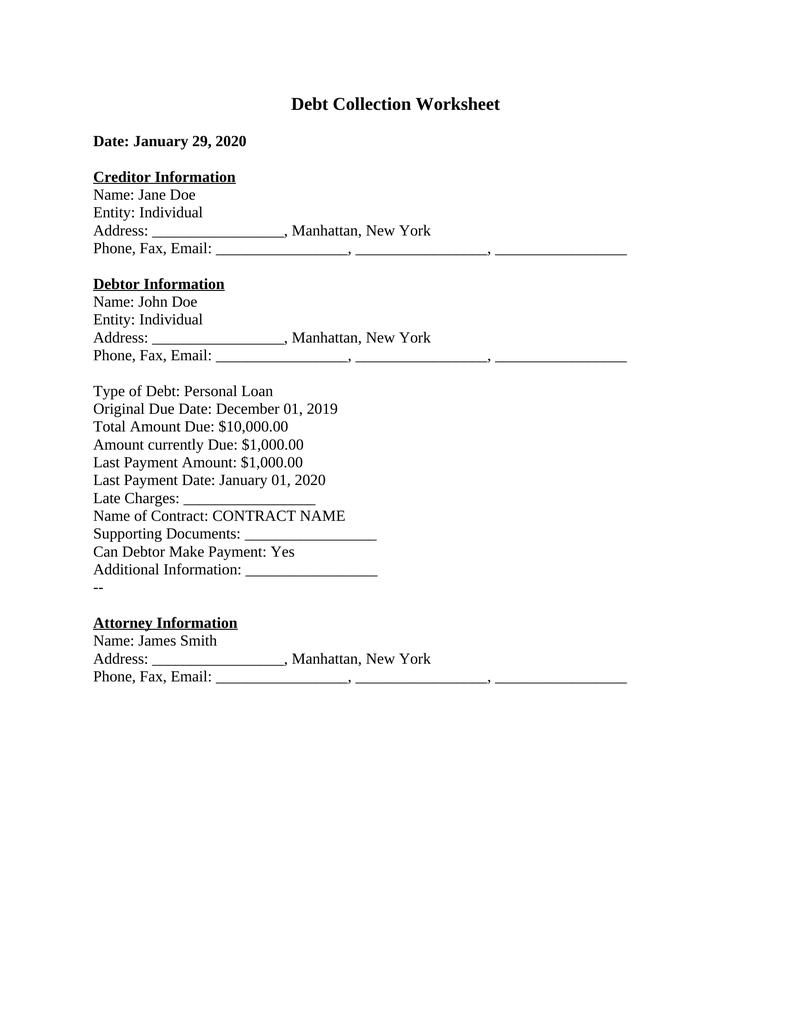

Cancellation of debt worksheet. Cancellation of Debt: What it Means to You - GunnChamberlain Second, the debt that was canceled may be excludable from taxable income to the extent that you are considered "insolvent" immediately prior to the cancellation of the debt. The Internal Revenue Service has provided an Insolvency Worksheet to assist taxpayers in determining whether they are considered insolvent. I Have a Cancellation of Debt or Form 1099-C In general, if you're liable for tax because a debt was canceled, forgiven, or discharged, you'll receive an Form 1099-C, Cancellation of Debt, from the lender or the person who forgave the debt. You may receive an IRS Form 1099-C while the creditor is still trying to collect the debt. If so, the creditor may not have canceled it. Insolvency Worksheet Canceled Debts - US Legal Forms Ensure the data you add to the Insolvency Worksheet Canceled Debts is up-to-date and correct. Include the date to the document using the Date tool. Select the Sign tool and make an electronic signature. Feel free to use three available alternatives; typing, drawing, or capturing one. Make sure that each field has been filled in correctly. Cancellation of Debt Income | Bills.com Cancellation of Debt Income Worksheet; Total Liabilities: Asset Fair Market Value: Insolvency Amount How Much Can Be Excluded From Income: Greg Example No. 1: $15,000-$7,000 = $8,000 Because this exceeds the amount of cancelled debt, Greg can exclude the entire $5,000 shown on his 1099-C. Greg Example No. 2: $10,000-$7,000 =

› FormsandPublications › PAPass Through Entities - Pennsylvania Department of Revenue Cancellation of Indebtedness Income. For additional information concerning cancellation of indebtedness, please refer to PA Personal Income Tax Guide - Cancellation of Debt for Pennsylvania Personal Income Tax Purposes and related PIT Tax Bulletins 2009-02 through 2009-06. Allocation of Partnership Income and Losses › publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... This publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax purposes as having income and may have to pay tax on this income. Note. consumer.ftc.gov › articles › home-equity-loans-andHome Equity Loans and Home Equity Lines of Credit Dec 17, 2021 · They may be willing to give you a deal on the interest rate or fees. Ask friends and family for recommendations of lenders. Then do some research into the lenders’ offerings and prepare to negotiate a deal that works best for you. Use the Shopping for a Home Equity Loan Worksheet. Ask each lender to explain the loan plans available to you. Screen 1099C - Cancellation of Debt, Abandonment (1040) The amount excluded from income (column C of the Cancellation of Debt Worksheet) will be reported on Form 982, line 2. There may be additional data entry required in the 982 screen for UltraTax CS to properly calculate Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness (and section 1082 Basis Adjustment). ...

› publications › p908Publication 908 (02/2022), Bankruptcy Tax Guide | Internal ... At the time of the debt cancellation, he was considered insolvent by $20,000. He can exclude from income the entire $10,000 debt cancellation because it was not more than the amount by which he was insolvent. Among Tom's assets, the only depreciable asset is a rental condominium with an adjusted basis of $50,000. recorder.butlercountyohio.org › search_records › subdivisionWelcome to Butler County Recorders Office Copy and paste this code into your website. Your Link Name Knowledge Base Solution - How do I report Cancellation of debt reported ... Generally, data from a Form 1099-C, Cancelled debt (box 2) is reported on Form 1040, line 21 for 2017 and prior. But for 2018 and current it goes on 1040 Schedule 1 Line 8, using Worksheet 7. However, as noted above there are cases where this should be reported elsewhere, or not reported at all. Knowledge Base Solution - How do I enter cancellation of debt in ... - CCH There is not a specific IRS 1099-C input form to fill in. Instead, depending how the cancellation of debt is to be treated, there are a few methods to get this to flow correctly to your return. Method 1: To have the amounts from the IRS 1099-C flow to the 1040 line 21 as other income.

Guide to Debt Cancellation and Your Taxes - TurboTax If you receive a Form 1099-C this year, it's because one of your creditors canceled a debt you owe, meaning the company writes it off and you no longer have to pay it back. In some cases, you may need to include the amount of debt your 1099-C reports on your tax return as income. However, there are a number of exceptions and exemptions that ...

Cancellation of Debt Insolvency Worksheet - Thomson Reuters Cancellation of Debt Insolvency Worksheet This tax worksheet calculates a taxpayer's insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. A debt includes any indebtedness whether a taxpayer is personally liable or liable only to the extent of the property securing the debt.

apps.irs.gov › 36 › mediaInsolvency Determination Worksheet Insolvency (Out of Scope ... Cancellation of Debt – Nonbusiness Credit Card Debt Cancellation Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent immediately before the debt was canceled, all the canceled debt will be included on Form 1040, line 21, Other Income. No additional supporting forms or schedules are needed to report ...

Cancellation Of Debt Insolvency - 2021 - CPA Clinics Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing the amount of cancelled debt to be reported as income. Generally, you must include all cancelled amounts, even if less than $600, as Other Income on Form 1040. Examples of COD Income

PDF Cancellation of Debt Insolvency Worksheet - Asheville Tax Insolvency Worksheet Keep for Your Records Date debt was canceled (mm/dd/yy) Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category) Amount Owed Liabilities (debts) Immediately Before the Cancellation 1. Credit card debt $ 2.

PDF Abandonments and Repossessions, Canceled Debts, This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as "can- celed debt." Sometimes a debt, or part of a debt, that you don't have to pay isn't considered canceled debt. These exceptions are discussed later un- der Exceptions.

Knowledge Base Solution - How do I enter a cancellation of debt in a ... If the cancellation of debt should be reported as a Gain, enter information the appropriate D-Series Interview form (D-1/D-1A for capital transactions or D-2 for 4797 gains/losses). ... Click her to see this solution using worksheet view. Solution Tools. Email Print. Attachments. Solution Id: 000030095/sw1351: Direct Link: Copy To Clipboard: To ...

Cancellation of Debt - Intuit Form 1099-C (Cancellation of Debt), fill out accordingly; Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason) Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion)

PDF Cancellation of Debt Insolvency Worksheet - RH Tax Services Cancellation of Debt ... Worksheet by: William Roos, EA, roos@bigsky.net Revised 11-27-12 NOTE: Do not use a spouse's separately owned assets in computing the taxpayer's insolvency. If any assets or liabilities are separately owned, use a separate worksheet for each spouse.

PDF Cancellation of debt 5/26/2016 4 Foreclosure Worksheet #1 Figuring Cancellation of Debt Income The amount on line 3 will generally equal the amount shown in box 2 of Form 1099‐C. This amount is taxable unless you meet one of the exceptions Enter it on line 21, Other Income, of your Form 1040 Foreclosure Worksheet # 2 Figuring Gain from Foreclosure

0 Response to "39 cancellation of debt worksheet"

Post a Comment