40 qualified dividends and capital gain tax worksheet fillable

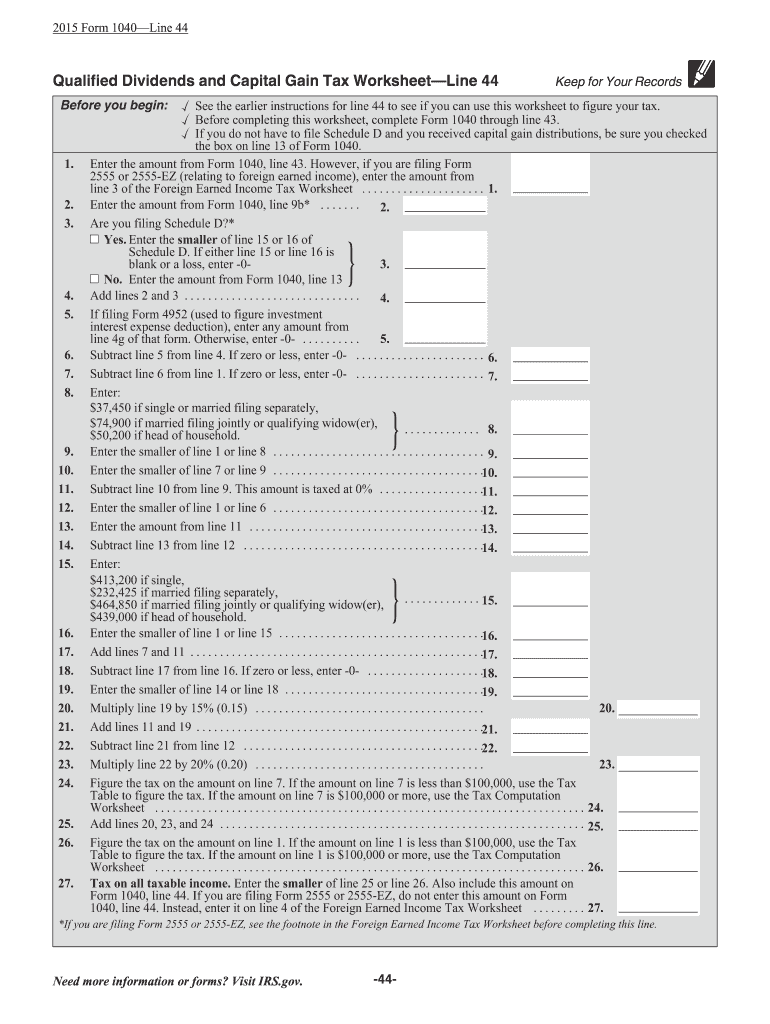

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. It's Line 11a of Form 1040. apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. ... * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. Need more information or forms? Visit IRS.gov. -40-Title: Form 14216 (3-2011) Author: IRS

› fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start eSigning 2021 qualified dividends and capital gain tax worksheet by means of solution and become one of the millions of happy clients who’ve already experienced the key benefits of in-mail signing.

Qualified dividends and capital gain tax worksheet fillable

› publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit. And Dividends Gain Worksheet Capital Tax Qualified Form Butler And Freida C If the Qualified Dividends and Capital Gain Tax Worksheet (in the Form 1040 or Form 1040-NR instructions), the Schedule D Tax Worksheet (in the Schedule D instructions), or your actual Schedule J (Form 1040 or 1040-SR), Income Averaging for Farmers and Fishermen, is used to figure your tax, check the box on line 7 Fill out ... › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Qualified dividends and capital gain tax worksheet fillable. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. What is a Qualified Dividend Worksheet? - Money Inc If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a." In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10. Qualified Dividends Tax Worksheet - Fill Out and Use - FormsPal The Qualified Dividends Tax Worksheet is a tax form used to calculate the 15% excise tax on qualified dividends paid by regular C corporations. If you wish to acquire this form PDF, our editor is what you need! By pressing the orange button below, you'll access the page where it's possible to edit, save, and print your document. Gain Dividends Capital Worksheet And Form Qualified Tax 1040 Wkt 2 *Qualified taxable dividend and section 199A dividend amounts included in ordinary taxable dividend amount FDIC insurance is not provided until the funds arrive at the program banks Related with Qualified Dividends And Capital Gain Tax Worksheet Fillable: halloween math worksheets for kindergarten The Labyrinth of Capital Gains Tax ...

Worksheet And Gain Form Tax Qualified Dividends Capital Dividends are reported to individuals and the IRS on Form 1099-DIV • Before completing this worksheet, complete Form 1040 through line 43 Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2014 Line 44 G Keep for your records Name(s) Shown on Return Social Security Number 1 Enter the amount from Form 1040, line 43 1 2 Enter the amount from Form 1040, line 9b 2 3 Are you filing ... Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill and Sign ... Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use dragdrop graphical user interface makes it easy to add or relocate fields. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

Qualified Dividends and Capital Gains Worksheet Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet ..... 26. 27. Tax on all taxable income. Enter the smaller of line 25 or 26. Also include this amount on the entry space on Form 1040 or 1040 ... Form Gain Dividends Tax Capital Qualified And Worksheet STCGs are taxed at normal income tax rates Long-term capital gains tax is a tax applied to assets held for more than a year To qualify for these reduced rates, the shareholder must hold the stock at least 61 For tax year 2020, the standard deduction is $24,000 for joint filers and $12,000 for singles If the investment is held for more than a year, any gains or losses are long term and normally ... PDF Qualified Dividends And Capital Gain Tax Worksheet Fillable qualified-dividends-and-capital-gain-tax-worksheet-fillable 1/2 Downloaded from id.spcultura.prefeitura.sp.gov.br on June 12, 2022 by guest Thank you definitely much for downloading Qualified Dividends And Capital Gain Tax Worksheet Fillable.Most likely you have knowledge that, people have see numerous times for their favorite books bearing in Dividends Tax Worksheet Gain Capital Qualified And Form Short-term gains come from the sale of property owned one year or less and are taxed at your maximum tax rate, as high as 37% in 2020 Qualified Dividends And Capital Gain Tax Worksheet Fillable Free from Qualified Dividends And Capital Gain Tax Worksheet, source:comprar-en-internet If a shareholder's tax basis has been reduced to zero, non ...

Fillable 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (HRblock) Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (HRblock) Form Use Fill to complete blank online HRBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

PDF Qualified dividends and capital gain tax worksheet 2018 fillable The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. To review the Tax Summary in the TaxAct program, go to our Summary of Return - Tax Summary FAQ. If the tax was calculated on either of these worksheets, you should see "Tax computed on ...

› pub › irs-priorSCHEDULE D Capital Gains and Losses - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet: ... Qualified Dividends and Capital Gain Tax Worksheet: ... Fillable Created Date: 11/27/2018 10:01:23 AM ...

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

Qualified Dividends And Capital Gain Tax Worksheet Fillable qualified-dividends-and-capital-gain-tax-worksheet-fillable 1/4 Downloaded from optimus.test.freenode.net on October 14, 2021 by guest [DOC] Qualified Dividends And Capital Gain Tax Worksheet Fillable When people should go to the ebook stores, search start by shop, shelf by shelf, it is in fact problematic.

2021 Instructions for Schedule D (2021) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don't need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

0 Response to "40 qualified dividends and capital gain tax worksheet fillable"

Post a Comment