43 applicable large employer worksheet

CUSTOMER DATA WORKSHEET - Farm Service Agency WebPersons with disabilities who require alternative means of communication for program information (e.g., Braille, large print, audiotape, American Sign Language, etc.) should contact the responsible Agency or USDA’s TARGET Center at (202) 7202600 (voice and TTY) or contact USDA through the - Federal Relay Service at (800) 877-8339 ... Safe Harbors Prove ACA Affordability | The ACA Times So here's the calculation: $50,000 x 9.61% = $4,805. Next, multiply $4,805 by the product of the number of months of coverage offered (9) by the total number of months in the year for partial coverage (9/12). This gives you $3,603.75, which is the maximum annual amount that Jonny's employer can make him pay for self-only coverage.

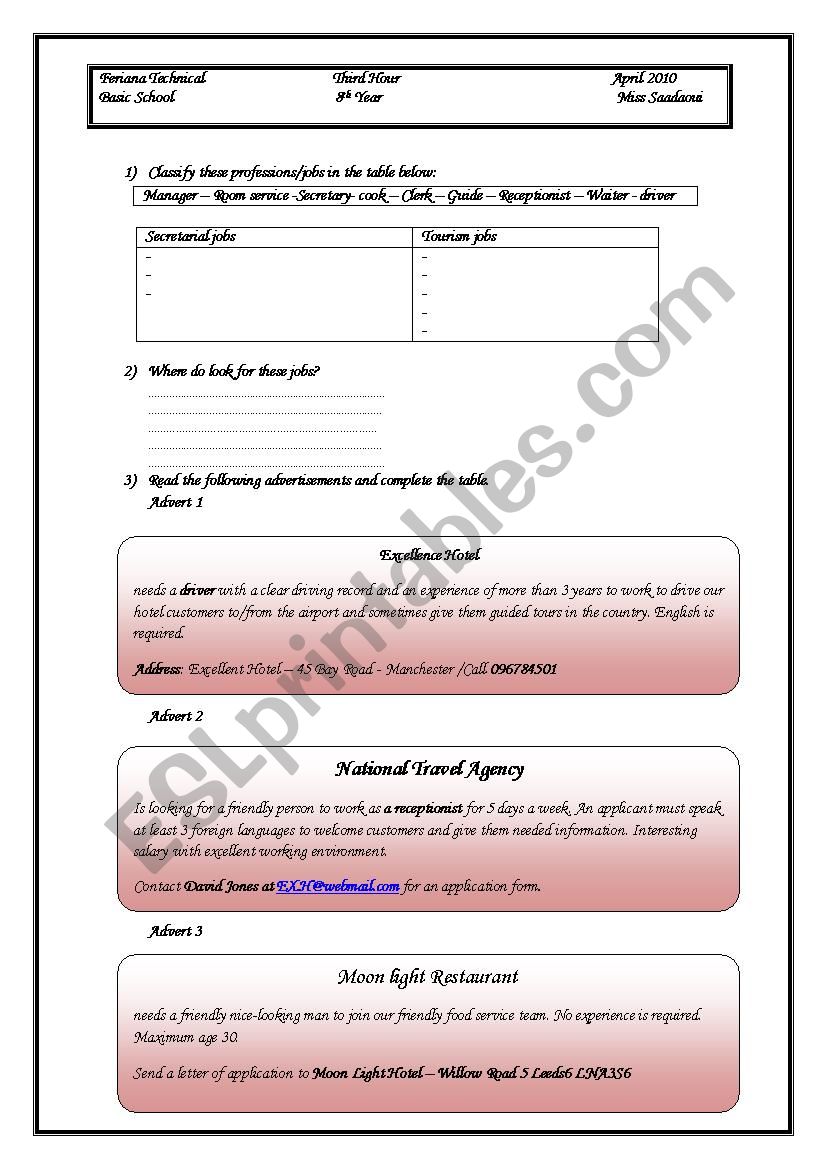

PDF APPENDIX A Applicable Large Employer 'ALE' Worksheet Instructions 1) Sort each monthly spreadsheet by the status. 2) Count each FTE once. Seasonal employees who are considered FTEs are counted here. Enter the number of FTEs for each month on the first tab, Line 6, "Count." 3) Add Part-Time Employee hours together for each month; enter total PTE hours for each month on the first tab, Line 12, "Hours."

Applicable large employer worksheet

Employer Shared Responsibility Provision - Taxpayer Advocate Service The size of your workforce in the previous calendar year determines whether you are an applicable large employer. In most cases, you determine your "workforce size" by looking at your employees in the previous calendar year and computing if you employed on average 50 or more full-time employees, including your full-time equivalent employees, across all 12 months of the year. ACA Fact Sheet: ALE (Applicable Large Employer) Calculation - TriNet What is an ALE ( Applicable Large Employer)? ALEs are companies with a monthly average of 50 or more full-time or full-time equivalent employees (FTEs) on its normal business days in the prior calendar year. To navigate through ACA requirements, you first must calculate your company's FTE count and determine ALE status. SOUTH CAROLINA EMPLOYEE'S WITHHOLDING … WebYour employer may be required to send a copy of this form to the SCDOR. 1 . First name and middle initial. Last nameAddress City State ZIP. Single. 2. Social Security Number. 3. Married. Married, but withhold at higher Single rate. If Married filing separately, check . Married, but withhold at higher Single rate. 4. Check if . your last name is different . on …

Applicable large employer worksheet. c; sides of paper. - NCDOR WebCut here and give this certificate to your employer. Keep the top portion for your records. PURPOSE - Complete Form NC-4 so that your employer can withhold the correct amount of State income tax from your pay. If you do not provide an NC-4 to your employer, your employer is required to withhold based on the filing status, “Single” with zero allowances. … Employer Shared Responsibility Provisions | Internal Revenue Service For employers that are an applicable large employer, an estimate of the maximum amount of the potential liability for the employer shared responsibility payment that could apply, based on the number of full-time employees reported if an employer fails to offer coverage to its full-time employees. IRS increases employer mandate penalties for 2021 - PeopleKeep An applicable large employer that fails to offer minimum essential coverage to 95% of full-time employees (Section 4980H (a) penalty): 2021 penalty is $2,700 per full-time employee if only one full-time employee receives subsidized coverage through the Exchange or Marketplace, a 5.1% increase from the $2,570 amount for 2020. Form Approved OMB No. 0560-0238 (See Page 2 for Privacy Act … Webstatute or regulation and/or as described in the applicable Routine Uses identified in the System of Records Notice for USDA/FSA-14, Applicant/Borrower. Providing the requested information is voluntary. However, failure to furnish the requested information may result in a deni al for loans and loan guarantees, and servicing of loans and loan guarantees. The …

PDF Appendix a - Applicable Large Employer Worksheet Instructions The Applicable Large Employer (ALE) Worksheet provides a tool with which to determine and document your ACA reporting status. It is easy to use and requires you to perform some basic calculations as described below. If you determine per the Worksheet that your business is on the cusp, be sure to monitor your status and reporting requirements. How to Determine if You're an Applicable Large Employer (ALE) - PropelHR Determining if You're an Applicable Large Employer (ALE) To determine its size for a year: An employer adds its total number of full-time employees for each month of the prior calendar year to the total number of full-time equivalent employees for each calendar month of the prior calendar year and divides that total number by 12. IT-2104 Employee’s Withholding Allowance Certificate worksheet or charts, you should complete a new 2022 Form IT-2104 and give it to your employer. Who should file this form This certificate, Form IT-2104, is completed by an employee and given to the employer to instruct the employer how much New York State (and New York City and Yonkers) tax to withhold from the employee’s pay. The Large Employer Calculator - MyEnroll360 As part of our continued commitment to helping you navigate Affordable Care Act compliance, BAS has created an Applicable Large Employer calculator. The calculator is an easy-to-use tool designed to guide you through the steps required to determine large employer status and provide you with quick answers. The Large Employer Calculator includes:

Publication 560 (2021), Retirement Plans for Small Business WebIncrease in credit limitation for small employer plan startup costs. The Further Consolidated Appropriations Act, 2020, P.L. 116-94, also amended section 45E. For tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup … 1095-B and 1099-HC tax form | Mass.gov Web07.01.2021 · IRS Form 1095-C provides information about the offer of health insurance coverage if you were a full-time employee of an Applicable Large Employer (i.e. employers with 50 or more full-time equivalent employees) at any time during 2020. If you are a Commonwealth of Massachusetts employee, including employees of higher education, … Understanding the Affordable Care Act Employer Mandates - QuickBooks However, if your workforce exceeds 50 full-time employees (including full-time equivalents) for 120 days or fewer during a calendar year, and the employees in excess of 50 who were employed during that period of no more than 120 days were seasonal workers, you are not considered an Applicable Large Employer. ACA Reporting and ESR Services - Paychex Prevent Penalties for Missing ESR Requirements With help from Paychex, you can take steps to comply with ESR requirements and avoid costly penalties: from $162,400 per year for businesses with 100 full-time employees to $394,400 for 200 full-time and $1,090,400 for 500 full-time employees.

What's the difference between a "large employer" and a "small ... - Gusto Large employers are defined as having 50 or more full-time equivalent employees. Small employers have fewer than 50 full-time equivalent employees. Note, a full-time equivalent employee count is different than just counting all your full-time employees— check out this article to learn how to calculate your count.

How to calculate FTEs to determine ALE status - PeopleKeep The Affordable Care Act's (ACA) employer mandate relies heavily on calculating your full-time equivalent employees (FTEs). This is because understanding the number of FTEs your company has allows you to determine if your company is considered an applicable large employer (ALE) and is even required to adhere to the employer mandate.. You can avoid the employer mandate's two penalties if you ...

Affordable Care Act Estimators - Taxpayer Advocate Service As background, the ESRP applies to applicable large employers (ALEs) - generally, that means employers that had an average of at least 50 full-time employees (including full-time equivalent employees - FTEs), during the preceding calendar year. Employers can use the Employer Shared Responsibility Provision Estimator to determine:

PDF Employer Shared Responsibility Applicable Large Employer Status FINAL The Applicable Large Employer Worksheet will: •Calculate the number of full-time employees per month for a review period; each employee paid for 130or more Hours of Service during a month will be counted as one full-time employee

Curing What Ails You - Relief for Small Employer HRAs | Employee ... This means that the employer, on a controlled group basis, may not be an applicable large employer under Code Section 4980H(c)(2). Therefore, an employer that employed at least 50 full-time employees, including full-time equivalent employees, in the prior calendar year may not offer a QSEHRA to its employees.

ACA 101 Calculate Your Full-Time Equivalent (FTE) Count There are two main points to ACA that you need to know: All Americans must have health insurance. Businesses over a certain size must provide affordable coverage. The key is, "businesses over a certain size" aka Applicable Large Employers. Applicable Large Employers (ALEs) are defined as businesses with 50 or more full-time equivalent employees.

Full-Time, Variable Hour and Seasonal Employees Fact Sheet - TriNet Full-Time Employee. A full-time employee is an individual reasonably expected to work at least 30 hours per week. For this purpose, "hours" include each hour for which an employee is paid or entitled to payment for performing duties for the employer or entitled to payment even if no work is done (e.g. holiday, vacation or sick time). Employees ...

13091: ACA Reporting Forms 1095-A, 1095-B, 1094-C, 1095-C - Drake Software Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Return. Filing is optional for CY 2014, but required for Coverage Years starting in 2015. All Applicable Large Employer (ALE) Members are required to file Forms 1094-C and 1095-C for Coverage Years starting in 2016.

What is an Applicable Large Employer (ALE)- Simplified! For the purpose of determining your status as an applicable large employer, a standard full-time employee is anyone working an average of at least 30 or more hours per week OR worked 130 or more hours in one month. Each person, regardless of how many actual hours they worked, are counted as one Full-Time Equivalent Employee (FTE).

0 Response to "43 applicable large employer worksheet"

Post a Comment