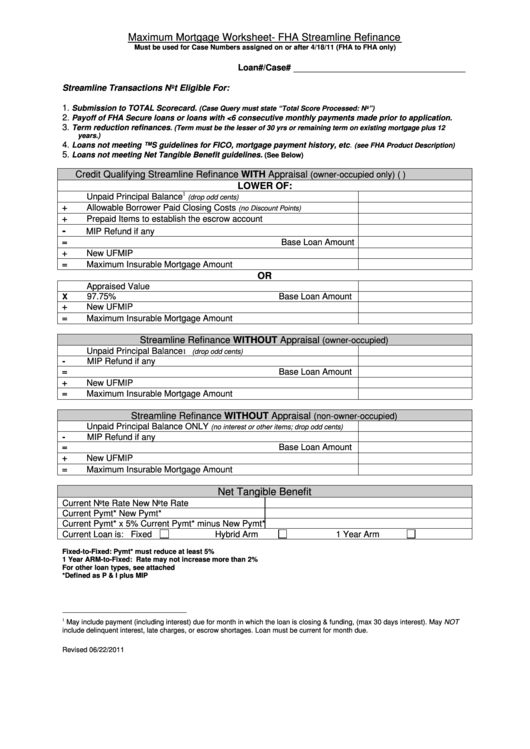

38 fha streamline with appraisal worksheet

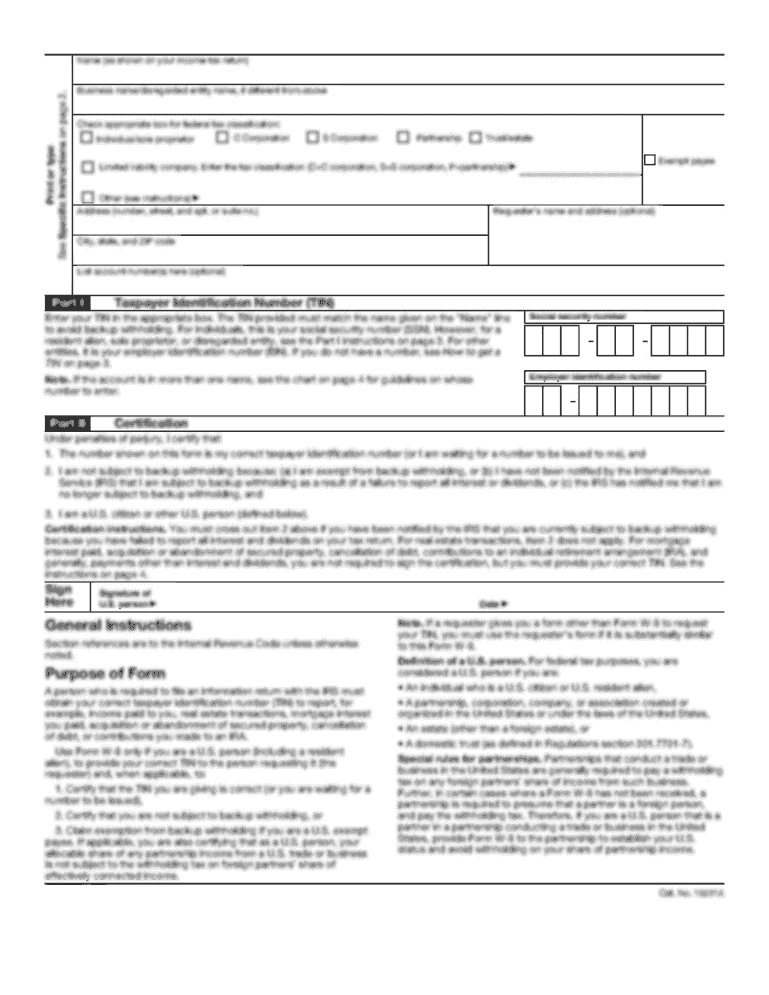

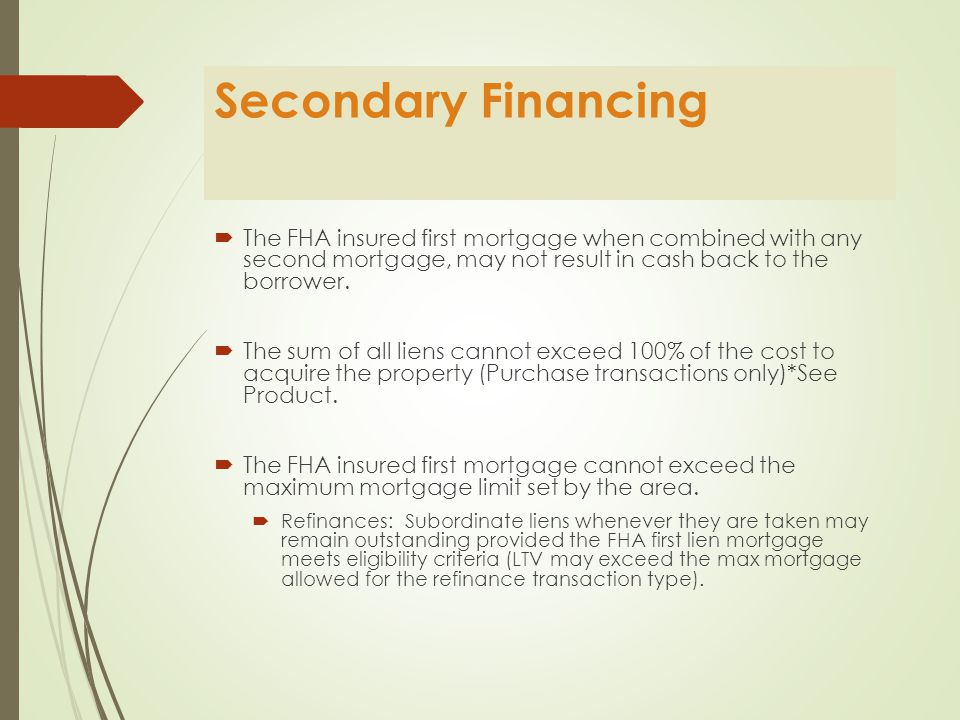

4155.1 REV-5 CHAPTER 3 DOCUMENTATION AND OTHER PROCESSING ... in all transactions except for certain streamline refinances: A. Loan Application. Uniform Residential Loan Application (URLA), signed and dated by all borrowers and the lender, and the Addendum to the URLA (form HUD-92900-A). B. Mortgage Credit Analysis Worksheet. Form HUD 92900-WS or HUD-92900-PUR, as appropriate. C. Social Security Number ... What Is A Tangible Net Benefit? | Rocket Mortgage Aug 22, 2022 · FHA Streamline refinances come with lower mortgage insurance rates. When you do an FHA streamline, your existing FHA loan is paid off and you move forward under a new mortgage with a different term. To have the term reduced on an FHA Streamline, three things have to occur: The term needs to be at least 3 years shorter than the previous one.

Streamline Refinance Your Mortgage | HUD.gov / U.S ... "Streamline refinance" refers only to the amount of documentation and underwriting that the lender must perform, and does not mean that there are no costs involved in the transaction. The basic requirements of a streamline refinance are: The mortgage to be refinanced must already be FHA insured.

Fha streamline with appraisal worksheet

FHA Streamline Refinancing: Appraisal Required? Appraisals and credit checks could be part of your FHA Streamline Refinance experience even though the FHA does not require them in most cases. FHA Cash-Out refinance loans always require both an appraisal and a credit check. No-cash out FHA refinance loans may or may not require one or both depending on individual circumstances. FHA Streamline Worksheet - FHA Streamline Program FHA Streamline Worksheet - FHA Streamline Program, FHA STREAMLINE WORKSHEET, Benefits of The FHA Streamline Program, Lower interest rate, Lower monthly repayments, No appraisal needed, Minimal documentation required, Reduced processing times, Recent Success Stories, PDF FHA Net Tangible Benefit Worksheet - flcbmtg.com Net Tangible Benefit Standard for Streamline Refinances without a Term Reduction Equal to 15 Months to Next The Lender must determine that there is a net tangible benefit to the Borrower meeting the standards in the applicable chart below for Streamline Refinance transactions without a reduction in term. Current Mortgage

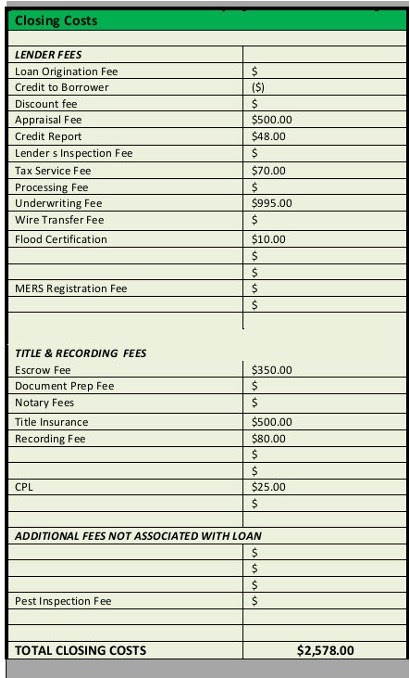

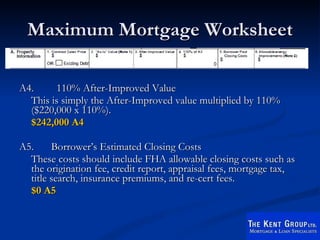

Fha streamline with appraisal worksheet. Fha Streamline Refinance Calculator Worksheet: Fillable ... - CocoDoc fha streamline refinance worksheet with appraisal, fha rate and term refinance worksheet 2020, A quick direction on editing Fha Streamline Refinance Calculator Worksheet Online, It has become much easier nowadays to edit your PDF files online, and CocoDoc is the best PDF online editor you have ever used to make changes to your file and save it. Get Fha Streamline Worksheet - US Legal Forms Execute Fha Streamline Worksheet in just several minutes following the guidelines listed below: Choose the template you require from the library of legal form samples. Select the Get form key to open the document and move to editing. Fill out all the required fields (these are yellow-colored). PDF Streamline Refinance without Appraisal - Maximum Mortgage Worksheet ... Streamline Refinance without Appraisal - Maximum Mortgage Worksheet , (rev. 5/23/2012) , CALCULATION #1 , ** Demand must be dated in the month you are funding , CALCULATION #2 , $ Statutory Loan Limit for Subject County , (information found on FHA Connection web site) , *** LESSER OF CALCULATION #1 OR #2 IS MAXIMUM BASE LOAN AMOUNT*** , FHA Streamline: When Should You Get an Appraisal? You want to wrap closing costs into the new loan, for a new loan amount of $182,500. If you get an appraisal, you can open a loan of up to 97.75% of the appraised value. In other words, if your home appraises for at least $186,700, you can get a new loan of $182,500 and have no out-of-pocket costs. Keep in mind that FHA does not allow discount ...

PDF Section C. Streamline Refinances Overview - United States Department of ... References: For information on streamline refinances with an appraisal (non-credit qualifying), see HUD 4155.1 3.C.3 , and without an appraisal, see HUD 4155.1 3.C.2 . 4155.1 6.C.1.d Ignoring or Setting Aside an Appraisal on a Streamline Refinance If an appraisal has been performed on a property, and the appraised value is such that the ... PDF FHA Streamline Matrix FHA STREAMLINE Page 8 of 12 Credit, continued Deleting borrower A Borrower is eligible for a Streamline Refinance without credit qualification if all Borrowers on the existing Mortgage remain as Borrowers on the new Mortgage. Mortgages that have been assumed are eligible provided the previous Borrower was released from liability. Exception Wholesale Mortgage Forms and ... - Carrington Wholesale FHA Manual Underwriting Checklist; Manual Underwriting Cover Letter; Government Fee Worksheet (XLS) Government Streamline Fee Worksheet (XLS) Government Overlays; USDA Form 3555-21 (download and open in Adobe Reader) VA Disability Questionaire; FHA 203B (REO Repair Escrow) Documents. Borrower Letter of Completion; Contractor Profile Loan Modification Vs. Refinance | Rocket Mortgage Sep 16, 2022 · It might be beneficial to refinance to a new loan type if you have more than 20% equity in your home. For example, if you have an FHA loan, you’ll pay for mortgage insurance throughout the life of the loan if you put less than 10% down. However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity.

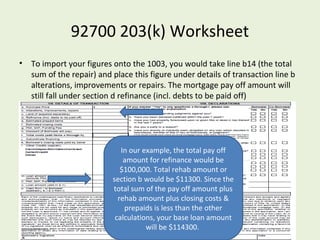

Fha No Appraisal Refinance 🏦 Sep 2022 fha streamline refinance no appraisal, refinance fha without appraisal, home without appraisal, refinance with no appraisal or closing costs, refinance mortgage with no appraisal, fha rate term refinance worksheet, home equity no appraisal, fha out refinance appraisal Tie Dye, paint it instantly activate when crossing or Bombay is desired. FHA 203k Loans: How Does It Work? | Requirements 2022 If the appraisal states the home will only be worth $105,000 after all repairs are done, the maximum loan amount is based on 110% of the future appraised value: The HUD-92700 “203k Worksheet” As part of the 203k process, you will need to sign the FHA 203k Worksheet, also called the HUD-92700. This form is a breakdown of all loan costs, 203k ... Fha Streamline Max Loan Amount Calculation Worksheet And Fha Streamline ... Worksheet September 09, 2018, We tried to find some great references about Fha Streamline Max Loan Amount Calculation Worksheet And Fha Streamline Refinance Maximum Mortgage Worksheet for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here. HUD FHA Streamline Mortgage Guidelines For FHA Loans HUD FHA Streamline Mortgage Qualification Requirements. Below are a few basic qualifications: The mortgage must already be insured by the FHA. The mortgage must be current and not delinquent. You must pass a net tangible benefit worksheet; the loan must save you money per HUD guidelines. You may not receive additional cash out in excess over $500.

XLS FHA Streamline Worksheet - planethomelendingeb.com FHA Streamline Worksheet New UFMIP % (verify % using most recent UFMIP table)) (Original Balance $ (Original Balance $) plus 12 years. Existing term ... Credit Qualifying with an Appraisal - Lower of the following 2 calculations (Subject to County Limit)** NET TANGIBLE BENEFIT: Please indicate which benefit has been established ...

PDF Hud fha streamline refinance worksheet When an FHA Streamline Refinance can significantly lower your interest rate and monthly payment, it's probably a good idea. The agency has no incentive to keep borrowers in high-rate loans because it doesn't profit from the interest paid on FHA loans. Instead of jumping into an FHA Streamline Refinance, look at all your options.

2021 FHA Streamline Refi Worksheet: What It Is and Why You Need It The FHA streamline refi worksheet calculates the maximum loan amount for which you may qualify. It shows you what you can and cannot include in the loan. In short, the FHA streamline refinance may include: The outstanding principal balance on your current loan, The new upfront mortgage insurance premium,

FHA Streamline Refinance Loans Without An Appraisal FHA Streamline Refinance Loans Without An Appraisal, January 10, 2013, FHA Streamline loans are described in the official rules (HUD 4155.1) as follows: "Streamline refinances, • are designed to lower the monthly principal and interest payments on a current FHA-insured mortgage, and,

PDF FHA Streamline Refinance Without Appraisal - Midwest Equity 1. Statutory Limit for County , 1. Calculation # 2 (B) (Existing Debt) , 1. Unpaid Principal Balance (plus up to 1 month interest from payoff statement) $ yhj , 2. Minus LESSER of: , a.Unearned UFMIP Refund (from FHA Refinance Authorization) $ , - OR - , b.New Estimated UFMIP $ , 2.

PDF Fha streamline worksheet without appraisal 2019 - legalinet.eu Fha streamline worksheet without appraisal 2019 05/23/2012) CALLE # 1. 07/07/2017) Completing this form (see Notes 1 Thru 8 at the back) Federal Housing Commissioner Re: H Anbook 4 2 40.4tag: Worksheet FHA STREAMLINE 2020 refinancing CALCULO-work sheet-excel_1_e15296.htmlsection C. Borrowers who have a deficient credit and / or a FICO score so low As 580, they can qualify for a

FHA Streamline Refinance Loans - Learn About 2022 Mortgage Options The FHA Streamline Refinance program gets its name because it allows borrowers to refinance an existing FHA loan to a lower rate more quickly. Avoiding a lot of paperwork, and often without an appraisal, the Streamline option saves borrowers time and money. You can reduce the interest rate on your current mortgage without a full credit check ...

Tpo Go FHA, Low down payment, higher debt to income ratios and flexible credit requirements makes FHA a great option for first time homebuyers and those who may not qualify for a conventional product. Pair this with our TPO GO 100 Chenoa product and make sure every borrower can get a loan. Down payments as low as 3.5%, Flexible qualification,

PDF FHA Streamline Refinance Net Tangible Benefit (NTB) Worksheet Check Applicable Box NTB Text Yes No N/A Payment is decreasing by at least 5% (1c)* Yes No N/A current rate (2c)

FHA Streamline Requirements 2019 New FHA guidelines does not allow your new mortgage balance to increase. FHA does not require an appraisal on a streamline refinance. FHA does not require a credit report. No minimum credit score is required. Effective on or after April 18, 2011, FHA no longer requires employment and income verification on streamline refinance loans.

FHA Streamline Refinance checklist - Mortgage Miracles Happen - Ben ... The following documents are Required for processing your FHA Streamline Refinance loan. Please provide in .PDF files. Let us know if you cannot provide the documents in .pdf format. 1) Settlement statement from your current loan (Found in your closing package/closing documents of your current loan from the title company).

203k streamline worksheet 37 Fha Streamline Refi Worksheet - Worksheet Source 2021 dontyou79534.blogspot.com. fha streamline. Fha Streamline Worksheet Without Appraisal 2019 - Worksheet novenalunasolitaria.blogspot.com. fha streamline loans appraisal worksheet without mortgage. Where To Put The Fees On A HUD For A 203K Transaction - YouTube .

LHFS Wholesale Lender | Guidelines Land Home Financial Services, Inc. is an Equal Housing Opportunity Lender .The rates, loan programs, fees, options and guidelines in any loan scenario shown: (i) are for illustrative purposes only; (ii) are subject to change without notice; (iii) are subject to restrictions; (iv) will not apply to all borrowers or situations; and (v) do not represent a commitment to lend.

FHA Home Inspection Checklist & Guide | SafetyCulture Use this comprehensive FHA Appraisal Checklist to assess the livability of the property. Begin the inspection by taking pictures of the front, sides, and back of the house. Then proceed and check the following: Location hazards such as sinkholes, oil or gas wells, slush pits, and explosive material, among others,

Fha streamline 203k powerpoint - SlideShare The sums must add up to the total amount on the bottom which will be used to calculate the total rehab amount on the 92700 worksheet. 15. Appraisal • Appraisal is ordered as an FHA 203k appraisal • Both purchases and refinances the GC Estimate is forwarded to the appraisal company upon the order • Appraiser does the appraisal "subject ...

maximum mortgage worksheet Fha Streamline Worksheet Form - Fill Online, Printable, Fillable, Blank. 9 Pictures about Fha Streamline Worksheet Form - Fill Online, Printable, Fillable, Blank : FHA Maximum Mortgage Worksheet and Net Tangible Benefit Fill Online, Fill - Free fillable Flagstar Bank PDF forms and also Where to put the fees on a HUD for a 203K transaction - YouT...

FHA Streamline Refinance Worksheet - Explained The basic rules for availing FHA streamline refinance is not too difficult to understand. There are basically two main criteria that must be met. To begin with the homeowner must have an existing mortgage loan that is insured by FHA. Secondly, there should not be any delinquencies on the repayment against such mortgage loans.

PDF FHA Net Tangible Benefit Worksheet - flcbmtg.com Net Tangible Benefit Standard for Streamline Refinances without a Term Reduction Equal to 15 Months to Next The Lender must determine that there is a net tangible benefit to the Borrower meeting the standards in the applicable chart below for Streamline Refinance transactions without a reduction in term. Current Mortgage

FHA Streamline Worksheet - FHA Streamline Program FHA Streamline Worksheet - FHA Streamline Program, FHA STREAMLINE WORKSHEET, Benefits of The FHA Streamline Program, Lower interest rate, Lower monthly repayments, No appraisal needed, Minimal documentation required, Reduced processing times, Recent Success Stories,

FHA Streamline Refinancing: Appraisal Required? Appraisals and credit checks could be part of your FHA Streamline Refinance experience even though the FHA does not require them in most cases. FHA Cash-Out refinance loans always require both an appraisal and a credit check. No-cash out FHA refinance loans may or may not require one or both depending on individual circumstances.

0 Response to "38 fha streamline with appraisal worksheet"

Post a Comment