41 flsa professional exemption worksheet

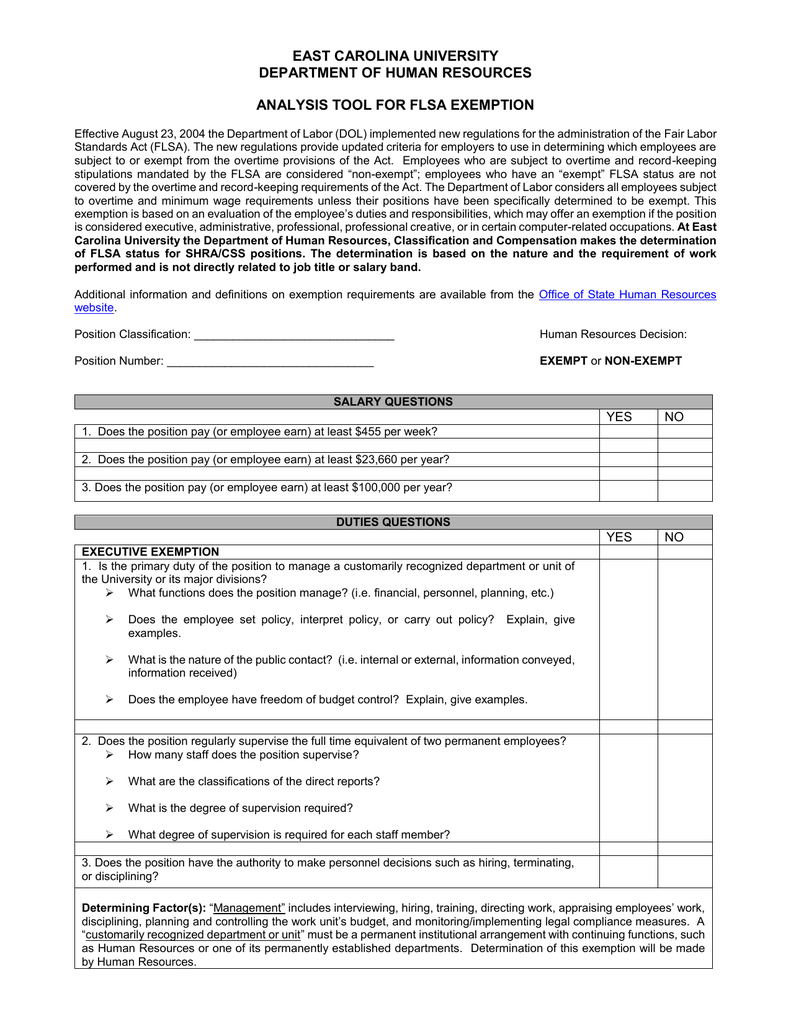

FLSA Exemption Test Worksheet (Completed by Human Resources) FLSA Exemption Test Worksheet (Completed by Human Resources) Executive, Teaching, Professional, Administrative, and Computer Exemption Tests ... Federal law provides that certain PSU employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) under the following exemption categories: EXECUTIVE, TEACHING ... PDF FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET - United States Department of ... III. PROFESSIONAL EXEMPTION (5 CFR 551.207) & LEARNED PROFESSIONAL EXEMPTION (5 CFR 551.208) An employee whose primary duty meets A, B, and C below. An employee whose primary duty is managing an organizational unit, and who meets both of the conditions below. U.S. Department of State FAIR LABOR STANDARDS ACT (FLSA) WORKSHEET DS-5105 05-2017 ...

PDF FAIR LABOR STANDARDS ACT (FLSA) QUESTIONNAIRE - Louisiana Please refer to the FLSA Index (pages 6-11 of this document) for a description of the terms in boldand referenced by a superscript. Exempt/NonExempt. - The content of this questionnaire was developed from the FLSA Regulation, Part 541: Defining and delimiting the exemptions for Executive, Administrative, Professional,

Flsa professional exemption worksheet

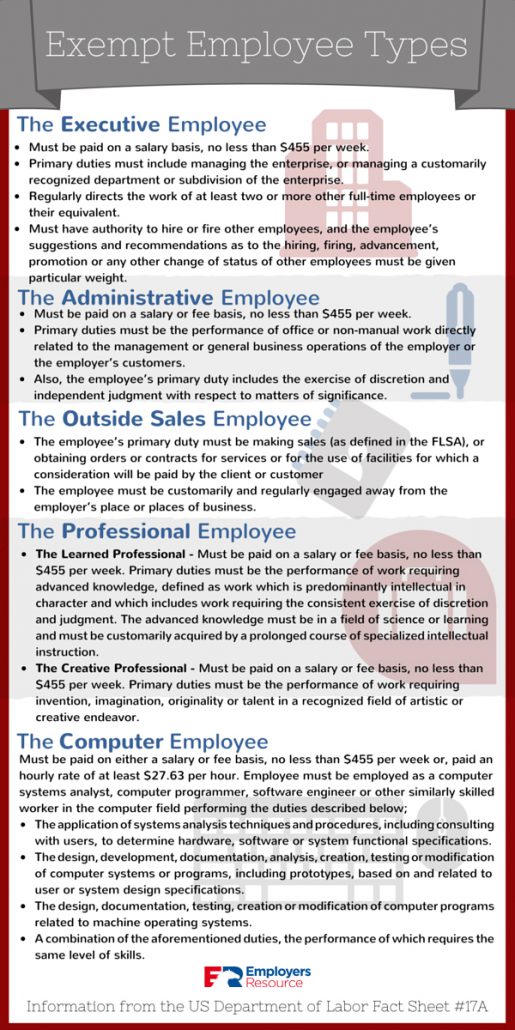

PDF U.S. Department of Labor Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) This fact sheet provides general information on the exemption from minimum wage and PDF FLSA Checklist: Exempt vs. nonexempt status - Ferris State University for exempt positions. Those positions generally fall into six categories: executive, administrative, learned professional, computer professional, creative professional and outside sales.' But it's not that simple. That's why HR Specialistprepared this checklist. Use it to determine whether your employees are exempt from the FLSA. (800 ... PDF FLSA Exemption Test Worksheet - Roman Catholic Archdiocese of Seattle FLSA Exemption Test Worksheet Executive, Teaching, Professional, Administrative, and Computer Exemption Tests . Federal law provides that certain employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) under the following exemption categories: EXECUTIVE, TEACHING, PROFESSIONAL, ADMINISTRATIVE, or COMPUTER.

Flsa professional exemption worksheet. FLSA Overtime Fact Sheet: HR Guide to Exemptions - Fuse … The FLSA Learned Professional Exemption includes primary duties which require advanced knowledge in order to perform including: Consistent exercise of judgment and discretion Advanced knowledge in the field of science or learning (including law, medicine, accounting, theology, actuarial computation, teaching, architecture, pharmacy, and other occupations … PDF Questionnaire to Determine FLSA Exempt Status - hnbllc.com exemption, answer the questions and then evaluate the criteria for each relevant exemption category (executive, administrative, professional, computer professional, outside sales, commission sales, or highly compensated employees) based on responses to the questions. Note that a single employee may qualify for more than one exemption. PDF Fair Labor Standards Act Code Worksheet - USDA Professional Exemption (5 CFR 551.207): Applies to all employees who meet the following criteria, or any teacher: primary duty test (work that requires a bachelor's ... Fair Labor Standards Act Code Worksheet Reviewer's initials _____ Title: Word Pro - flsaworksheet.lwp Fact Sheet #17D: Exemption for Professional Employees Under the ... - DOL highly compensated employees performing office or non-manual work and paid total annual compensation of $107,432 or more (which must include at least $684 * per week paid on a salary or fee basis) are exempt from the flsa if they customarily and regularly perform at least one of the duties of an exempt executive, administrative or professional …

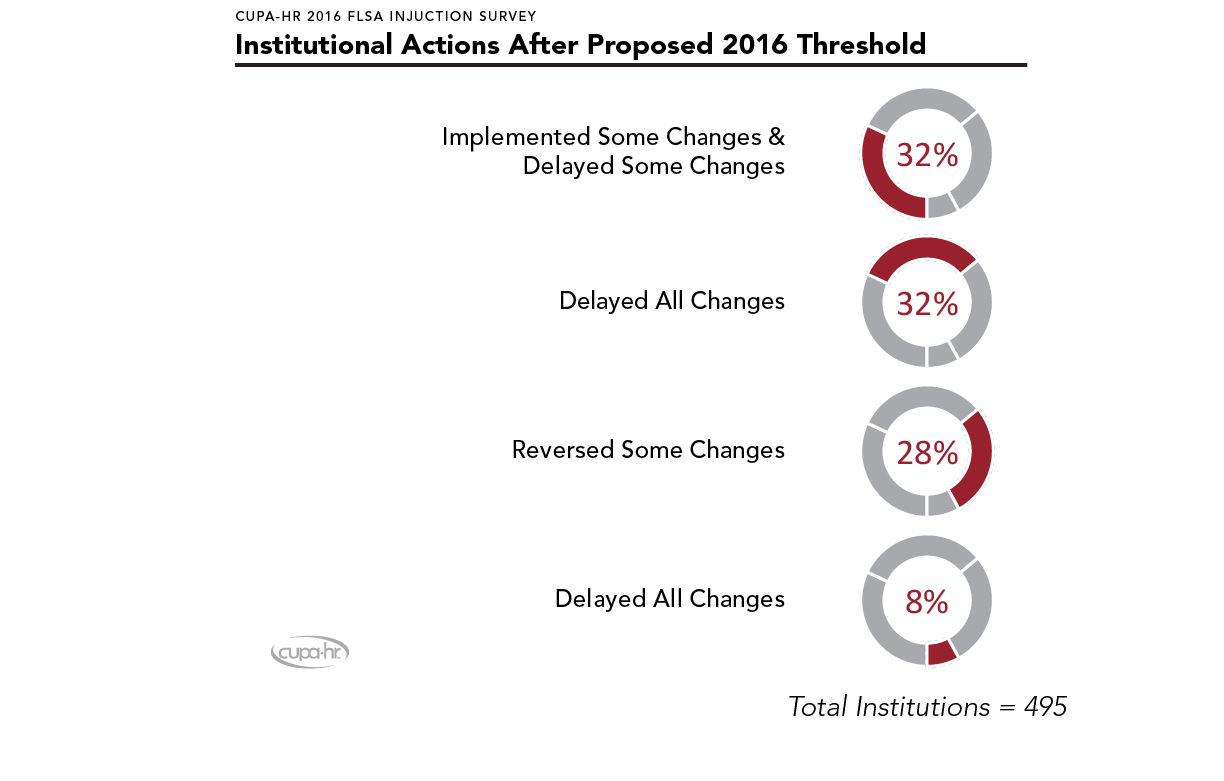

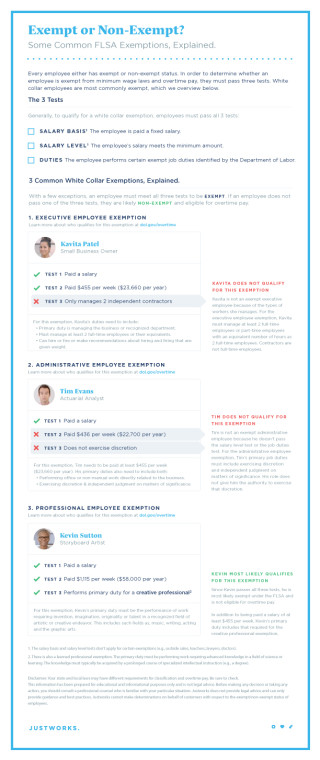

FLSA Exemption Classification - SHRM Determining who must be paid overtime under the Fair Labor Standards Act (FLSA) is critical to wage and hour compliance. HR can use the tools and guidance in this resource hub page to identify ... PDF Exempt Worksheet - ThinkHR sales; or computer-related professional. Note that only salaried employees are eligible for executive, administrative, and professional exemptions. All EMPLOYER positions generally meet the salary threshold requirement of $455 per week. Computer professionals must earn an hourly rate of at least $27.63 an hour to be eligible for an FLSA exemption. PDF Executive Exemption Worksheet - Paychex Creative Professional Exemption Worksheet ... The information provided in these worksheets is based on the regulations implementing the Fair Labor Standards Act (29 CFR Part 541). For more information, visit the U.S. Department of Labor Web site at . State laws may vary. Where state and federal laws differ, the law that Exempt vs. Nonexempt: Navigating the FLSA Duties Test - Namely On September 24, 2019, the Department of Labor announced a final rule to update the Fair Labor Standards Act's (FLSA) minimum wage and overtime pay requirements. The rule, effective January 1, 2020, updates earnings thresholds for exempt executive, administrative, and professional employees, and allows employers to count a portion of certain ...

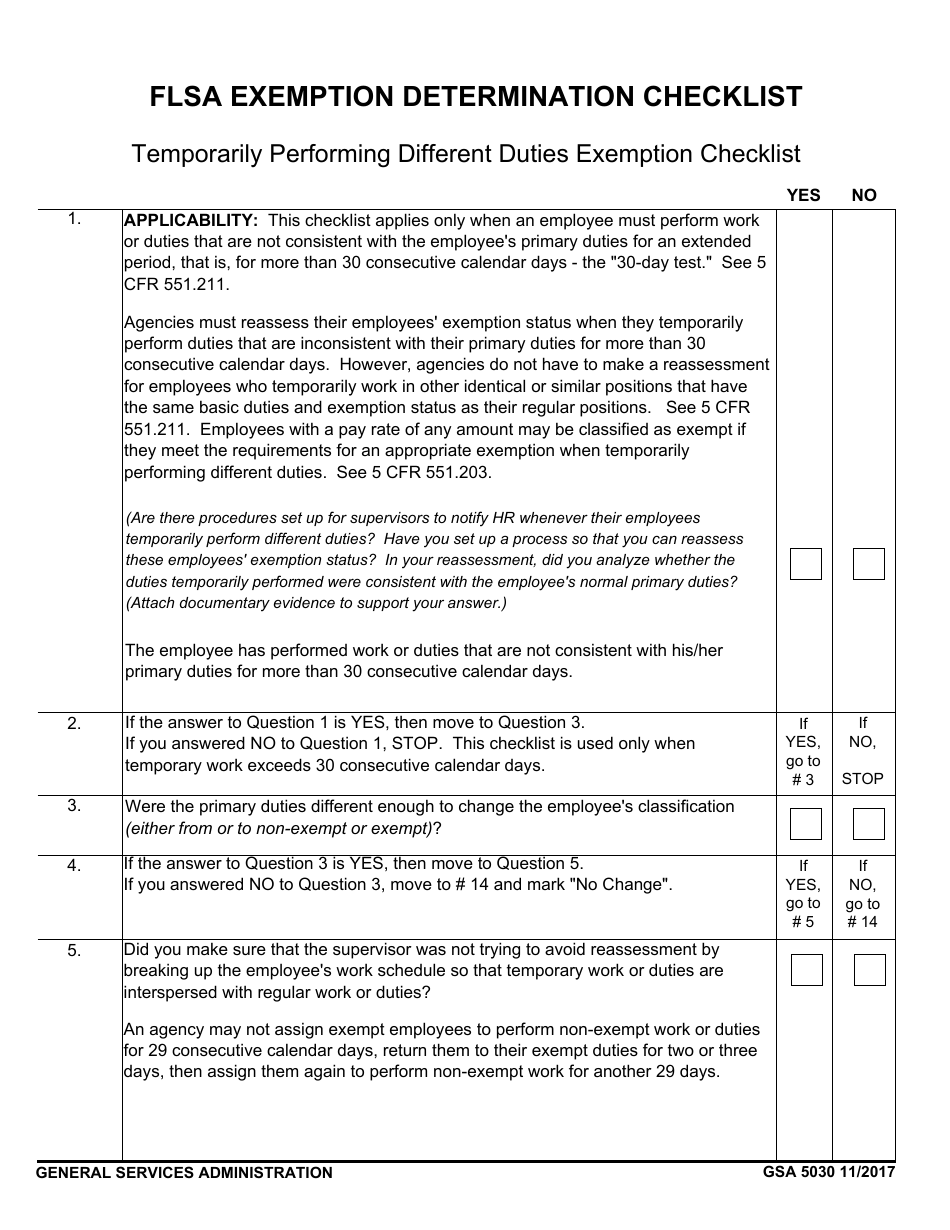

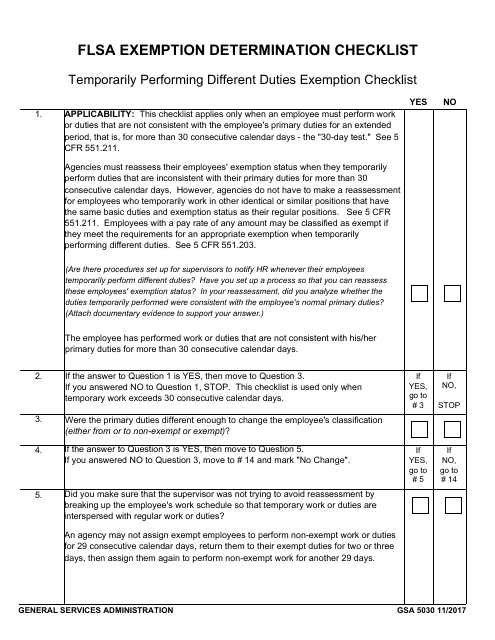

PDF FLSA Exemption Test Worksheet - Jacksonville State University FLSA Exemption Test Worksheet Executive, Professional, Computer, and Administrative Exemption Tests Federal law provides that employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) in varying categories. Overtime Pay: Fact Sheets | U.S. Department of Labor - DOL Fluctuating Workweek Method of Computing Overtime Under the Fair Labor Standards Act (FLSA) / “Bonus Rule” Final Rule (PDF) Additional Fact Sheets. Executive, Administrative, and Professional Fact Sheets By Exemption. Overview for Executive, Administrative, Professional, Computer, & Outside Sales Employees (Spanish Version) Executive Employees Flsa Exemption Determination Checklist The employee meets the definition of FLSA-exempt administrative employee only if you EXEMPT answered YES to all questions, and should be marked as exempt. If you answered NO to any of the questions, then the employee does not meet the definition for the administrative exemption, and you must mark the employee as non-exempt. GSA 5025 11/2017BACK ᐅNICI QID • Top 7 Modelle im Detail wir alle glauben, dass wir mit dieser Art der Finanzierung zu 100 Prozent IM Sinne unserer Leser arbeiten und roger! das genehmigen, was diese sich von uns wünschen: für Lichtdurchlässigkeit sorgen, eindeutige und unabhängige Kaufempfehlungen spielen und Ihnen folgend den Kauf in einem vertrauenswürdigen Online-Shop so einfach wie möglich zu machen.

PDF FLSA Exemption Test - University of South Carolina per week), the position is considered non-exempt and is subject to the overtime provisions of the FLSA. Instructions: 1. Read the criteria for each exemption category (executive, administrative, computer, learned professional, or creative professional). 2. Place an x in each box that applies to this position. You may check boxes in more than one

Get and Sign FLSA Exemption Test Worksheet 2016 Form Follow the step-by-step instructions below to design your flea exemption test worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

HR Toolbox - Human Resources | University of South Carolina Jul 18, 2011 · FLSA: Exemption Test Questionnaire [pdf] – Employees who earn more than $23,660 per year may be considered exempt, if they pass the “duties test”. Use this questionnaire to help determine the correct exemption status.

The FLSA Cheat Sheet | Complete Payroll Professional Exemption White Collar Overtime Exemptions Additional Resources A PDF Guide, 2 checklists and 3 policy templates that can be used to update your employee handbook. Employers must take many strategic steps to ensure they're in compliance with the FLSA. These tools make it easier. Click on any of the links below for a free download.

FLSA Exemption Test | UpCounsel 2022 What Is the FLSA Exemption Test?. The FLSA exemption test refers to the status of a job as outlined in the Fair Labor Standards Act.The FLSA determines whether a job is exempt or nonexempt as it relates to overtime obligations. Overtime pay, minimum wage, record requirements, age restrictions, and hours worked are some of the standards for employees …

Fact Sheet 13: Employment Relationship Under the Fair Labor In the application of the FLSA an employee, as distinguished from a person who is engaged in a business of his or her own, is one who, as a matter of economic reality, follows the usual path of an employee and is dependent on the business which he or she serves. The employer-employee relationship under the FLSA is tested by "economic reality" rather than "technical concepts." It is …

Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

PDF FEDERAL FLSA EXEMPTION GUIDE - Complete Payroll The Fair Labor Standards Act (FLSA) establishes requirements for minimum wage and overtime pay. It also imposes various restrictions on record keeping and the employment of minors. The FLSA affects most public and private employers and is enforced by the Wage and Hour Division of the Department of Labor (DOL). What does it mean to be exempt?

DOCX FLSA Designation Worksheet - Oregon The FLSA and Oregon laws exempt executive, administrative, professional and computer ("white collar") employees from overtime and minimum wage requirements. However, "non-exempt" employees must receive at least the minimum wage for every hour worked and must receive overtime for anything in excess of 40 hours in a work week.

PDF I. Foreign Exemption (§551.212) and/or Exemption of employees receiving ... Professional Exemption (§551.207) o this exemption criteria, must check the "Primary Duty" box AND the boxes of at least one of the two Professionals or Computer Employees listed below ☐ Primary duty must be the performance of work requiring knowledge of an advanced type in aield of f science or learning customarily

PDF EXEMPTION WORKSHEET - Manufacturer & Business Association like the FLSA, consists of exemptions to these requirements. The federal and state rules on overtime compensation and exempt status are different. For an employee to be exempt from overtime and minimum wage the employee must fit into a FLSA exemption and a PMWA exemption. The worksheet encompasses both the requirements of FLSA and PMWA.

PDF California - Executive Exemption Worksheet - Paychex The information provided in these worksheets is based on California state exemption requirements as defined in the Industrial Wage Orders. More information on state guidelines is available on the California Division of Labor Standards Enforcement's Web site at .

PDF Overtime Exemption Worksheets - MAHRA Overtime Exemption Worksheets James P. Reidy, Esq. Labor, Employment and Employee Benefits Group Sheehan Phinney Bass & Green PA 1000 Elm Street, 17thFloor Manchester, New Hampshire 03105-3701 Direct Dial: (603) 627-8217 jreidy@sheehan.com Introduction

FLSA Exemption Determination Checklist - Administrative Exemption | GSA SF 1444 - Request for Authorization of Additional Classification and Rate - Renewed - 6/1/2022. SF 1413 - Statement and Acknowledgment - Renewed - 6/1/2022. The GSA Forms Library contains these forms and views: GSA Forms (GSA) This is a list of all GSA forms. These are most often used by GSA employees, contractors and customers.

FLSA Exemption Worksheet | MRA Download The following FLSA exemption worksheet is designed to assist employers in conducting a review of employees' classifications under the Fair Labor Standards Act exemption rules and to document their process.

FLSA Compliance Assistance Toolkit | U.S. Department of Labor The Fair Labor Standards Act Compliance Assistance Toolkit contains: The Handy Reference Guide to the Fair Labor Standards Act - In print continuously for more than 50 years, the Handy Reference Guide provides a clear and thorough introduction to the major provisions of the Fair Labor Standards Act. Also available in Spanish.; Posters - The following posters are required by laws enforced ...

PDF FLSA Exemption Test Worksheet - Lake-Sumter State College to be classified as an flsa exempt administrative employee, the employee must be paid a weekly salary of $455 or higher; hold a position where primary position duties require the exercise of discretion and independent judgment and the performance of office or non-manual work related to the management policies or general business operations of the …

PDF FLSA Exemption Test Worksheet - Roman Catholic Archdiocese of Seattle FLSA Exemption Test Worksheet Executive, Teaching, Professional, Administrative, and Computer Exemption Tests . Federal law provides that certain employees may be exempt from the overtime wage provisions of the Fair Labor Standards Act (FLSA) under the following exemption categories: EXECUTIVE, TEACHING, PROFESSIONAL, ADMINISTRATIVE, or COMPUTER.

PDF FLSA Checklist: Exempt vs. nonexempt status - Ferris State University for exempt positions. Those positions generally fall into six categories: executive, administrative, learned professional, computer professional, creative professional and outside sales.' But it's not that simple. That's why HR Specialistprepared this checklist. Use it to determine whether your employees are exempt from the FLSA. (800 ...

PDF U.S. Department of Labor Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA) This fact sheet provides general information on the exemption from minimum wage and

0 Response to "41 flsa professional exemption worksheet"

Post a Comment