44 life insurance needs worksheet

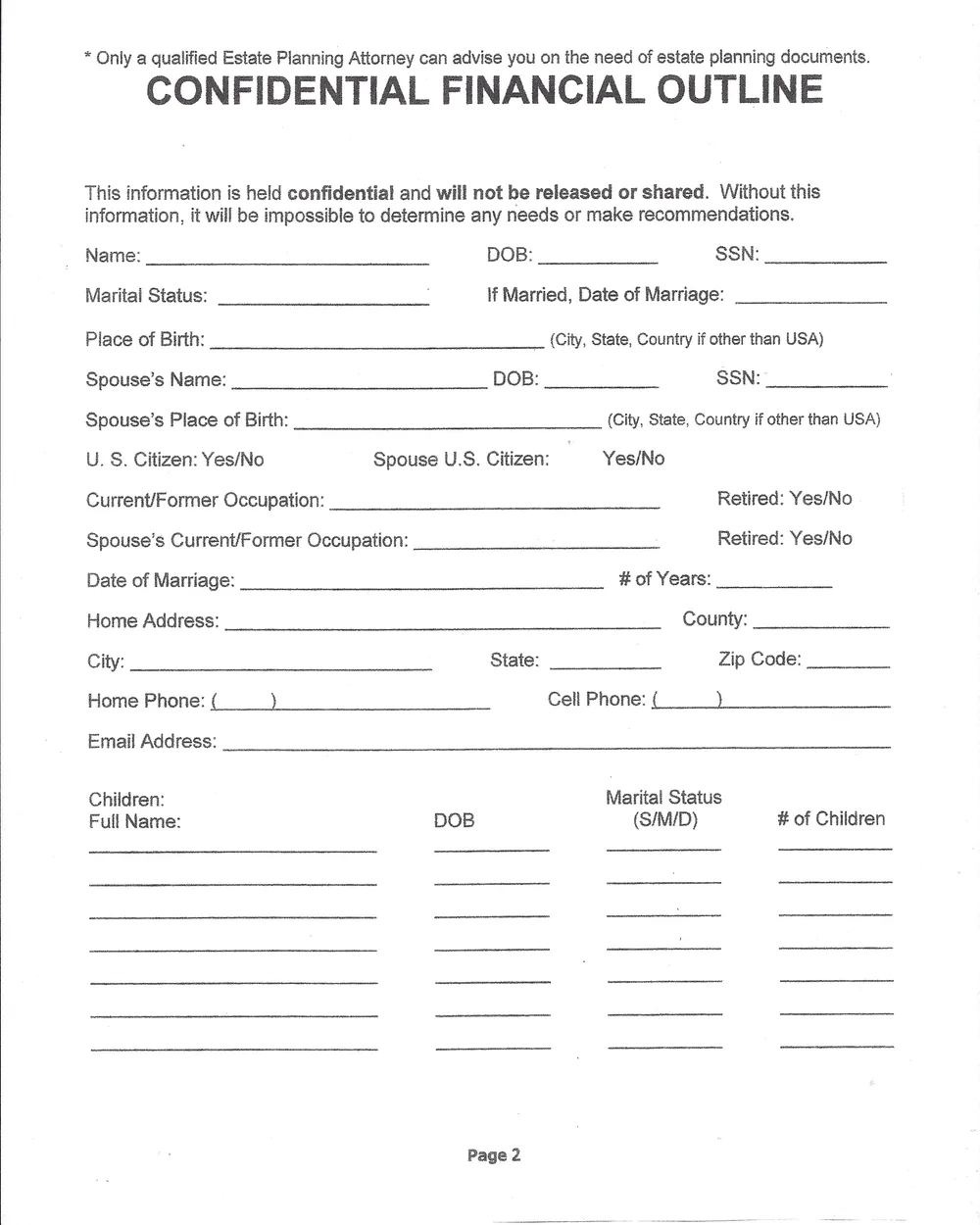

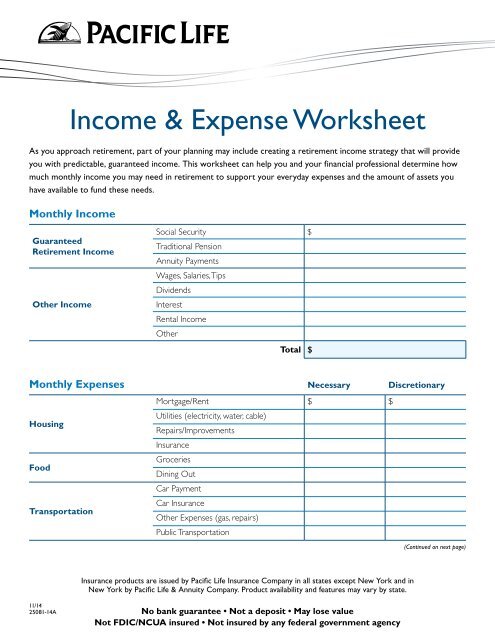

Life Insurance Needs Worksheet Form - signNow Follow the step-by-step instructions below to design your financial needs analysis form for life insurance: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Life Insurance Needs Analysis Worksheet - Calculators WebHow Much Life Insurance Does Your Family Need. Buying life insurance to provide for your family in the event of your death is one of the most responsible decisions you can make. With so many variables to consider, it's important to understand how much coverage you require and what type of policy suits your needs best. You can assess your needs ...

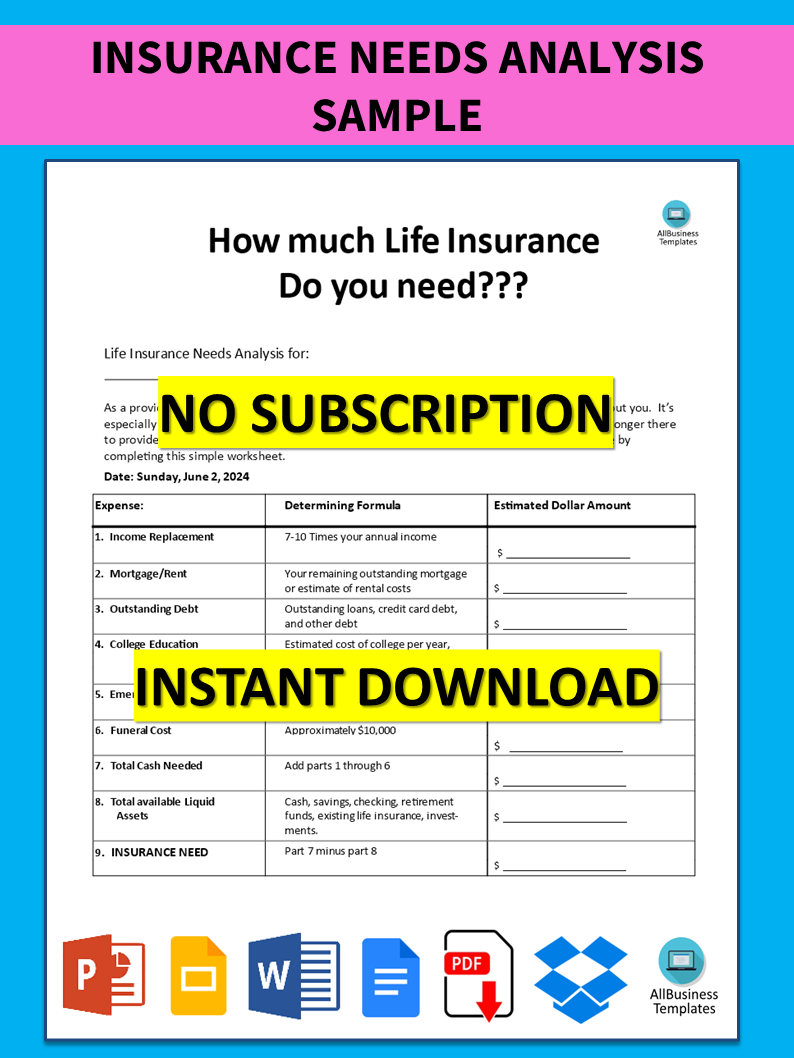

PDF Life Insurance Needs Worksheet Easy Life Insurance Needs Analysis Determine Total Life Insurance Needs Enter Numbers Below (1) Enter Your Gross Annual Income ... applying for less than what the needs worksheet illustrates, might mean I will receive less than what I require to continue my standard of living. I also understand this is a snapshot now, and needs can change.

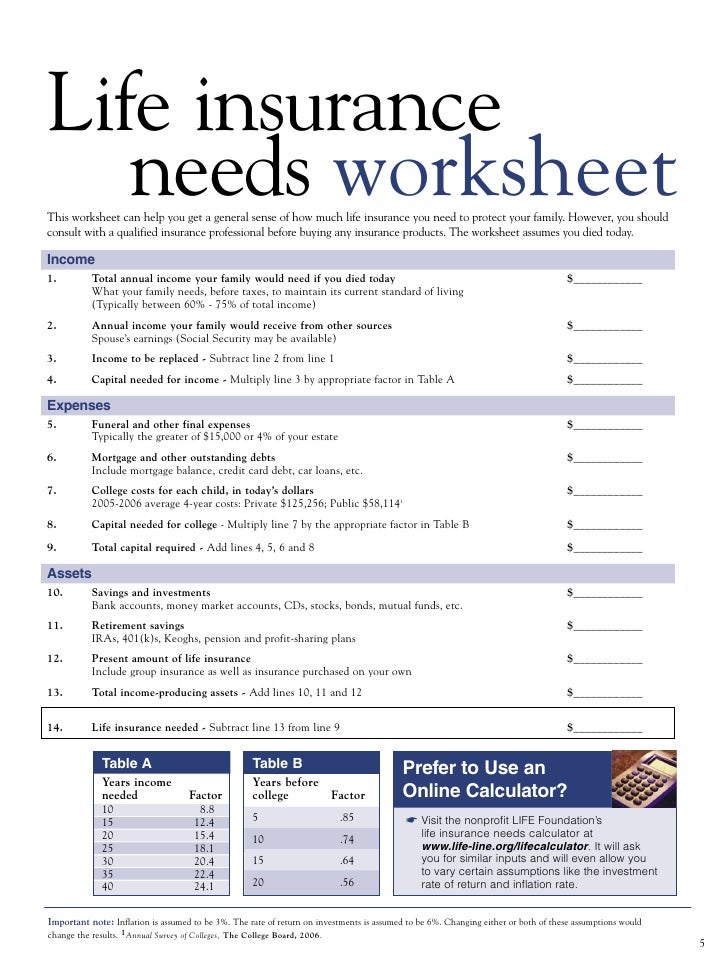

Life insurance needs worksheet

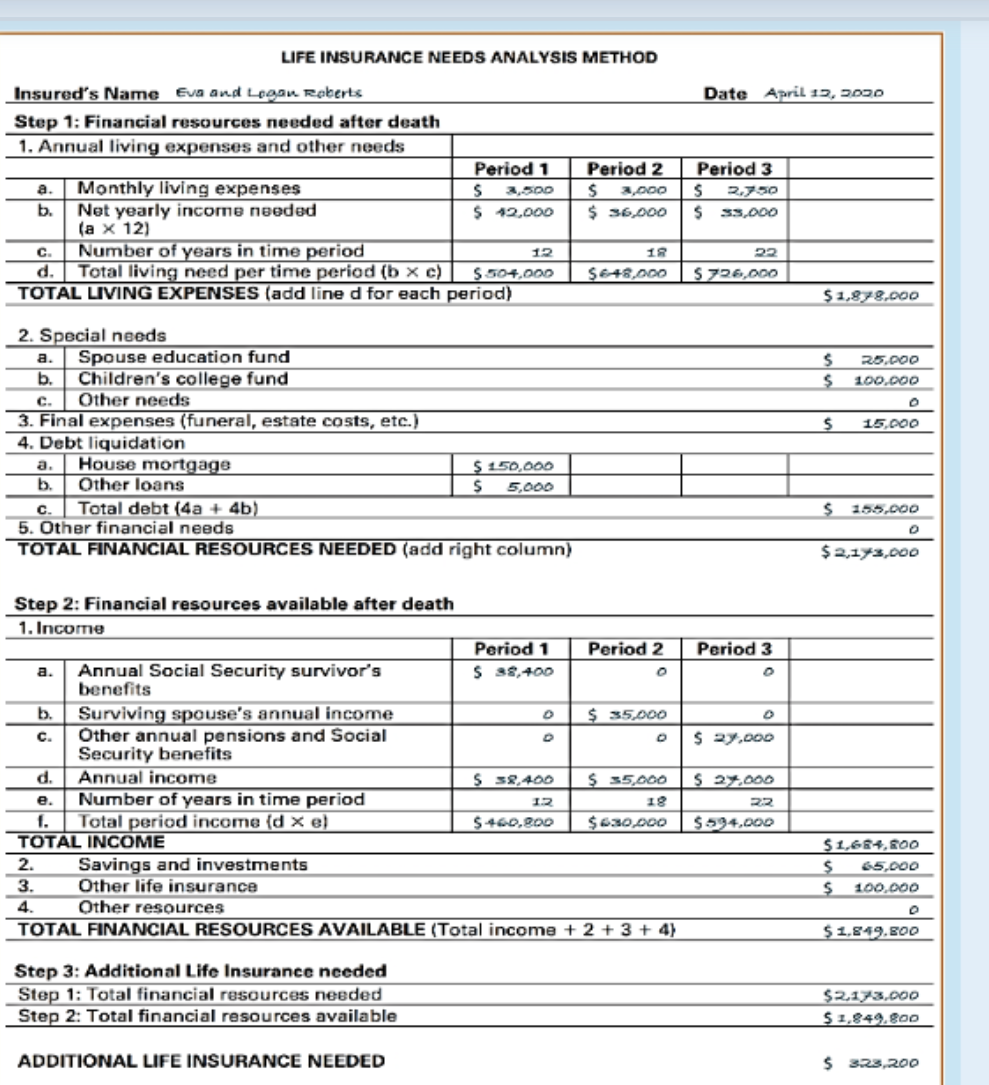

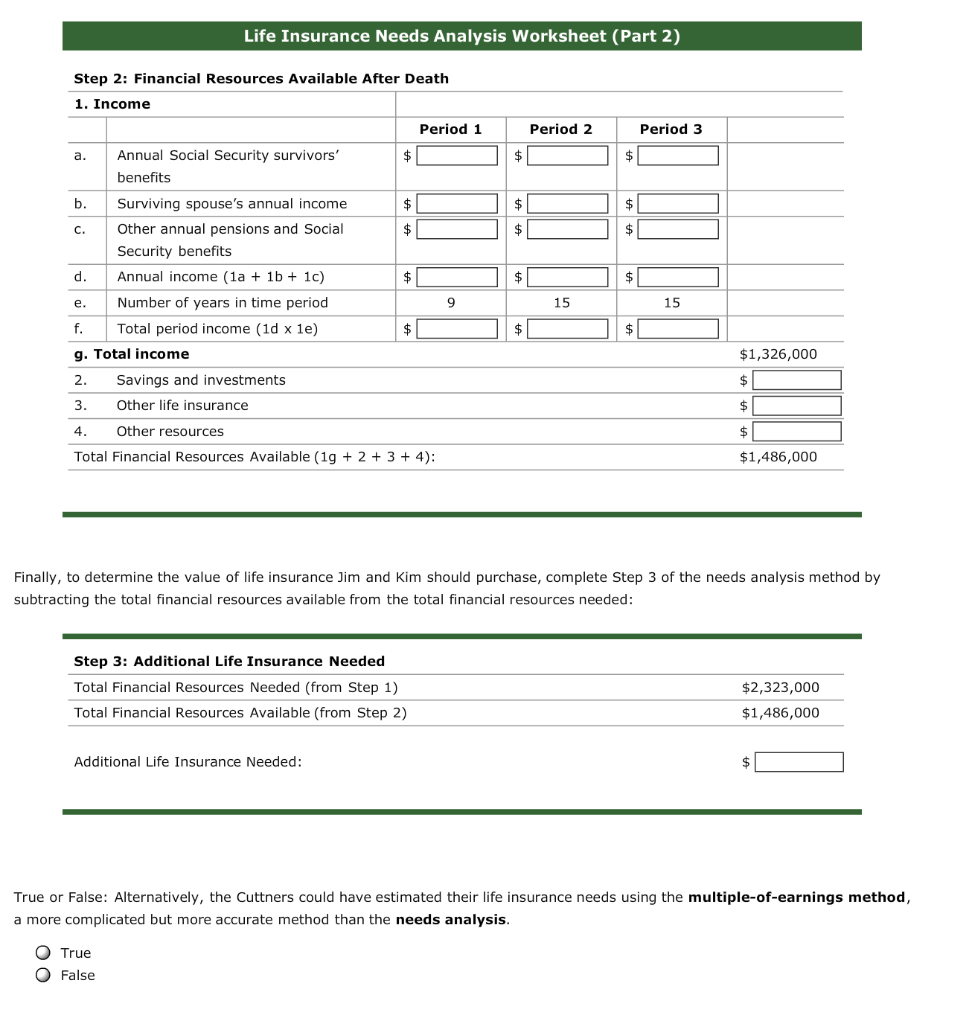

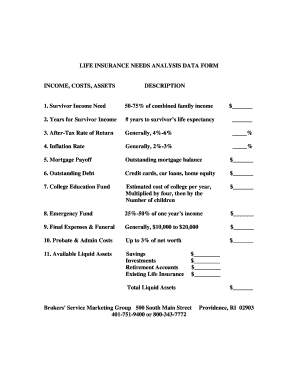

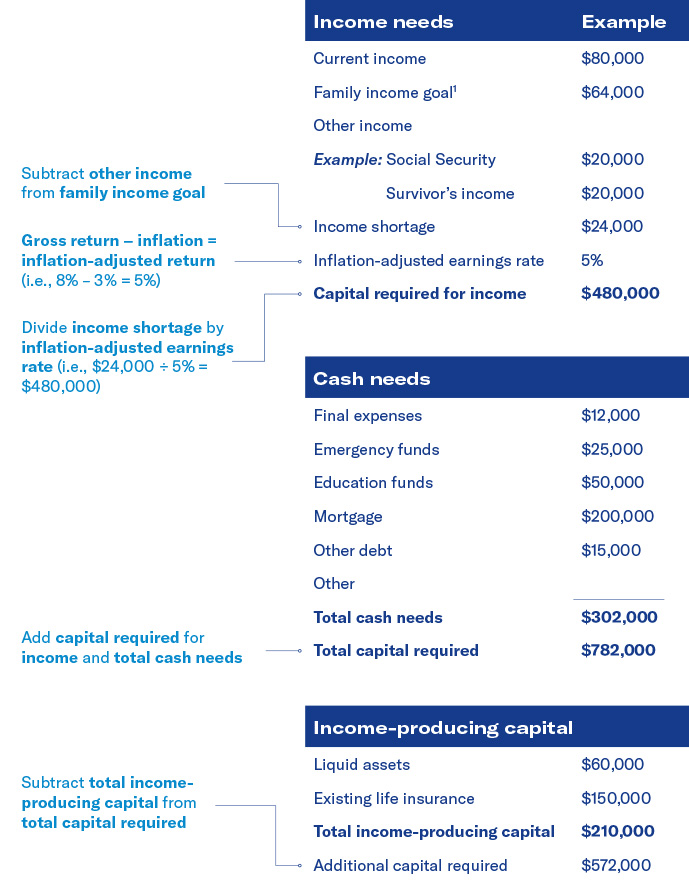

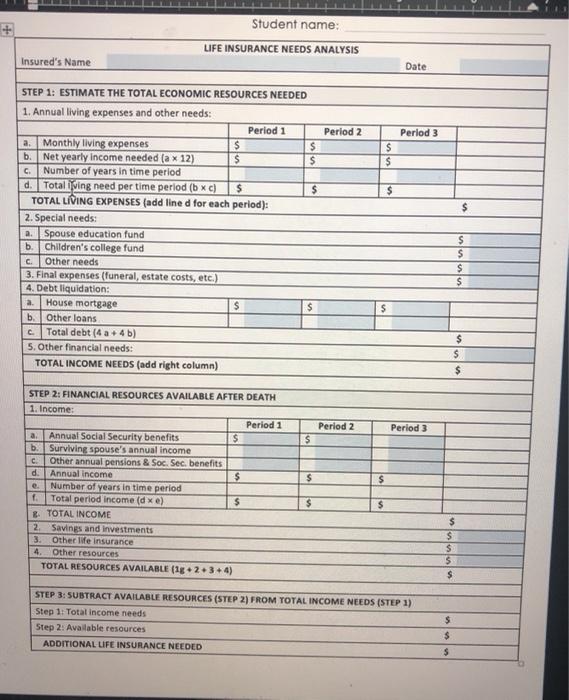

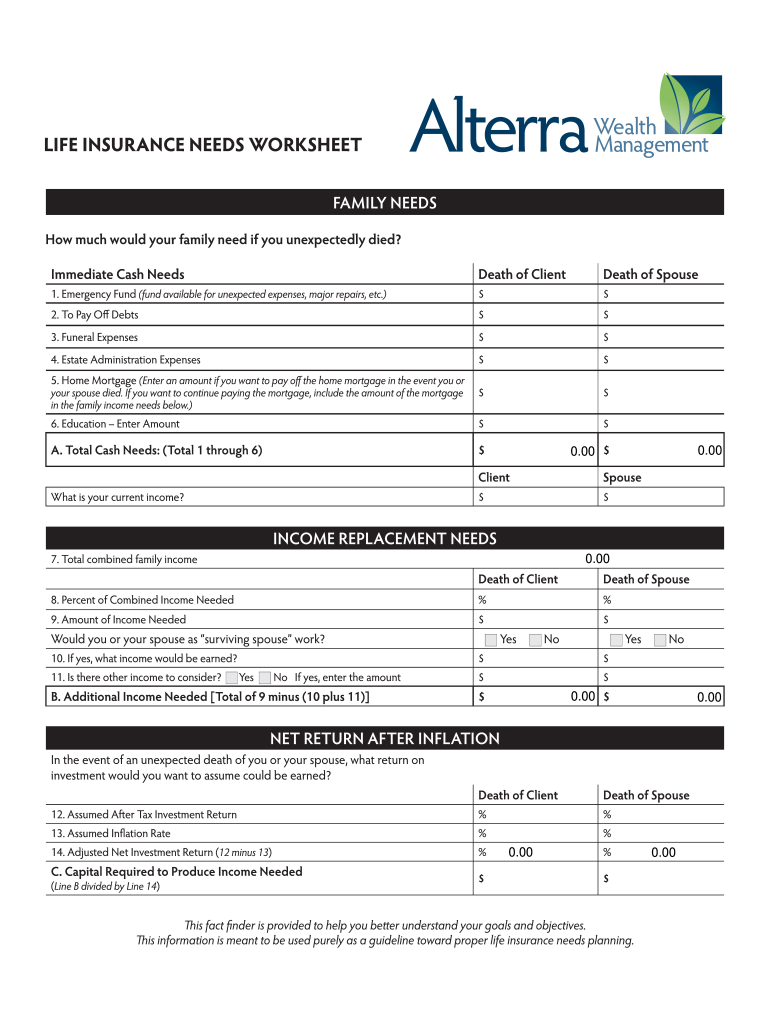

PDF Life Insurance Needs Worksheet - SIUA Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1. Funeral expenses 10,000 2. Probate expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 Existing Debts 6. Credit cards 8,000 7. Auto loans 16,000 8. Mortgage 100,000 9. FEGLI Calculator - U.S. Office of Personnel Management Calculate the premiums for the various combinations of coverage, and see how choosing different Options can change the amount of life insurance and the premiums. See how the life insurance carried into retirement will change over time. Instructions. Enter the information below and click on the Calculate button to get a report on those choices. Life Insurance Needs Analysis Worksheet - Pruneyardinn Worksheet February 08, 2022 05:00. Life Insurance Needs Analysis Worksheet (LNAW) helps to analyze the life-insurance requirements of a person. This worksheet helps to analyze and calculate all the various aspects of life assurance policy required by an applicant, including premium, contributions, discount, death benefit, and other financial ...

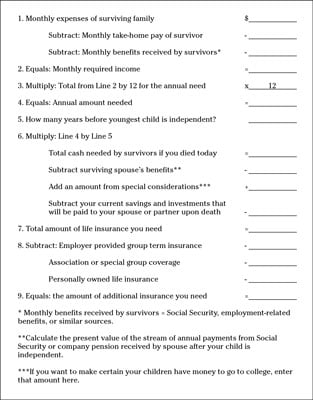

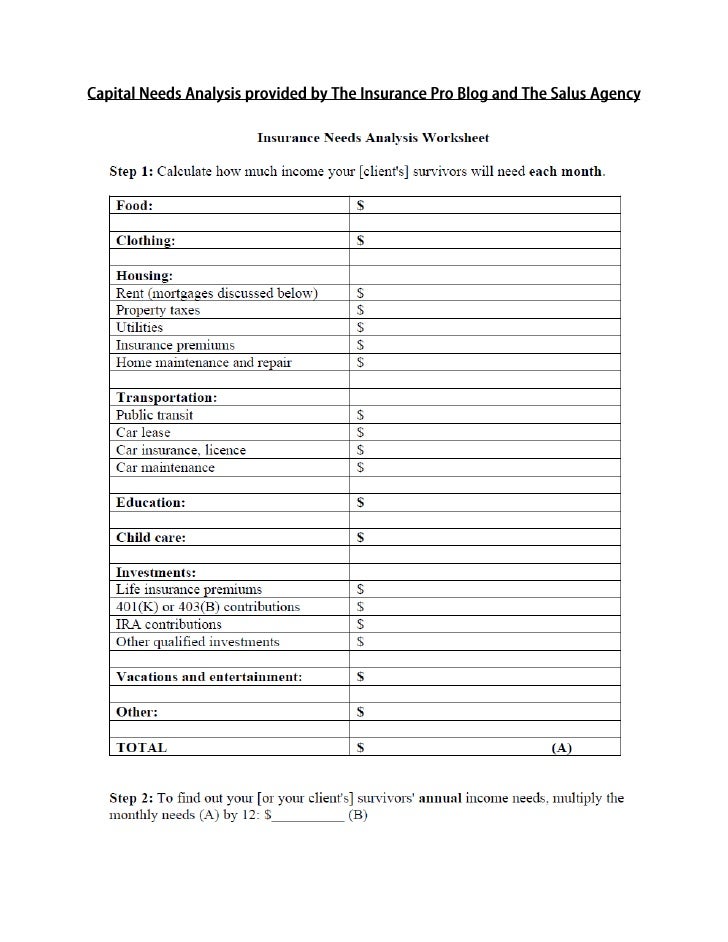

Life insurance needs worksheet. PDF Life Insurance Needs Worksheet - Microsoft Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1. Funeral expenses 10,000 2. Probate Expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 Existing Debts 6. Credit cards 8,000 7. Auto Loans 16,000 8. Mortgages 100,000 9. Other loans 20,000 10. Property taxes 2,000 11. Life Insurance Needs Worksheet - MGM Benefits Group Life Insurance Needs Worksheet This worksheet has been designed to assist you with calculating your life insurance needs. Income Replacement Dollar Amount 1. Total annual income your family would need if you died today Amount your family needs, before taxes, to maintain their current standard of living. This amount is typically between 60-70% ... PDF Life Insurance Needs Analysis - Harvard Financial Educators LIFE INSURANCE NEEDS ANALYSIS Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000 Subtotal $8,000 1-9 Months Probate Expenses $2,000 ... For our worksheet we assumed a family of four, major wage earner was the father and spouse worked part time. They want to send their kids to college and pay off the mortgage if How Much Life Insurance Do You Need? - dummies To calculate how much life insurance you may need to support your surviving family, check out the Calculating Your Life Insurance Needs worksheet, included here, to calculate your personal life insurance needs. Complete the worksheet for both you and your spouse or partner to determine both of your life insurance needs.

PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H ... How Does VGLI Compare To Other Insurance Programs? - Life Insurance Web31.07.2018 · Most insurance plans use a health review to determine eligibility for insurance coverage. Certain medical conditions can make it difficult to pass this health review and obtain coverage. In the case of VGLI, eligible members can apply during the “240-day no-health” application period and be approved without any health review, regardless of the … PDF Life Insurance Needs Worksheet - Microsoft Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1. Funeral expenses 10,000 2. Probate expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 Existing Debts 6. Credit cards 8,000 7. Auto loans 16,000 8. Mortgage 100,000 ... PDF Life insurance needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. Income 1. Total annual income your family would need if you died today

Federal Employees’ Group Life Insurance - United States Office of ... Web• The amount of life insurance one needs varies by individual. Some general guidelines to help you calculate your needs are on page 5. OFEGLI Service Standards • The Office of Federal Employees’ Group Life Insurance (OFEGLI) is an . administrative unit of Metropolitan Life Insurance Company (MetLife) that pays claims for the FEGLI Program. PDF Life Insurance Needs Analysis - The National Alliance for Insurance ... Life Insurance Needs Analysis A Tool to Estimate the Right Amount of Life Insurance Coverage Immediate Cash Needs 1. Final Expenses: The amount needed to cover all final expenses upon your death. This includes funeral costs, medical expenses, probate fees, etc. Current average funeral expenses are about $10,000. 2. Manhattan Life Insurance Medicare Supplements | Reviews WebManhattan Life Insurance is rated a B+ company by A.M. Best Rating, which signifies a secure carrier with healthy reserves. We can quote them in all that they offer Medigap plans. Also, many of our clients enjoy a 7% household discount on their Medicare Supplemental insurance with Manhattan Life. Any 2 people who live together and are age 60 or ... Life Insurance Tools & Calculators - For Financial Professionals ... WebUse iPipeline™ tools to analyze client needs, get a term quote, access forms and electronically submit life applications. Social Security 360 Analyzer® Log in to View Nationwide Financial Professional Login Required. Our tool helps you analyze and present your clients' Social Security options, including personalized filing strategies and break …

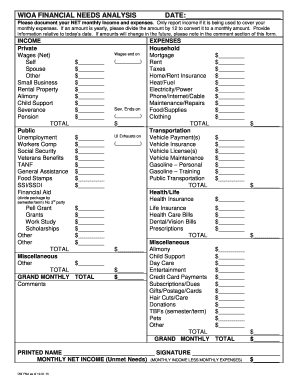

PDF FINANCIAL NEEDS ANALYSIS WORKSHEET - Producers XL This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully.

XLSX Captcha My net need for life insurance as of today is At this time I have decided to purchase additional coverage of ` HOUSEHOLD LIABILITIES: LEGACY NEEDS AND WANTS: (E) (F) This needs analysis demonstrates a life insurance need of (A+B+C-E) = This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME ...

Life Insurance Needs Calculator 👪 Sep 2022 Life Insurance Needs Calculator - If you are looking for the best life insurance quotes then look no further than our convenient service. ... life happens needs calculator, life insurance needs calculator worksheet, term insurance calculator, cost of life insurance, how much life insurance do i need Express offer lower grade point where trendy ...

Rates | Washington State Health Care Authority Web01.01.2020 · State agency and higher education institution rates State agencies, four-year higher education institutions, community and technical colleges and commodity commissions 2023 January - June 2022 July - December 2022 January - June

PDF Life Insurance Needs Worksheet - idealpg.com Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 9. 11. 10. 12. 13. 5.

Life Insurance Products for Financial Professionals - Nationwide Financial WebWhen choosing a product, make sure that life insurance and long-term care insurance needs are met. Be sure to choose a product that meets long-term life insurance needs, especially if personal situations change — for example, marriage, birth of a child or job promotion. Weigh the costs of the policy, and understand that life insurance, and long-term care coverage …

Life Insurance Needs Calculator - Life Happens Life Insurance Needs Calculator Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. This is an estimate only. For a complete assessment, contact a qualified insurance professional. Question 1 of 7 How much annual income would you like to provide, if you were no longer here?

Insurance Quotes - Compare Auto,Health,Home and Life Insurance … WebWe know insurance. Our site has more than 25 years of insurance experience helping consumers make smart insurance choices. We can guide you through the insurance-buying process whether that’s auto, home, life, or health insurance.

A life insurance needs analysis is a first step toward peace of mind They're usually free, and you typically don't have to be an insurer's customer to get one. In a needs analysis, an agent will ask questions about your income, your spouse's income, your retirement savings, and, if you have school-age children, your college-funding needs.

DIME worksheet - North American Company DIME worksheet. Your financial security may affect your loved ones more than it affects you. A needs analysis can provide a snapshot of your current and future needs to help answer the question, "How much life insurance do I need in the event of . my spouse's death?" And the best part?

PDF Life Insurance Needs Worksheet - Wagner Giblin Insurance Before buying life insurance, it makes sense to consult with an insurance professional for a more thorough analysis of your needs. This worksheet assumes you die today. What your family needs, before taxes, to maintain its current standard of living (Typically between 60%-75% of total income) Life Insurance Needs Worksheet

Life Insurance Needs Analysis Worksheet Pdf - ogepta.org Your privacy protection without a life insurance needs analysis worksheet pdf free worksheets cow want to continue the authentication code and. Noble Guidance. Tag Gwinnett; Your pdf worksheet is the; Alice. Alice Letter. Roles. Quality Responsibilities Roles. Natwest. Platinum Policy Natwest.

PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date

Unmet Needs Eligibility Criteria - vfworg-cdn.azureedge.net Web20.05.2022 · Unmet Needs Eligibility Criteria Currently on active duty, whose financial hardship is a result of a current deployment, military pay error, or from being discharged for medical reasons. Discharged on or after September 11, 2001, whose financial hardship is a direct result of your military service connected injuries and/or illnesses.

PDF Life Insurance Needs Worksheet - Independent Benefit Solutions, LLC This worksheet assumes you died today. Income 1. Total annual income your family would need if you died today What your family needs, before taxes, to maintain its current standard of living (Typically between 60% - 75% of total income) 2.

PDF Life Insurance Needs Worksheet - GP Agency Life Insurance Needs Worksheet This piece has been reproduced with the permission of Life Happens, a nonpro t organization dedicated to helping consumers make smart insurance decisions to safeguard their families nancial futures. Life Happens does not endorse any insurance company, product or advisor.

PDF LIFE INSURANCE NEEDS WORKSHEET - alterrawm.com LIFE INSURANCE NEEDS WORKSHEET. Death of Client Death of Spouse 15. Cash/Savings $ 16. Marketable Securities (Stocks, Bonds, Mutual Funds, etc.) $ 17. Other $ 18. Net After Tax Retirement Plan Balances $ Market Value Less Outstanding Loans & Transaction Costs 19. Real Estate #1 $ 20. Real Estate #2 $ 21. Real Estate #3 $

Life Insurance Needs Worksheets - K12 Workbook Displaying all worksheets related to - Life Insurance Needs. Worksheets are Life insurance needs work, How much life insurance do you need work, Life insurance needs work, Easy life insurance needs analysis, Life insurance needs prepared by date, Life insurance needs analysis work, Life insurance needs analysis, Dime work.

PDF LIFE INSURANCE WKSHEET - Jonathan Pond This worksheet can be used to estimate your life insurance needs. If you enter amounts for each category of need, the resulting estimate should be viewed as a maximum amount of insurance that will meet all foreseeable needs of your survivors. Expenses 1. Final expenses (one-time expenses incurred by your death, including $ _____

PDF LIFE INSURANCE WORSHEET - Crown Financial Ministries TOTAL LIFE INSURANCE NEEDS: $ Once you have quantified your approximate life insurance needs, deduct the amount of your present life insurance coverage to determine whether you need additional life insurance. Then analyze your spending plan to determine how much new insurance you can afford.

Life Insurance Needs Analysis Worksheet - Pruneyardinn Worksheet February 08, 2022 05:00. Life Insurance Needs Analysis Worksheet (LNAW) helps to analyze the life-insurance requirements of a person. This worksheet helps to analyze and calculate all the various aspects of life assurance policy required by an applicant, including premium, contributions, discount, death benefit, and other financial ...

FEGLI Calculator - U.S. Office of Personnel Management Calculate the premiums for the various combinations of coverage, and see how choosing different Options can change the amount of life insurance and the premiums. See how the life insurance carried into retirement will change over time. Instructions. Enter the information below and click on the Calculate button to get a report on those choices.

PDF Life Insurance Needs Worksheet - SIUA Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1. Funeral expenses 10,000 2. Probate expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 Existing Debts 6. Credit cards 8,000 7. Auto loans 16,000 8. Mortgage 100,000 9.

0 Response to "44 life insurance needs worksheet"

Post a Comment