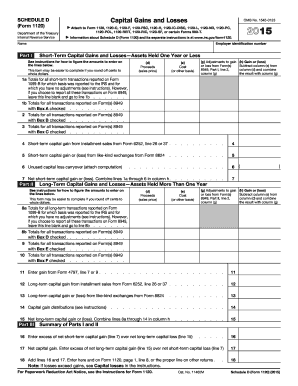

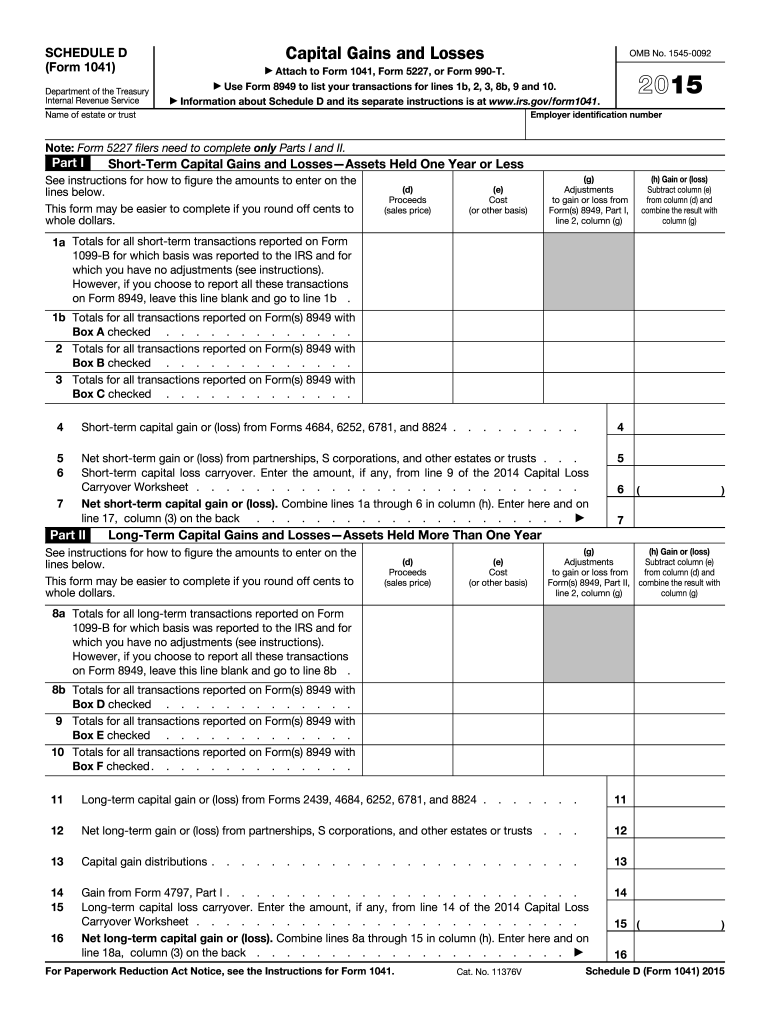

39 capital gain worksheet 2015

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › article › taxes2021-2022 Capital Gains Tax Rates & Calculator - NerdWallet The difference between your capital gains and your capital losses for the tax year is called a “net capital gain.” But if your losses exceed your gains, you have what's called a "net capital ...

› publications › p502Publication 502 (2021), Medical and Dental Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Capital gain worksheet 2015

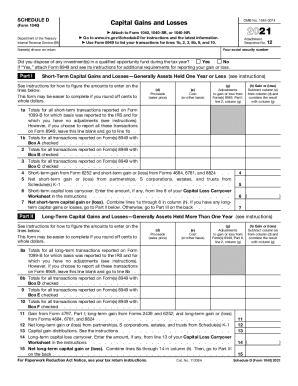

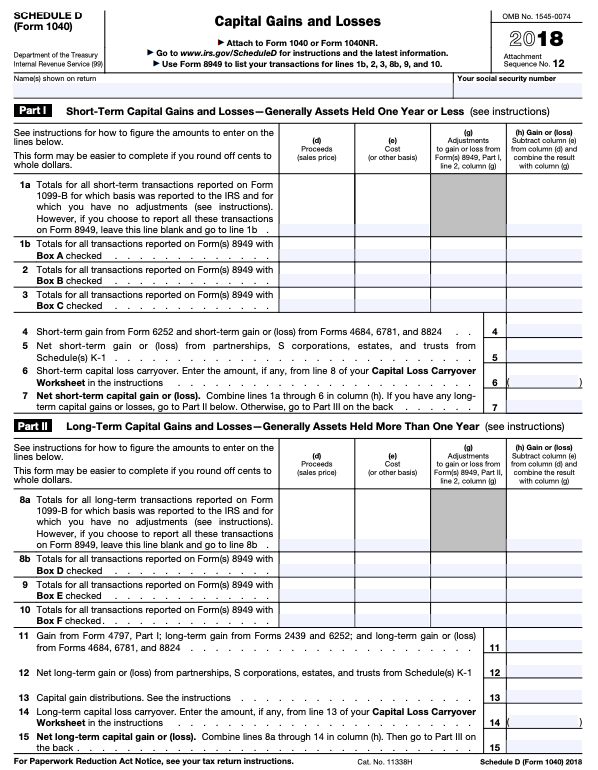

› instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... Object Identifier System This is the web site of the International DOI Foundation (IDF), a not-for-profit membership organization that is the governance and management body for the federation of Registration Agencies providing Digital Object Identifier (DOI) services and registration, and is the registration authority for the ISO standard (ISO 26324) for the DOI system. › publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... Certain short-term capital gain dividends. There may not be any 30% tax on certain short-term capital gain dividends from sources within the United States that you receive from a mutual fund or other RIC. The mutual fund will designate in writing which dividends are short-term capital gain dividends.

Capital gain worksheet 2015. › publications › p544Publication 544 (2021), Sales and Other Dispositions of Assets Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... Certain short-term capital gain dividends. There may not be any 30% tax on certain short-term capital gain dividends from sources within the United States that you receive from a mutual fund or other RIC. The mutual fund will designate in writing which dividends are short-term capital gain dividends. Object Identifier System This is the web site of the International DOI Foundation (IDF), a not-for-profit membership organization that is the governance and management body for the federation of Registration Agencies providing Digital Object Identifier (DOI) services and registration, and is the registration authority for the ISO standard (ISO 26324) for the DOI system. › instructions › i1040sd2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

0 Response to "39 capital gain worksheet 2015"

Post a Comment