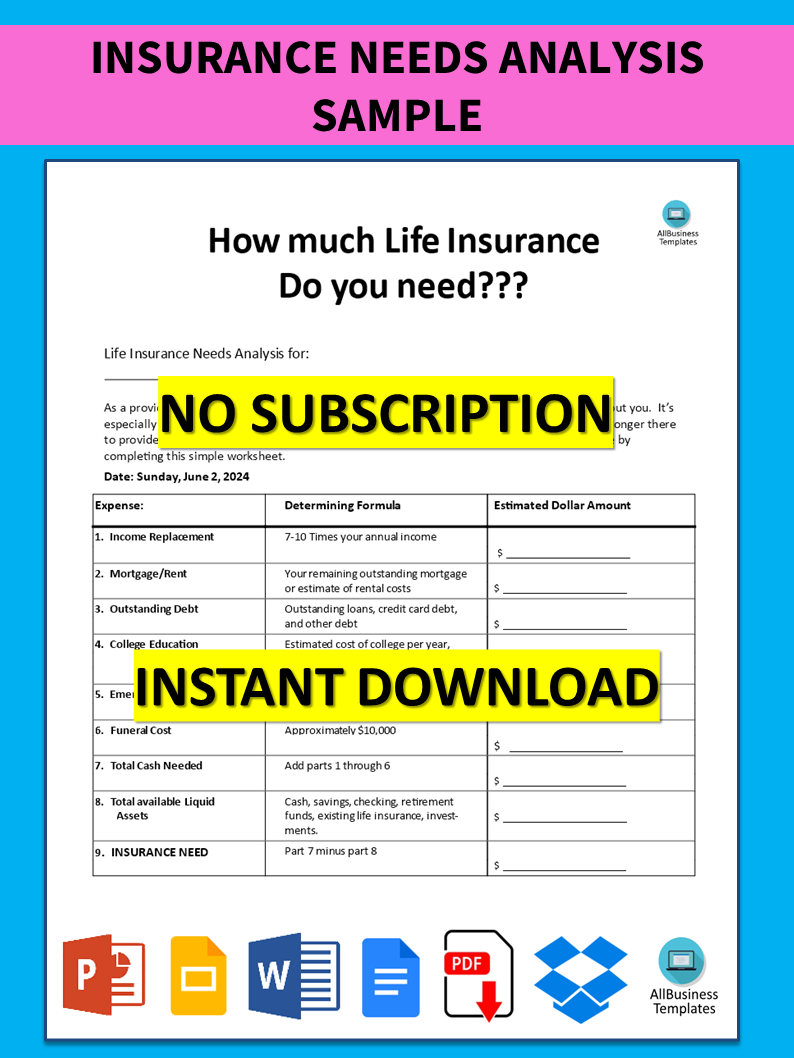

40 life insurance needs analysis worksheet pdf

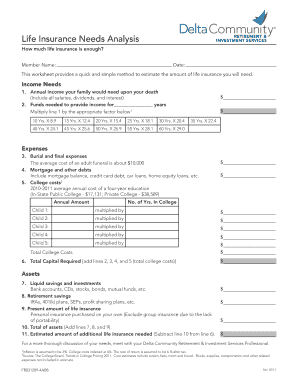

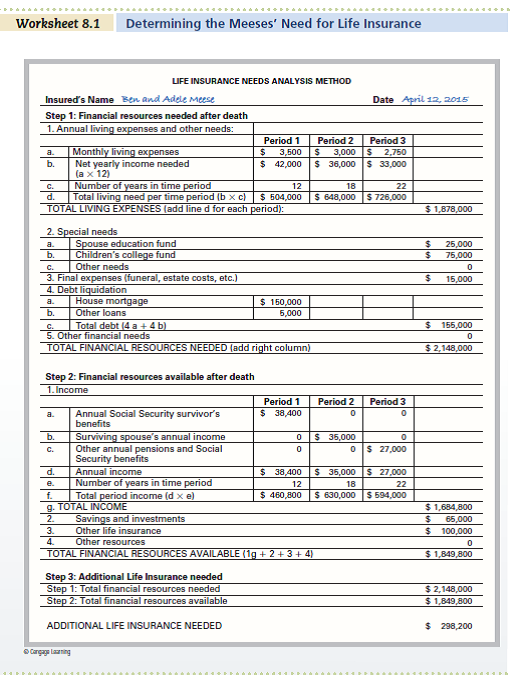

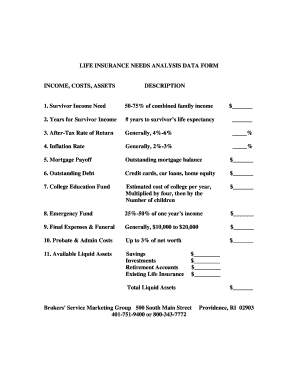

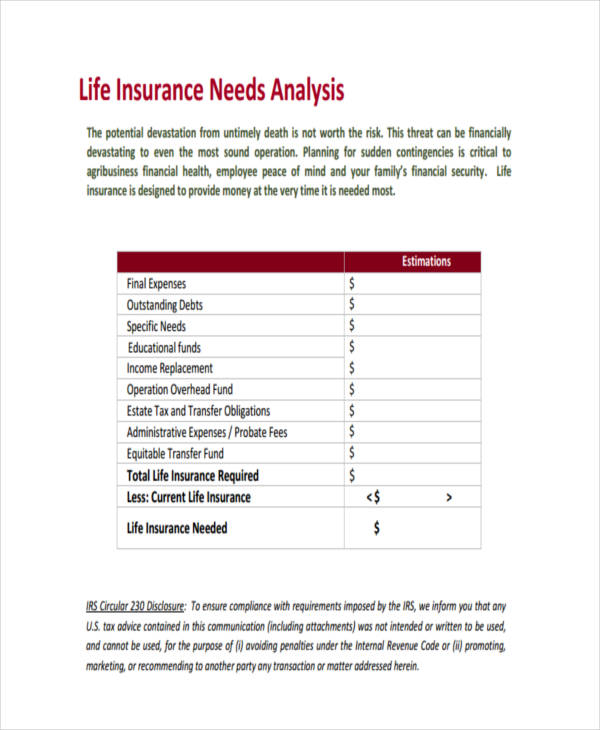

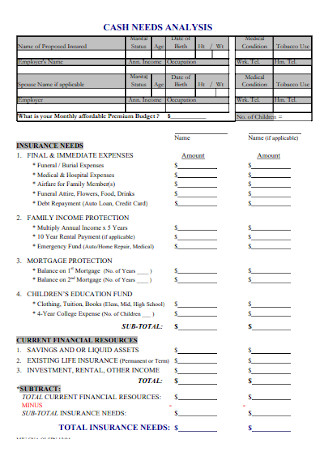

PDF Life Insurance Needs Worksheet - Independent Benefit Solutions, LLC 5. Funeral and other final expenses Typically the greater of $15,000 or 4% of your estate 6. Mortgage and other outstanding debts Include mortgage balance, credit card balance, car loans, etc. 7. Capital needed for college (2016-2017 average 4-year cost: Private $181,480; Public $80,3602) , 8. Total capital required Add items 4, 5, 6 and 7, Income, PDF Easy Life Insurance Needs Analysis Total Additional Life Insurance Needs $0 Applicant print name: Sign name: Date: As Surviving Spouse or Beneficiary, I understand that any changes to my estimated life insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than ...

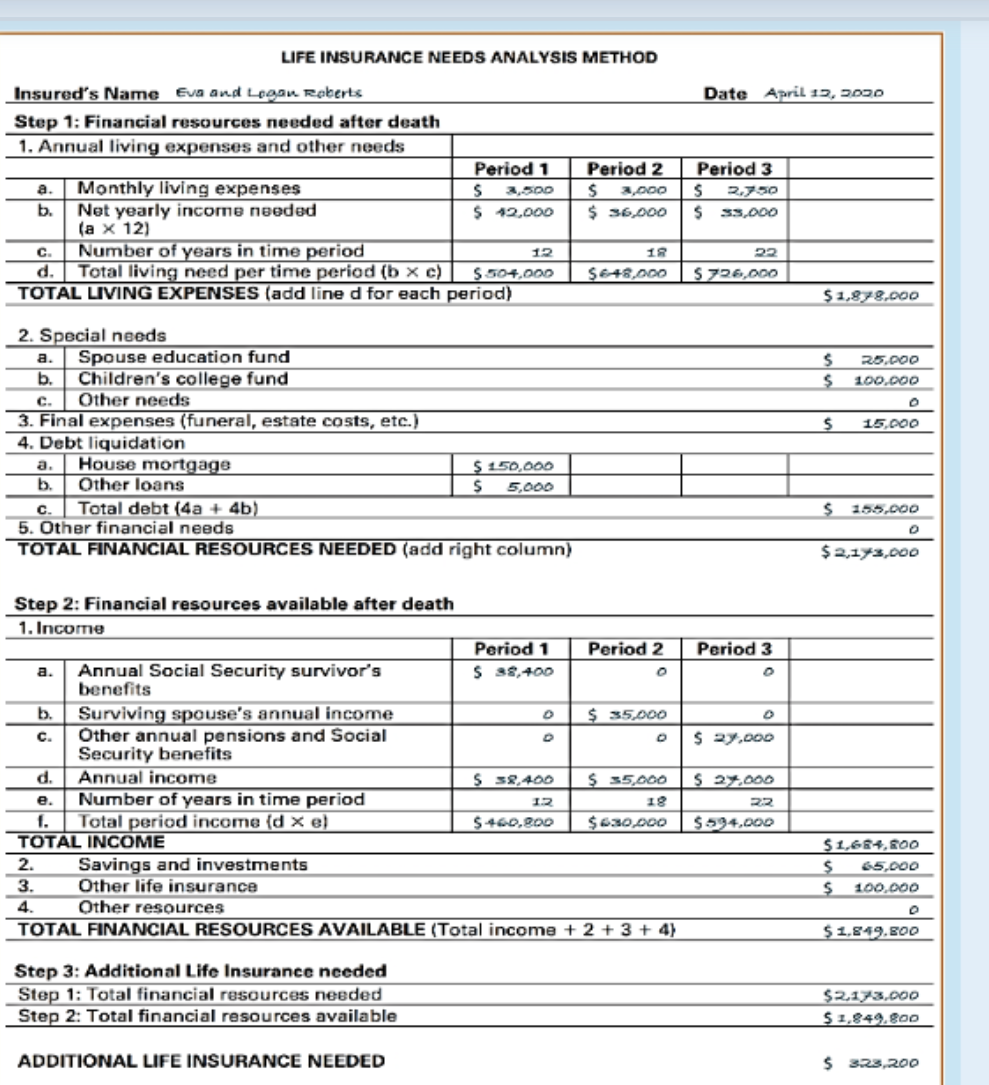

PDF Life Insurance Needs Worksheet - SIUA Life Insurance Needs Worksheet, Financial Requirements Example You , Final Expenses, 1. Funeral expenses 10,000 2. Probate expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 , Existing Debts, 6. Credit cards 8,000 7. Auto loans 16,000 8. Mortgage 100,000 9.

Life insurance needs analysis worksheet pdf

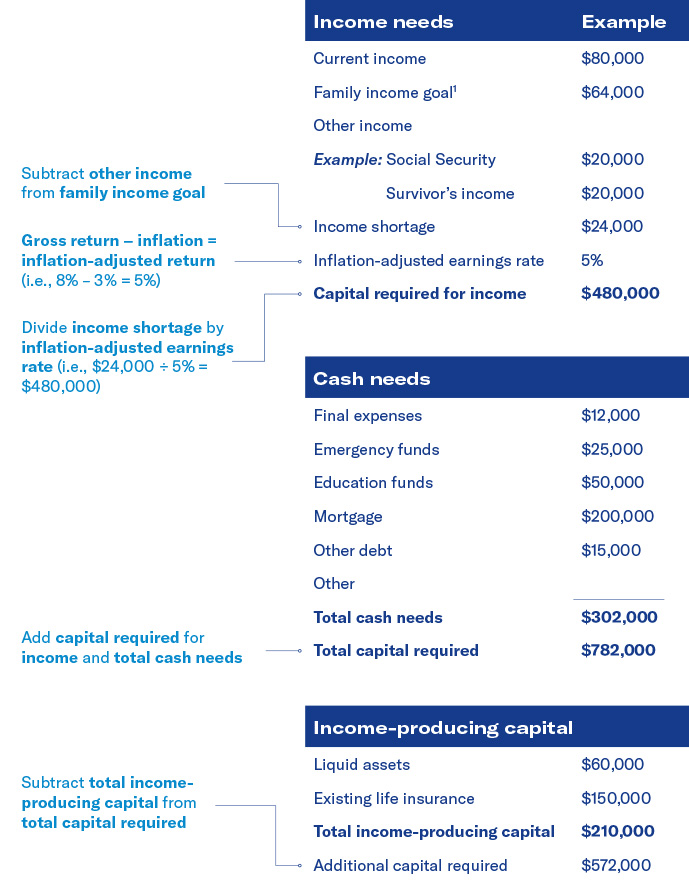

Life Insurance Needs Calculator - Life Happens Think about how much money your family will need to cover daily living expenses. This is typically 60-80% of your individual post-tax income. Don't include college savings, childcare or any debts that you would like to pay off immediately (such as your mortgage), since those are covered in other questions. PDF Life Insurance Needs Analysis - Harvard Financial Educators Subtotal $110,000 Lifetime Living Expenses Annual Living Expenses $60,000 (from cash flow worksheet) Less Mortgage Payments -$12,000 (if you pay it off) Less Spouse's Take-Home Pay -$20,000 Less Social Security Benefits -$6,000 , Subtotal $22,000 Multiplied By Number of Years Needed x 18 x , PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet, Life Insurance Needs Worksheet, This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase.

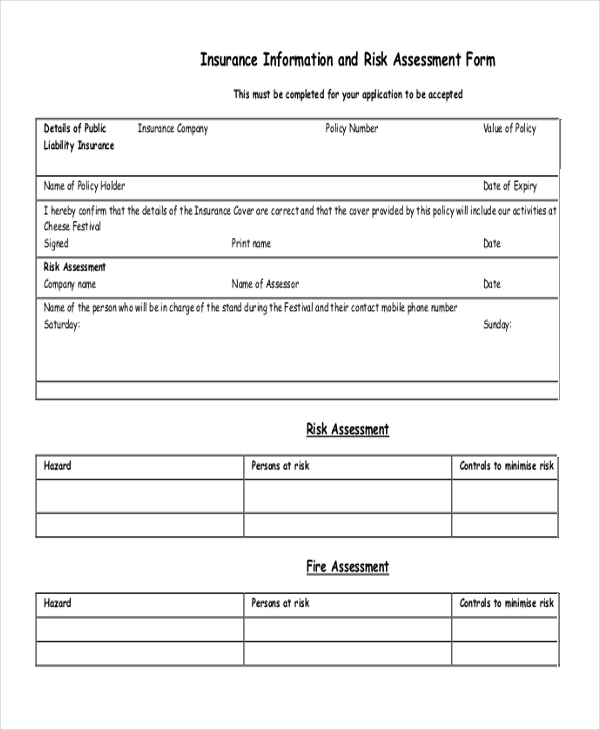

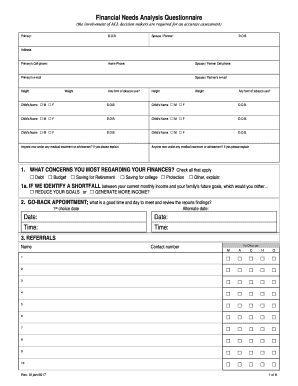

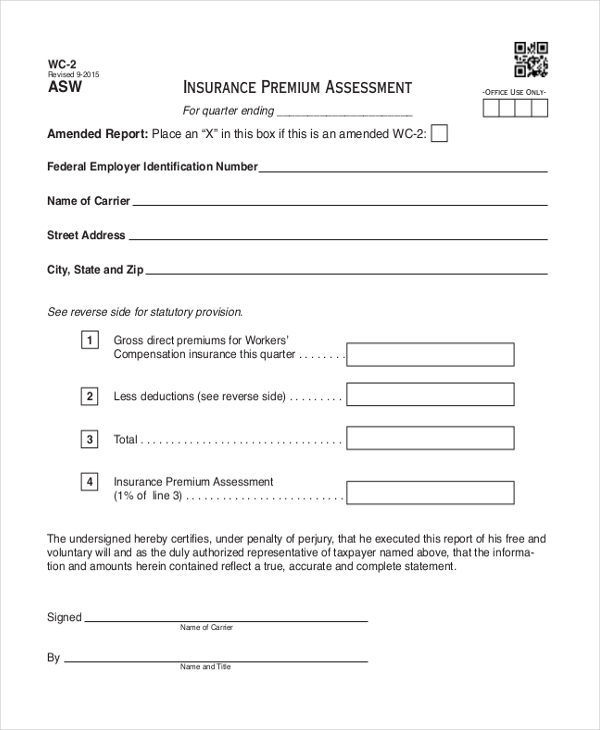

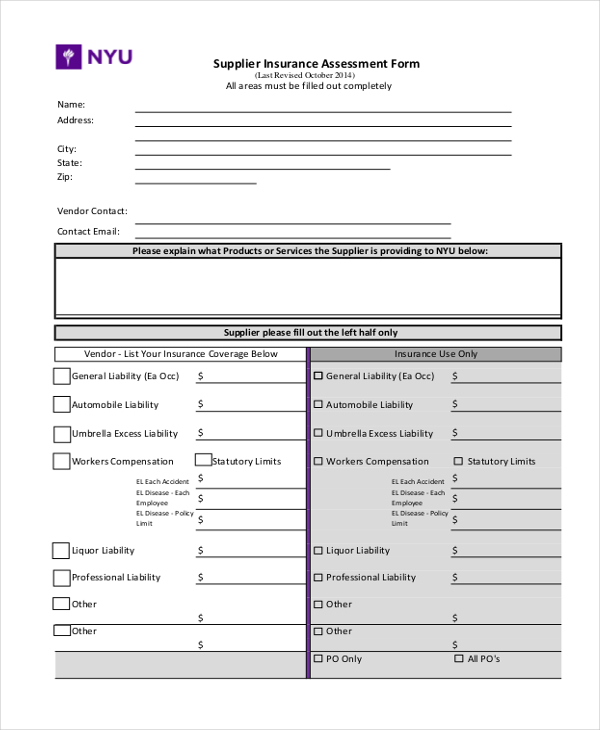

Life insurance needs analysis worksheet pdf. coursehelponline.comCourse Help Online - Have your academic paper written by a ... We will take care of all your assignment needs. We are a leading online assignment help service provider. We provide assignment help in over 80 subjects. You can request for any type of assignment help from our highly qualified professional writers. All your academic needs will be taken care of as early as you need them. Place an Order FREE 9+ Sample Insurance Assessment Forms in PDF | Excel | MS Word PDF. Size: 28 KB. Download. Get this insurance risk assessment form downloaded for your insurance company and carry out a kind of thorough survey on your customer's insurance needs. This risk assessment form will enable you to explore complete information about associated risk with the client or his/her property. PDF Easy Disability Insurance Needs Analysis - My Family Life Insurance Total Add'l Monthly Income Needs Applicant print name: Sign name: Date: As Spouse or Beneficiary, I understand that any changes to my estimated disability insurance needs could either positively or negatively affect me. For instance, applying for less than what the needs worksheet illustrates, might mean I will receive less than what I require ... PDF A Short Version of A Financial Needs Analysis - Clhia This work sheet will help you to estimate how much your estate would be worth if you were to die today, what income flow it can generate and what other sources of income are available to your survivors. [A] Estimating the Income-Producing Assets of Your Estate, Life insurance (including employer-provided)

PDF This worksheet can help you get a general sense of how much life ... Before buying any insurance products you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Income 1 Total annual income your family would need if you died today: What does your family need, before taxes, to maintain its current PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet , This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date, INSURERIGHT Life insurance worksheet - CIBC COMPLETING THE WORKSHEET, 1. Burial costs may range from $3,000 to $15,000.1, Your advisor can help estimate additional fees. 2. Total fees, including cost of living, may range from , $10,000 to $20,000 per year, per child.2, 3. Typically, the percentage of annual income your family will , need if you die is 60% to 75% of your total family income , › System_Analysis_And_Design_pdfSystem Analysis And Design.pdf - Academia.edu Enter the email address you signed up with and we'll email you a reset link.

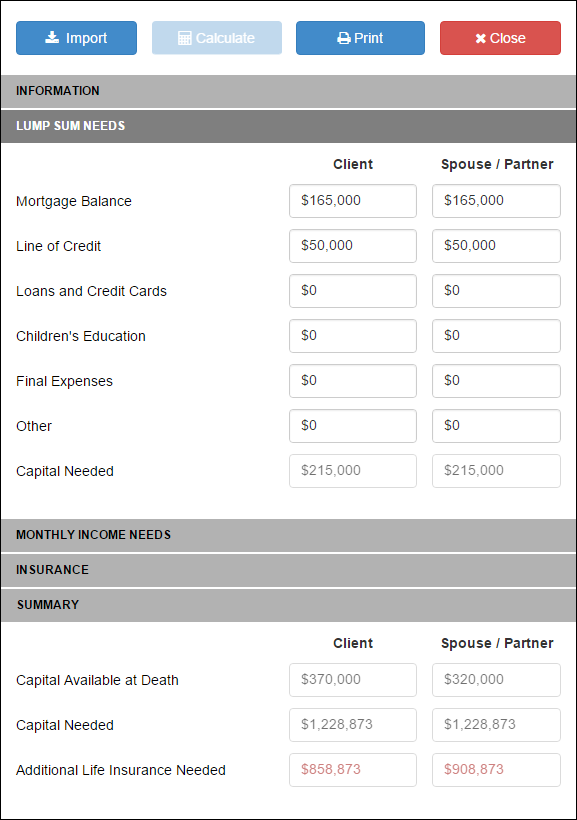

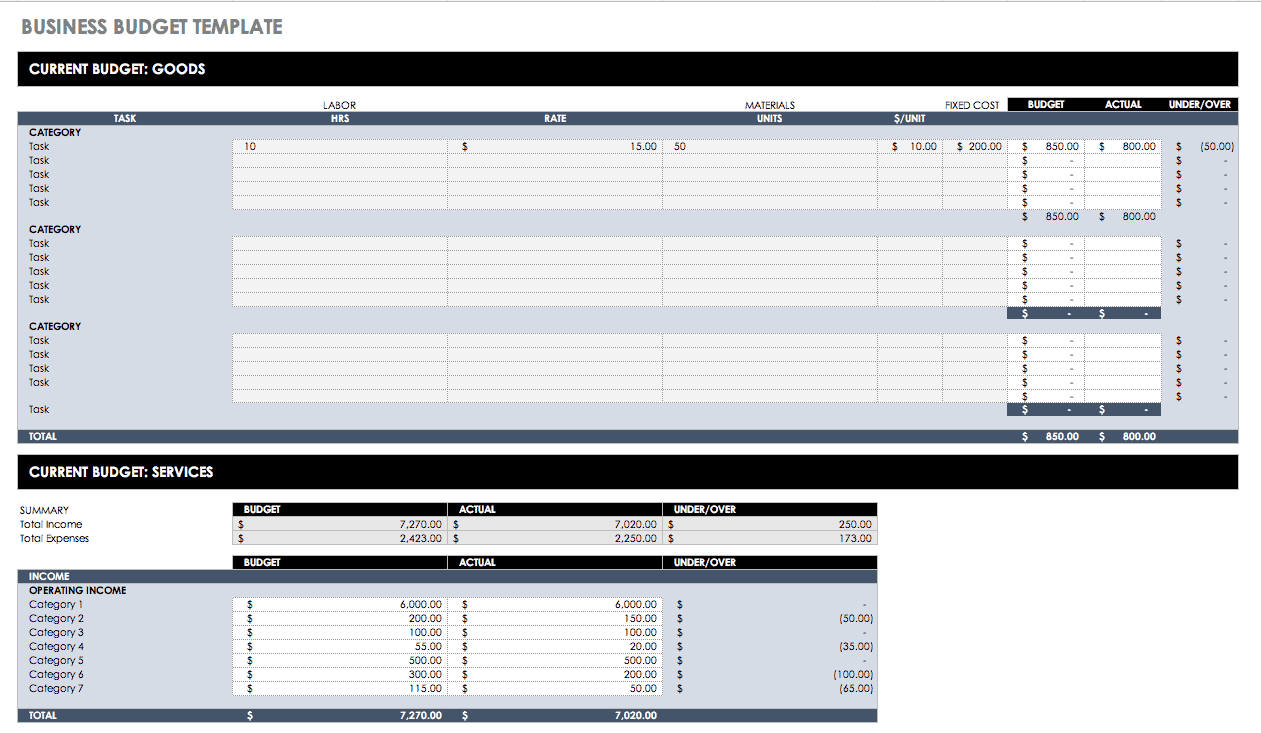

PDF Insurance Needs Analyzer - BMO Insurance Needs Analyzer - BMO XLSX Captcha My net need for life insurance as of today is At this time I have decided to purchase additional coverage of ` HOUSEHOLD LIABILITIES: LEGACY NEEDS AND WANTS: (E) (F) This needs analysis demonstrates a life insurance need of (A+B+C-E) = This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME ... › content › construction-budgetFree Construction Budget Templates | Smartsheet Apr 24, 2020 · This budget worksheet includes sections for separating project expenses into categories. Add your own tasks, materials, and associated costs to get an accurate estimate of total expenses. The worksheet is available in Excel, Word, and PDF formats to simplify budget planning on a residential construction project. Life Insurance Needs Analysis Worksheet - Calculators This calculator will help you determine what your life insurance needs are. First enter potential funeral costs and estate taxes. Then include amounts needed for non-mortgage debt, emergency expenses, and college funds. Then enter annual living expenses, your spouse's annual income after taxes, and annual Social Security benefits.

Needs Analysis Worksheet for Life - Level Four Insurance Agency What debt will be present at death? (typically the greater of $15,000 or 4% of your estate*). Funeral $. Legal Fees $. Mortgage or Home Equity Lines $.

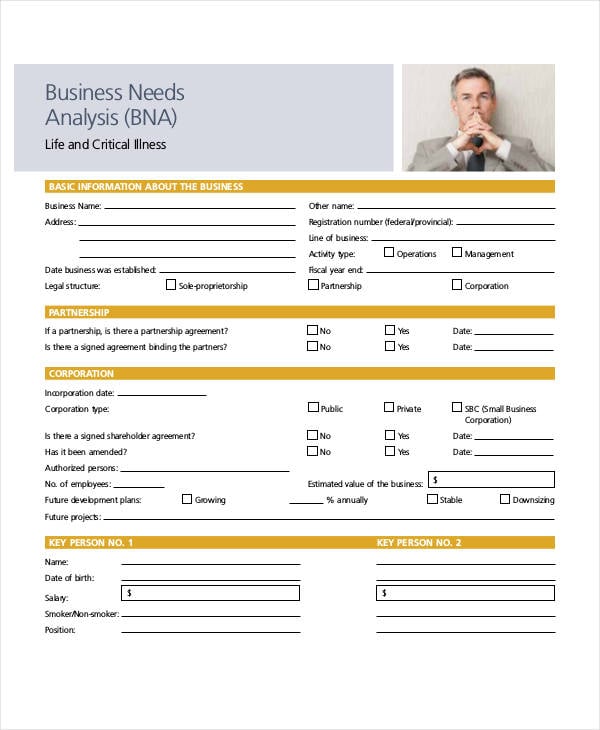

Life Insurance Needs Analysis Worksheet - Empire Life This Worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family.

PDF Life Insurance Needs Worksheet - Microsoft Life Insurance Needs Worksheet Determining the amount of insurance you need is not an exact science. Nevertheless, the worksheet that follows will help you get to a good ballpark figure. If you've got a sizable estate though, or if you are uncomfortable following this worksheet, you should seek the advice of a qualified fee-only

Needs-Analysis-Worksheet-for-Life.pdf - NEEDS ANALYSIS... NEEDS ANALYSIS WORKSHEET FOR LIFE HOW MUCH LIFE INSURANCE DO YOU NEED? 1. What debt will be present at death? (typically the greater of $15,000 or 4% of your estate*) Funeral $ Legal Fees $ Mortgage or Home Equity Lines $ Credit Cards $ Auto Loans $ Miscellaneous Debt $ Total Debt $ 2. What do you anticipate paying for your children ' s education? Average Annual Cost: $ $18,943 public ...

Needs Analysis Worksheet - Financial Professional Login Life insurance is designed to help you reach future financial goals and provide asset and income protection, financial stability and peace of mind to your ...

PDF FINANCIAL NEEDS ANALYSIS WORKSHEET - Producers XL This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully.

PDF LIFE INSURANCE NEEDS WORKSHEET - alterrawm.com This fact finder is provided to help you better understand your goals and objectives. This information is meant to be used purely as a guideline toward proper life insurance needs planning. , EXISTING ASSETS, SUMMARY OF AMOUNTS NEEDED FOR LIFE INSURANCE, Insurance Professional's Name, State Insurance License Number , (or ax your business card)

PDF Life insurance worksheet - Warren Ross Manulife's life insurance worksheet provides an estimate of the amount of life insurance you may need, based on the information you provide. Your insurance needs will change over time, so you should periodically review these needs with your advisor. Determining your insurance needs is simple, with InsureRight,

PDF Life Insurance Needs Analysis - n.b5z.net This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs, 1. Annual income your family would need if you die today, Enter a number that's typically 10%-80% of total income. Include all salaries, dividends, interest and any other sources of income. $ 2.

PDF Life Insurance Needs Analysis Worksheet - Empire Life Insurance Needs Analysis Worksheet Date: _____ This Worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. The type and amount of information required to be collected will vary depending on each client's particular circumstances, therefore the information ...

› healthcare-insurance › life-insuranceFederal Employees’ Group Life Insurance • The amount of life insurance one needs varies by individual. Some general guidelines to help you calculate your needs are on page 5. OFEGLI Service Standards • The Office of Federal Employees’ Group Life Insurance (OFEGLI) is an . administrative unit of Metropolitan Life Insurance Company (MetLife) that pays claims for the FEGLI Program.

PDF Calculating your life insurance needs in 3 easy steps… - BMO A + B - C = Your Life Insurance Needs $ Client Signature: Date: Advisor Signature: Date: I understand that the values illustrated in this life insurance analysis are based on financial information that I have provided and my understanding of my future financial needs in the event of my death. The illustrated insurance coverage is subject to

PDF Life Insurance Needs Analysis Fact Finder Life Insurance Needs Analysis Fact Finder, Life Insurance Needs Analysis Fact Finder, Income Needs, Family Income Need(60-80% of total family income) $, Income Available to Family(Spouse earnings, Social Security etc.) $, Years Family Income Needed(Number of years —10,15,20,25,30,35,40,45,50) Expenses,

Insurance Needs Analysis Worksheet – Term Life Insurance Needs Analysis Worksheet – Term Life. Term Life. Pays out a Lump Sum in the event of your death, or being told you have less than 12 months to ...

› business › contracts50+ SAMPLE Trust Agreement Templates in PDF | MS Word Life is unpredictable, don’t you think? Thus, it is imperative to prepare for any life-changing event or the worst circumstances in life. At least, while you are still alive and in the right mind, asset management runs continuously. You no longer worry if your business, house, or insurance policy ceases in the long run. Tax Benefits

Life Insurance Needs Worksheet Form - signNow Follow the step-by-step instructions below to design your financial needs analysis form for life insurance: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

LIFE INSURANCE NEEDS ANALYSIS WORKSHEET (To replace your income and how long will it be needed?) $. LIFE INSURANCE NEEDS. ANALYSIS WORKSHEET. INSURANCE AND SERVICES, INC. Your situation is unique.

Life Insurance Needs Analysis Worksheet Pdf - Wakelet These narrow tubes carry urine from the kidneys to the bladder. Muscles in the ureter walls continually tighten and relax forcing urine downward, away from the kidneys. If urine backs up, or is allowed to stand still, a kidney infection can develop. About every 10 to 15 seconds, small amounts of urine are emptied into the bladder from the ureters.

DIME worksheet - North American Company DIME worksheet, Your financial security may affect your loved ones more than it affects you. A needs analysis can provide a snapshot , of your current and future needs to help answer the question, "How much life insurance do I need in the event of , my spouse's death?", And the best part?

› about › careersJobs and Career Opportunities at Purdue Global Eligible part-time employees have access to a third-party company that can help them enroll in a range of coverage from multiple insurance carriers, including: Health insurance; Supplemental hospital plan; Life insurance; Dental and vision rider option; Disability insurance; Prescription discount card (free)

PDF CAPITAL NEEDS ANALYSIS - RBC Insurance RBC Life Insurance Company . YOUR PRIVACY MATTERS TO US At RBC Insurance, we're committed to protecting your privacy. We respect your privacy and want you to understand how ... use the electronic Capital Needs Analysis in your computer. Disability Benefit Eligibility 4 LEVEL OF EARNINGS CLIENT CO-CLIENT Current Gross Annual Income

PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet, Life Insurance Needs Worksheet, This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase.

PDF Life Insurance Needs Analysis - Harvard Financial Educators Subtotal $110,000 Lifetime Living Expenses Annual Living Expenses $60,000 (from cash flow worksheet) Less Mortgage Payments -$12,000 (if you pay it off) Less Spouse's Take-Home Pay -$20,000 Less Social Security Benefits -$6,000 , Subtotal $22,000 Multiplied By Number of Years Needed x 18 x ,

Life Insurance Needs Calculator - Life Happens Think about how much money your family will need to cover daily living expenses. This is typically 60-80% of your individual post-tax income. Don't include college savings, childcare or any debts that you would like to pay off immediately (such as your mortgage), since those are covered in other questions.

0 Response to "40 life insurance needs analysis worksheet pdf"

Post a Comment