41 capital gains tax worksheet

› reduce-avoid-capital-gainsHow to Reduce or Avoid Capital Gains Tax on Property or ... Aug 26, 2022 · If you sell capital assets like vehicles, stocks, bonds, collectibles, jewelry, precious metals, or real estate at a gain, you’ll likely pay a capital gains tax on some of the proceeds. Capital gains rates can be as high as 37%, and as low as 0%. Therefore, it’s worth exploring strategies to keep these taxes at a minimum. Capital Gains Tax ... › taxtopics › tc409Topic No. 409 Capital Gains and Losses - IRS tax forms Oct 04, 2022 · Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total ...

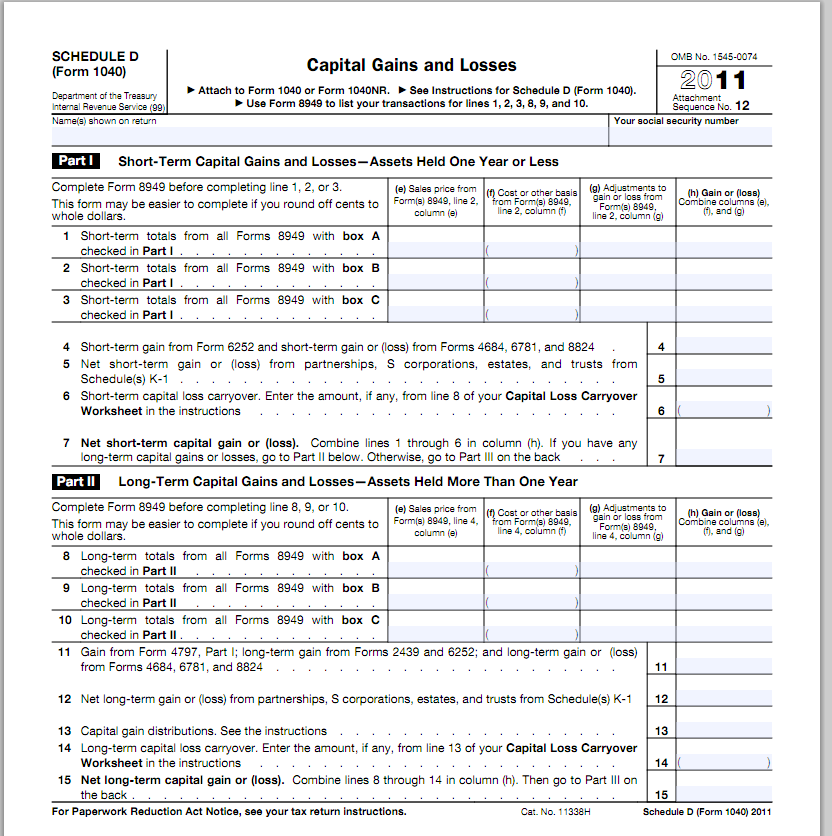

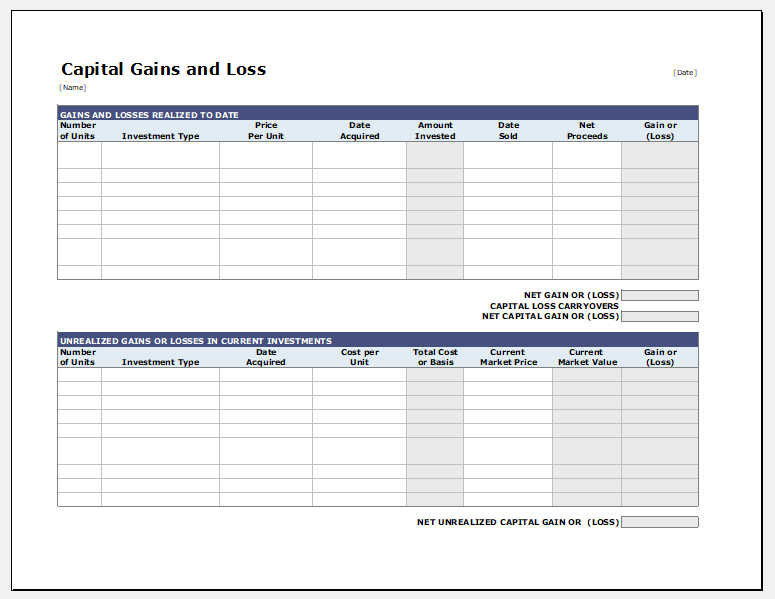

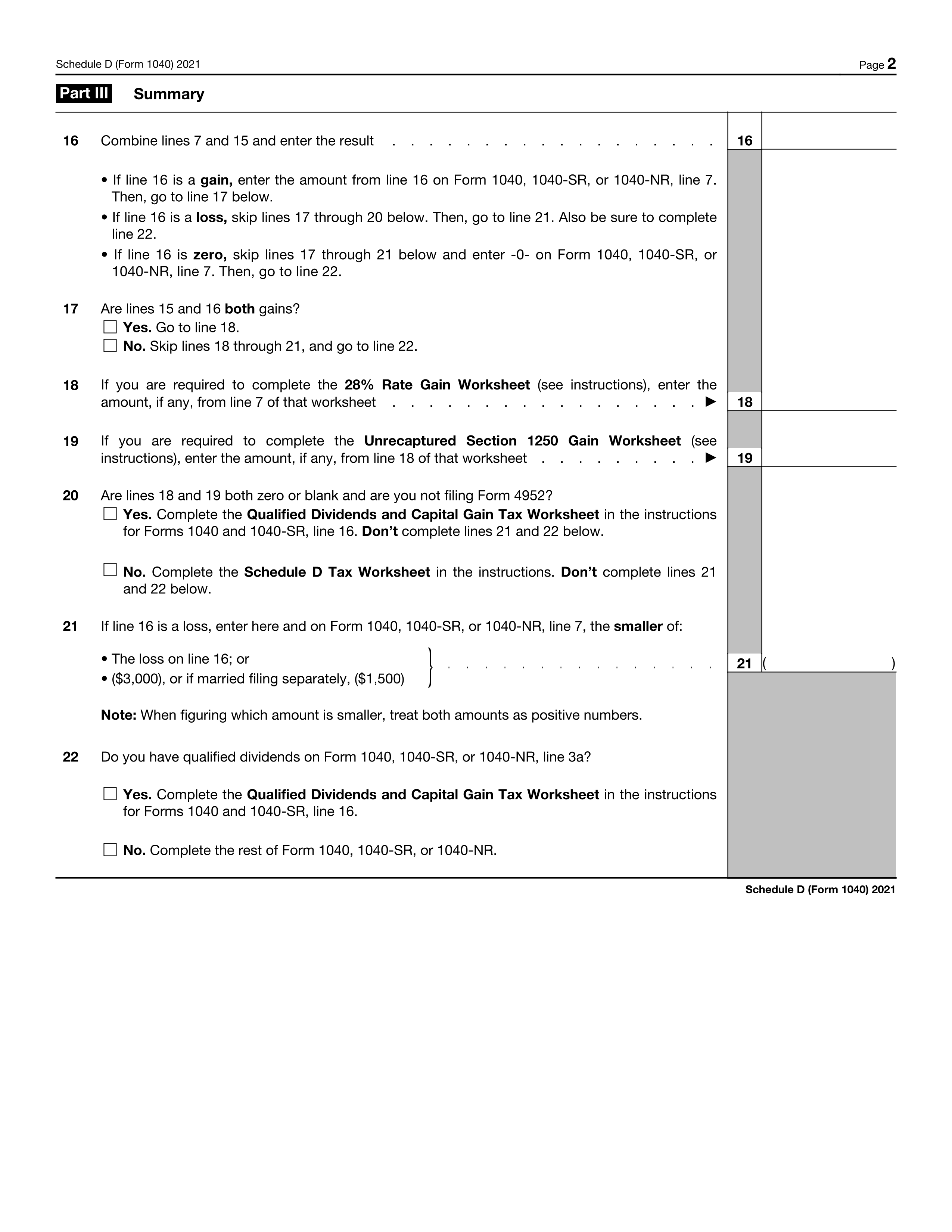

About Schedule D (Form 1040), Capital Gains and Losses Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9 ... “Capital Loss Carryover Worksheet – Lines 6 and 14”-- 11-JULY-2022. Instructions for Schedule D (Form 1040) Rollover of Gain from Empowerment Zone Assets is Available for 2018-- 05-MAR-2020. Other Items You May Find Useful. All Schedule D (Form 1040) Revisions. About Publication …

Capital gains tax worksheet

› sale-of-your-home-3193496Home Sale Exclusion From Capital Gains Tax - The Balance Mar 10, 2022 · Unmarried individuals can exclude up to $250,000 in profits from capital gains tax when they sell their primary personal residence, thanks to a home sales exclusion provided for by the Internal Revenue Code (IRC). Married taxpayers filing jointly can exclude up to $500,000 in gains. › t4037 › capital-gainsCapital Gains – 2021 - Canada.ca If you had a net capital loss during the period from January 1, 1985, to May 22, 1985, and you had taxable capital gains later in 1985, your taxable capital gains will reduce your pre-1986 capital loss balance. › taxes › capital-gains-tax-rates2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet Oct 20, 2022 · The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12% ...

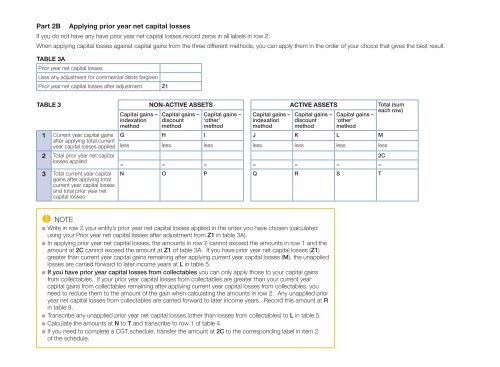

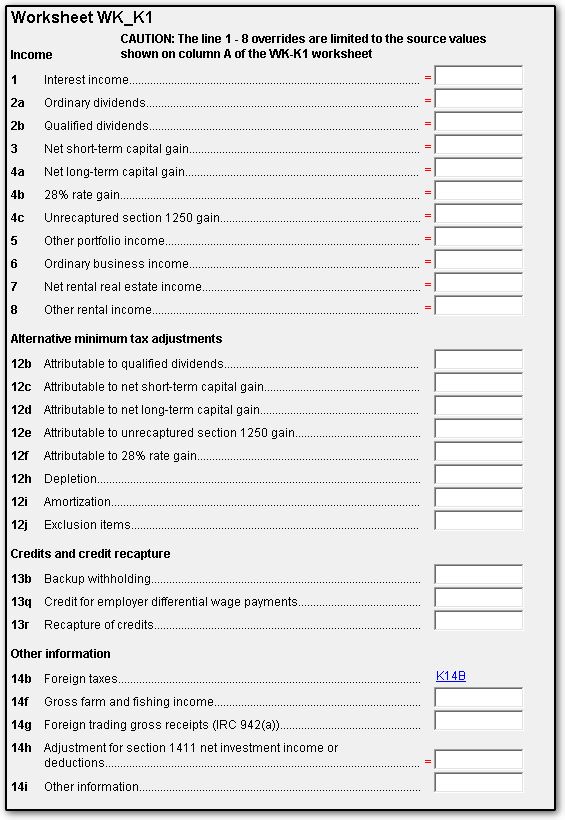

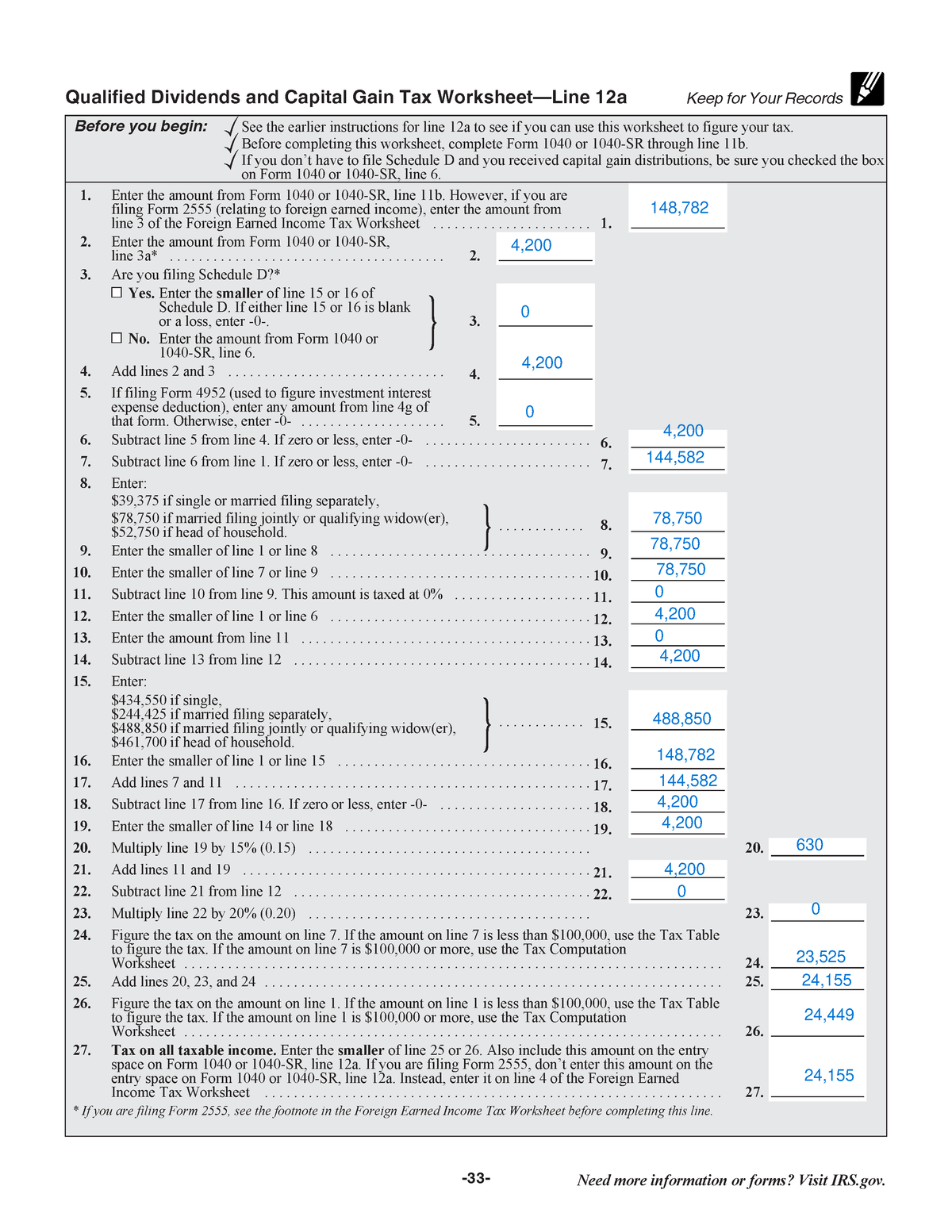

Capital gains tax worksheet. › capital-gains-worksheetCapital Gains Tax Calculation Worksheet - The Balance Feb 23, 2022 · Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply. Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Page 40 of 117 - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of … Topic No. 409 Capital Gains and Losses - IRS tax forms 04/10/2022 · Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line … › long-term-capital-gains-tax2021-2022 Long-Term Capital Gains Tax Rates | Bankrate Apr 07, 2022 · The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. ... You’ll have to complete the worksheet in the instructions for Schedule D on your tax ...

› taxes › capital-gains-tax-rates2022-2023 Capital Gains Tax Rates & Calculator - NerdWallet Oct 20, 2022 · The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets: 10%, 12% ... › t4037 › capital-gainsCapital Gains – 2021 - Canada.ca If you had a net capital loss during the period from January 1, 1985, to May 22, 1985, and you had taxable capital gains later in 1985, your taxable capital gains will reduce your pre-1986 capital loss balance. › sale-of-your-home-3193496Home Sale Exclusion From Capital Gains Tax - The Balance Mar 10, 2022 · Unmarried individuals can exclude up to $250,000 in profits from capital gains tax when they sell their primary personal residence, thanks to a home sales exclusion provided for by the Internal Revenue Code (IRC). Married taxpayers filing jointly can exclude up to $500,000 in gains.

0 Response to "41 capital gains tax worksheet"

Post a Comment