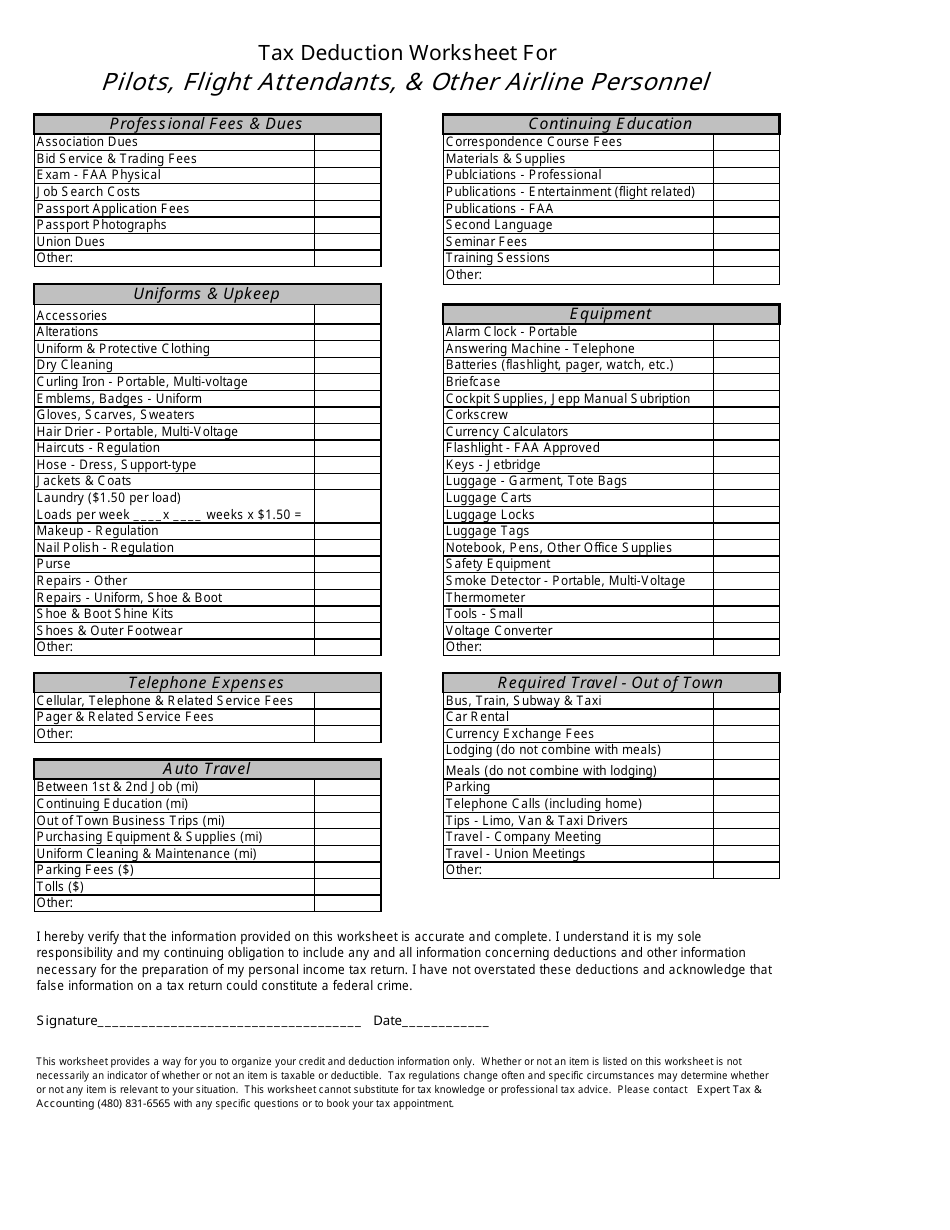

41 flight attendant tax deductions worksheet

awardviewer.fwo.gov.au › award › showMA000009: Hospitality Industry (General) Award 2020 37.6 Deductions for accommodation or accommodation and meals—employees on junior rates [37.6 varied by PR718826 , PR729263 , PR740684 ppc 01Oct22] An employer may deduct from the wages of a junior employee on junior rates,aged as specified in column 2 of Table 16—Employees on junior rates ,the amount specified in column 4 for the service ... › publications › p525Publication 525 (2021), Taxable and Nontaxable Income You're employed as a flight attendant for a company that owns both an airline and a hotel chain. Your employer allows you to take personal flights (if there is an unoccupied seat) and stay in any one of their hotels (if there is an unoccupied room) at no cost to you. The value of the personal flight isn't included in your income.

atlas.ct.gov › portal › pagesAccess Manager for Web Login Tax return due date or paid date, whichever is later + 4 Year(s) Destroy after receipt of signed Form RC-108 [26 CFR 31.6001-1(e)(2)] Consists of Form W-9 used to request the taxpayer identification number (TIN) of a U.S. person and to request certain certifications and claims for exemption.

Flight attendant tax deductions worksheet

awardviewer.fwo.gov.au › award › showMA000119: Restaurant Industry Award 2020 31. Deductions for breakages or cashiering underings. 31.1 Right to make deductions. Subject to clauses 31.2 and 31.3,an employer must not deduct any sum from the wages due to an employee under this award in respect of breakages or cashiering underings except in the case of wilful misconduct. 31.2 Deductions to be reasonable and proportionate › moneywatchMoneyWatch: Financial news, world finance and market news ... IRS hires 4,000 customer service workers ahead of 2023 tax season ... Bird appears to set record with 8,435-mile flight from Alaska to Australia › Individuals › Income-and-deductionsOccupation and industry specific guides | Australian Taxation ... Fire fighter deductions (PDF, 320KB) This link will download a file. Fitness and sporting industry employees. Fitness employee deductions (PDF, 302KB) This link will download a file. Flight Crew. Flight crew deductions (PDF, 336KB) This link will download a file. Gaming attendants. Gaming attendant deductions (PDF, 296KB) This link will ...

Flight attendant tax deductions worksheet. › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; › Individuals › Income-and-deductionsOccupation and industry specific guides | Australian Taxation ... Fire fighter deductions (PDF, 320KB) This link will download a file. Fitness and sporting industry employees. Fitness employee deductions (PDF, 302KB) This link will download a file. Flight Crew. Flight crew deductions (PDF, 336KB) This link will download a file. Gaming attendants. Gaming attendant deductions (PDF, 296KB) This link will ... › moneywatchMoneyWatch: Financial news, world finance and market news ... IRS hires 4,000 customer service workers ahead of 2023 tax season ... Bird appears to set record with 8,435-mile flight from Alaska to Australia awardviewer.fwo.gov.au › award › showMA000119: Restaurant Industry Award 2020 31. Deductions for breakages or cashiering underings. 31.1 Right to make deductions. Subject to clauses 31.2 and 31.3,an employer must not deduct any sum from the wages due to an employee under this award in respect of breakages or cashiering underings except in the case of wilful misconduct. 31.2 Deductions to be reasonable and proportionate

![Amex Platinum Card vs. Delta Platinum Card [Detailed Comparison]](https://upgradedpoints.com/wp-content/uploads/2021/11/Delta-passenger-flight-attendant-masks.jpg)

0 Response to "41 flight attendant tax deductions worksheet"

Post a Comment