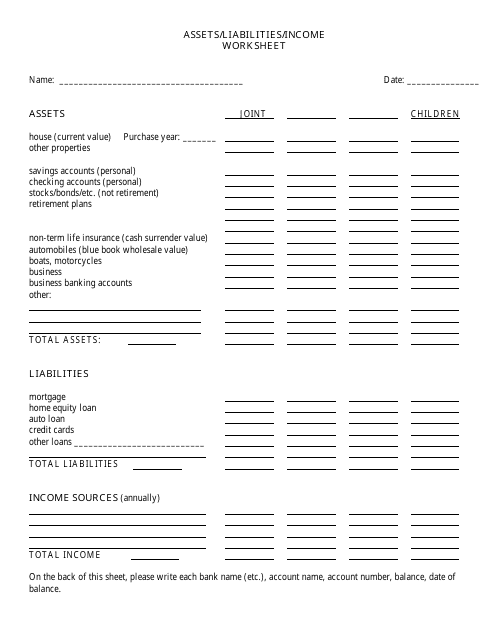

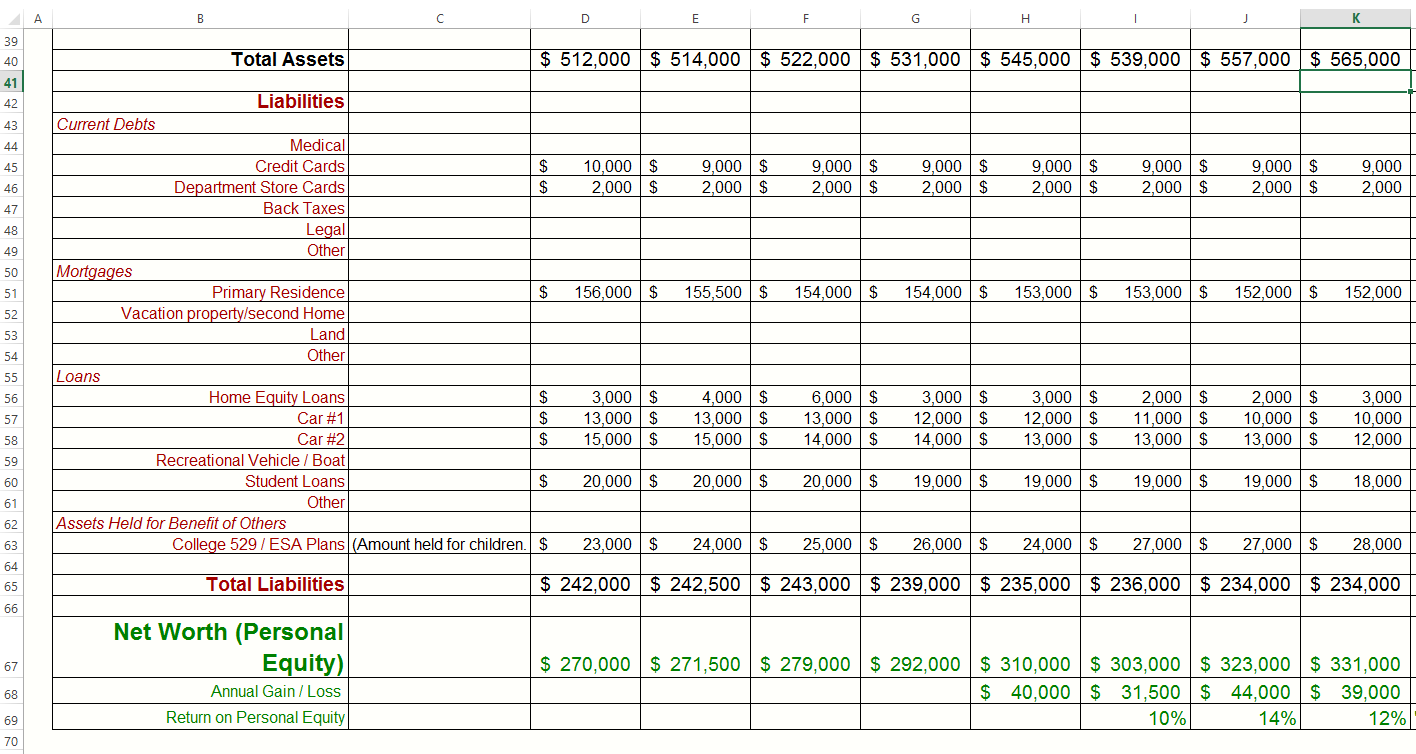

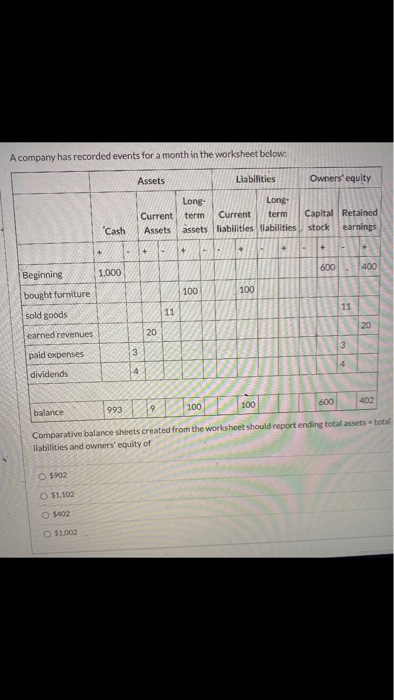

43 assets and liabilities worksheet

Accounting Equation Quiz and Test | AccountingCoach "I am an engineer pursuing an MBA diploma and accounting & financial economics have been a huge challenge for me to overcome. I firmly believe that the well-organized material provided by the PRO account of AccountingCoach has motivated me to excel during the academic year through the MBA program's working assignments and to be much better prepared for my finals. Publication 971 (12/2021), Innocent Spouse Relief | Internal ... Feb 11, 2022 · Herb and Wanda timely filed their 2018 joint income tax return on April 15, 2019. Herb died in March 2020, and the executor of Herb's will transferred all of the estate's assets to Wanda. In August 2020, the IRS assessed a deficiency for the 2018 return. The items causing the deficiency belong to Herb.

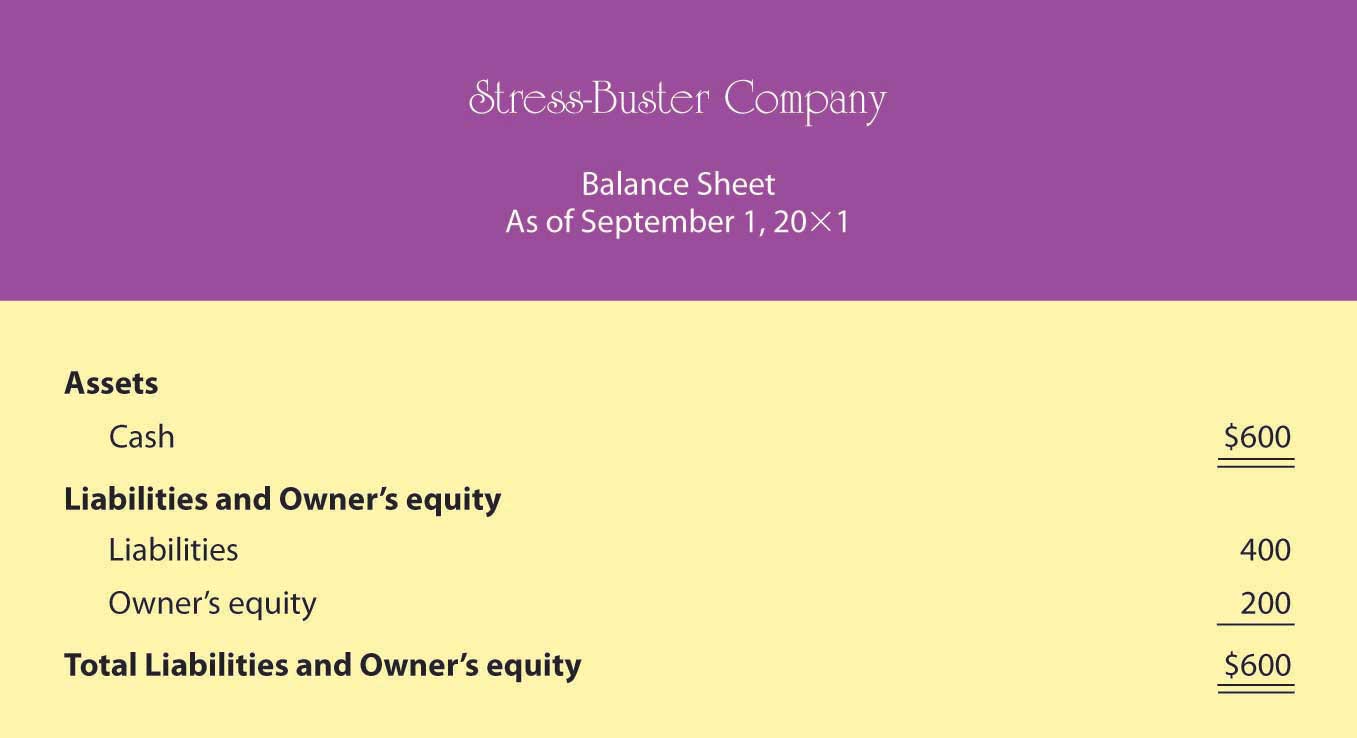

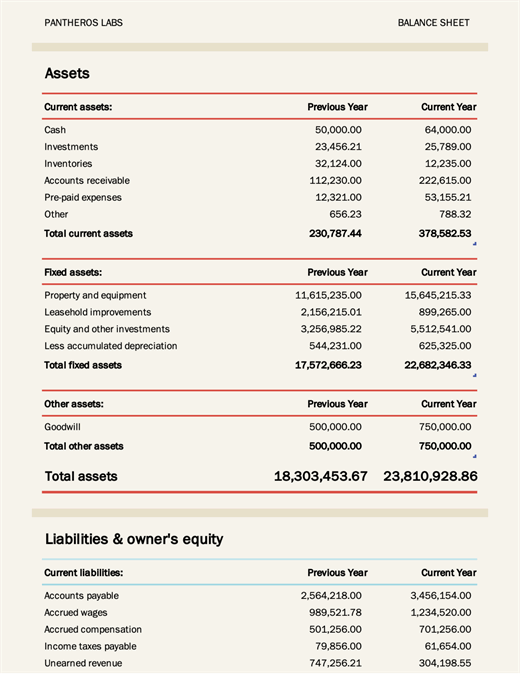

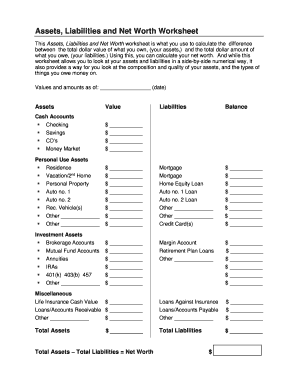

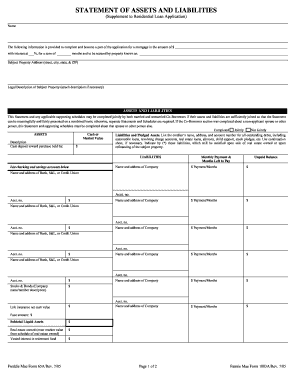

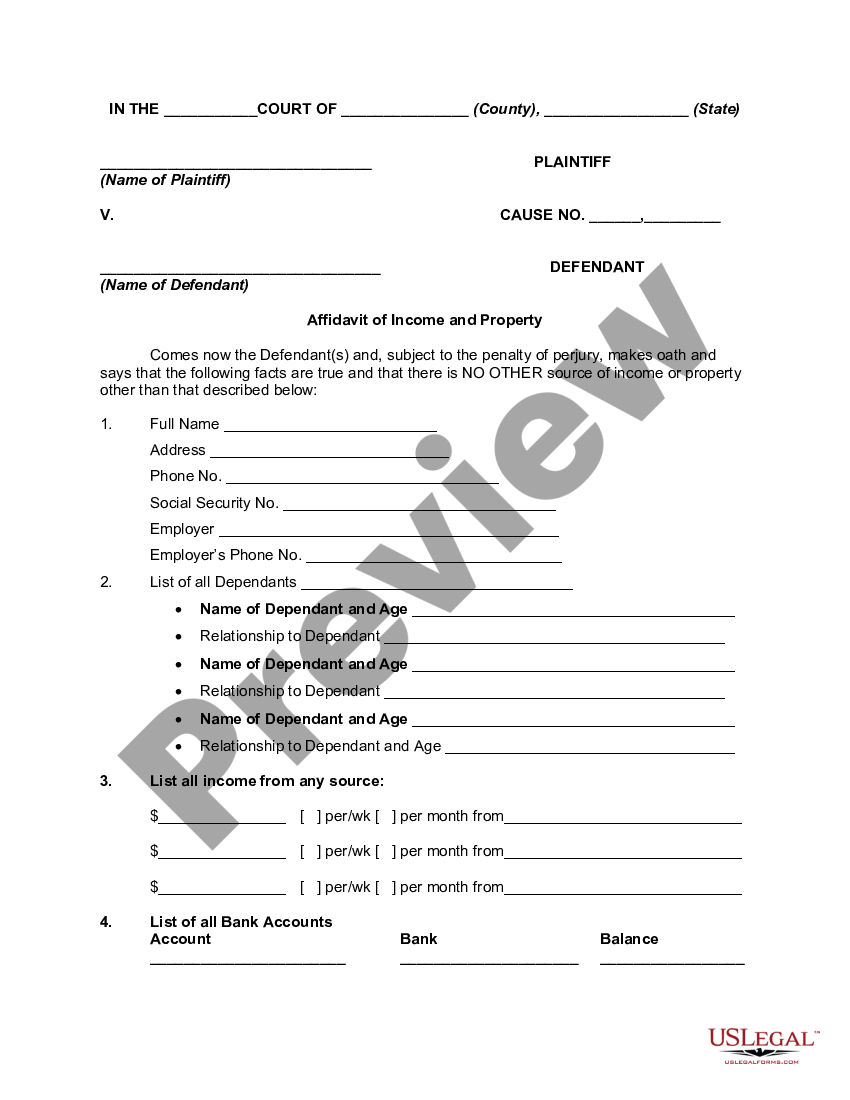

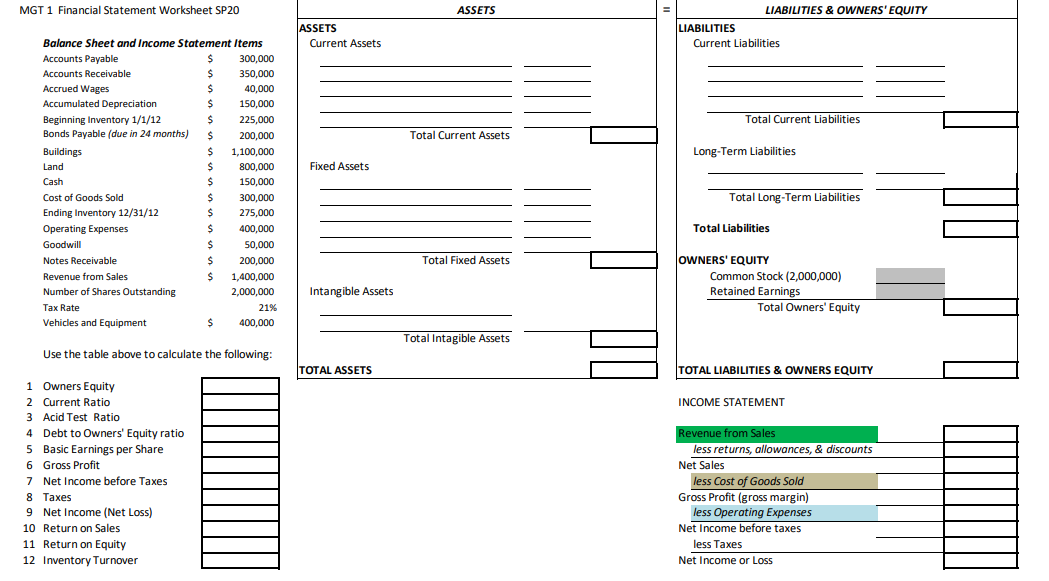

13+ Assets & Liabilities Statement Templates in DOC | PDF The assets and liabilities are the two sides of the coin. The asset means resources like cash, account receivable, inventory, prepaid insurance , investment , land, building, equipment, etc. The liabilities are the expenses like the account payable, salary payable, etc.

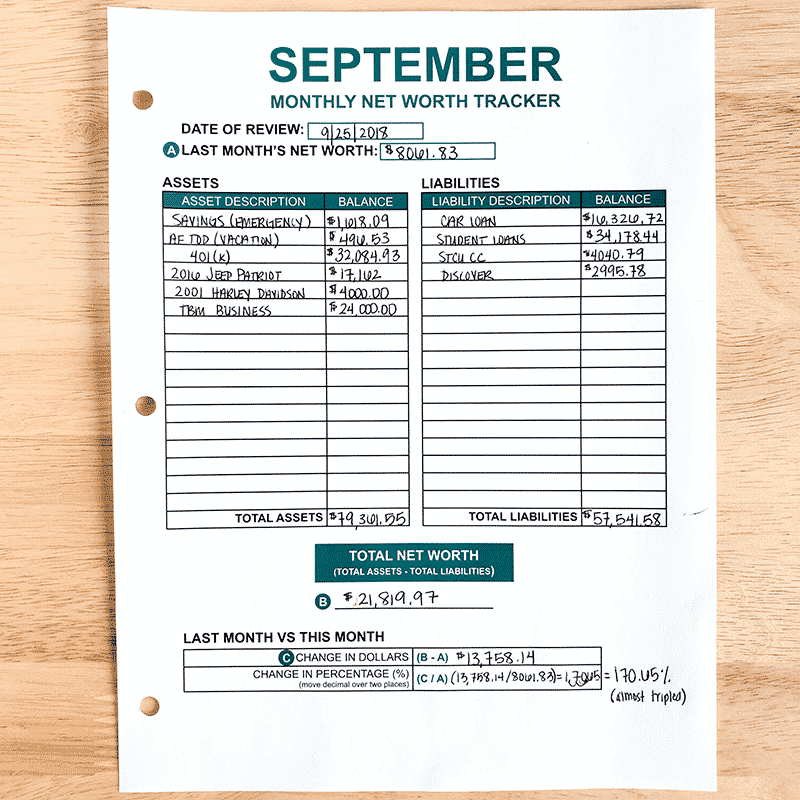

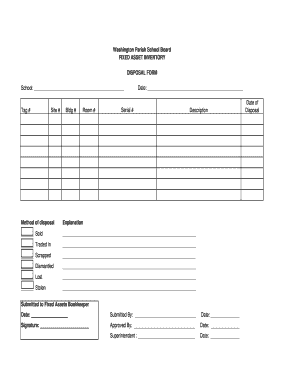

Assets and liabilities worksheet

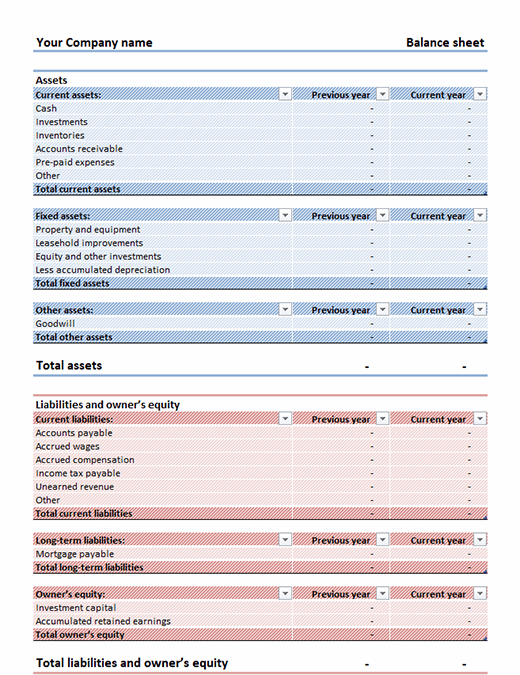

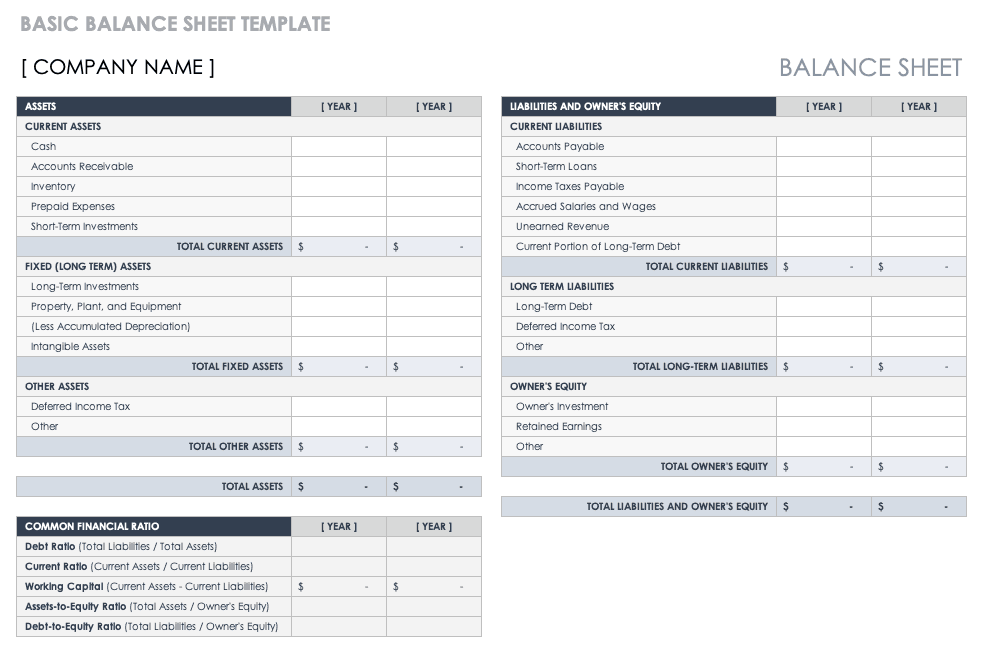

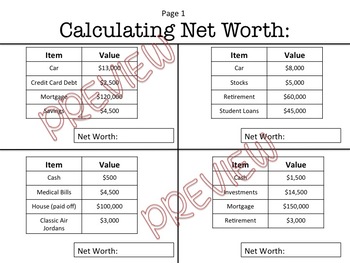

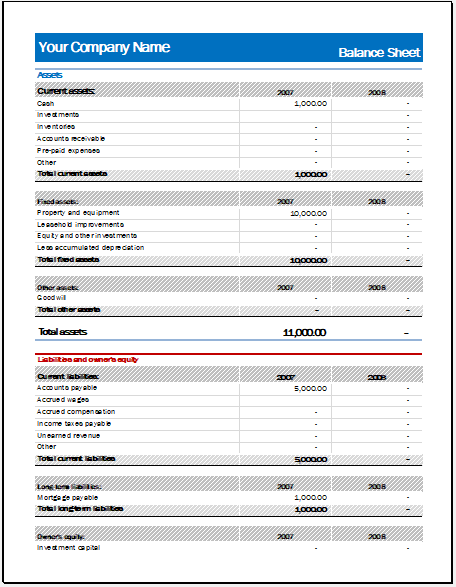

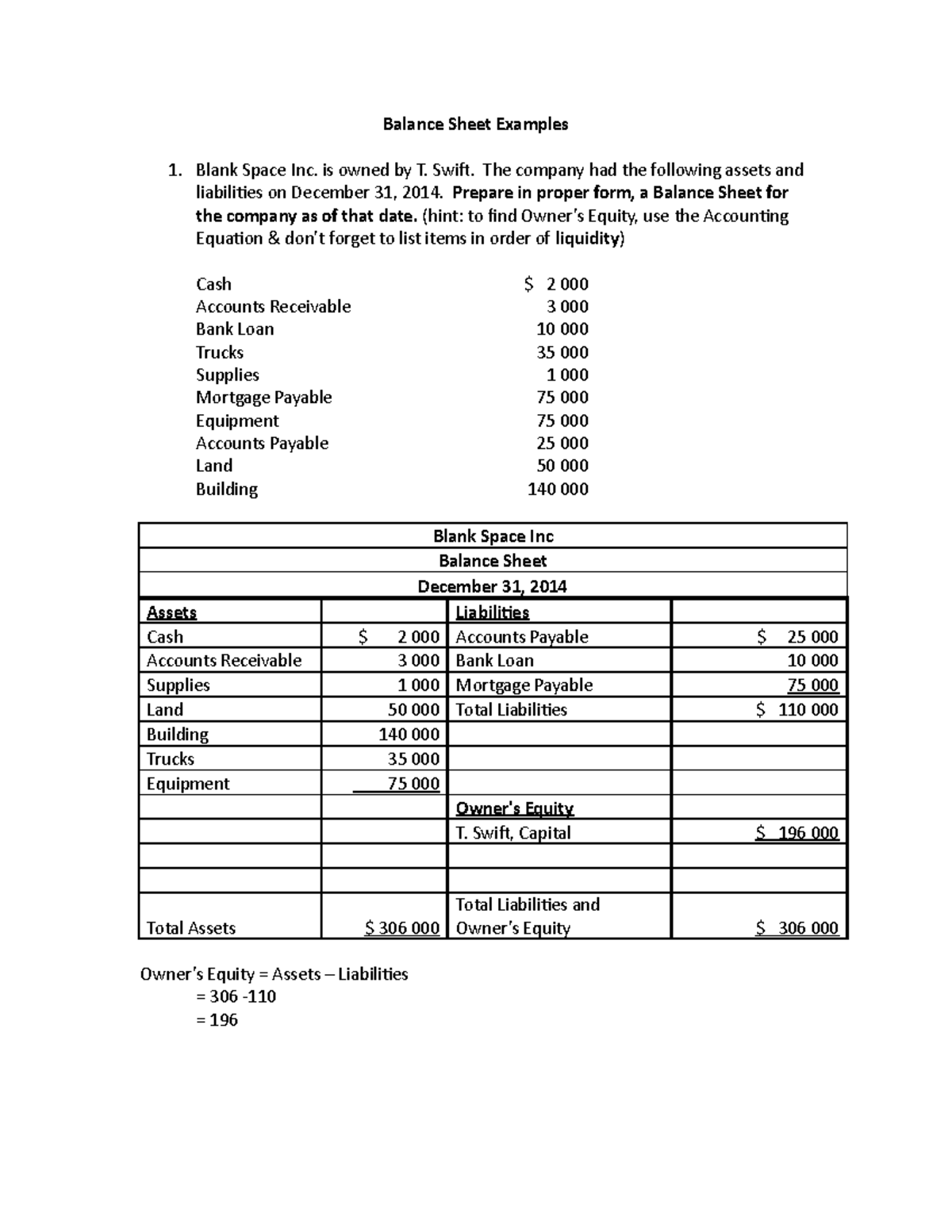

Financial Ratio Calculator » The Spreadsheet Page 04.01.2022 · Basically, it is the opposite of liquidity ratio where it sees financial performance from liabilities/debt side. Debt Ratio = Total Liabilities/Total Assets. Reading this ratio should give you a quick measurement whether company's assets can cover all of their liabilities. Debt to Equity Ratio = Total Debts (Long Term Liabilities)/Total Equity Balance sheet (Simple) - templates.office.com Report on your assets and liabilities with this accessible balance sheet template. This simple balance sheet template includes current assets, fixed assets, equity, and current and long-term liabilities. This example of a simple balance sheet is fully customizable and ready to print. Assets and liabilities worksheet for couples - Canada.ca Subtract the liabilities from the assets to calculate each person’s net worth; Add the two partners’ net worth calculations and put the sum in the box marked “Couple’s net worth.” If the number is negative, you owe more than you own in assets. If the number is positive, your assets outweigh your liabilities; Partner 1: _____

Assets and liabilities worksheet. Statement Of Financial Position | Components | Format ... Since the total assets of a business must be equal to the amount of capital invested by the owners (i.e. in the form of share capital and profits not withdrawn) and any borrowings, the total assets of a business must equal to the sum of equity and liabilities. This leads us to the Accounting Equation: Assets = Liabilities + Equity 15+ Financial Statement Templates for Excel - Vertex42.com Download free financial statements for your business including balance sheets, income statements, profit and loss statements, budgets, and break even analysis templates. Assets and liabilities worksheet for couples - Canada.ca Subtract the liabilities from the assets to calculate each person’s net worth; Add the two partners’ net worth calculations and put the sum in the box marked “Couple’s net worth.” If the number is negative, you owe more than you own in assets. If the number is positive, your assets outweigh your liabilities; Partner 1: _____ Balance sheet (Simple) - templates.office.com Report on your assets and liabilities with this accessible balance sheet template. This simple balance sheet template includes current assets, fixed assets, equity, and current and long-term liabilities. This example of a simple balance sheet is fully customizable and ready to print.

Financial Ratio Calculator » The Spreadsheet Page 04.01.2022 · Basically, it is the opposite of liquidity ratio where it sees financial performance from liabilities/debt side. Debt Ratio = Total Liabilities/Total Assets. Reading this ratio should give you a quick measurement whether company's assets can cover all of their liabilities. Debt to Equity Ratio = Total Debts (Long Term Liabilities)/Total Equity

0 Response to "43 assets and liabilities worksheet"

Post a Comment