45 calculating your paycheck worksheet

Paycheck & Tax Withholding Calculator for W-4: Tax Planning - e-File Then, look at your last paycheck's tax withholding amount, e.g. $250, and subtract the refund adjust amount from that: $250 minus $200 = $50. That result is the tax withholding amount you should aim for when you use this tool, in this example, $50. The W-4 requires information to be entered by the wage earner in order to tell their employer how ... Calculating Your Paycheck Salary Worksheet Answer Key Follow the step-by-step instructions below to design you're calculating your paycheck salary worksheet 1: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Lesson Plan: Calculating Gross and Net Pay - Scholastic Use the example of a $740 laptop computer in a state with 5% sales tax. First, show how 5% is converted to the decimal .05 and multiplied by $740 to arrive at a sales tax of $37. Adding the price of the laptop ($740) and the sales tax ($37) results in the total cost of $777. Step 3: While sales tax is added to the starting amount of a purchase ...

Calculating your paycheck worksheet

Payroll Deductions Calculator - Bankrate Use this calculator to help you determine the impact of changing your payroll deductions. You can enter your current payroll information and deductions, and then compare them to your proposed... How to Calculate Payroll Taxes | Business.org For the 2020 tax year, employers and employees both pay 6.2% of the employee's wages toward Social Security (the total contributions must equal 12.4%). And employers and employees both pay 1.45% towards Medicare for a matched total of 2.9%. In total, FICA taxes (from both employer and employee) should total 15.3% of each employee's paycheck. Free Employer Payroll Calculator and 2022 Tax Rates | OnPay Social Security tax: Withhold 6.2% of each employee's taxable wages until they earn gross pay of $147,000 in a given calendar year. The maximum an employee will pay in 2022 is $9,114.00. As the employer, you must also match your employees' contributions. Medicare tax: Under FICA, you also need to withhold 1.45% of each employee's taxable ...

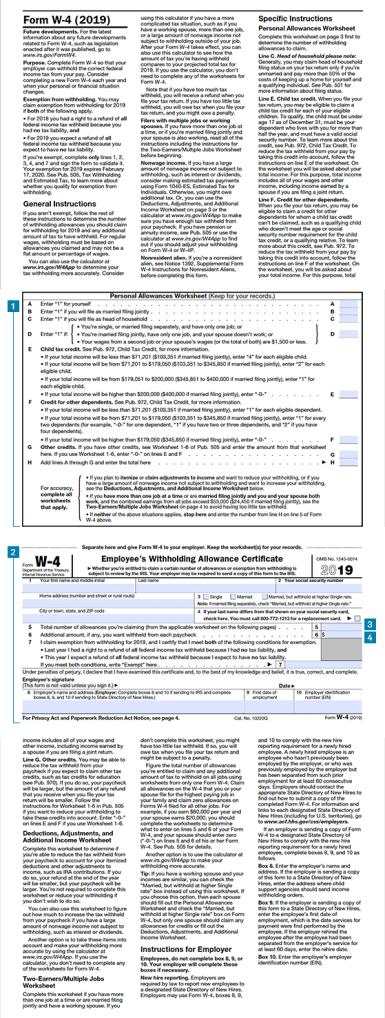

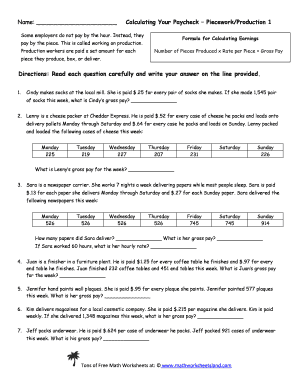

Calculating your paycheck worksheet. Solved Calculating Your Paycheck - Salary Worksheet 1 Some | Chegg.com Formula for Calculating Earnings Annual Salary + Total Number of Pay Periods in the Year = Amount of Salary for each Pay Period Directions: Read each question carefully and write your answer on the line provided. 1. Ed Callahan is an executive at the local bank. His annual salary is $75,530. Salary Paycheck Calculator · Payroll Calculator · PaycheckCity To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay. Don't want to calculate this by hand? The PaycheckCity salary calculator will do the calculating for you. Payroll Calculator - Free Payroll Calculator - PayCheck ... You can use the W-4 worksheet to calculate additional allowances. These allowances are based on deductions for interest on your home mortgage, contributions you made to charities, state and local taxes, some medical expenses, and various other deductions you might have taken. See the W-4 form for details. PDF Bring Home The Gold - National Payroll Week Your paycheck = total hours worked x rate of pay. 4. Name two mandatory deductions. 5. Name three other deductions. 10 Calculating a Paycheck #1 EMPLOYEE AT A GOURMET COFFEE Employee's name: Pay period Weekly Semimonthly Monthly Number of allowances (0 or more) Single Married GROSS PAY 1.

Get Calculating Your Paycheck Salary Worksheet 1 Answer Key The tips below will help you fill out Calculating Your Paycheck Salary Worksheet 1 Answer Key quickly and easily: Open the template in the full-fledged online editing tool by clicking Get form. Complete the necessary fields which are colored in yellow. Press the arrow with the inscription Next to jump from one field to another. PDF Calculating the numbers in your paycheck This answer guide provides possible answers for the "Calculating the numbers in . your paycheck" worksheet. Keep in mind that students' answers may vary. The . important thing is for students to have reasonable justification for their answers. Answer guide. 1. Which tax provides for federal health insurance? A. State income tax Tax Withholding Estimator | Internal Revenue Service Estimate your federal income tax withholding See how your refund, take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. What You Need Have this ready: Paystubs for all jobs (spouse too) Calculating Paycheck Teaching Resources Results 1 - 24 of 111 — Browse calculating paycheck resources on Teachers Pay Teachers, ... Your students will then practice calculating taxes owed in several ...

Calculating Your Paycheck Salary Worksheet 1 Answer Key Mar 19, 2021 - Calculating Your Paycheck Salary Worksheet 1 Answer Key. Check out how easy it is to complete and eSign documents online using fillable ... State of Oregon: Businesses - Corporate Activity Tax FAQ Estimated payments, which can be calculated using the estimated payments worksheet included in the CAT return instructions, are due for the previous quarter on or before the last day of the 4 th, 7 th, and 10 th months of the tax year, and on the last day of the first month immediately following the end of the tax year. Kami Export - calculating your paycheck worksheet 1.pdf The salary is then divided by the total number of pay periods in the year to determine how much money the employee will receive with each paycheck. Formula for Calculating Earnings Annual Salary ÷ Total Number of Pay Periods in the Year = Amount of Salary for each Pay Period. Directions: Read each question carefully and write your answer on ... Calculating Your Paycheck Salary Worksheet 1 Answer Key ... Fill Calculating Your Paycheck Salary Worksheet 1 Answer Key, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ...

Free Paycheck Calculator: Hourly & Salary - SmartAsset Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. ... When you fill out your W-4, there are worksheets that will walk you through withholdings based on your marital status, the number of children you have, the number of ...

Free Online Paycheck Calculator | Calculate Take Home Pay | 2022 The following check stub calculator will calculate the percentage of taxes withheld from your paycheck, and then use those percentages to estimate your after-tax pay on a different gross wage amount. You can either enter the year-to-date (YTD) figures from your payslip, or for a single pay period. Secret Tip For Increasing Your Net Pay

Free Paycheck & Payroll Calculator: Hourly & Salary | QuickBooks If the employee is hourly, input their hourly wage under "pay rate," and fill in the number of hours they worked that pay period. If the employee worked more than 40 hours, and thus accrued overtime, record 40 here and save the rest for "additional pay." If the employee is salaried, both the "pay rate" and "hours worked" fields will disappear.

Calculating Your Paycheck Salary Worksheet 1 Answer Key Name: Date: Calculating Your Paycheck Salary Worksheet 1 Some employers base their employees pay on a salary. A Formula for Calculating Earnings salary is a ...

Calculating Your Paycheck Salary Worksheet 1 Answer Key: Fill ... - CocoDoc How to Edit and sign Calculating Your Paycheck Salary Worksheet 1 Answer Key Online To start with, look for the "Get Form" button and tap it. Wait until Calculating Your Paycheck Salary Worksheet 1 Answer Key is ready to use. Customize your document by using the toolbar on the top. Download your customized form and share it as you needed.

Calculating the numbers in your paycheck Distribute the “Calculating the numbers in your paycheck” worksheet and explain that students will use information from the handout to answer the worksheet ...

W-4 Calculator 2022 - TurboTax The W-4 calculator can help you adjust your withholdings to determine if you'll get a refund or a balance due come tax time. Once you're happy with your projected outcome, the W-4 calculator will show how to fill out your W-4. Depending on your employer, updates to your W-4 could take a few weeks to be reflected on your paycheck.

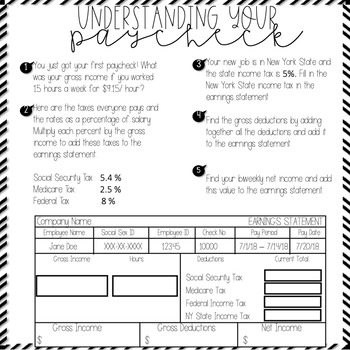

Calculating the numbers in your paycheck II TUDENT WORKSHEET 1 of 2 Calculating the numbers in your paycheck Name: Date: Class: BUILDING BLOCKS STUDENT WORKSHEET. Calculating the numbers in your paycheck Knowing how to read the pay stub from your paycheck can help you manage your money. The taxes and deductions on your pay stub may not always be easy to understand.

Calculate your paycheck with paycheck calculators and withholding ... Free salary, hourly and more paycheck calculators. paycheck calculators. Use PaycheckCity's free paycheck calculators, gross-up and bonus and supplementary calculators, withholding forms, 401k savings and retirement calculator, and other specialty payroll calculators for all your paycheck and payroll needs.

Net Worth Calculator: What is My Net Worth? | RamseySolutions.com Start with what you own: cash, retirement accounts, investment accounts, cars, real estate and anything else that you could sell for cash.Then subtract what you owe: credit card debt, student loans, mortgages, auto loans and anything else you owe money on.

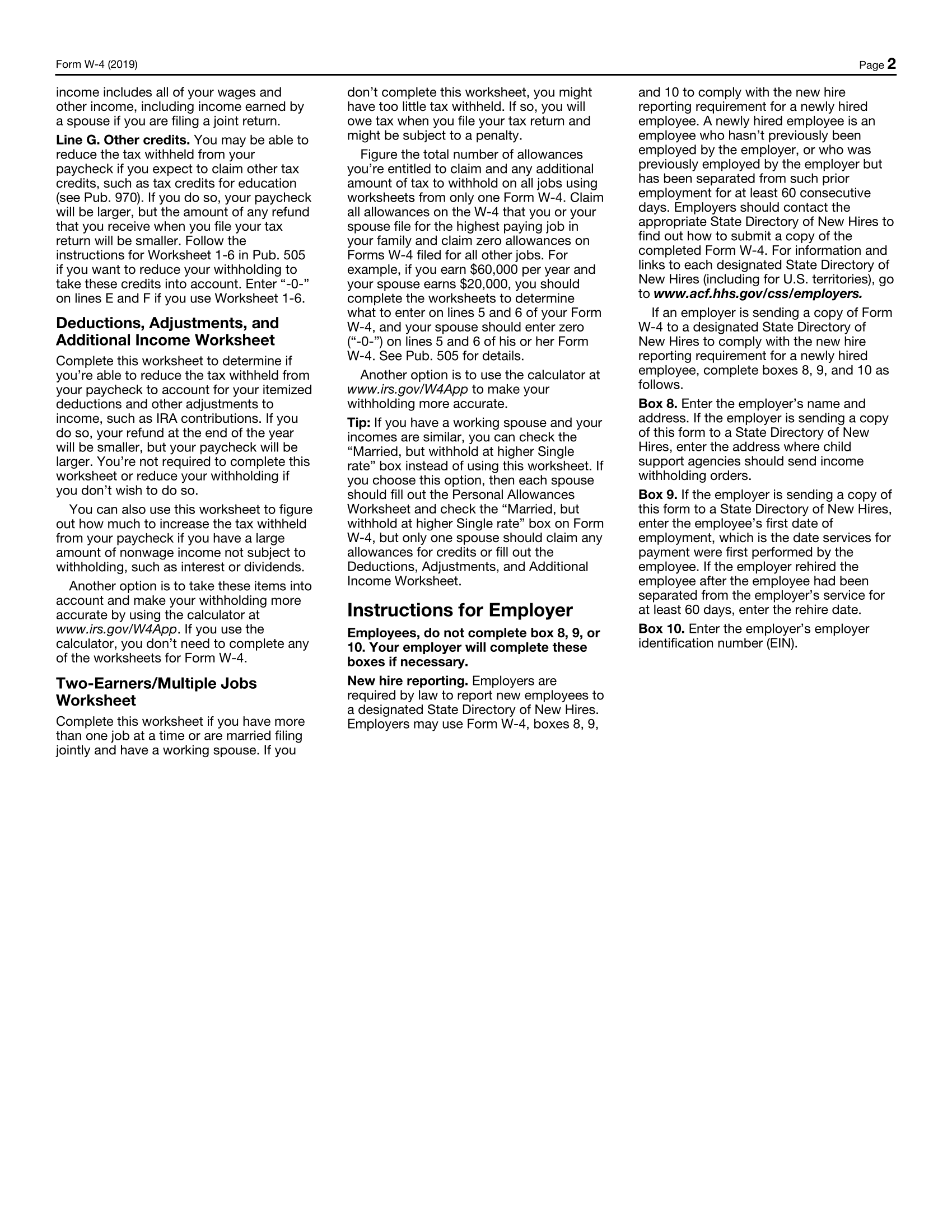

How Many Exemptions Should I Claim On My W-4 Feb 05, 2018 · Calculating Your Exemptions. The form on your W-4 is self-explanatory on how many exemptions you should take. For example, if you live along then you take one exemption, provided that no one else can claim you as a deduction on their tax forms. This applies mostly to children who can still be listed on their parent’s taxes as dependents.

Paycheck Calculator - Take Home Pay Calculator - Vertex42.com Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it.

gross pay worksheet MO Section 8 Rent Calculation Worksheet - Lake County Montana - Fill. . calculation montana form. How to calculate gross pay and what employers should include. Downloadable, free payroll deductions worksheet using the wage bracket. 35 calculating your paycheck worksheet.

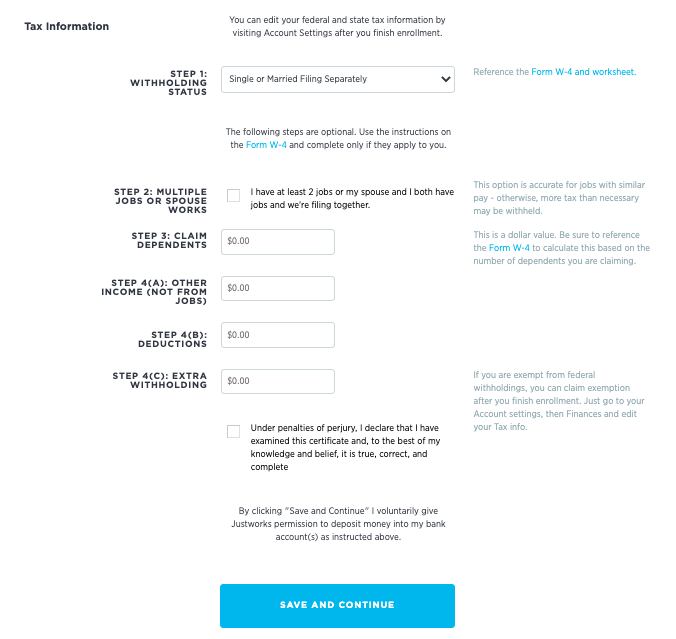

How to Calculate Deductions & Adjustments on a W-4 Worksheet The fourth step of this process involves finalizing your W-4 worksheet results, which means that the totals listed on your worksheet should be added to the appropriate W-4 section. The final deduction amount that you wrote down on line five of the deductions worksheet should be added to Step 4(b) on IRS Form W-4.

Salary Paycheck Calculator - Calculate Net Income | ADP How to calculate annual income To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000. How to calculate taxes taken out of a paycheck

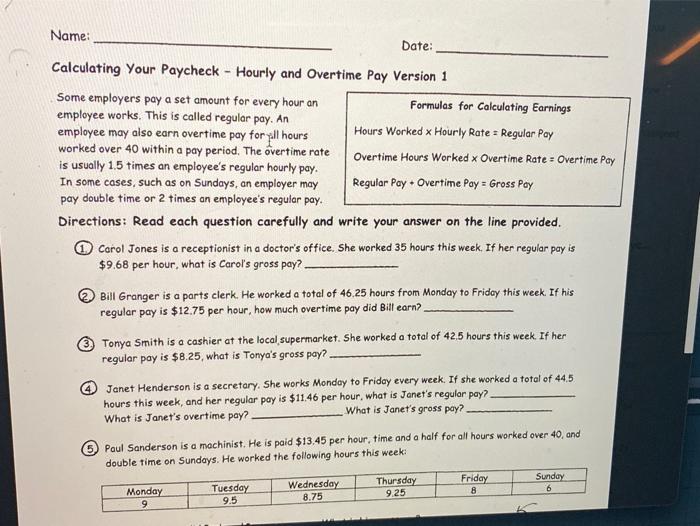

Hourly and Overtime Pay Version 2 and Answer Keys Calculating Your Paycheck – Hourly and Overtime Pay Version 2. Directions: Read each question carefully and write your answer on the line provided.3 pages

Calculating Your Withholding | Integrated Service Center How to Calculate Your Paid Family and Medical Leave (PFML) Withholding. To calculate the amount of Paid Family Medical Leave withheld from your paycheck, multiply your gross wages by .6%. You pay 73.22% of that 0.6%. Note that premiums are capped at the 2022 Social Security Wage Base of $147,000; the maximum premium paid for PFML is $649.32.

How to Calculate Severance Pay · PaycheckCity If you have been at the company for 10 years, your severance pay would be $40,000 ($4,000 X 10 years). Remember severance pay is not always given; it is dependent on the scenario with your employer. If you are looking for an easy way to estimate severance paycheck out this worksheet: Severance Pay Estimation Worksheet.

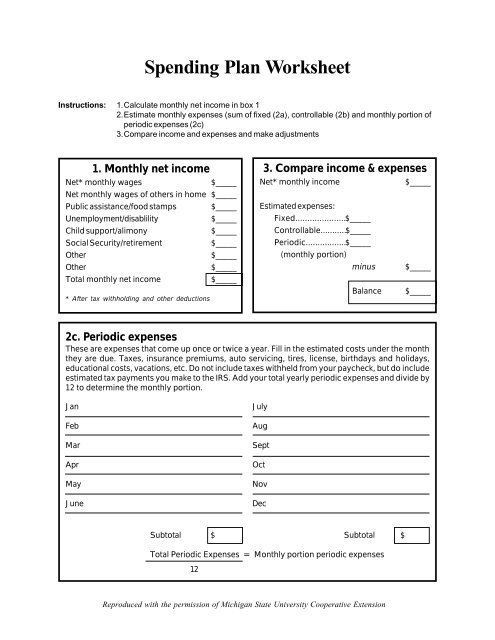

INCOME CALCULATION WORKSHEET - bostonplans.org Earnings ÷ Number of pay periods YTD = Average earnings per pay period x Period (Number of per year) = Estimated Annual Income ÷ = x =$ ÷ = x =$ ÷ = x =$ ÷ = x =$ Total $ LINE 2 Asset Calculation Type of Account Bank Name & Account # Current Balance x 1% = Total Imputed Assets

Calculating Your Gross Monthly Income Worksheet - NeighborWorks Calculating Your Gross Monthly Income Worksheet Calculating Your Gross Monthly Income Worksheet If you are paid hourly $ _________ x _________ x 52 weeks ÷ 12 months = $ ____________ (pay before (# of hours you (gross monthly deductions) work in 1 week) income) If you are paid weekly

E-File 2022 Form 941 Online - Taxbandits Worksheet 3 - This worksheet is used to calculate the nonrefundable and refundable portion of credits for sick and family wages taken after April 1, 2021 . Worksheet 4 - Calculating the employee retention credit for the third and fourth quarter of 2021 (Qualified Wages Paid After June 30, 2021) can be done using 941 Worksheet 4 .

Calculating the numbers in your paycheck | Consumer Financial ... Calculating the numbers in your paycheck Updated Aug 25, 2022 Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they receive. Big idea The amount of money you earn from your job is different from the amount of money you receive in your paycheck. Essential questions

How to Calculate Your Modified Adjusted Gross Income - The Balance Adjusted gross income is your taxable income for the year, so it is what your income tax bill is based on. There are two steps to finding your AGI. First, it includes all your income sources, such as: 6 Wages Investment income Business income Retirement income Alimony Rental income Farm income The total amount of income is then "adjusted."

Calculating Your Paycheck Salary Worksheet 1 Answer Key 2020-2022 ... Use your e-signature to the PDF page. Click on Done to save the adjustments. Download the record or print your PDF version. Send instantly to the receiver. Make use of the quick search and advanced cloud editor to generate an accurate Calculating Your Paycheck Salary Worksheet 1 Answer Key. Remove the routine and produce paperwork on the internet!

Free Employer Payroll Calculator and 2022 Tax Rates | OnPay Social Security tax: Withhold 6.2% of each employee's taxable wages until they earn gross pay of $147,000 in a given calendar year. The maximum an employee will pay in 2022 is $9,114.00. As the employer, you must also match your employees' contributions. Medicare tax: Under FICA, you also need to withhold 1.45% of each employee's taxable ...

How to Calculate Payroll Taxes | Business.org For the 2020 tax year, employers and employees both pay 6.2% of the employee's wages toward Social Security (the total contributions must equal 12.4%). And employers and employees both pay 1.45% towards Medicare for a matched total of 2.9%. In total, FICA taxes (from both employer and employee) should total 15.3% of each employee's paycheck.

Payroll Deductions Calculator - Bankrate Use this calculator to help you determine the impact of changing your payroll deductions. You can enter your current payroll information and deductions, and then compare them to your proposed...

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

0 Response to "45 calculating your paycheck worksheet"

Post a Comment