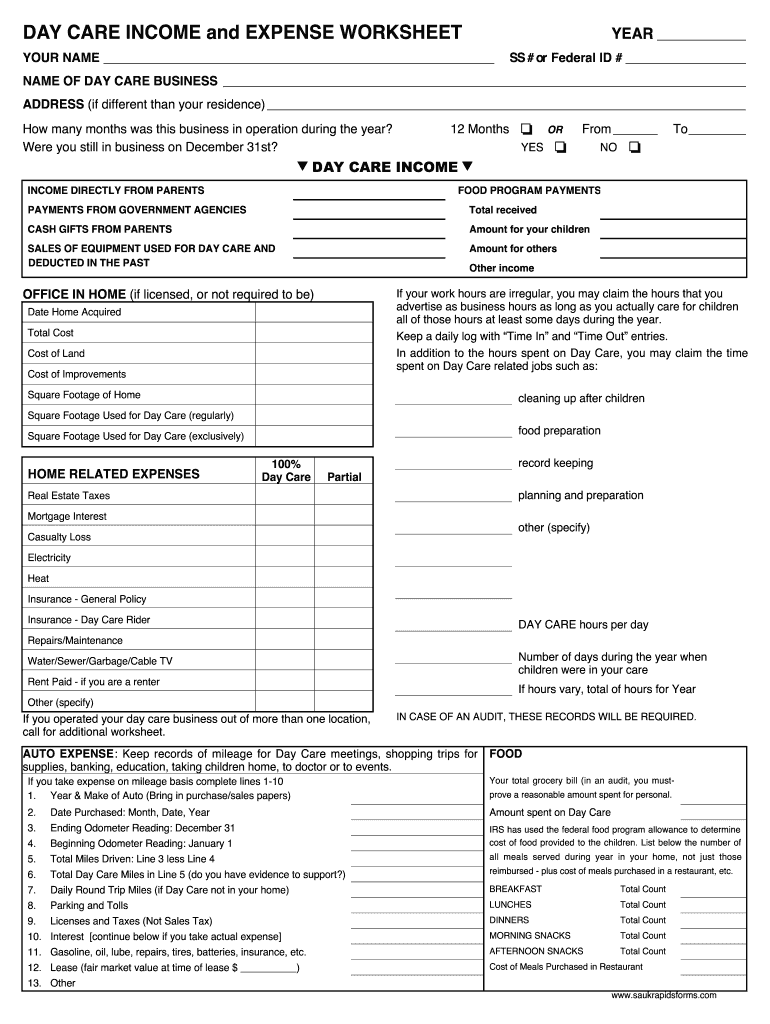

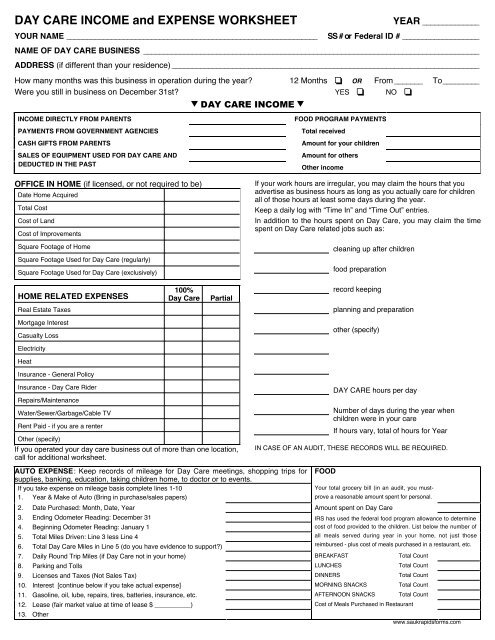

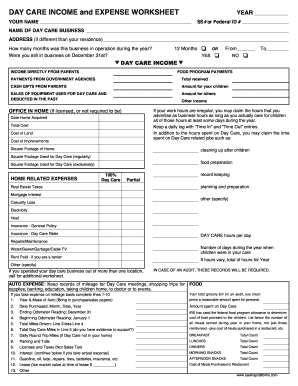

38 home daycare tax worksheet

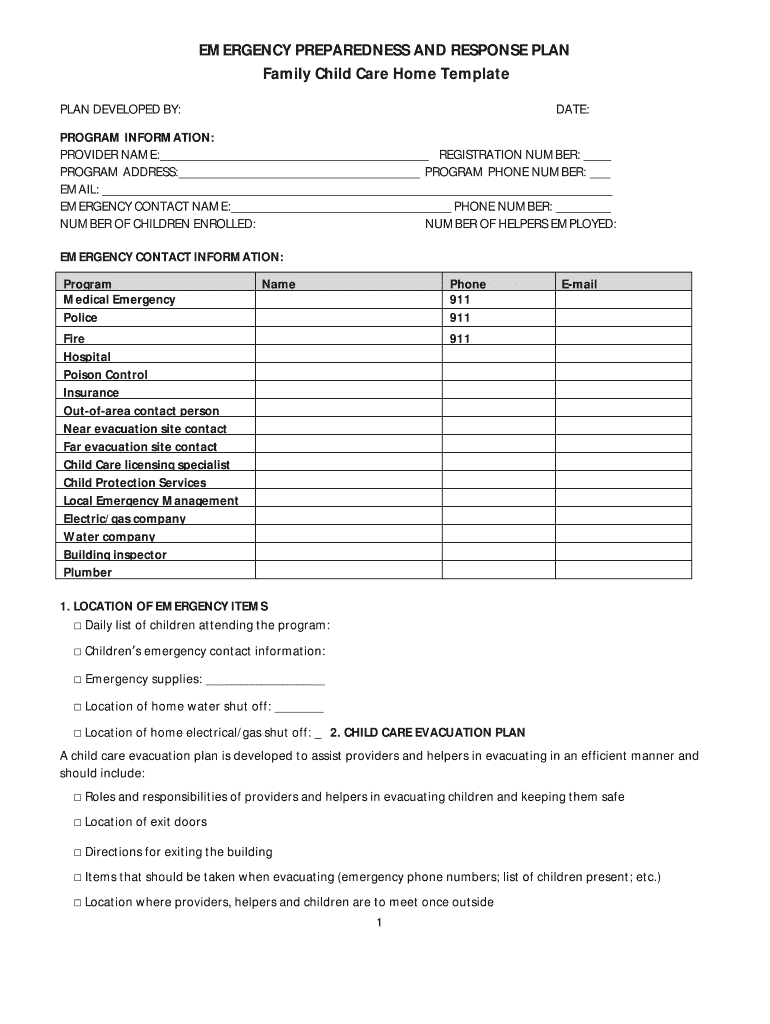

ttlc.intuit.comTax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. › providers › Child-CareChild Care Regulations - Department of Human Services A family care home must be located in a home and must have a certificate of compliance (license) from DHS in order to operate. Family Child Care: What to Expect in an Inspection All family child care homes in Pennsylvania will soon be required to earn a Certificate of Compliance as a CERTIFIED, also called LICENSED, child care provider.

texflex.payflex.comHome | TexFlex IRS Resources. Medical and Dental Expenses - IRS Publication 502; Dependent Care Expenses - IRS Form 2441; Dependent Care Expenses - Instructions for IRS Form 2441

Home daycare tax worksheet

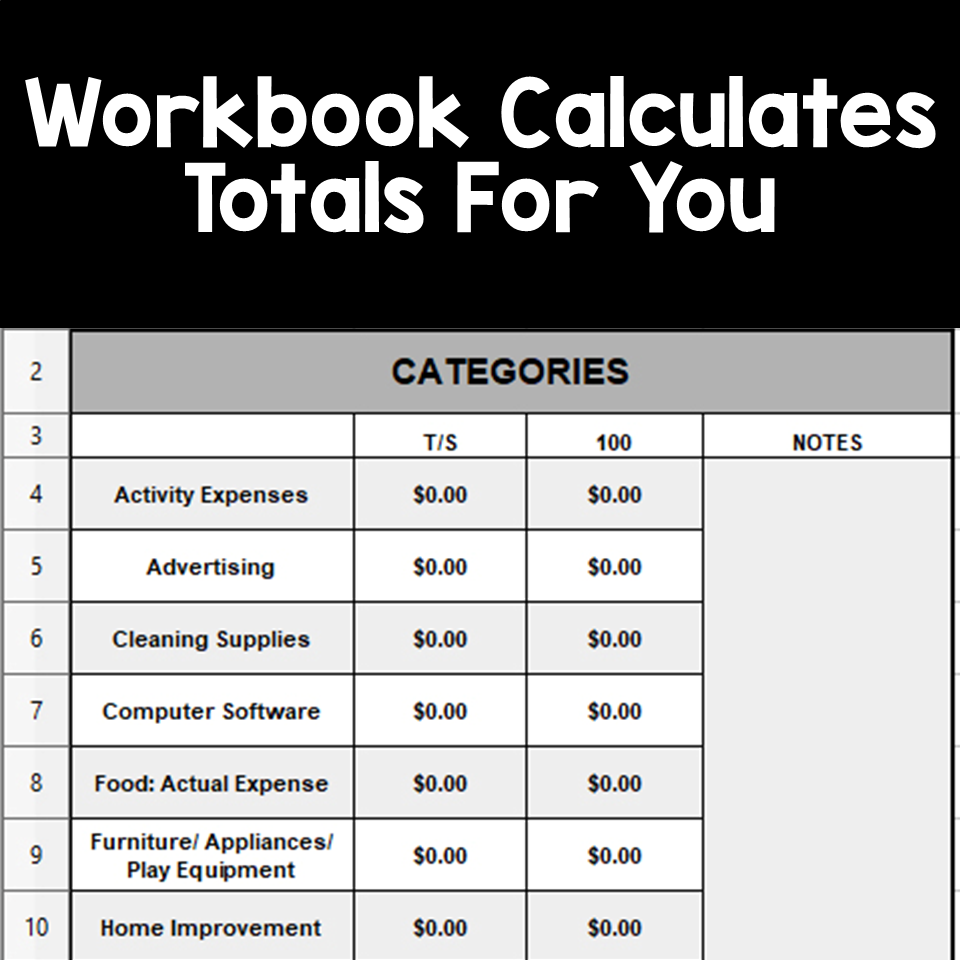

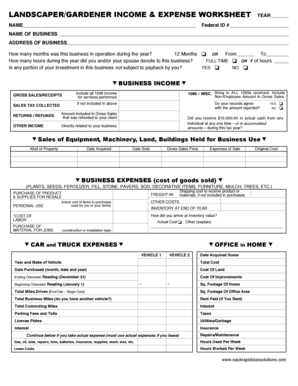

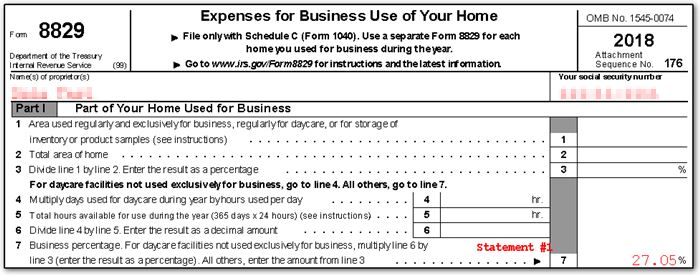

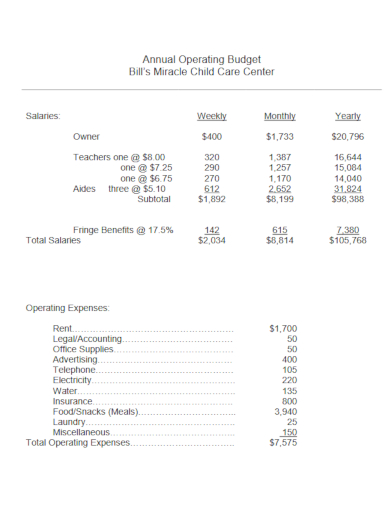

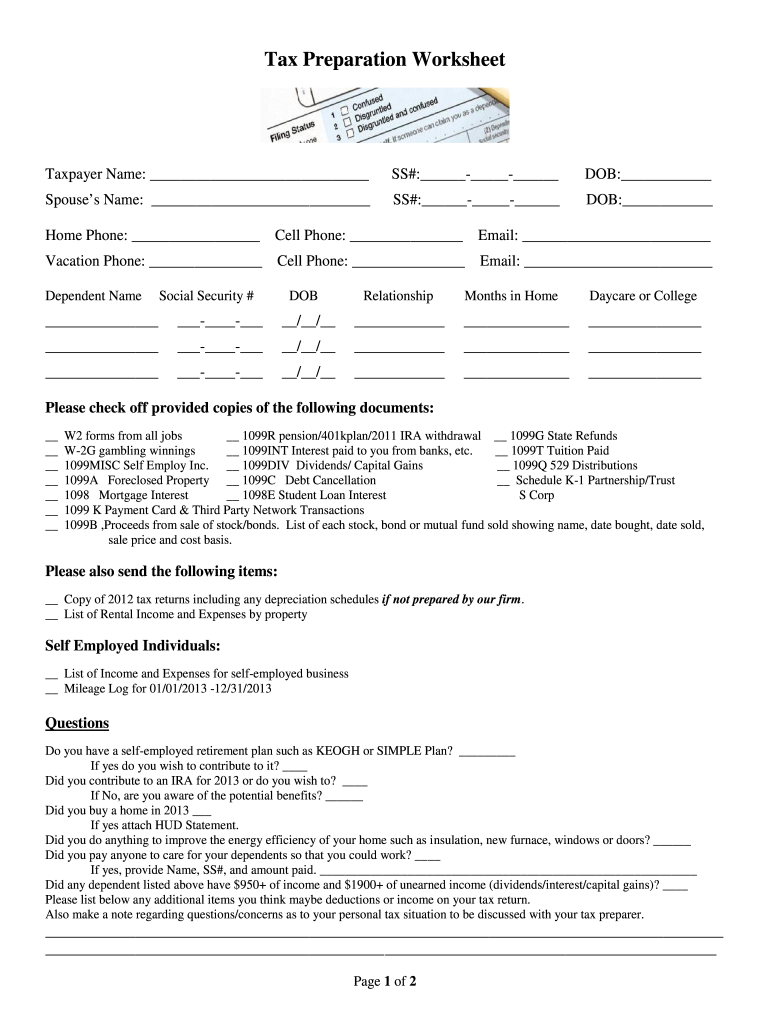

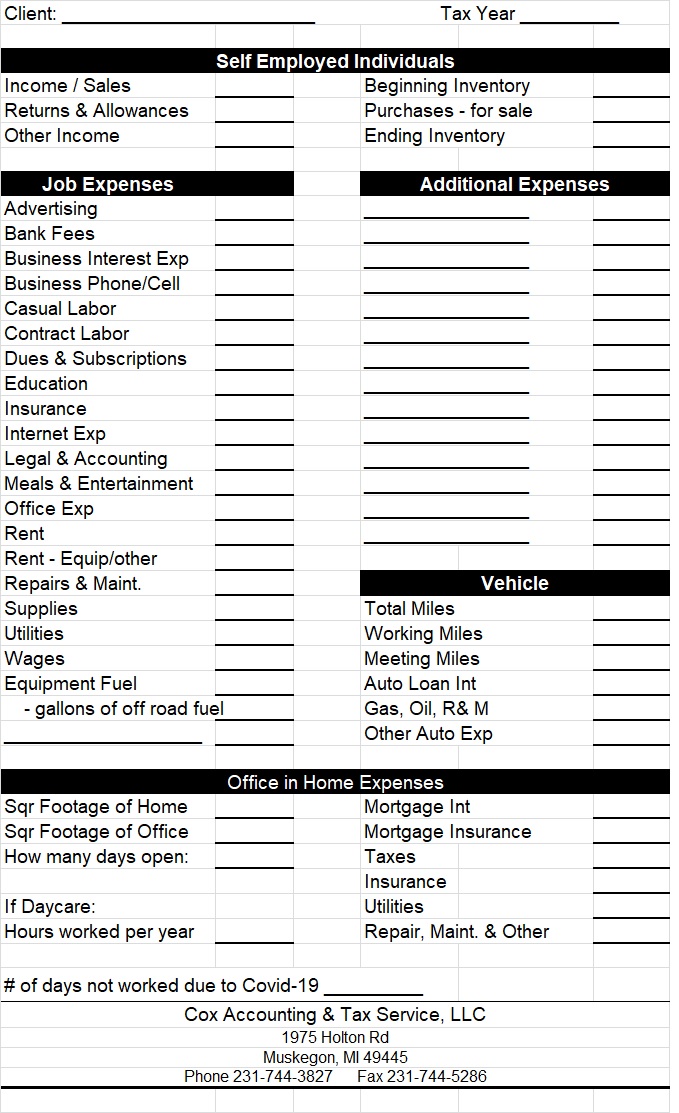

whereimaginationgrows.com › home-daycare-taxHome Daycare Tax Deductions for Child Care Providers Feb 09, 2017 · Home daycare is a unique business and because of this, you can write of things that beginning providers easily miss. Below you will find my list of common home daycare tax deductions. There are so many deductions you can take but please remember that not all may apply to every home daycare and/or there may be some that I have missed. › forms-pubs › about-publication-587About Publication 587, Business Use of Your Home (Including ... Aug 26, 2022 · Publication 587 explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. This publication explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. › publications › p587Publication 587 (2021), Business Use of Your Home If you are filing Schedule C (Form 1040) to report a business use of your home in your trade or business and you are using the simplified method to figure the deduction, use the Simplified Method Worksheet and the Daycare Facility Worksheet in your Instructions for Schedule C for that business use.

Home daycare tax worksheet. › publications › p526Publication 526 (2021), Charitable Contributions - IRS tax forms Worksheet 1. Donations of Food Inventory: See separate Worksheet instructions. (Keep for your records) 1. Enter fair market value of the donated food _____ 2. Enter basis of the donated food _____ 3. Subtract line 2 from line 1. If the result is zero or less, stop here. Don't complete the rest of this worksheet. › publications › p587Publication 587 (2021), Business Use of Your Home If you are filing Schedule C (Form 1040) to report a business use of your home in your trade or business and you are using the simplified method to figure the deduction, use the Simplified Method Worksheet and the Daycare Facility Worksheet in your Instructions for Schedule C for that business use. › forms-pubs › about-publication-587About Publication 587, Business Use of Your Home (Including ... Aug 26, 2022 · Publication 587 explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. This publication explains how to figure and claim the deduction for business use of your home. It includes special rules for daycare providers. whereimaginationgrows.com › home-daycare-taxHome Daycare Tax Deductions for Child Care Providers Feb 09, 2017 · Home daycare is a unique business and because of this, you can write of things that beginning providers easily miss. Below you will find my list of common home daycare tax deductions. There are so many deductions you can take but please remember that not all may apply to every home daycare and/or there may be some that I have missed.

0 Response to "38 home daycare tax worksheet"

Post a Comment