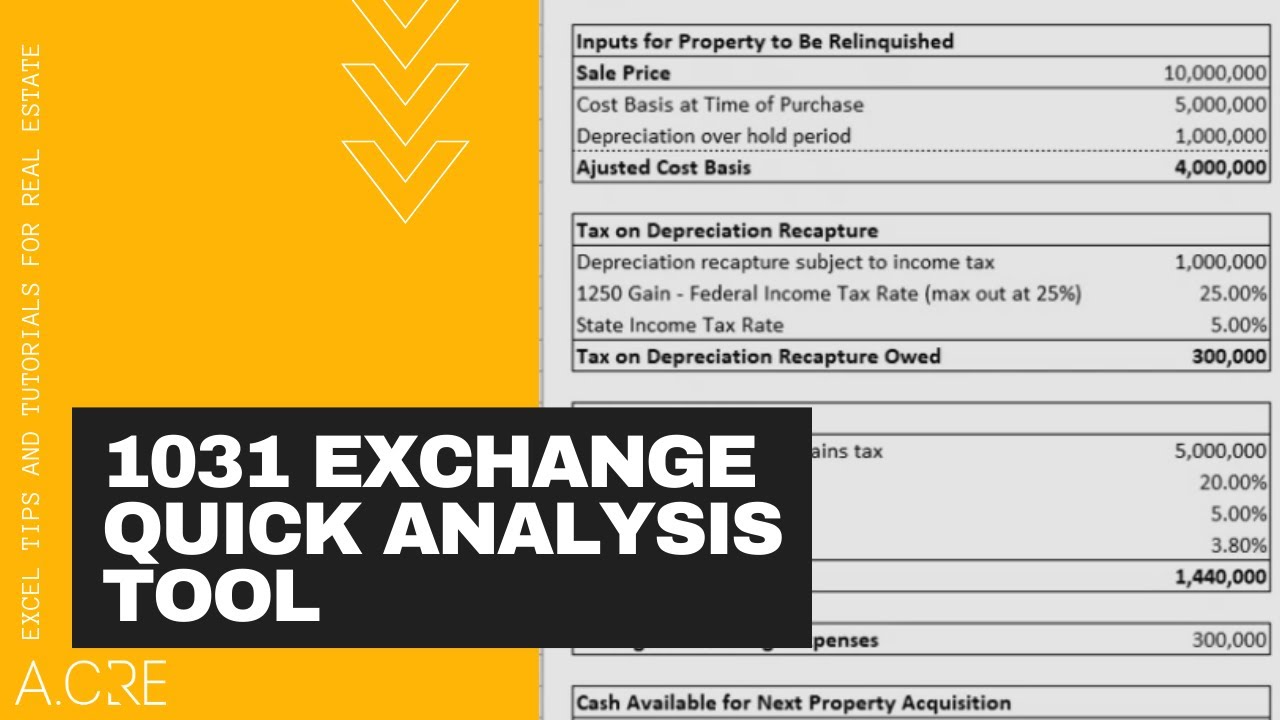

39 1031 exchange calculation worksheet

Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 … Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

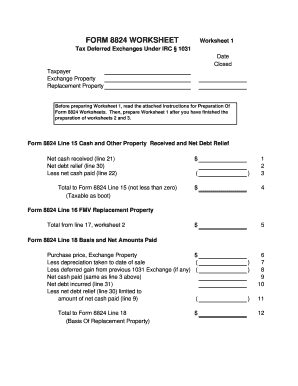

Publication 544 (2021), Sales and Other Dispositions of Assets Worksheet for Foreclosures and Repossessions . Part 1. ... Reporting the exchange. Report the exchange of like-kind property, even though no gain or loss is recognized, on Form 8824, Like-Kind Exchanges. The Instructions for Form 8824 explain how to report the details of the exchange. ... (as defined in Treasury Regulations section 1.1031(a-)3 ...

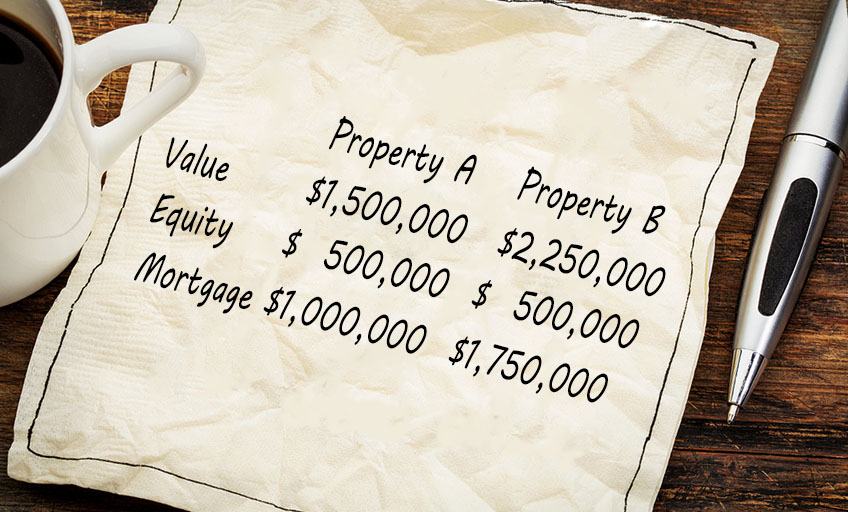

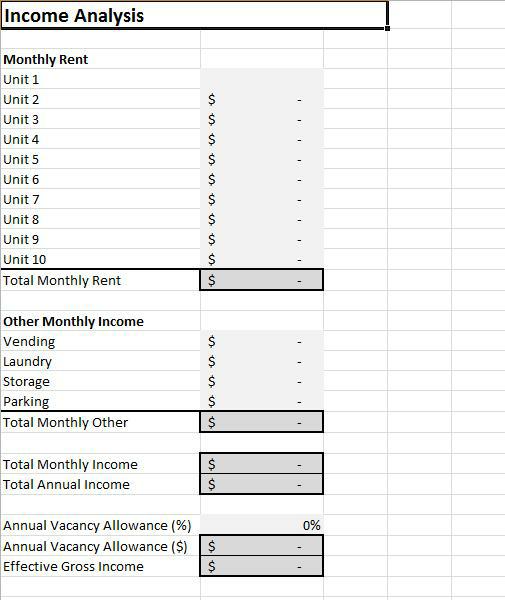

1031 exchange calculation worksheet

2020 Fiduciary Income 541 Tax Booklet | FTB.ca.gov - California Form 706, United States Estate (and Generation‑Skipping Transfer) Tax Return, to figure estate tax imposed by Chapter 11 of the IRC on the decedent’s estate.It also computes the generation-skipping transfer tax imposed by Chapter 13; Form 990T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)); Form 990PF, Return of Private Foundation … Alternative minimum tax - Wikipedia Alternative minimum tax calculation. Each year, high-income taxpayers must calculate and then pay the greater of an alternative minimum tax (AMT) or regular tax. The alternative minimum taxable income (AMTI) is calculated by taking the taxpayer's regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options, … Publication 523 (2021), Selling Your Home | Internal Revenue Service See Like-kind/1031 exchange. ... (see Regulations section 1.1015-5 for further details on this calculation). ... For each number on your “Total” worksheet, figure the business-related portion of that number and enter it on your “Business or Rental” worksheet. You may use different methods to determine the business portion of different ...

1031 exchange calculation worksheet. Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the … May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Net Gains (Losses) from the Sale, Exchange, or Disposition of … Definitions of like-kind properties can be found in IRC Section 1031. Involuntary Conversions Pennsylvania PIT law follows the provisions of IRC Section 1033 for property subject to involuntary conversion (destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) after September 11, 2016. PlayStation userbase "significantly larger" than Xbox even if every … Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

Publication 523 (2021), Selling Your Home | Internal Revenue Service See Like-kind/1031 exchange. ... (see Regulations section 1.1015-5 for further details on this calculation). ... For each number on your “Total” worksheet, figure the business-related portion of that number and enter it on your “Business or Rental” worksheet. You may use different methods to determine the business portion of different ... Alternative minimum tax - Wikipedia Alternative minimum tax calculation. Each year, high-income taxpayers must calculate and then pay the greater of an alternative minimum tax (AMT) or regular tax. The alternative minimum taxable income (AMTI) is calculated by taking the taxpayer's regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options, … 2020 Fiduciary Income 541 Tax Booklet | FTB.ca.gov - California Form 706, United States Estate (and Generation‑Skipping Transfer) Tax Return, to figure estate tax imposed by Chapter 11 of the IRC on the decedent’s estate.It also computes the generation-skipping transfer tax imposed by Chapter 13; Form 990T, Exempt Organization Business Income Tax Return (and proxy tax under section 6033(e)); Form 990PF, Return of Private Foundation …

0 Response to "39 1031 exchange calculation worksheet"

Post a Comment