40 1040 qualified dividends worksheet

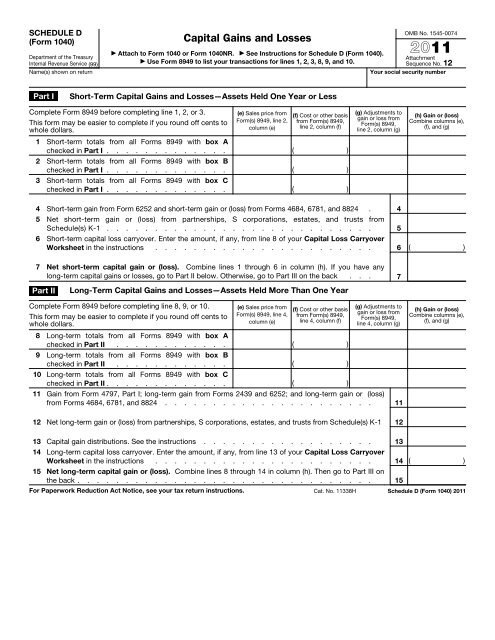

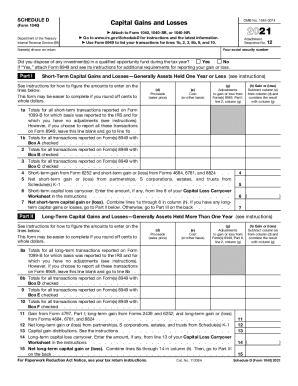

Qualified Dividends and Capital Gain Tax Worksheet. - CCH According to the IRS Form 1040 instructions for line 16: Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 16. Qualified Dividends and Capital Gain Tax Worksheet. Instructions for Form 1040-NR (2021) | Internal Revenue Service Line 3a—Qualified Dividends Exception. Line 3b—Ordinary Dividends Exception. Lines 4a and 4b—IRA Distributions Lines 5a and 5b—Pensions and Annuities Exception 1. Exception 2. Exception 3. Effectively Connected Pension Distributions Fully Taxable Pensions and Annuities Exception. Partially Taxable Pensions and Annuities Exception 1. Exception 2.

Fillable Qualified Dividends and Capital Gain Tax Worksheet Get your Qualified Dividends and Capital Gain Tax Worksheet in 3 easy steps 01 Fill and edit template 02 Sign it online 03 Export or print immediately What is Qualified Dividends and Capital Gain Tax Worksheet 2021? This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure's 'Tax and Credits' section.

1040 qualified dividends worksheet

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. About Schedule B (Form 1040), Interest and Ordinary Dividends Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

1040 qualified dividends worksheet. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). What is a Qualified Dividend Worksheet? - Money Inc If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a." In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10. PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the ... of rates will apply for the whole year. Worksheet Alternative For several years, the IRS has provided a tax computation worksheet in the Form 1040 and 1040A instructions for certain investors ... Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields Country of origin: US File type: PDF

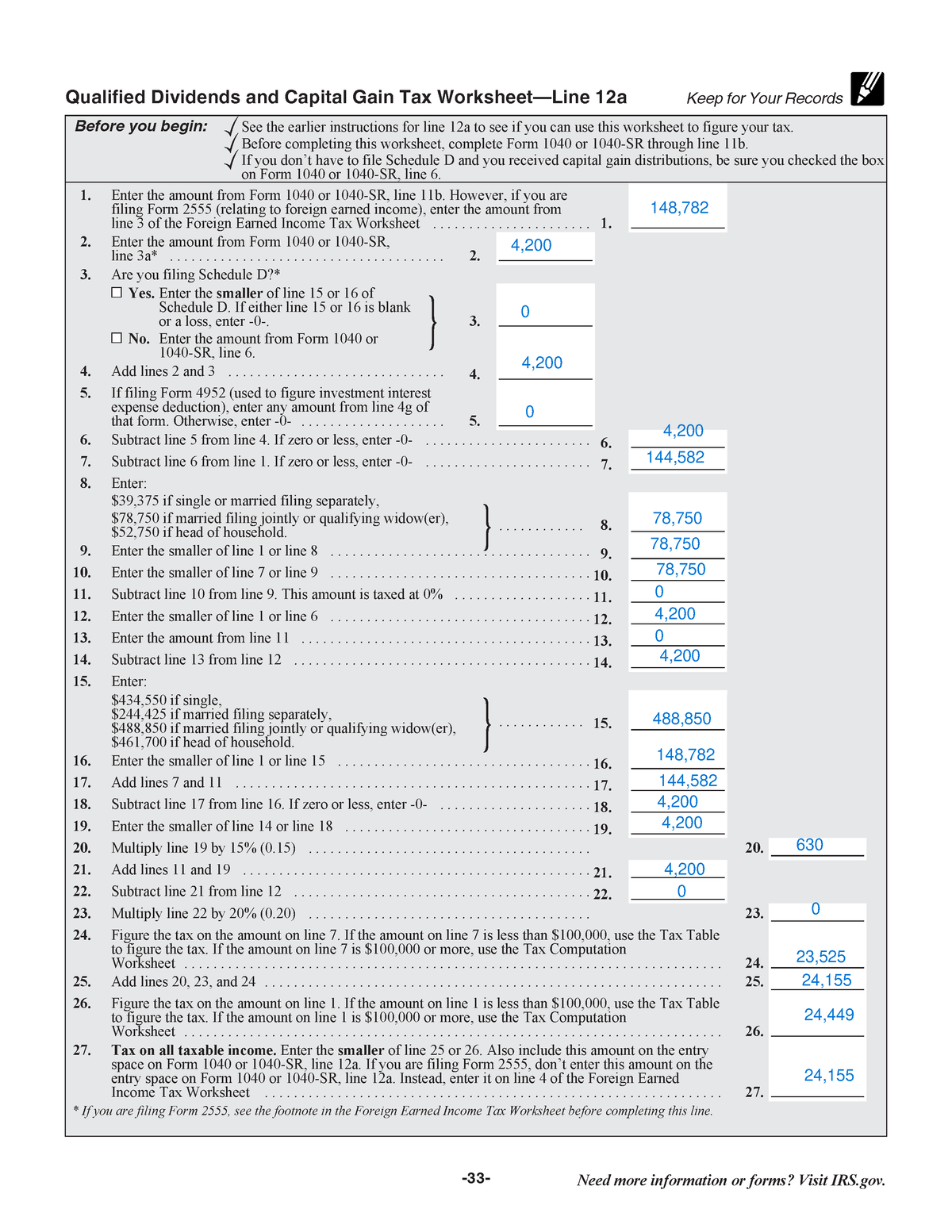

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. It's Line 11a of Form 1040. Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form. Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub... 2018 Qualified Dividends Worksheets - K12 Workbook 2018 Qualified Dividends. Displaying all worksheets related to - 2018 Qualified Dividends. Worksheets are 2018 form 1041 es, 2018 form 1040 es, 2018 estimated tax work keep for your records 1 2a, 44 of 107, Pacific grace tax accounting, Qualified dividends and capital gain tax work an, 2017 qualified dividends and capital gain tax work ...

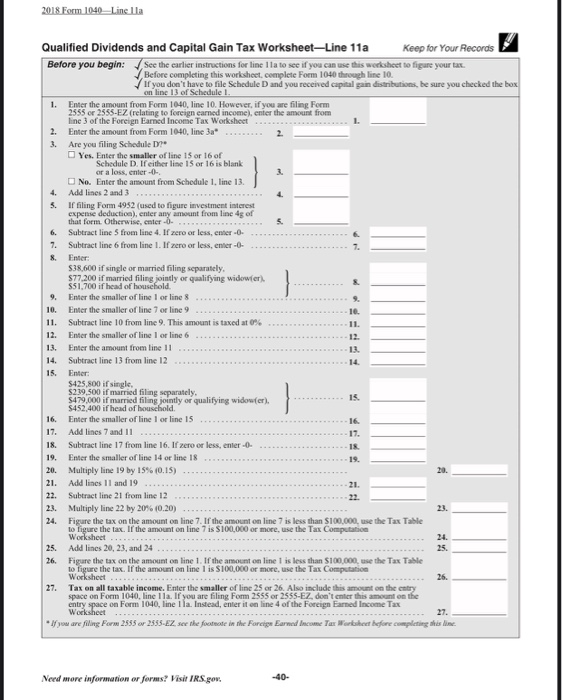

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Qualified Dividends Tax Worksheet PDF Form - FormsPal The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. What are qualified dividends? Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow 2019 form 1040 qualified dividends and capital gain tax worksheet. qualified dividends and capital gain tax worksheet--line 12a. Create this form in 5 minutes! ... capital gains worksheet 2021 qualified dividends and capital gain tax worksheet 2021? signNow combines ease of use, affordability and security in one online tool, all without forcing ... Qualified dividends, on 1040 Schedule D, worksheet, does not… This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet.

PDF Attach to Form 1040, 1040-SR, or 1040-NR. Go to ... (Form 1040) 2022 Income Averaging for Farmers and Fishermen Department of the Treasury Internal Revenue Service Attach to Form 1040, 1040-SR, or 1040-NR. ... Tax Computation Worksheet, Qualified Dividends and Capital Gain Tax Worksheet, or Schedule D Tax Worksheet. Attach Schedule J only if you are using it to figure your tax. Schedule J (Form ...

How Dividends Are Taxed and Reported on Tax Returns - The Balance Dividends can be taxed at either ordinary income tax rates or at the lower long-term capital gains tax rates. Dividends that qualify for long-term capital gains tax rates are referred to as "qualified dividends." In 2022, ordinary income tax rates range from 10% and 37% while long-term capital gains tax rate is capped at 20%. 1 2.

How to Figure the Qualified Dividends on a Tax Return Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the...

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ...

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ...

How do I generate the Worldwide Qualified Dividends and Capital Gains ... Individual Tax return - Form 1040 Worksheet View Procedure Could you please follow the below mentioned steps : Go to Worksheet View>Federal section>Foreign section Form 1116>Foreign tax credit>Passive category>Section 10>Other>Line 13 Elect to not calculate rate differential>Uncheck the Box Calculate the tax return Additional Information

Qualified Dividends and Capital Gain Tax Worksheet - Course Hero Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D.

1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

2021 Instructions for Schedule D (2021) | Internal Revenue Service If there is an amount in box 2d, include that amount on line 4 of the 28% Rate Gain Worksheet in these instructions if you complete line 18 of Schedule D. If you received capital gain distributions as a nominee (that is, they were paid to you but actually belong to someone else), report on Schedule D, line 13, only the amount that belongs to you.

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Solved: On my 1040, ordinary dividends include qualified dividends in ... Qualified dividends also are included in the ordinary dividend total required to be shown on line 3b. " So qualified dividends end up being in Adjusted Gross Income, even though they are taxed differently (you should be able to find a Qualified Dividend/Capital Gains Worksheet showing the calculation).

About Schedule B (Form 1040), Interest and Ordinary Dividends Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

0 Response to "40 1040 qualified dividends worksheet"

Post a Comment