40 itemized deduction worksheet 2015

Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) On average this form takes 18 minutes to complete. The Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) form is 1 page long and contains: 0 signatures. Itemized Deduction Worksheet - Picket Fence Tax Preparation Service We created this worksheet to help make it easy to pull your tax paperwork together. For a downloadable copy click here: Itemized Deduction Worksheet 7 Overlooked Itemized Deductions Medical mileage: Did you know you can deduct mileage, tolls and parking for all the doctors and dentist visits as well as trips to the pharmacy or hospital.

Download Itemized Deductions Calculator Excel Template Whereas the itemized deductions are actual amounts of deductions claimed. When deciding between standard and itemized deductions the following points must be considered: Total of the all the itemized deductions should be higher than the standard deduction amount. You must have proper documents to support the claim whenever demanded by the IRS.

Itemized deduction worksheet 2015

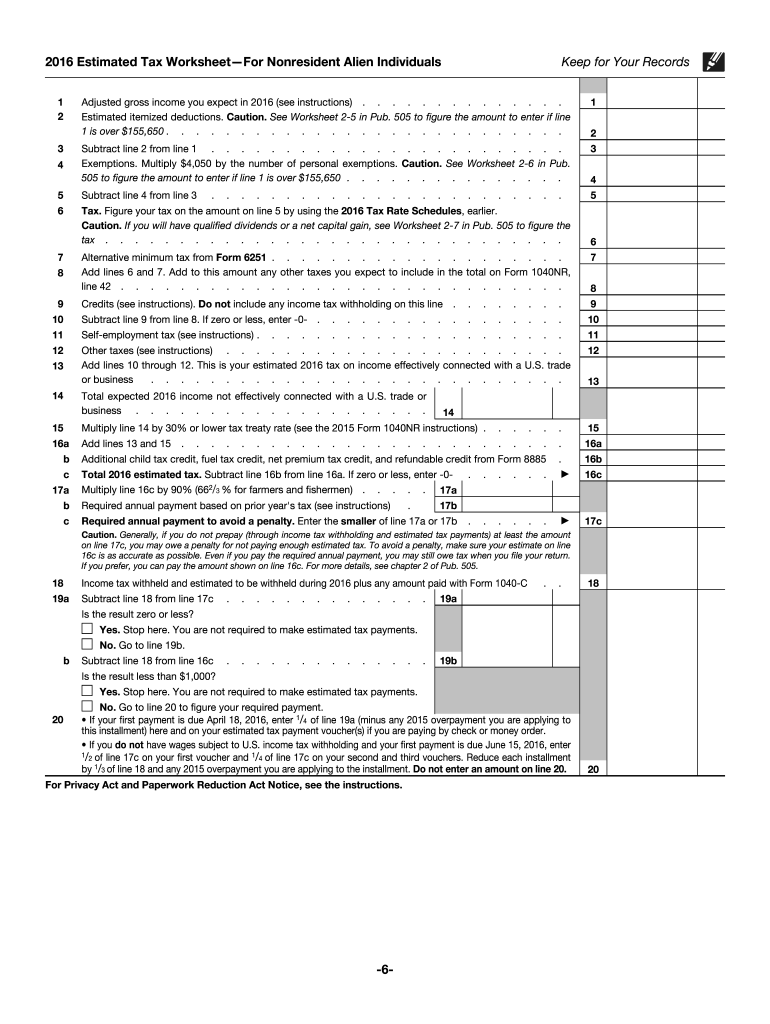

Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre- PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A Get Printable Itemized Deductions Worksheet - US Legal Forms Turn on the Wizard mode in the top toolbar to have more pieces of advice. Fill in every fillable area. Make sure the data you fill in Printable Itemized Deductions Worksheet is updated and correct. Indicate the date to the record using the Date option. Select the Sign tool and create an electronic signature.

Itemized deduction worksheet 2015. Schedule A – Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance Deductions | FTB.ca.gov - California 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction 2. $1,100 3. Enter the larger of line 1 or line 2 here 3. 4. Enter amount shown for your filing status: Single or married/RDP filing separately, enter $4,803 2015 ITEMIZED DEDUCTIONS WORKSHEET - static.contentres.com 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. What Is an Itemized Deduction? - The Balance The total amount of the itemized deductions you could claim used to be reduced by 3% of the amount by which your AGI exceeded that year's threshold, up to 80% of your total itemized deductions. This is no longer the case. The TCJA has repealed the Pease limitations through 2025 when the law will expire unless Congress acts to renew it. 14 15

Itemized Deduction Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Schedule A Itemized Deductions ReloadOpenDownload 2. Deductions (Form 1040) Itemized - ReloadOpenDownload 3. Itemized Deductions Worksheet ReloadOpenDownload 4. Itemized Deduction Worksheet TAX YEAR ReloadOpenDownload 5. PERSONAL ITEMIZED DEDUCTIONS WORKSHEET - ReloadOpenDownload 6. Itemized deduction - Wikipedia A taxpayer can only deduct the amount of miscellaneous itemized deductions that exceed 2% of their adjusted gross income. [6] For example, if a taxpayer has adjusted gross income of $50,000 with $4,000 in miscellaneous itemized deductions, the taxpayer can only deduct $3,000, since the first $1,000 is below the 2% floor. itemized deduction worksheet 8 Best Images of Monthly Bill Worksheet - 2015 Itemized Tax Deduction Worksheet Printable, Free. 8 Pictures about 8 Best Images of Monthly Bill Worksheet - 2015 Itemized Tax Deduction Worksheet Printable, Free : Itemized Tax Deduction Worksheet Oaklandeffect Deductions — db-excel.com, Goodwill Donation Spreadsheet Template Google Spreadshee goodwill donation spreadsheet template and also ... PDF Itemized Deductions Worksheet-Line 15 2016 - 1040.com No. Stop. Your deduction is not limited. Enter the amount from line 1 above on Schedule A, line 15. Yes. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Total itemized deductions. Subtract line 9 from line 1. Enter the result here and on Schedule A, line 15 WK_A_NR.LD Name(s) as shown on return Tax ...

recoveries of itemized deductions worksheet 29 Itemized Deduction Worksheet 2015 - Worksheet Resource Plans starless-suite.blogspot.com. itemized worksheet deductions 2002 deduction 1040 tax irs archives main. 5 Best Images Of Itemized Tax Deduction Worksheet - 1040 Forms Itemized Deductions Worksheet . PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to: itemized deductions worksheet Itemized Deduction Wor 2015 Itemized Deductions Worksheet — Db-excel.com db-excel.com. itemized deduction deductions wor. 12 Best Images Of Self -Employed Tax Worksheet - Free Self-Esteem Building Worksheets, Personal . PDF Form IT-203-B:2015:Nonresident and Part-Year Resident Income Allocation ... And College Tuition Itemized Deduction Worksheet Name(s) and occupation(s) as shown on Form IT-203 Your social security number Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203. Schedule A - Allocation of wage and salary income to New York State Nonworking days included in line 1a:

2015 ITEMIZED DEDUCTIONS WORKSHEET - saralandtax.com 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

2014 itemized deductions worksheet 30 Itemized Deductions Worksheet 2015 - Worksheet Information. 8 Pictures about 30 Itemized Deductions Worksheet 2015 - Worksheet Information : 10 Best Images of 2014 Itemized Deductions Worksheet - 1040 Forms, 8 Best Images of Tax Itemized Deduction Worksheet - IRS Form 1040 and also 8 Best Images of Tax Itemized Deduction Worksheet - IRS Form 1040.

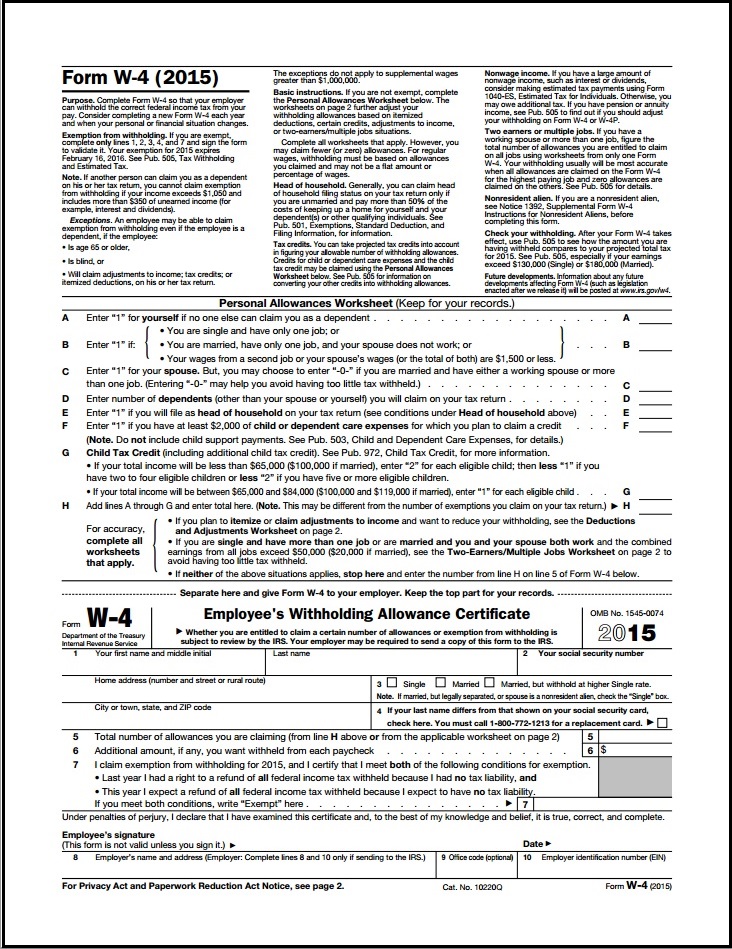

How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

Itemized Deductions Worksheet 2015 - Worksheet List DD9 8 Best Images of Monthly Bill Worksheet - 2015 Itemized Tax Deduction ... How to Fill Out a Form W-4 (2019 Edition) 10 Best Images of 2014 Itemized Deductions Worksheet - 1040 Forms ... Job Vacancy In Nepal Bank Limited - Job Finder in Nepal ... 1992-93 Ferguson's Ceylon Directory.

An Overview of Itemized Deductions - Investopedia This final category of itemized deductions includes items such as gambling losses to the extent of gambling winnings, losses from partnerships or subchapter S corporations, estate taxes on income...

Solved: Itemized deduction worksheet? - Intuit June 1, 2019 5:05 PM. TurboTax will automatically select the type of deduction that brings you the most tax benefit based off of your entries within the program. You can view your Scheule A: Itemized Deductions by taking the following steps: 1.) In the upper right-hand corner, click Forms.

About Schedule A (Form 1040), Itemized Deductions Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current Revision Schedule A (Form 1040) PDF Instructions for Schedule A (Form 1040) | Print Version PDF | eBook (epub) EPUB Recent Developments

PDF 19 2021 Itemized Deduction (Sch A) Worksheet - cotaxaide.org 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors.

Get Printable Itemized Deductions Worksheet - US Legal Forms Turn on the Wizard mode in the top toolbar to have more pieces of advice. Fill in every fillable area. Make sure the data you fill in Printable Itemized Deductions Worksheet is updated and correct. Indicate the date to the record using the Date option. Select the Sign tool and create an electronic signature.

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

0 Response to "40 itemized deduction worksheet 2015"

Post a Comment