42 form 1023 ez eligibility worksheet

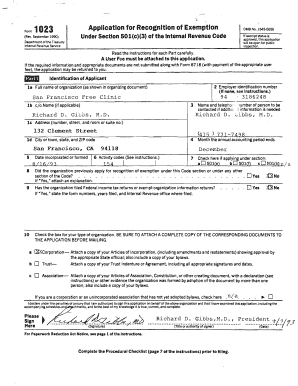

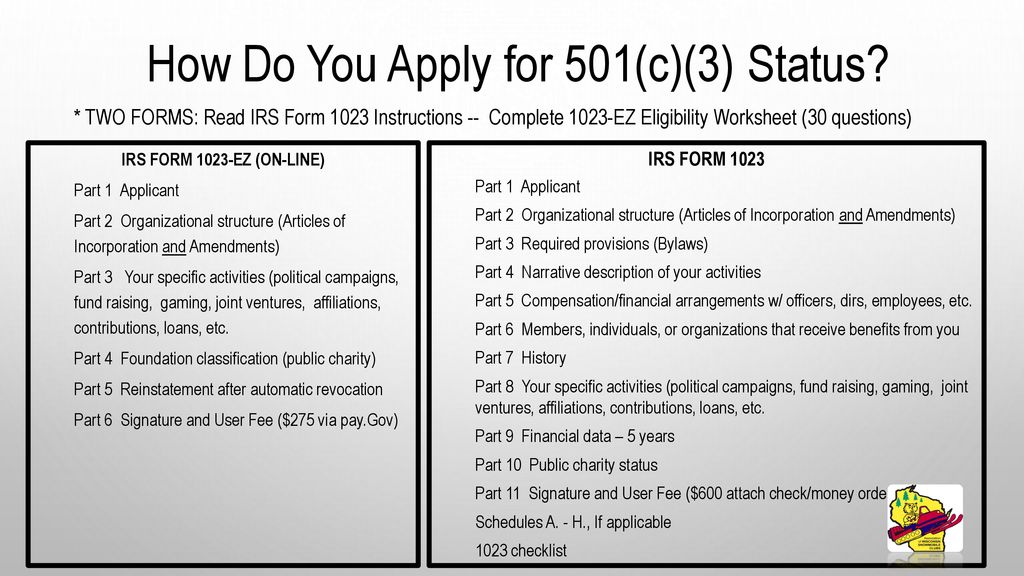

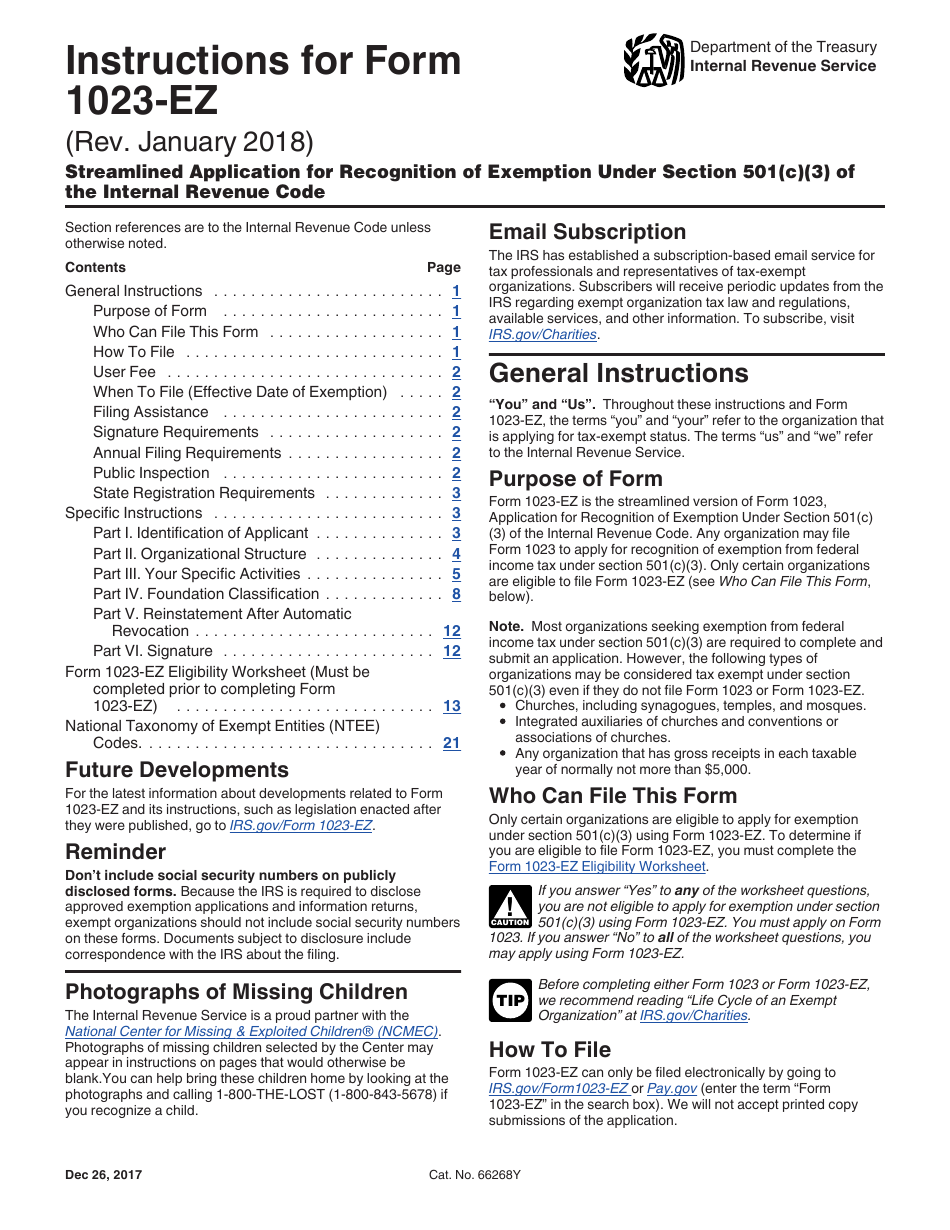

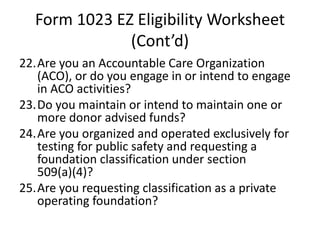

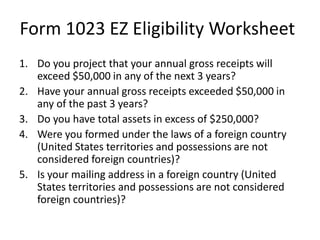

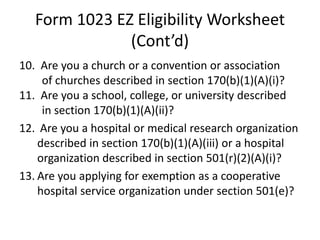

How to Start a Nonprofit in Michigan| 10-Step Guide 11.05.2022 · To file Form 1023-EZ you must answer “no” to all the questions asked on the eligibility worksheet. Form 1023-EZ has a $275 fee. If you answered “yes” to any of the eligibility worksheet questions, you would need to fill out Form 1023 and pay the $600 fee. Michigan State Tax Exemptions . All nonprofits in the state of Michigan are exempt from its 6% … About Form 1023, Application for Recognition of Exemption … You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. Current Revision. To submit Form 1023, you must: Register for an account on Pay.gov. Enter "1023" in the search box and select Form 1023. Complete the …

Instructions for Form 1023 (01/2020) | Internal Revenue Service Complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. You can visit IRS.gov/Charities for more information on application requirements. Leaving a group exemption. A subordinate organization under a group exemption can use Form 1023 to leave the group and obtain individual …

Form 1023 ez eligibility worksheet

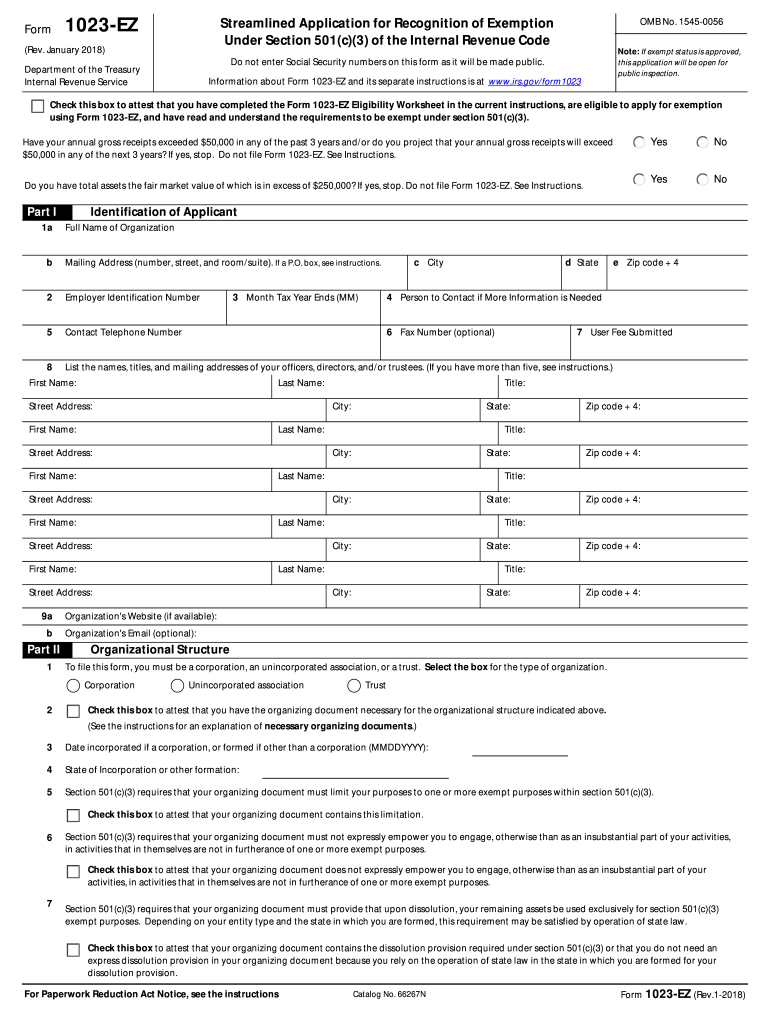

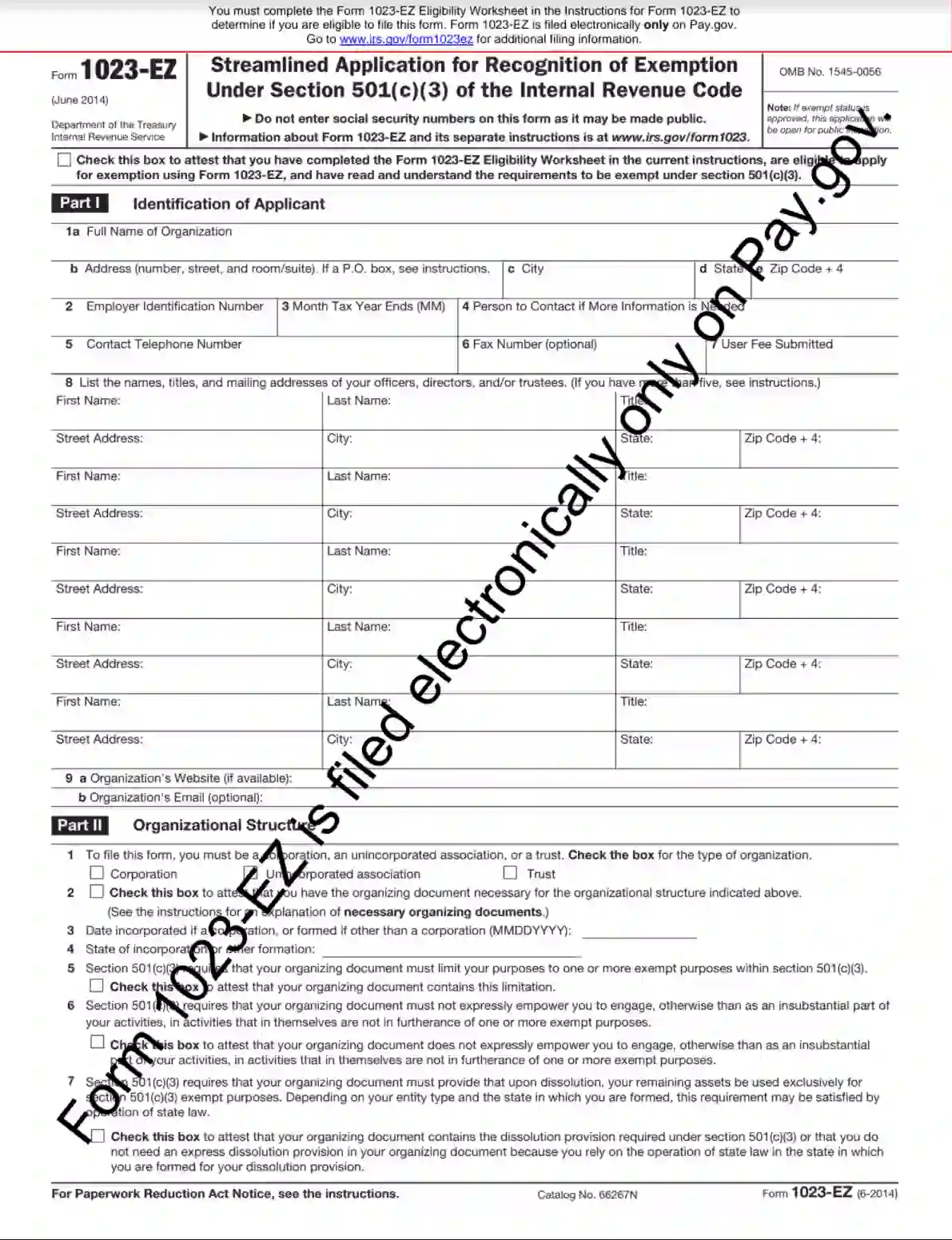

Form 1023-EZ (June 2014) - IRS tax forms Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant . 1a . Full Name of Organization. b Filing Your Nonprofits Tax Exempt Forms: 1023 vs. 1023 EZ Form 1023-EZ: Eligibility Criteria For determination of whether your nonprofit meets eligibility criteria for completing the EZ version of Form 1023, fill out this Eligibility Worksheet . If even a single time you must answer "yes" to one of the 30 questions, your organization is not eligible for the shortcut and must fill out the standard Form 1023. PlayStation userbase "significantly larger" than Xbox even if … Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

Form 1023 ez eligibility worksheet. Instructions for Form 1023-EZ (01/2018) - IRS tax forms 20.12.2019 · Before completing the Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you meet the eligibility requirements, you must check the box at the top of Form 1023-EZ to attest that you are eligible to file the form. By checking the box, you are also attesting that you have read and understand the requirements to be exempt ... Form 1023-EZ Revisions | Internal Revenue Service - IRS tax forms 05.10.2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must file a full ... Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Before completing either Form 1023 or Form 1023-EZ, we recommend … About Form 1023-EZ, Streamlined Application for Recognition of ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ...

PlayStation userbase "significantly larger" than Xbox even if … Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Filing Your Nonprofits Tax Exempt Forms: 1023 vs. 1023 EZ Form 1023-EZ: Eligibility Criteria For determination of whether your nonprofit meets eligibility criteria for completing the EZ version of Form 1023, fill out this Eligibility Worksheet . If even a single time you must answer "yes" to one of the 30 questions, your organization is not eligible for the shortcut and must fill out the standard Form 1023. Form 1023-EZ (June 2014) - IRS tax forms Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption using Form 1023-EZ, and have read and understand the requirements to be exempt under section 501(c)(3). Part I Identification of Applicant . 1a . Full Name of Organization. b

0 Response to "42 form 1023 ez eligibility worksheet"

Post a Comment