38 worksheet for figuring net earnings loss from self employment

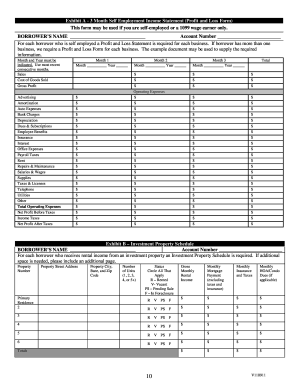

PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. PDF FHA Self-Employment Income Calculation Worksheet Job Aid The FHA Self-Employment Income Calculation Worksheet, which is located at . wholesale.franklinamerican.com under Forms > FHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self-employment business per borrower. • A new worksheet will need to be used for ...

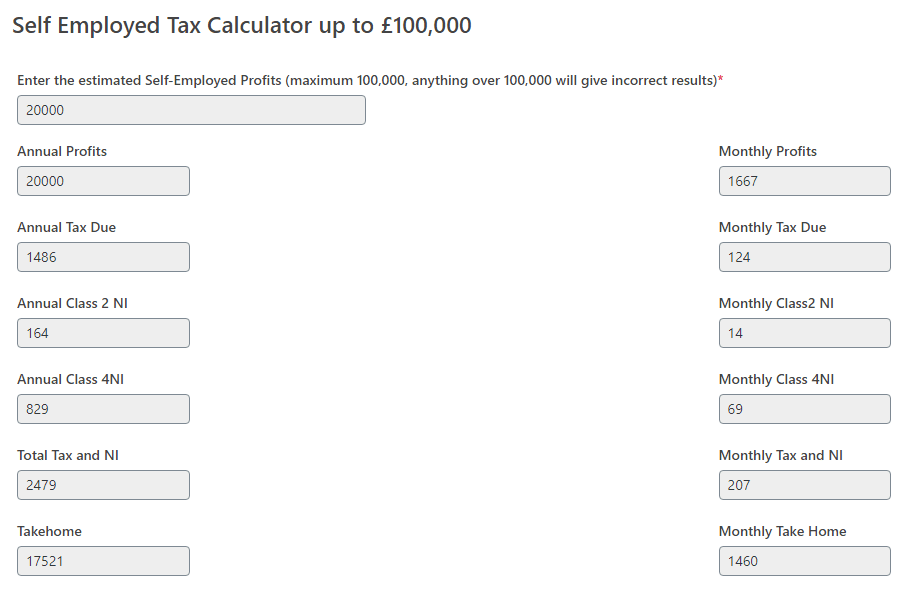

Self Employed Tax Deductions Worksheet Form - Fill Out and Sign ... The total self-employment tax is 15.3% of your net earnings and consists of two parts. The first part is Social Security at 12.4×. The law sets a maximum amount of net earnings that is subject to the Social Security tax. Anything over that amount is not subject to the tax.

Worksheet for figuring net earnings loss from self employment

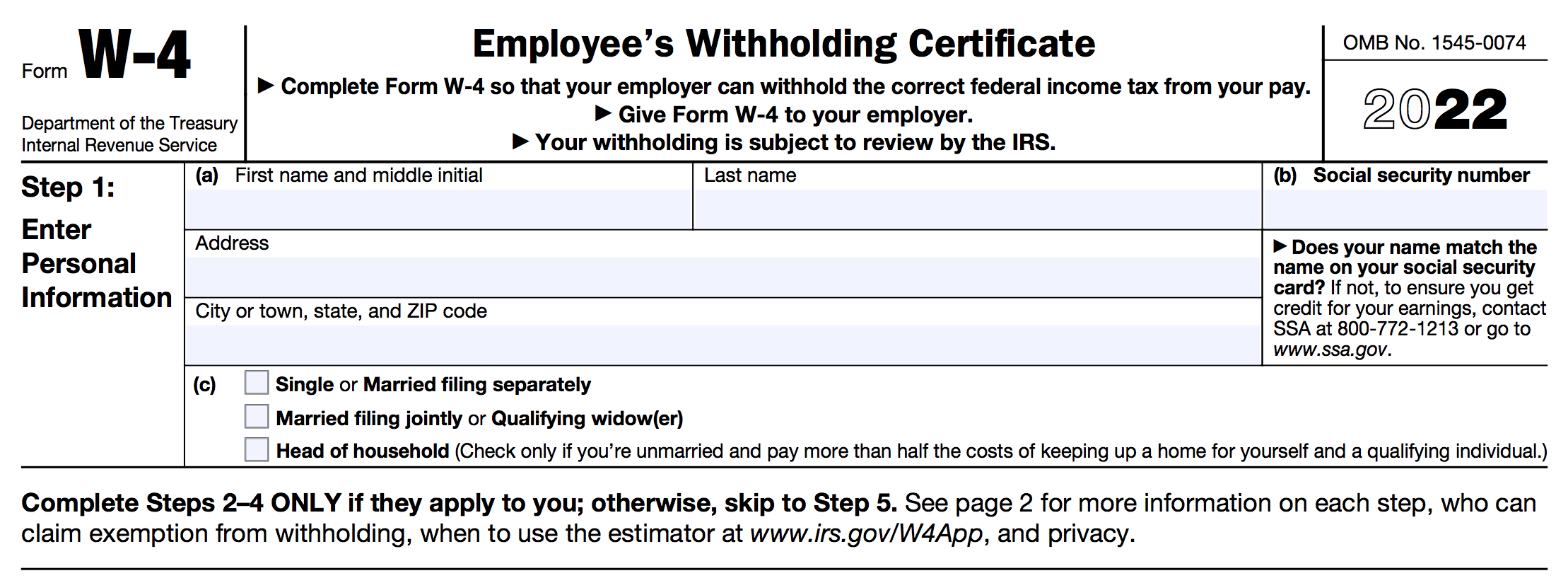

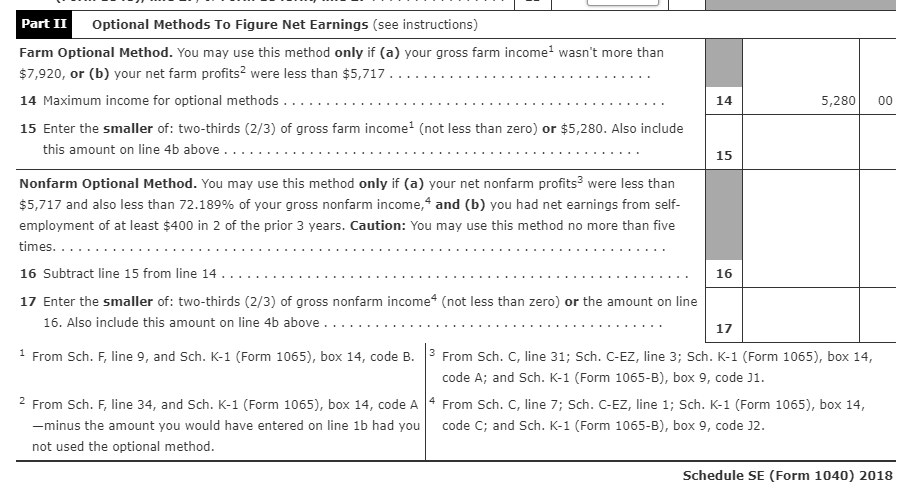

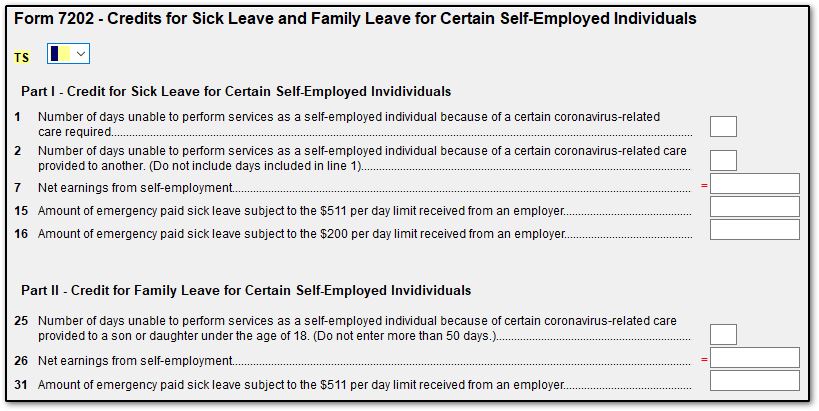

Calculating Your Net Earnings From Self-Employment You must complete the following federal tax forms by April 15 following any year in which you have net earnings of $400 or more: Form 1040 (U.S. Individual Income Tax Return). Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) as appropriate. Schedule SE (Self-Employment Tax). 1065-US: Calculating Schedule K, line 14a - Net earnings from self ... UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items. How To Calculate Net Earnings (loss) From Self-employment Calculate net earnings from self employment. You can't simply multiply your net profit on schedule c by 10%. To do this, multiply the net income by 92.35 percent. Find your net profit before taking exemptions or paying taxes (from schedule c of your tax return) for the two most recent years you filed taxes. You must use form 1040 for your tax ...

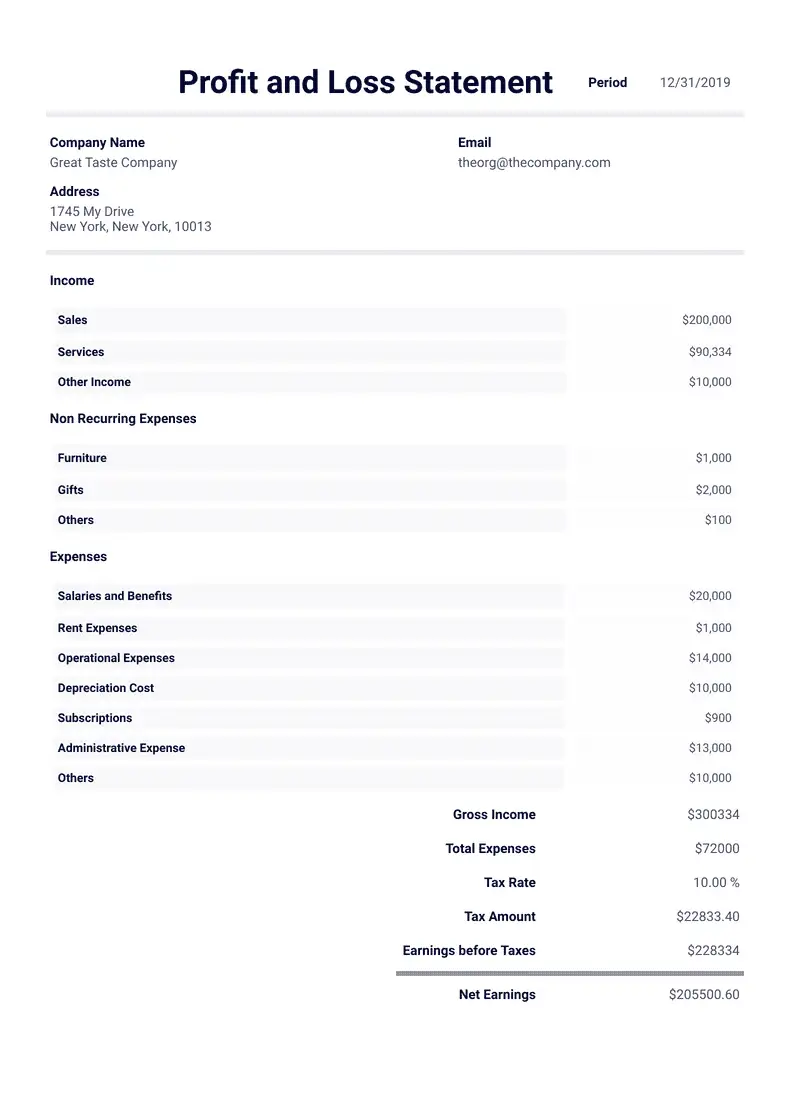

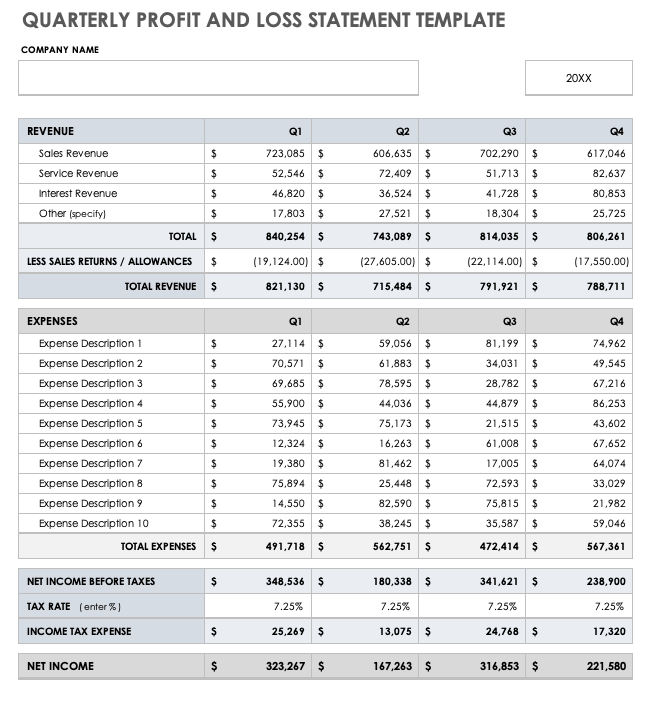

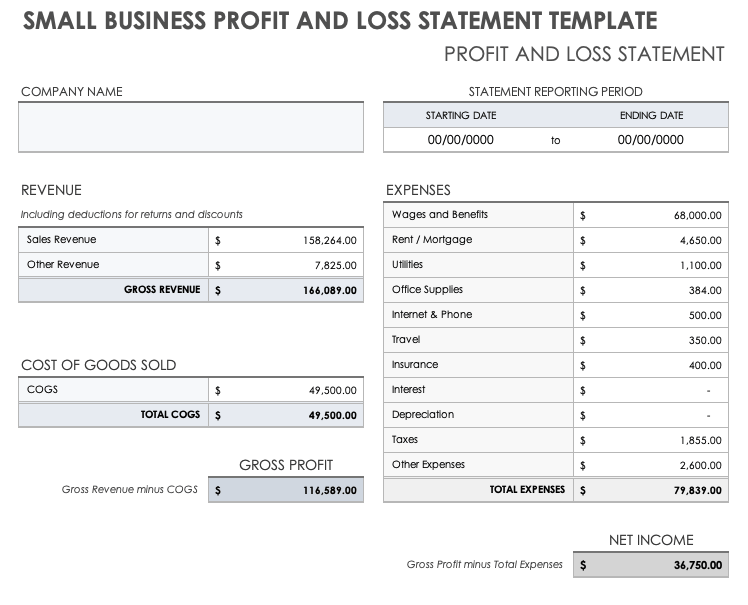

Worksheet for figuring net earnings loss from self employment. SSA Handbook § 1200 - Social Security Administration To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A). SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income Liquidity ratios Rental income Get the worksheets Net Earnings (Loss) Definition | Law Insider Worksheet for Figuring Net Earnings (Loss) From Self-Employment 1a Ordinary income (loss) (Schedule K, line 1) b Net income (loss) from certain rental real estate activities (see instructions) c Net income (loss) from other rental activities (Schedule K, line 3c) d Net loss from Form 4797, Part II, line 18, included on line 1a above. Simple Profit and Loss Statement for the Self-Employed If you're a self-employed worker or business owner, a profit and loss statement is an absolute necessity to: Reveal if your business is profitable or losing money, Provide the information you need to make sound business decisions, and Report financial information to interested parties, including your accountant, tax attorney, investors, and banks.

Self-Employed Individuals - Calculating Your Own Retirement-Plan ... You can use the Table and Worksheets for the Self-Employed (Publication 560) to find the reduced plan contribution rate to calculate the plan contribution and deduction for yourself. Deducting retirement plan contributions Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan. self employed income calculation worksheet Worksheet for figuring net earnings loss from self employment. Schedule c income. ... Worksheet For Figuring Net Earnings Loss From Self Employment nofisunthi.blogspot.com. figuring calculation taxes. 35 Fannie Mae Rental Income Calculation Worksheet - Worksheet Source 2021 dontyou79534.blogspot.com. Reporting Self-Employment Income to the Marketplace Filling out your Marketplace application On your Marketplace application, you'll report your net income from your self-employment. (Net income is sometimes called "profit.") If your self-employment income is higher than your business expenses, you report this net income. If your business expenses are higher than your income, you report a net loss. How to Calculate Self-Employment Income - Experian Calculating Your Income for a Mortgage Application. Mortgage lenders like to see stability—long employment histories and steady income. Most prefer to see at least two years of self-employment to show your ability to generate income over time. To calculate your monthly income for a mortgage application, start with this simple formula:

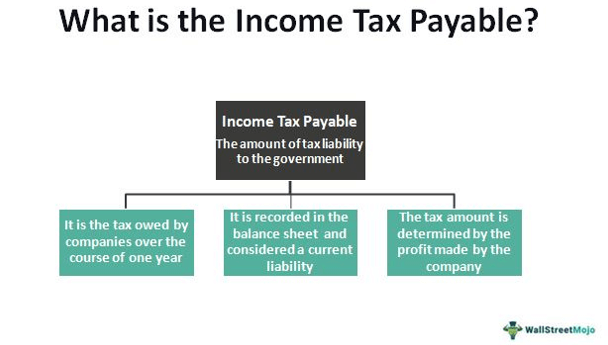

SI 00820.210 How to Determine Net Earnings from Self-Employment (NESE) Apply the monthly net loss first to the member of the couple who incurred the loss. Then apply any balance of the monthly net loss to the earned income of the spouse. In couples cases where there is no leftover net loss from self-employment to apply to the spouse, follow the instructions for an individual in SI 00820.210B.2.b. 2021 Instructions for Schedule SE (2021) | Internal Revenue Service Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. FHA Self-Employment Income Calculation Worksheet FHA Self-Employment Income Calculation Worksheet. Previous post: USDA REO Net Rental Income Loss worksheet. Next post: FHA Refinance Worksheets. Recent Posts. Guaranty Home Mortgage Announces New Mortgage Loan Originators; Guaranty Home Mortgage Donates to There With Care & Nashville Children's Alliance; SI 00820.200 Net Earnings from Self-Employment (NESE) If a determination is made that the activity does not result in wages or NESE, then the income derived by the activity is unearned income. Sometimes, just one different factor in two similar cases can result in each case being treated differently. The examples in SI 00820.200C. illustrate how specific factors of a case may result in a different ...

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai After all, a self-employed taxpayer will owe 15.3% on their earnings from self-employment or Social Security and Medicare taxes. After you calculate your net earnings from self-employment, multiply it by the self-employed tax rate and you'll see how much you'll owe Uncle Sam. If you are concerned with how much you'll owe, don't worry.

How To Calculate Self Employment Income for a Mortgage | 2022 To get approved, you'll need: A FICO score of at least 580. A debt-to-income ratio below 50 percent. A 3.5% down payment. It's possible to find an FHA lender willing to approve a loan even if your credit score falls as low as 500, but the lender would require a 10 percent down payment instead of the usual 3.5 percent.

Self-Employed Borrower Tools by Enact MI Determining a self-employed borrower's income isn't always straightforward. That's why we've developed several self-employed borrower calculators to help you calculate and analyze their assets properly. ... Form 92 Net Rental Income Calculations - Schedule E updated. UPDATED Rental Income Calculator (2021-2020) ... Use this worksheet to ...

Net Earnings from Self-Employment - SocialSecurityHop.com To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A).

Understanding Schedule K-1 self-employment income for partners ... - Intuit The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income?

5 look at the worksheet for figuring net earnings - Course Hero - In general, Line1, 3c, and 4 are involved in the calculation of Self-Employment income. Line 1---Ordinary business income (Loss) Line 3C---Other net rental income (Loss) Line 4---Guaranteed payments to partners - In a partner's self-employment income, the guaranteed payment included are payments to partners derived from a trade or business.

How do I generate Schedule SE, page 2 in an Individual return using ... Self employment income entered will automatically produce Schedule SE if earnings are above $400. Business Income: Go to the Income/Deductions > Business worksheet. Select section 2 - Income and Cost of Goods Sold . Enter line 1 - Gross Receipts or sales. Partnership Passthrough: Go to the Income/Deductions > Partnership Passthrough worksheet.

Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) SELF-EMPLOYMENT EARNINGS (LOSS) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership.

PDF SELF EMPLOYMENT INCOME WORKSHEET - caclmt.org - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify sources): 3. Total Gross Income

Schedule K Line 14a (Form 1065) Calculating Self-Employment Earnings Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Return tab. Scroll down to the Federal Tax Options section.

Line 14a net earnings loss from self employment use - Course Hero Net Earnings (Loss) From Self-Employment Use the Worksheet for Figuring Net Earnings (Loss) From Self-Employment in theseinstructions. Schedule K. Enter on line 14a the amountfrom line 5 of the worksheet. Schedule K-1. Do not complete this line forany partner that is an estate, trust,corporation, exempt organization, or IRA.

How To Calculate Net Earnings (loss) From Self-employment Calculate net earnings from self employment. You can't simply multiply your net profit on schedule c by 10%. To do this, multiply the net income by 92.35 percent. Find your net profit before taking exemptions or paying taxes (from schedule c of your tax return) for the two most recent years you filed taxes. You must use form 1040 for your tax ...

1065-US: Calculating Schedule K, line 14a - Net earnings from self ... UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. General Partner and LLC Member (SE Income) calculate SE for all applicable items.

Calculating Your Net Earnings From Self-Employment You must complete the following federal tax forms by April 15 following any year in which you have net earnings of $400 or more: Form 1040 (U.S. Individual Income Tax Return). Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) as appropriate. Schedule SE (Self-Employment Tax).

0 Response to "38 worksheet for figuring net earnings loss from self employment"

Post a Comment