42 foreign earned income tax worksheet

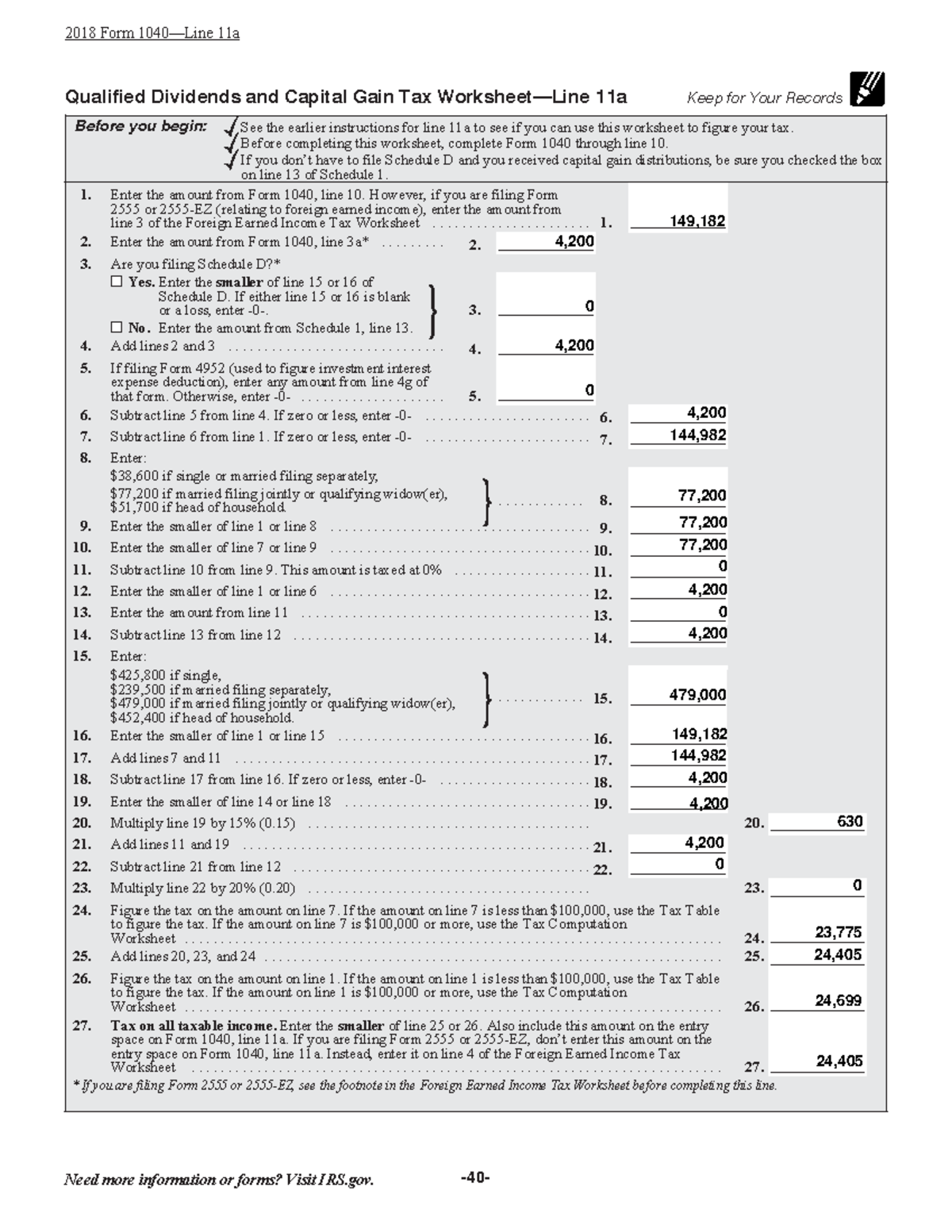

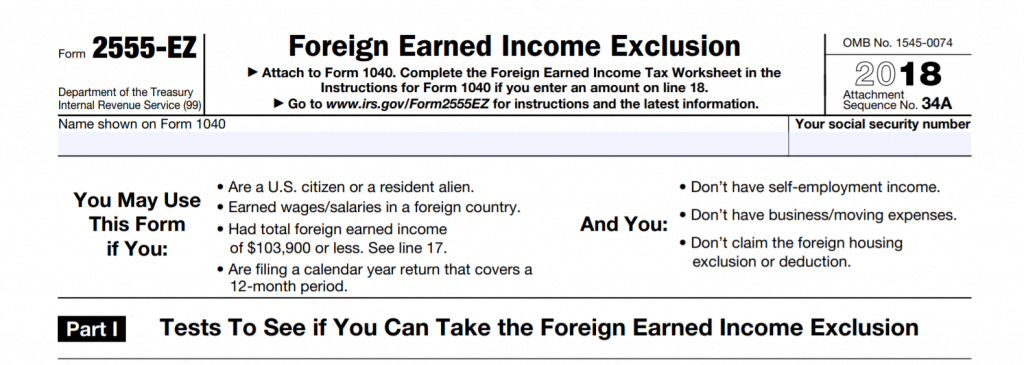

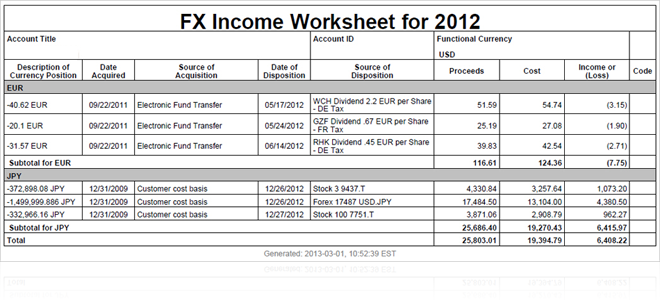

Publication 550 (2021), Investment Income and Expenses ... Foreign source income. If you are a U.S. citizen with investment income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt by U.S. law. This is true whether you reside inside or outside the United States and whether or not you receive a Form 1099 from the foreign payer. Foreign Earned Income Exclusion | Internal Revenue Service Nov 14, 2022 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions.

Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Foreign earned income exclusion. Certain taxpayers can exclude income earned in foreign countries. For 2021, this exclusion amount can be as much as $108,700. However, the foreign earned income exclusion doesn’t apply to the wages and salaries of military and civilian employees of the U.S. Government.

Foreign earned income tax worksheet

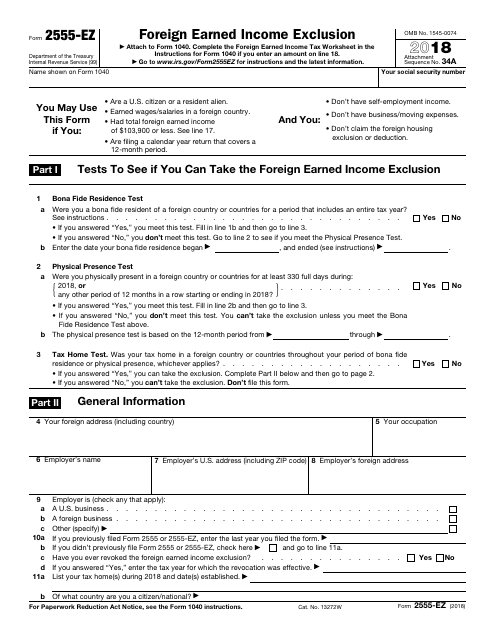

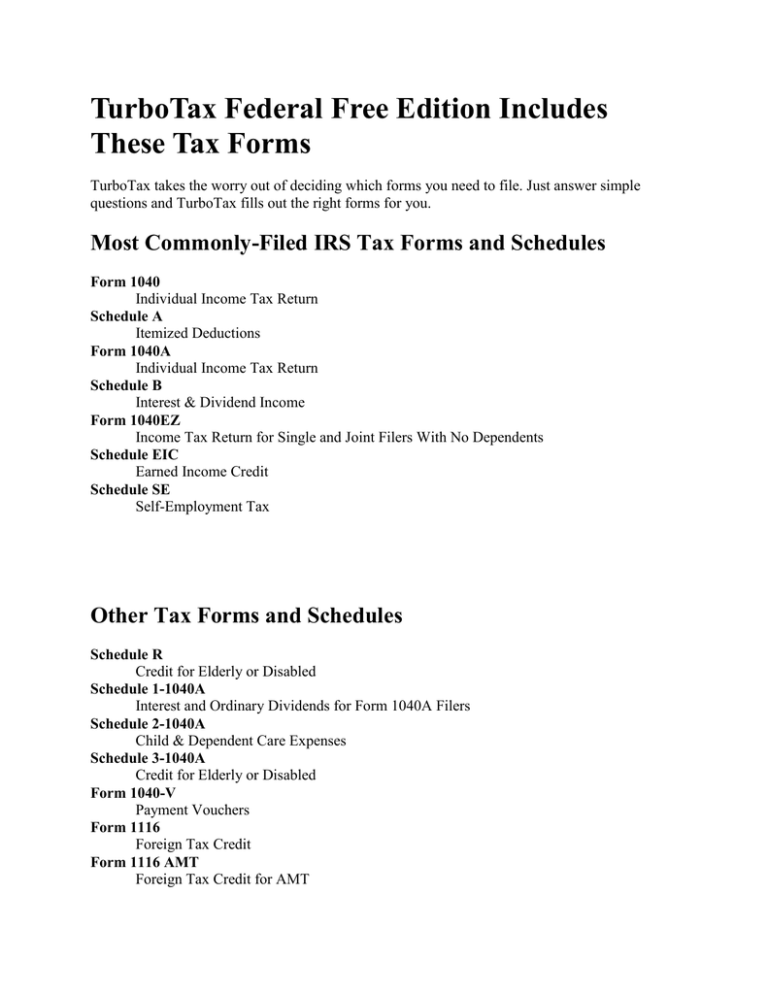

Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. 2022 Form 2555 - IRS tax forms Enter on lines 19 through 23 all income, including noncash income, you earned and actually or constructively received during your 2022 tax year for services you performed in a foreign country. If any of the foreign earned income received this tax year was Claiming the Foreign Tax Credit with Form 1116 - TurboTax Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when:

Foreign earned income tax worksheet. Foreign Housing Exclusion or Deduction - IRS tax forms Jul 27, 2022 · Your foreign housing deduction cannot be more than your foreign earned income less the total of (1) your foreign earned income exclusion, plus (2) your housing exclusion, if any. You would not have both a foreign housing deduction and a foreign housing exclusion unless during the tax year you were both self-employed and an employee. Claiming the Foreign Tax Credit with Form 1116 - TurboTax Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when: 2022 Form 2555 - IRS tax forms Enter on lines 19 through 23 all income, including noncash income, you earned and actually or constructively received during your 2022 tax year for services you performed in a foreign country. If any of the foreign earned income received this tax year was Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

0 Response to "42 foreign earned income tax worksheet"

Post a Comment