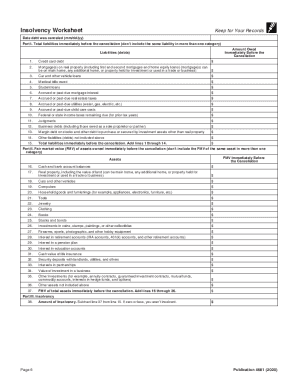

43 worksheet for foreclosures and repossessions

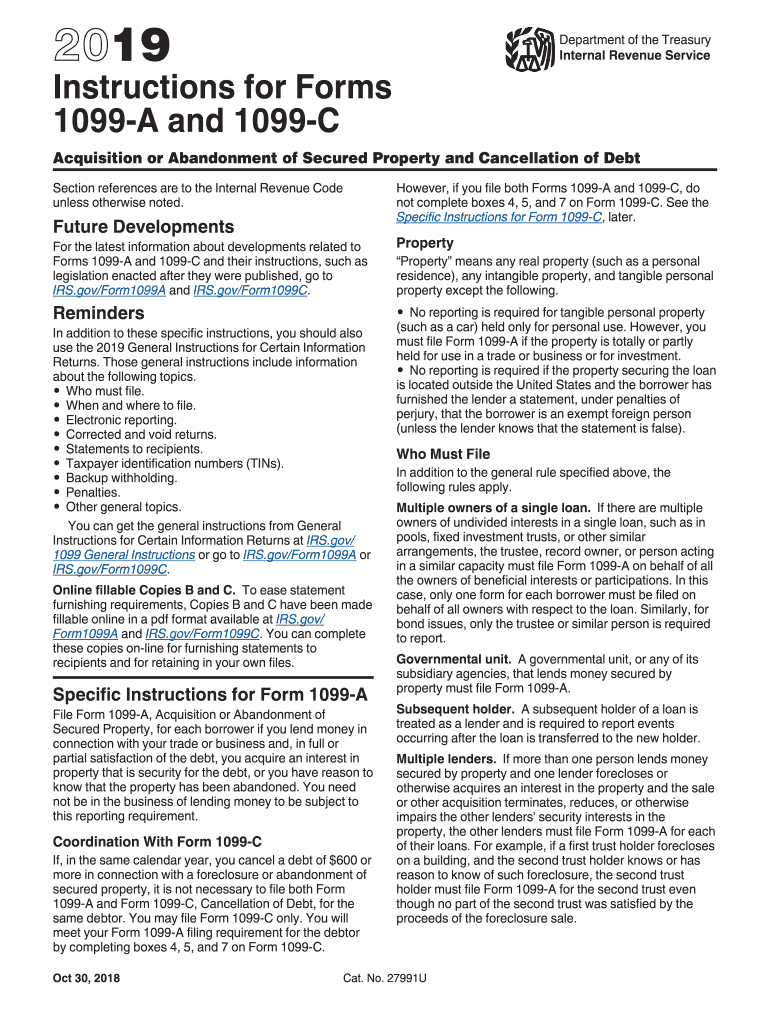

Section 6. Specific Claims and Other Issues - IRS tax forms Refer to Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Debt forgiven on second homes, rental property, business property, credit cards or car loans does not qualify for the tax-relief provision. Topic No. 431 Canceled Debt – Is It Taxable or Not? See Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Caution: If property secured your debt and the creditor takes that property in full or partial satisfaction of your debt, you're treated as having sold that property to the creditor. Your tax treatment depends on whether you were personally ...

Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Worksheet for foreclosures and repossessions

Publication 523 (2021), Selling Your Home | Internal Revenue ... If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. See Pub. 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. 544, for examples of how to figure gain or loss. Publication 544 (2021), Sales and Other Dispositions of Assets For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. Involuntary Conversions An involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other property or money in payment, such as insurance or a ... IRS tax forms IRS tax forms

Worksheet for foreclosures and repossessions. Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... IRS tax forms IRS tax forms Publication 544 (2021), Sales and Other Dispositions of Assets For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. Involuntary Conversions An involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other property or money in payment, such as insurance or a ... Publication 523 (2021), Selling Your Home | Internal Revenue ... If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. See Pub. 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. 544, for examples of how to figure gain or loss.

0 Response to "43 worksheet for foreclosures and repossessions"

Post a Comment