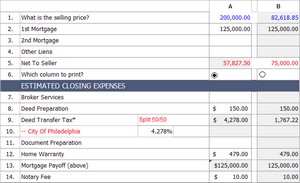

42 seller closing cost worksheet

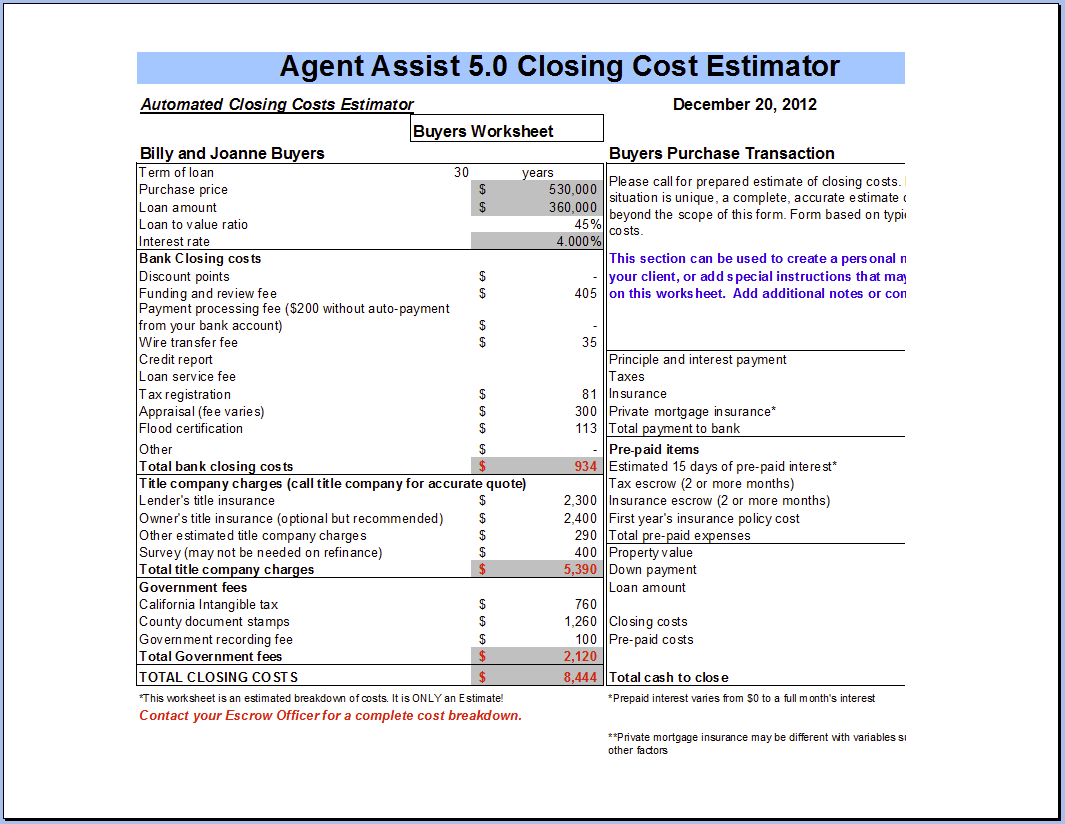

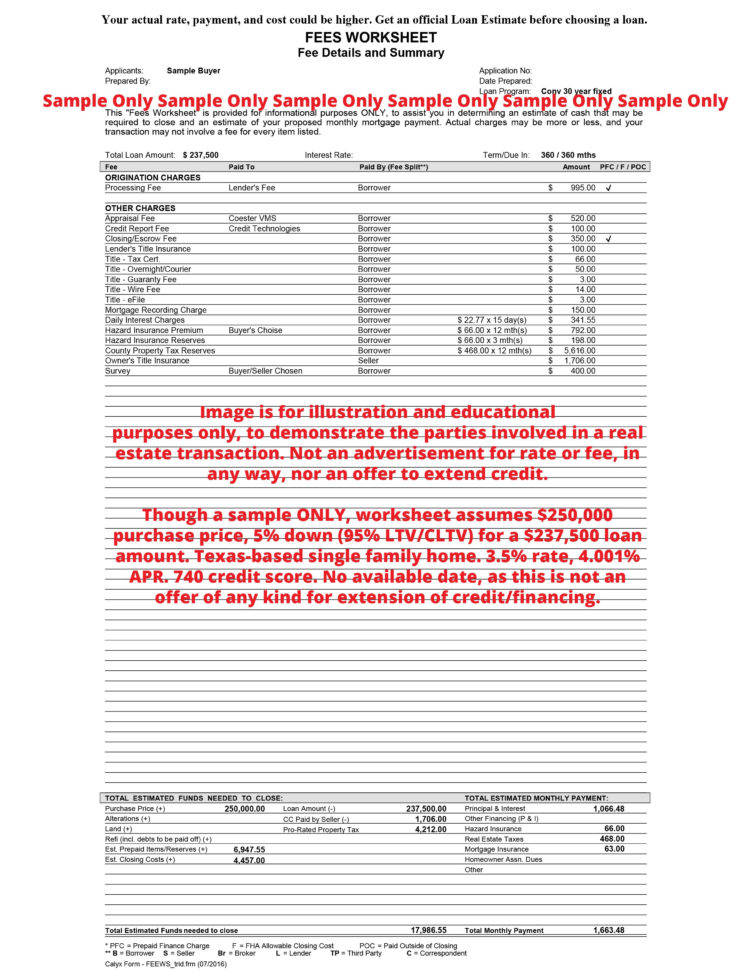

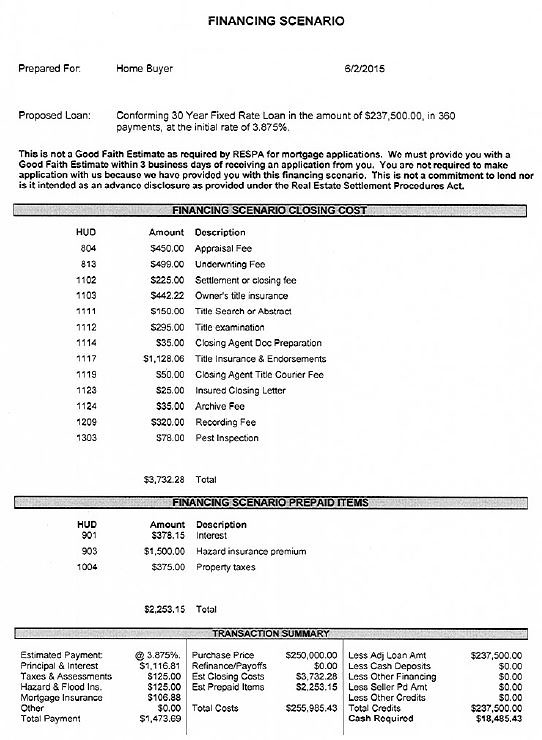

0431210094 IT-2663 (2021) Page 3 of 3 This area is for county clerk use only. IT-2663-V Individual taxpayer’s full name or name of estate or trust Spouse’s name (if applicable) or name and title of fiduciary Spouse’s SSN Individual taxpayer’s street address or address of fiduciary or representative (see instructions) City, village, or post office State ZIP code One cost to the closing process comes from the amount you have to pay in advance for items you will be paying regularly as a homeowner. Our closing costs calculator accounts for those as well. Some of these pre-payments are placed into an escrow account (a special holding account from which funds can only be accessed in certain circumstances) so that there is a reserve in …

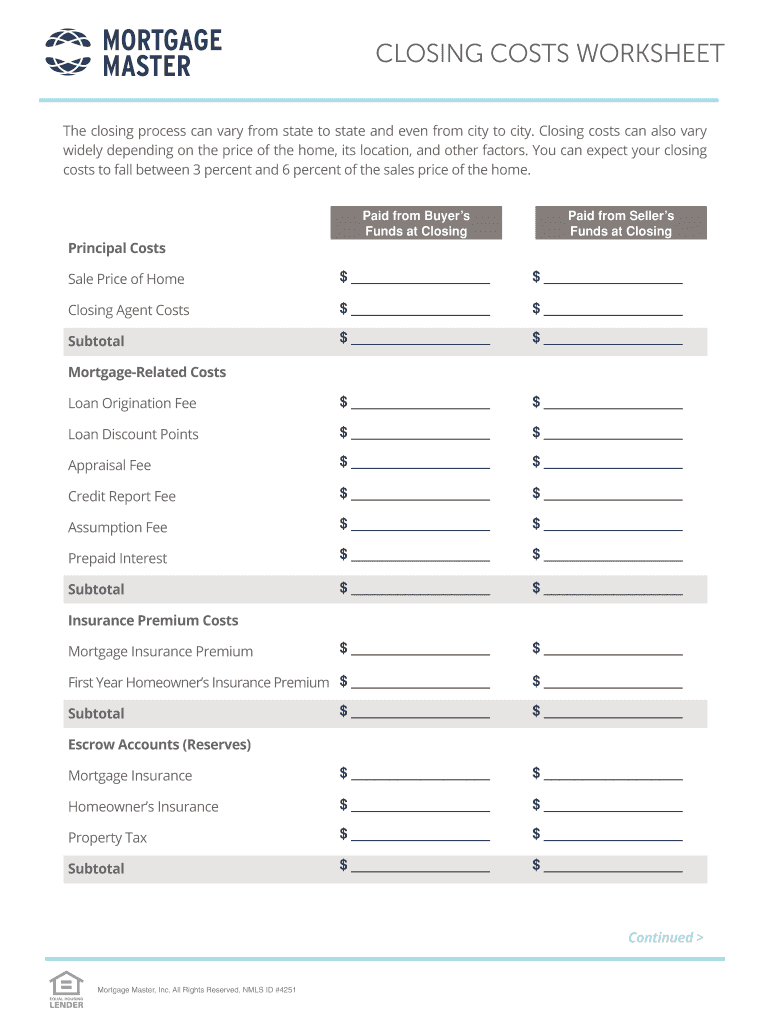

Cost range is $40 – 60. $ Important: You can use this worksheet to get a rough cost estimate of the typical closing, but please consult an attorney for a comprehensive estimate designed specifically for your situation. Keep in mind that some of the closing costs may be paid to either the seller or added to your mortgage. TOTAL: $ Disclaimer

Seller closing cost worksheet

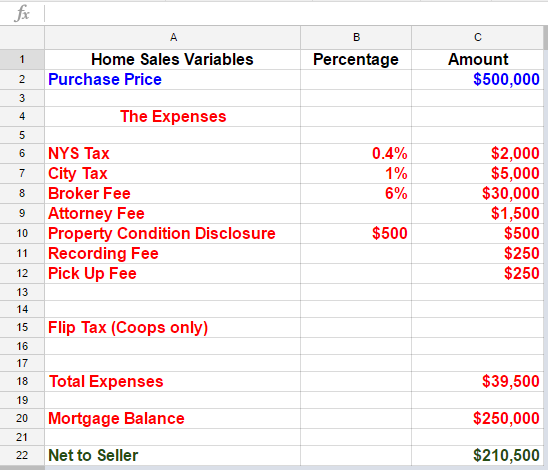

Seller Closing Cost Calculator. The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. Simply enter your sales price, mortgage information & closing date and we'll estimate your totals. The actual fees, expenses & outstanding loan balance will depend on the ... Realtor Commission %. Realtor Commission Total. Real Estate Taxes Due at closing (proration) Special Assessments due at closing. Closing Fee ($275-$325) Broker Administration Fee. Recording Fees ($75 - $150) State Deed Tax. Seller Paid Closing Costs for Buyer. Your cost includes your down payment and any debt such as a first or second mortgage or notes you gave the seller or builder. It also includes certain settlement or closing costs. In addition, you must generally reduce your basis by points the seller paid you. If you built all or part of your house yourself, its basis is the total amount it cost you to complete it. Don’t include in the cost ...

Seller closing cost worksheet. Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if applicable. Click on "Print Column A" to print a nice clean closing cost estimate for the Florida … settlement closing fee for $300 (ish), document prep fee for $250 (ish), courier fee estimated at $40 (ish), tax cert for $38 (ish), recording fee for $40 (ish), and a state guarantee fee for a whopping $2. The total estimate for the seller’s closing costs is $670 (ish). These seller’s closing costs are used in our seller’s net sheet worksheet. This tool is intended to help property owners with a reasonable estimate of closing costs and net proceeds from the sale of their property. Closing costs for the seller are determined by summing up all the expenses that are made at closing. This value is subtracted from the estimated home selling ...

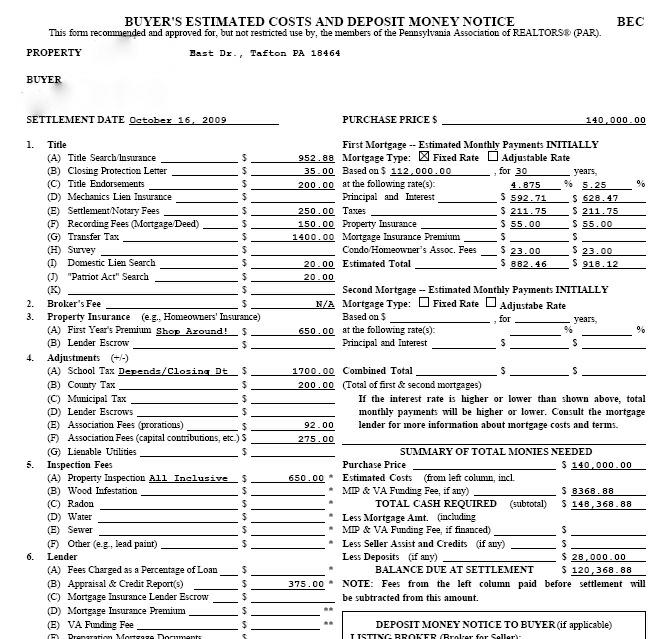

Seller closing costs in Virginia can range anywhere between 5%-10% of the selling price of the house and calculating these costs can be a tedious and overwhelming routine to do. In such cases, a calculator can be a rewarding tool to have by your side and our “Closing Costs Calculator for Sellers in Virginia” is here for your assistance. Every situation is different and many closing costs are determined by the home’s value, loan amount, and where you live among others. The best way to get an accurate closing cost estimate is to apply for your upcoming purchase or refinance loan. Lenders will work up an itemized worksheet of closing costs specific to your situation. Texas Seller Closing Costs & Net Proceeds Calculator. Easily calculate the Texas home seller closing costs and seller "net" proceeds with this home-sale calculator. Enter the property sale price (or list price) and then enter the various closing costs. Great tool for the TX Realtor® or the "for sale by owner" (FSBO). Substitute Form 1099 Seller Statement - The information contained in Blocks E, G, H and I and on line 401 (or, if line 401 is astericked, lines 403 and 404) , 406, 407 and 408-412 (applicable part of buyer's real estate tax reportable to the IRS) is important tax information and is being furnished to the Internal Revenue Service.

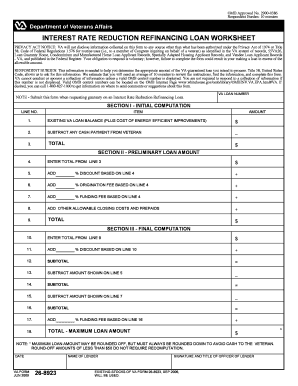

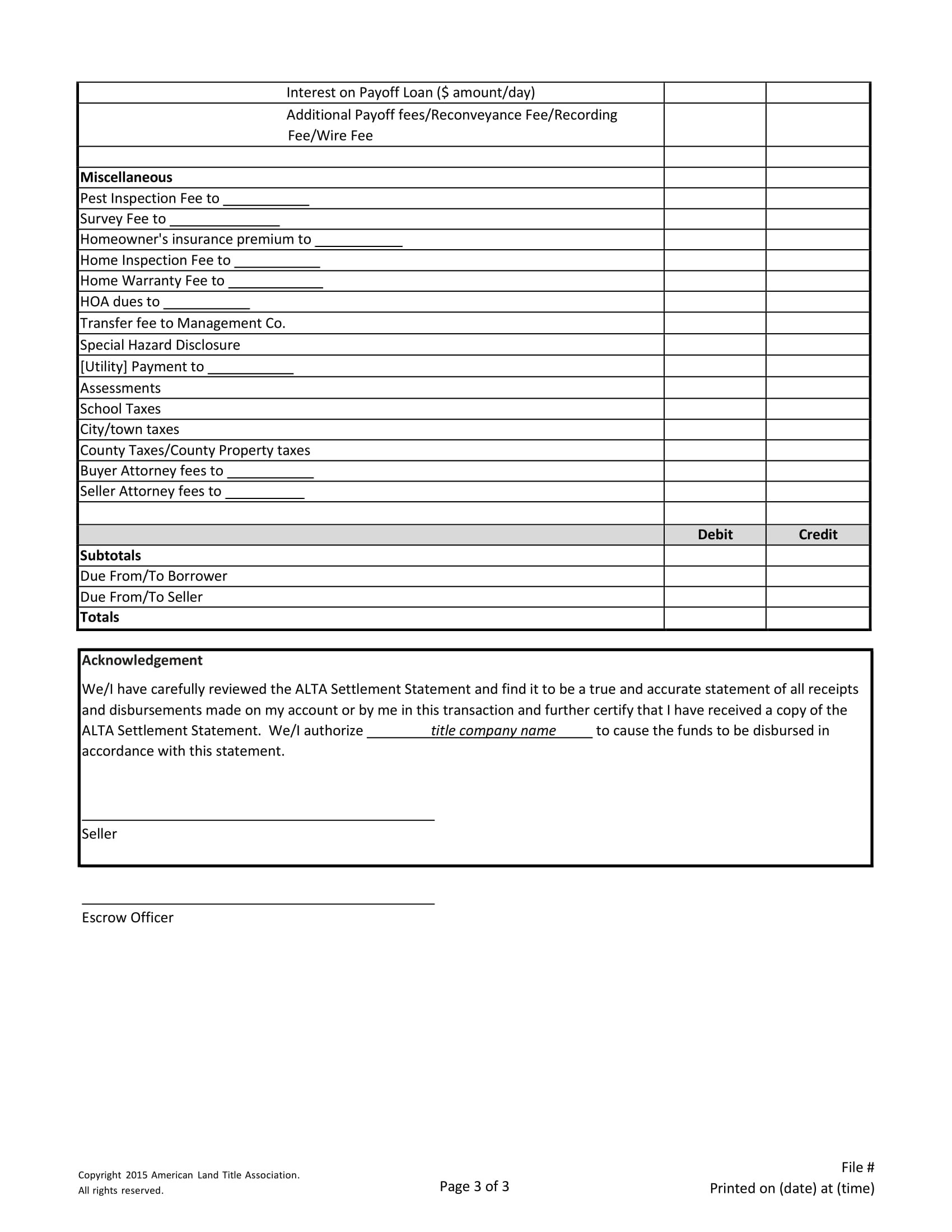

Use seller closing cost calculator to help estimate your closing costs and net proceeds from the sale of a home. You will need to know your closing date, ... The only closing cost that can be truly rolled on top of your loan is the VA Funding Fee. Veterans can pay this fee in cash at closing, but most choose to finance the fee, essentially spreading the cost over the loan term. VA buyers can’t just roll their other closing costs and fees on top of their loan. But they can look to build them into the offer and have the seller pay for them at ... 06.07.2020 · If you aren’t sure what “cash to close” means, what your closing cost amounts are or how to pay them, read on to learn more. Cash To Close, Defined Cash to close (also referred to as funds to close) is the total amount of money you’ll need to pay on closing day to finalize the home purchase transaction. Unless you're using a dry closing, you'll need to know ahead of … Inspections and obligations. Presenting your home to buyers. Showing your home. Completing the sale. Seller responsibilities. Seller estimated "Costs of Sale" worksheet (page 1) Seller estimated "Costs of Sale" worksheet (page 2) Parent's checklist. Information herein believed to be accurate but not warranted.

Title insurance policy premiums in Florida show up as line items within a closing cost worksheet for a buyer and seller such as a Closing Disclosure, Loan Estimate, HUD-1, or an ALTA Settlement Statement. If you're looking to get a preview of what these costs look like, use this free Florida title insurance calculator.

Seller closing costs are a combination of taxes, fees, prepayments and services that vary depending on your location. Closing costs can differ due to variations in local tax laws, lender costs, and title and settlement company fees.

Closing costs can represent a surprisingly big chunk of money, between 3% and 6% of the mortgage. Here are some of the best ways to trim them.

A The transferor/seller is: an individual an estate or trust B ... Part 2 – Estimated tax information (Complete Worksheet for Part 2 on page 2 before completing this part.) 1 Sale price (from Worksheet for Part 2, line 15) ..... 1. 2 Total gain (from Worksheet for Part 2, line 17; if a loss, enter 0)..... 2. 3 Estimated tax due (from Worksheet for Part 2, line 20)..... 3. 00 Part 3 ...

Use our home sale calculator to estimate the cost of selling and the net ... Also referred to as closing costs, these fees can range from 1% to 3% of the ...

Your cost includes your down payment and any debt such as a first or second mortgage or notes you gave the seller or builder. It also includes certain settlement or closing costs. In addition, you must generally reduce your basis by points the seller paid you. If you built all or part of your house yourself, its basis is the total amount it cost you to complete it. Don’t include in the cost ...

Realtor Commission %. Realtor Commission Total. Real Estate Taxes Due at closing (proration) Special Assessments due at closing. Closing Fee ($275-$325) Broker Administration Fee. Recording Fees ($75 - $150) State Deed Tax. Seller Paid Closing Costs for Buyer.

Seller Closing Cost Calculator. The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. Simply enter your sales price, mortgage information & closing date and we'll estimate your totals. The actual fees, expenses & outstanding loan balance will depend on the ...

0 Response to "42 seller closing cost worksheet"

Post a Comment