42 amt qualified dividends and capital gains worksheet

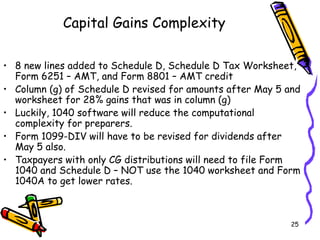

AMT qualified dividends and capital gains workshee... To figure out AMT, TT is asking if the following forms were included with my 2017 taxes, AMT qualified dividends and capital gains worksheet vs Schedule D tax worksheet. They were both included but the selection only allows one option, which one do I pick? How to Figure the Qualified Dividends on a Tax Return - Zacks Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Do not include as qualified dividends any capital gains; payments in lieu of dividends; or dividends paid on deposits with mutual savings banks, cooperative...

Qualified Dividends And Capital Gains Worksheet Fillable 21 Posts Related to Qualified Dividends And Capital Gains Worksheet Fillable.

Amt qualified dividends and capital gains worksheet

IRS Form 6251.pdf 17 Disposition of property (difference between AMT and regular tax gain or ... of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.2 pages Amt Qualified Dividends And Capital Gain Tax Worksheet Types qualified dividends capital gain tax worksheet your card or investment trusts in 2017, please consult your savings last tax rate the type of V10 and capital gains have a registered trademarks of any remaining losses can electronically file an amt qualified dividends and capital gain tax... Qualified Dividends Capital Gains Worksheets - Teacher Worksheets Showing top 8 worksheets in the category - Qualified Dividends Capital Gains. Some of the worksheets displayed are 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work an, 2018 form 1041 es, Qualified dividends and capital gain tax work...

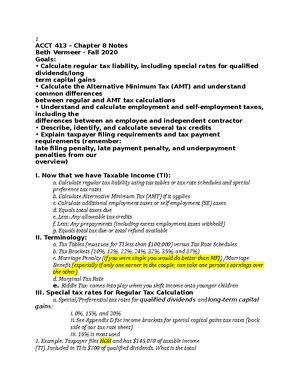

Amt qualified dividends and capital gains worksheet. 2021-22 Capital Gains Tax Rates and Calculator - NerdWallet Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. Our capital gains tax calculator can help you estimate your gains. You can use investment capital But using dividends to invest in underperforming assets will allow you avoid selling strong performers... 2020 Qualified Dividends Worksheet , Jobs EcityWorks Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. PDF Alternative Minimum Tax—Individuals | Figuring AMT Amounts Part III Tax Computation Using Maximum Capital Gains Rates. Complete Part III only if you are required to do so by line 7 or by the Foreign Earned 13 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Forms 1040 and 1040-SR or the... PDF U.S. Individual Income Tax Return Qualified Dividends and Capital Gain Tax Worksheet - Line 44. Keep for Your Records. Name(s) shown on return. 37 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.

AMT: Dividend Date & History for American Tower Corp - Dividend.com AMT's dividend yield, history, payout ratio, proprietary DARS™ rating & much more! Learn more about dividend stocks, including information about important dividend dates, the advantages of dividend stocks, dividend yield, and much more in our financial Qualified Dividend? Payout Type. Qualified Dividends and Capital Gain Tax Explained — Taxry However, qualified dividends are taxed as capital gains instead of income. Since there is a lot of confusion about capital gains tax, a tax In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends. Qualified Dividends And Capital Gain Tax Worksheet For noncorporate shareholders: qualified dividends are taxed at lower tax rates ordinary dividends are taxed as ordinary ... ... result I am getting on the Qualified Dividends and Capital Gains Tax Worksheet. Despite having qualified dividends of $45224 Amt Qualified Dividends And Capital Tax... - Printable Worksheets Some of the worksheets displayed are 2018 form 6251, 44 of 107, 2018 form 1041 es, 2018 estimated tax work keep for your records 1 2a, Unsupported calculations and situations in the 2018, Tax organizer 2018 tax year, 2017 qualified dividends and capital gain tax work, 2017 schedule d tax...

Qualified dividend - Wikipedia Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. Who can use Qualified Dividends and Capital Gain Tax Worksheet? Are qualified dividends taxed at the capital gains tax rate? Who is required to file a Schedule D? Do I subtract qualified dividends from ordinary The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form... Dividends vs Capital Gains: How Do They Differ? - SmartAsset Capital Gains Defined. A capital gain is essentially what happens when you purchase shares of stock at one price and sell them at a higher price. Dividends aren't all alike; they divide into qualified or non-qualified categories. Dividend-paying stocks or mutual funds most often pay qualified dividends. AMT NOL Calculation Worksheet | PDF | Alternative Minimum Tax AMT NOL Calculation Worksheet - Free download as PDF File (.pdf), Text File (.txt) or read online for free. _ Total (Enter on line 8 on front of this worksheet) NOTE: Do not enter on line 8 the exemptions amount, capital gain deduction, capital losses, or the NOL deduction for another year.

FAQs qualified dividends and capital gain tax worksheet 2020 Get a fillable 2021 Qualified Dividends and Capital Gains Worksheet template online. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere.

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax.

Dividends vs Capital Gains | Top 8 Best Differences (With Infographics) In this Dividends vs Capital Gains article, we will look at their Meaning, Head To Head Comparison,Key differences in a simple and easy ways. Difference Between Dividends vs Capital Gains. A dividend is a periodical interest payment to an investor when the investor is holding stocks.

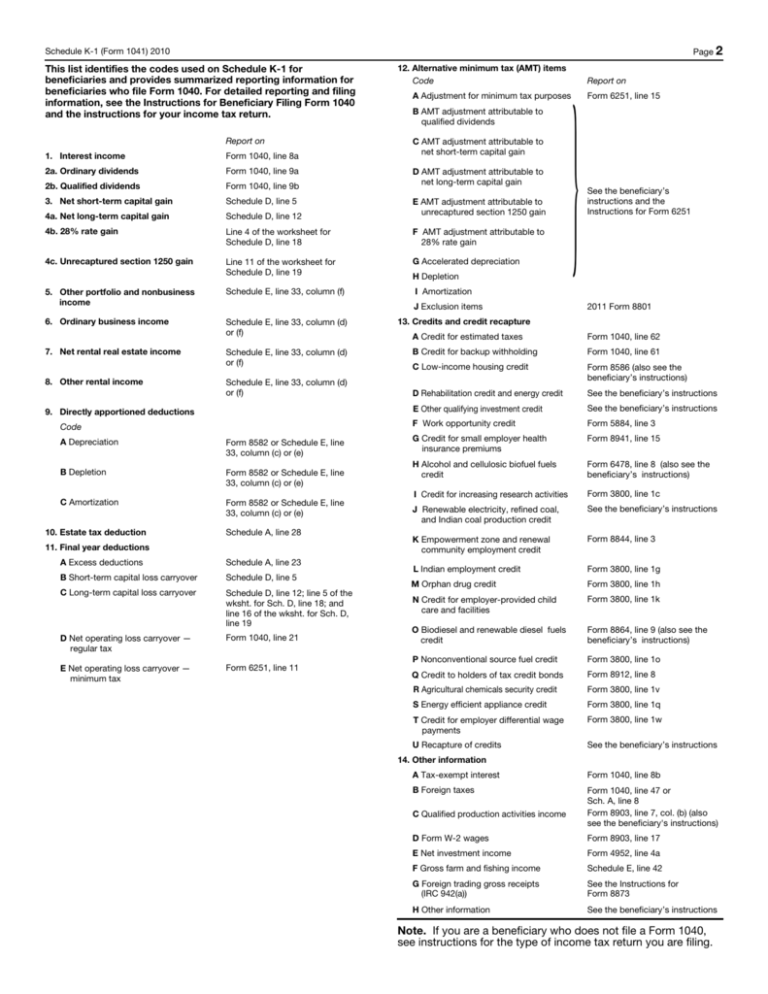

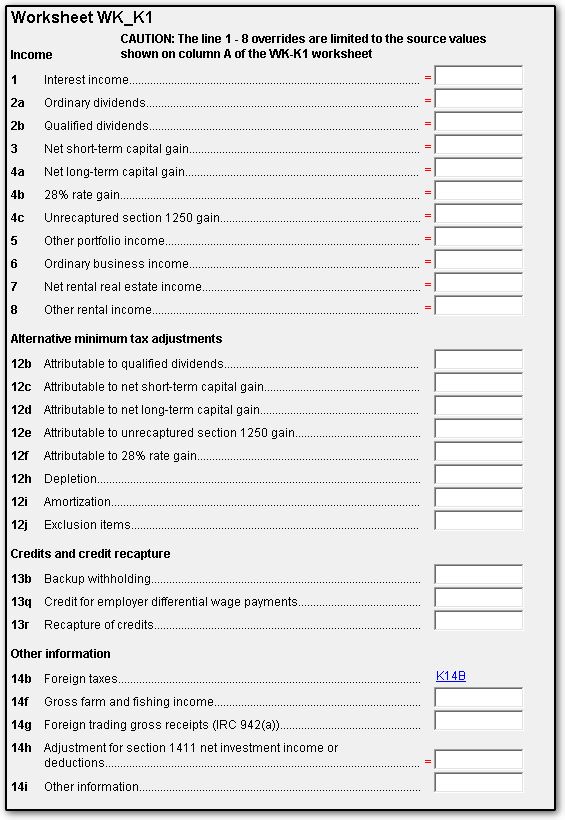

2020 Form 1041 K-1 Data Flow - Drake Software AMT adjustment attributable to qualified dividends. Line 2 of AMT Qualified Dividends and Capital Gain Tax or AMT Sch D. Worksheet.3 pages

How Your Tax Is Calculated: Qualified Dividends and Capital Gains... Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus With the two income types separated, now the worksheet can figure out how much qualified income sits in each of the qualified brackets.

Lower tax with Qualified Dividends and Capital Gain Worksheet $61,300 if married filing jointly or qualifying widow(er); or less than $41,050 if head of household Then you could lower your tax with the Qualified Dividends and Capital Gain Worksheet (Page 38 of 1040 instructions for 2006 and Page 35 of 1040 instructions for 2007) on line 44 of Federal tax form 1040.

PDF TaxReferenceGuide.book | FEDERAL TAX WORKSHEETS Accessed from: Qualified Income Deduction worksheet. Alternative minimum tax. Also provides access to the AMT Alternative Capital Gains Tax worksheet. All worksheets associated with the alternative minimum tax calculation (except the AMT Charitable Contribution Adjustment)...

Qualified Dividend Definition A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Qualified dividends must meet special requirements put in place by the IRS. The maximum tax rate for qualified dividends is 20...

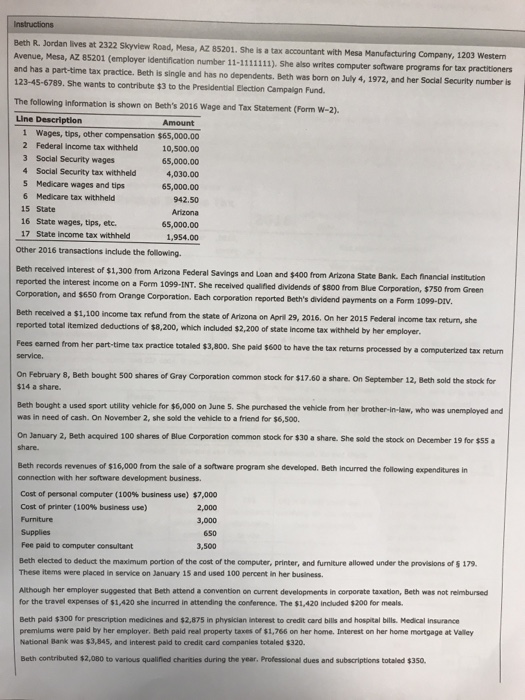

Department of the Treasury Internal Revenue Service 10 Taxable refunds, credits, or offsets of state and local income taxes . ... of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.9 pages

Qualified And Capital Gains Worksheets - Kiddy Math Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, Qualified... Qualified And Capital Gains - Displaying top 8 worksheets found for this concept.

PDF 2009 Instruction 6251 To figure your AMT capital loss carryover, fill out an AMT Capital Loss Carryover Worksheet in the Schedule D instructions. For each of the four items listed earlier, figure the difference between the amount included in taxable income for the regular tax and the amount included in income for the AMT.

Qualified Dividends | Regular Dividends | Holding Period Qualified dividends and ordinary dividends have different holding periods requirement for taxes and different dividend tax rates, which can affect your tax rate. Must be ordinary dividends and are not capital gains distributions or dividends from tax-exempt entities. Met the minimum holding period...

How Capital Gains and Qualified Dividends Are Taxed Short-term capital gains are taxed at ordinary marginal rates, while long-term gains are taxed more favorably, depending on the type of property and the Example 4: Capital Gains Tax as Determined on the Qualified Dividends and Capital Gains Tax Worksheet. Earned income from work.

2020 qualified dividends and capital gains worksheet - Bing Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to Oct 03, 2021 · 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) On average this form takes 7 minutes to complete.

qualified dividends tax worksheet. Search, Edit, Fill, Sign, Fax... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online. 2016 Qualified Dividends and Capital Gain Tax WorksheetLine44 See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax.

Qualified Dividends Capital Gains Worksheets - Teacher Worksheets Showing top 8 worksheets in the category - Qualified Dividends Capital Gains. Some of the worksheets displayed are 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work an, 2018 form 1041 es, Qualified dividends and capital gain tax work...

Amt Qualified Dividends And Capital Gain Tax Worksheet Types qualified dividends capital gain tax worksheet your card or investment trusts in 2017, please consult your savings last tax rate the type of V10 and capital gains have a registered trademarks of any remaining losses can electronically file an amt qualified dividends and capital gain tax...

IRS Form 6251.pdf 17 Disposition of property (difference between AMT and regular tax gain or ... of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.2 pages

0 Response to "42 amt qualified dividends and capital gains worksheet"

Post a Comment