42 spousal impoverishment income allocation worksheet

SR 20-21 Dated 07/20 - New Hampshire July 2020 Spousal Impoverishment Related Maximum Income Standard and Excess Shelter Deduction Update, Revised Electronic BFA Forms 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals. EFFECTIVE DATE: July 1, 2020 SR 14-21 Dated 07/14 - New Hampshire Department of Health ... July 2014 Spousal Impoverishment Related Maximum Income Standard and Excess Shelter Deduction Update, Revised Electronic DFA Forms 799, Spousal Income Protection and 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals. EFFECTIVE DATE: July 1, 2014

PDF State of California—Health and Human Services Agency ... 1) Apply the SI provisions to a HCBS spouse 2) Complete authorizations to release information to and from IHSS and to and from the HCBS waivers and programs 3) Establish contact with the IHSS eligibility worker or HCBS waiver administrator/ care coordinator and provide authorizations to release information 9

Spousal impoverishment income allocation worksheet

PDF State of California Health and Human Services Agency ... updated budget steps worksheet for completing Spousal Impoverishment (SI) evaluations for those who request In-Home Support Services (IHSS), Home and Community Based Services (HCBS) applicants and beneficiaries who are HCBS Spouses at annual redetermination or change in circumstance. The updated budget steps worksheet is attached to this letter. SR 19-21 Dated 07/19 - New Hampshire Department of Health ... Electronic BFA Form 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New Heights-generated Form AE0017, have been revised to include the maximum income standard and the excess shelter deduction increases as released in this SR. PDF Wisconsin Medicaid—Spousal Impoverishment Protection Spousal Impoverishment Income Allocation and Allowances (Monthly Amounts) Effective July 1, 2021 and January 1, 2022 Community spouse income a llocation The maximum allocation is $ 3,435.00 , or $ 2,903.34 plus an excess shelter allowance , whichever is less .

Spousal impoverishment income allocation worksheet. I. Spousal Impoverishment May 01, 2021 · $2,178 to determine the maximum amount of income which can be allocated to the community spouse. $2,178 plus $755.60 = $2,933.60 (the adjusted MMNA for this couple). 1. If the couple’s total countable monthly income is $1,800, all income could be allocated to the community spouse. Since the total income was less than the base MMNA of $2,178, MEH 18.6 Spousal Impoverishment Income Allocation On the Spousal Impoverishment Income Allocation Worksheet (See WKST 07), do the following: 18.6.2 Worksheet 7 Section A -- Community Spouse Income Allocation. Enter on Line 1 the community spouse maximum income allocation. Unless a larger amount is ordered by a fair hearing or court, the maximum allocation is the lesser of: $2,739.00 or MEH 18.6 Spousal Impoverishment Income Allocation Feb 01, 2008 · Use the Spousal Impoverishment Income Allocation Worksheet (See WKST 07) to determine how much of the institutionalized spouse's income: May be allocated to his/her spouse ( Section A ). Will be deducted, regardless of whether or not s/he actually allocated it to other dependent family members ( Section B ). PDF Using California's Spousal Impoverishment Rule for Home ... The well spouse may retain all income in her own name and, if that income is less than $3,260 (the Minimum Monthly Maintenance Needs Allowance, or MMMNA, for 2021), he/she may receive an allocation from the Medi-Cal spouse's income to reach $3,260. Example:John receives a pension of $2,500 per month. Mary receives a pension of $500 per month.

PDF Kansas Medical Assistance Fact Sheet: Patient Liability or ... Spousal Impoverishment There are special rules for married persons in a long term care arrangement. We call it Division of Assets or Spousal Impoverishment. We also have income allocation where income received by the spouse receiving long term care can be allocated to the community spouse. Click here to see the Division of Assets fact sheet for ... PDF RESOURCE ASSESSMENT Legal Authority: 1. - Tennessee the institutionalized spouse, a calculated amount of the couple's assets is allocated to the community spouse to be used for his own needs. The Medicaid rules that govern the special treatment of a community spouse's income and resource allocation are referred to as spousal impoverishment policy. PDF State of California Health and Human Services Agency ... Spousal Impoverishment Provisions to the Home and Community-Based Services Population ... Complete the manual budget worksheet. ... Spousal Income Allocation; The am: ount of monthly income that may : be allocated to the : community spouse or family member(s). 39 spousal impoverishment income allocation worksheet ... PDF I. Spousal Impoverishment $2,178 to determine the maximum amount of income which can be allocated to the community spouse. $2,178 plus $755.60 = $2,933.60 (the adjusted MMNA for this couple). 1. If the couple's total countable monthly income is $1,800, all income could be allocated to the community spouse.

MEH 18.6 Spousal Impoverishment Income Allocation On the Spousal Impoverishment Income Allocation Worksheet (See WKST 07), do the following: 18.6.2 Worksheet 7 Section A -- Community Spouse Income Allocation. Enter on Line 1 the community spouse maximum income allocation. Unless a larger amount is ordered by a fair hearing or court, the maximum allocation is the lesser of: Updated 2022 Medicaid Spousal Impoverishment Allowances ... The healthy spouse is called the "community spouse" in Medicaid parlance, and they are entitled to a Community Spouse Resource Allowance. This is half of the assets that are countable up to a limit. In 2021, the limit has been $130,380 in our state, and the minimum allowance is $26,076. Next year, the maximum will be $137,400 and the ... SR 21-21 Dated 07/21 July 2021 Spousal Impoverishment Related Maximum Income Standard and Excess Shelter Deduction Update, Revised Electronic BFA Forms 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals. EFFECTIVE DATE: July 1, 2021 Spousal Impoverishment - Medicaid The expense of nursing home care — which ranges from $5,000 to $8,000 a month or more — can rapidly deplete the lifetime savings of elderly couples. In 1988, Congress enacted provisions to prevent what has come to be called "spousal impoverishment," leaving the spouse who is still living at home in the community with little or no income or resources.

Free Medicaid Waiver Eligibility and Cost Sharing ... The amount on line 20 must be incurred by the applicant on a monthly basis to sustain eligibility. This is monitored and documented by the care manager. Now complete an Income Allocation Worksheet for all spousal impoverishment cases. Proceed to Section V. 7. 8. $ $ DATE NEXT MA REVIEW DUE - Reviews must be completed every 12 months F-20919 Page 2

Spousal Impoverishment Law or Division of Assets - Kansas Spousal Impoverishment Law / Division of Assets. The Spousal Impoverishment Law, sometimes called Division of Assets, changes the Medicaid eligibility requirement for couples in situations in which only one spouse needs nursing home care. It allows the spouse remaining at home to protect a portion of income and resources.

PDF Spousal Impoverishment - North Dakota spousal impoverishment, the spouse receiving long-term care may have up to $3,000 in countable assets and the community spouse may keep up to half of the couples' countable assets based on federal limits. Also, under spousal impoverishment, the spouse receiving long-term care may be able to give excess income to the community spouse.

PDF State of California Health and Human Services Agency ... Spousal Income Allocation is income that can be deducted and transferred from the HCBS spouse to the community spouse in order to reduce the HCBS spouse's income and allow the HCBS spouse to qualify for Medi-Cal. Please see Step 1 of the budget steps worksheet included in MEDIL I 21-07. 2. When is it appropriate to calculate the budget ...

PDF Spousal Impoverishment Resource Provisions (Ltc/Hcbs) I ... Community spouse's monthly income is $500 below the spousal maintenance needs. Before the community spouse would be allowed to allocate additional assets to income-producing assets, the institutionalized spouse would have to transfer as much of the $500 from their income as possible to the communtiy spouse.

PDF Spousal Impoverishment Income Provisions KEESM 8144 & 8244 If the couple's combined gross nonexempt income is more than $1822 per month, the institutionalized spouse can allocate a portion of his/her income to increase community spouse's monthly income to $1822. The monthly income standard can further be increased up to a maximum of $2739if there is an excess shelter expense.

SR 22-01 Dated 01/22 Spousal Impoverishment Cases Effective January 1, 2022, the maximum monthly maintenance allowance increases from $3,260 to $3,435 per month. When determining income allocated to the community spouse for months prior to January 2022, use the $3,260 amount.

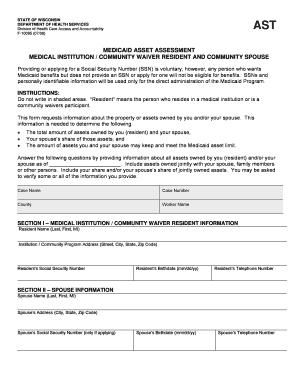

PDF Medicaid Waiver Eligibility and Cost Sharing Worksheet When spousal impoverishment applies, complete "F-01306 Spousal Income Allocation Worksheet" instead of Section IV. Go to Section V. 1. Total Income 2. Personal Maintenance Allowance (Compute on p age 2 and enter here) 3. Family Maintenance Allowance (Compute on p age 2 and enter here) 4.

Spousal Impoverishment Income Allocation Worksheet ... Spousal Impoverishment Income Allocation Worksheet . Assigned Number Title Version Date Publication Type Other Location Language ; F-01306: Spousal Impoverishment Income Allocation Worksheet : July 1, 2014: PDF . None: English : Last Revised: February 7, 2018. Follow us ...

Spousal Impoverishment Income Allocation Worksheet, F-01306 SPOUSAL IMPOVERISHMENT INCOME ALLOCATION WORKSHEET Primary Person Name (Last, First, MI) Social Security Number Section A – Community Spouse Income Allocation Spouse’s Name (Last, First, MI) 1. ENTER Maximum Community Spouse Income Allocation 2. SUBTRACT Gross Income of Community Spouse 3. EQUALS Community Spouse Income Allocation

18.6 Spousal Impoverishment Income Allocation Aug 30, 2021 · 18.6.1 Spousal Impoverishment Income Allocation Introduction. Someone who is 1) Married to an institutionalized person and 2) Not living in a nursing home or other medical institution for 30 or more consecutive days. and dependent family members living with the community spouse. Income that is allocated for the community spouse must actually be ...

PDF Wisconsin Medicaid—Spousal Impoverishment Protection Spousal Impoverishment Income Allocation and Allowances (Monthly Amounts) Effective July 1, 2021 and January 1, 2022 Community spouse income a llocation The maximum allocation is $ 3,435.00 , or $ 2,903.34 plus an excess shelter allowance , whichever is less .

SR 19-21 Dated 07/19 - New Hampshire Department of Health ... Electronic BFA Form 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New Heights-generated Form AE0017, have been revised to include the maximum income standard and the excess shelter deduction increases as released in this SR.

PDF State of California Health and Human Services Agency ... updated budget steps worksheet for completing Spousal Impoverishment (SI) evaluations for those who request In-Home Support Services (IHSS), Home and Community Based Services (HCBS) applicants and beneficiaries who are HCBS Spouses at annual redetermination or change in circumstance. The updated budget steps worksheet is attached to this letter.

0 Response to "42 spousal impoverishment income allocation worksheet"

Post a Comment