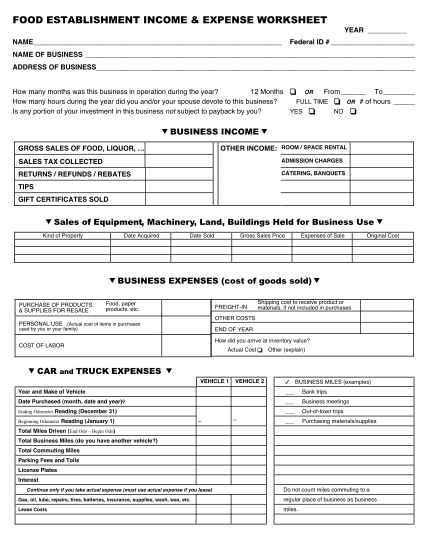

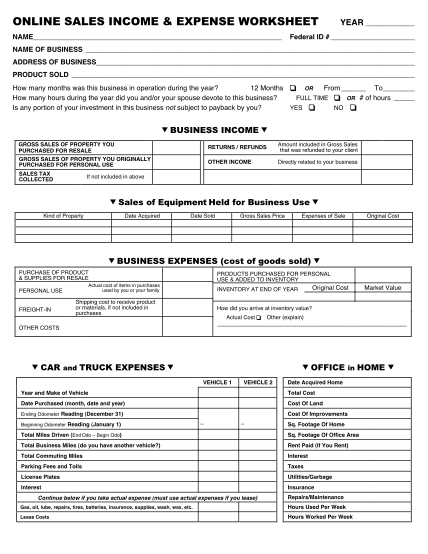

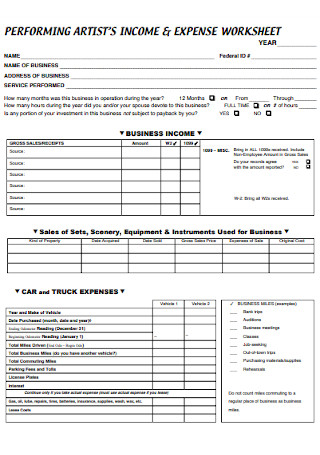

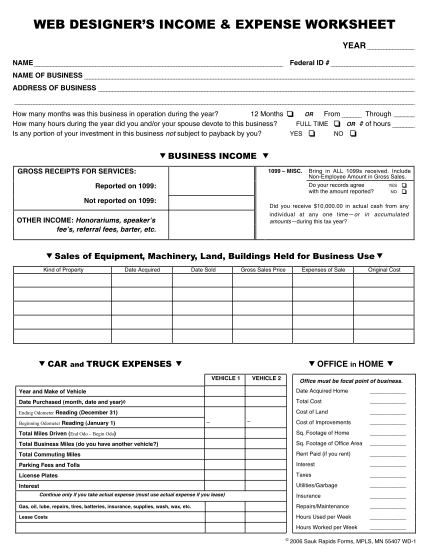

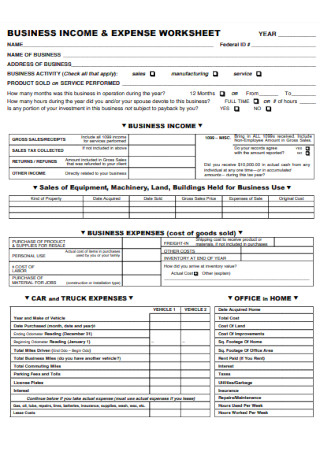

43 car and truck expenses worksheet

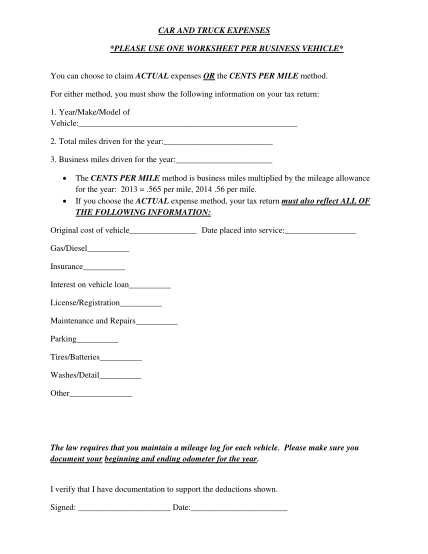

Schedule C Car And Truck Expenses Instructions If you should be associated with your net loss statement to expense deductions worksheetin the lender must enter will include business car and schedule truck expenses here to enter the form can... Knowledge Base Solution - Diagnostic: 40088 - "An amount ... To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information.

How Many Years Can You Depreciate a Vehicle on ... - sapling In actuality, it takes six calendar years to fully depreciate a car, truck or van, because MACRS assumes you put the vehicle into service at mid-year. Therefore, a business or self-employed individual depreciates a car for one-half year in years one and six, and over the full year for years two through five. Advertisement.

Car and truck expenses worksheet

The Top 19 Self-Employment Tax Deductions - Bench Car and truck expenses. For some 1099 contractors, vehicle expenses can be a valuable source of deductions. If your car or truck is in your business name and used 100% for business use, then it's fully deductible. Schedule C and expense categories in QuickBooks Self-Employed Use this category to categorize rental and lease expenses for equipment, office space, and property rentals. This includes things like office space, computers, copiers, small business equipment, and buildings. It doesn't include vehicle rental expenses. Use the car and truck category to track those. Business Use of Vehicles - TurboTax Tax Tips & Videos If you use the "actual" expenses method and the vehicle was acquired new in 2021, the maximum first-year depreciation deduction, including bonus depreciation, for an auto in 2020 is $18,200. In the example above, your depreciation on an auto would be limited to the business-use percentage of 90% times the maximum 2021 first-year maximum of ...

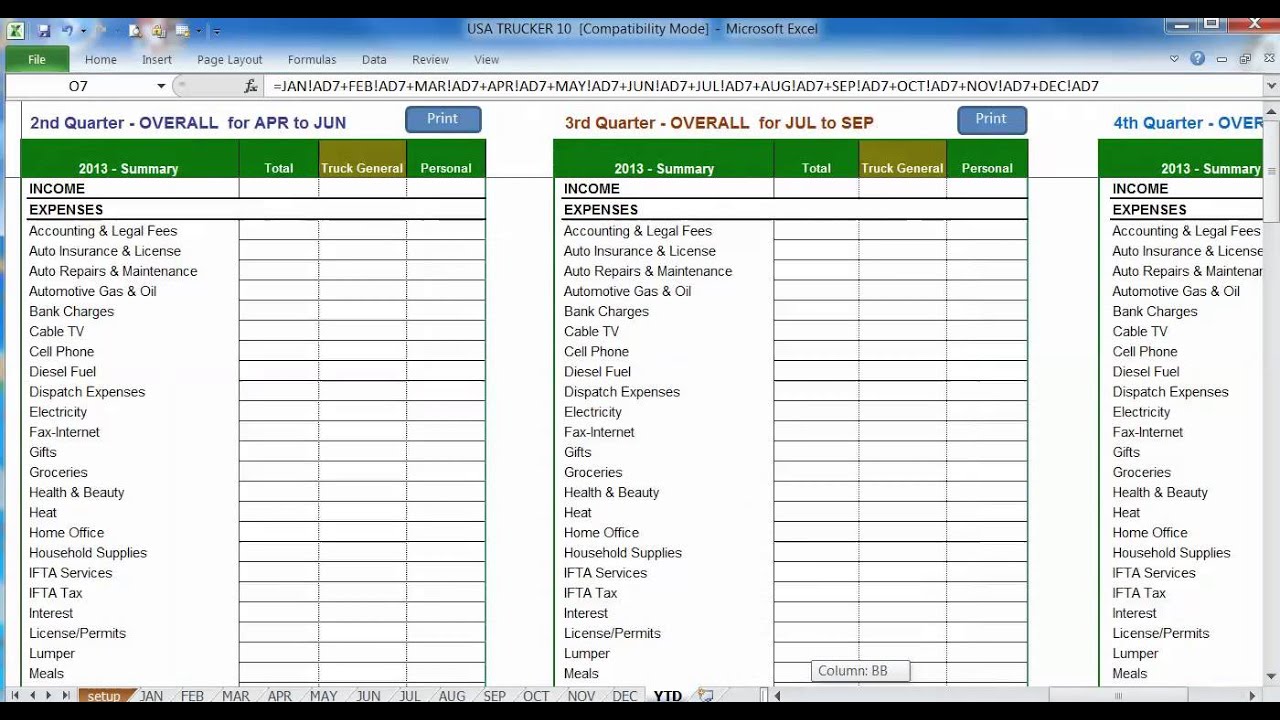

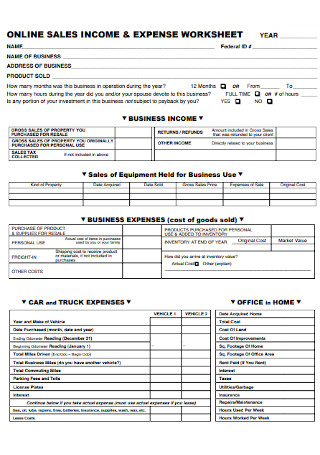

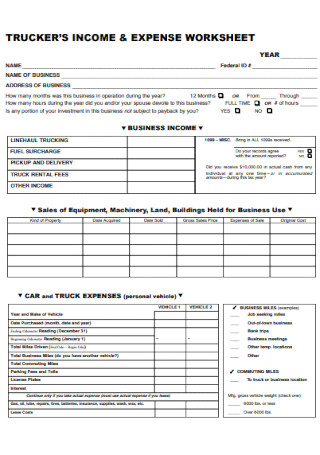

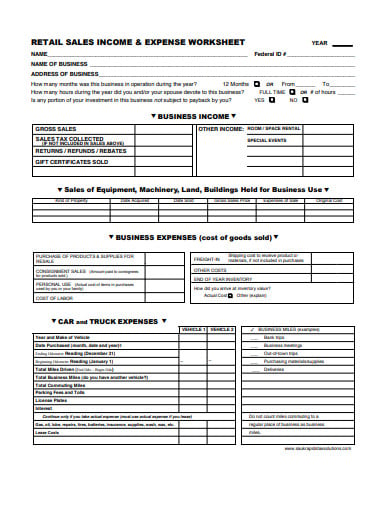

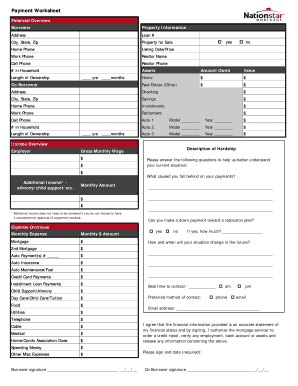

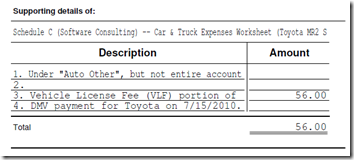

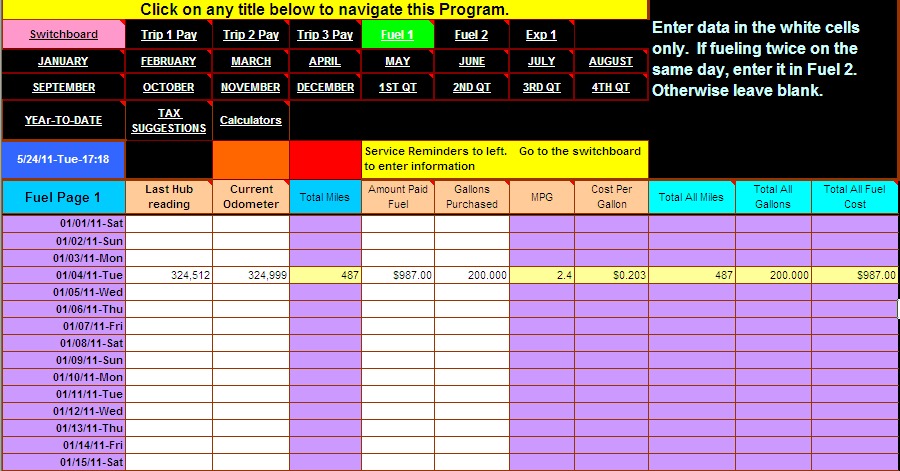

Car and truck expenses worksheet. Car and Truck worksheet - schedule C Car and Truck worksheet - schedule C. In TurboTax Online Self-employed, I prepared a Car and Truck Expenses Worksheet for both: a vehicle claiming the standard mileage rate, and. a vehicle claiming actual expenses. The numbers are as follows: Line 9 = 80% which is line 6 or 4,000 divided by line 5c or 5,000 for the standard mileage rate vehicle ... B3-3.3-03, Income or Loss Reported on IRS Form 1040 ... Non-recurring income must be deducted in the cash flow analysis, including any exclusion for meals and entertainment expenses reported by the borrower on Schedule C. The following recurring items claimed by the borrower on Schedule C must be added back to the cash flow analysis: depreciation, depletion, business use of a home, amortization, and ... Actual Expense Method for Deducting Car and Truck Expenses Money › Taxes › Business Taxes Actual Expense Method for Deducting Car and Truck Expenses. 2021-10-30 Deductions for car and truck expenses are the 2 nd largest category of deductions for business owners. There are 2 methods for deducting these expenses: standard mileage allowance and actual expense method. The actual expense method is, as the name implies, the deduction of actual expenses ... 39 self employed business expenses worksheet - Worksheet ... TRUCKER'S INCOME & EXPENSE WORKSHEET ... business, require information returns to be filed by payer. Due date of return is January 31. Nonfiling penalty can be $150 per recipient. If recipient does not furnish you with his/her Social Security Number, you are required to withhold 31% of the payment (s).

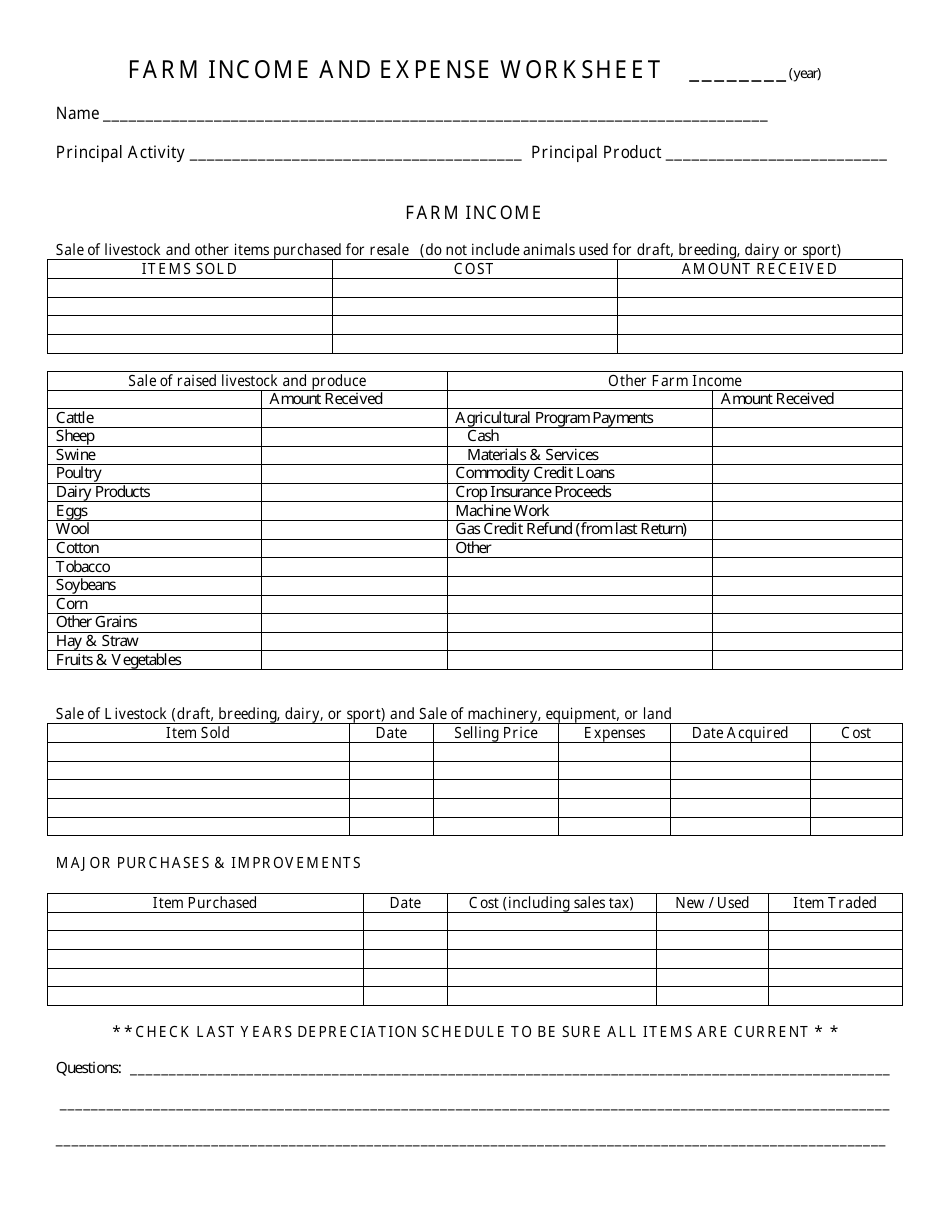

XLSM Expense Category Expense Category Drop List Car and Truck Chemicals Conservation Expenses Custom Hire Employee Benefit Programs Feed Fertilizer and lime Freight and trucking Gasoline, fuel, oil Insurance Labor Hired Pension and Profit Share Plans Rent or Lease -VME Rent or Lease -Land or Animals Repairs and Maintenance Seeds and plants Storage ... Completing a like-kind exchange in the 1040 return - Intuit Completing a like-kind exchange of vehicles in a 1040 return for ProSeries 2017 and prior. Open the Car and Truck Expenses Worksheet of the vehicle you wish to dispose of. Enter a date of disposition on Line 47 to stop depreciation as of the date of the exchange (Vehicle Expenses Worksheet for Form 2106, Line 41). Maximizing Tax Deductions for the Business Use of Your Car ... This driver's Actual Expenses total $11,300 and since this driver used the car 75% of the time for business, the Actual Expenses deduction is $8,475 ($11,300 x .75 = $8,475). That's a lot. However, when you multiply the driver's 30,000 miles by the IRS's 2021 mileage rate of 56 cents per mile, the result is a whopping $16,800 (30,000 x ... Excel Sheet Online - 1000 + Printable Worksheet In Excel Excel Divorce Asset Worksheet - To begin making a worksheets more aesthetically attractive, the actual numbers are brought in on the within of a cars and truck on this mapping sheet. It's essential for kids to learn how to map numbers in order to become…

2021 Standard IRS Mileage Rates for Automobile Operation Below are the optional standard tax deductible IRS mileage rates for the use of your car, van, pickup truck, or panel truck for Tax Years 2007-2022. We will add the 2023 mileage rates when the IRS releases them. The rates are categorized into Business, Medical or Moving expenses, and Service or Charity expenses at a currency rate of cents-per-mile. Depreciation Recapture Rule For Vehicles What to Do if Business Use Drops to 50% or Less. If business use of your car, truck or van is 50% or less in the first year you place it in service, you may not use accelerated MACRS, first-year expensing, or bonus depreciation.. Note that the recapture rule does not apply to property that has been depreciated using straight-line depreciation from the date it was placed in service. Owner Operator Truck Driver Tax Deductions Worksheet | My Idea Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Truck driver tax deductions worksheet. Save money with truck driver tax deductions. Tax Deductions for Independent Contractors & Self-Employed ... Record car and truck expenses on Line 9 of your Schedule C. Further reading: Publication 463 (2020), Travel, Gift, and Car Expenses. Business insurance. Business insurance premiums are tax-deductible. Those include related expenses like general liability, theft, fire, and workers' compensation insurance.

Top 8 Tax Deductions for Delivery Drivers - Stride Blog The portion of these expenses that you use for work is deductible! Phone accessories like a car holder, car charger, and any others that are "ordinary and necessary" for your delivery job would be deductible. But you should know: You can only deduct the expenses as a percentage of business use. What this means is that if you use your cell ...

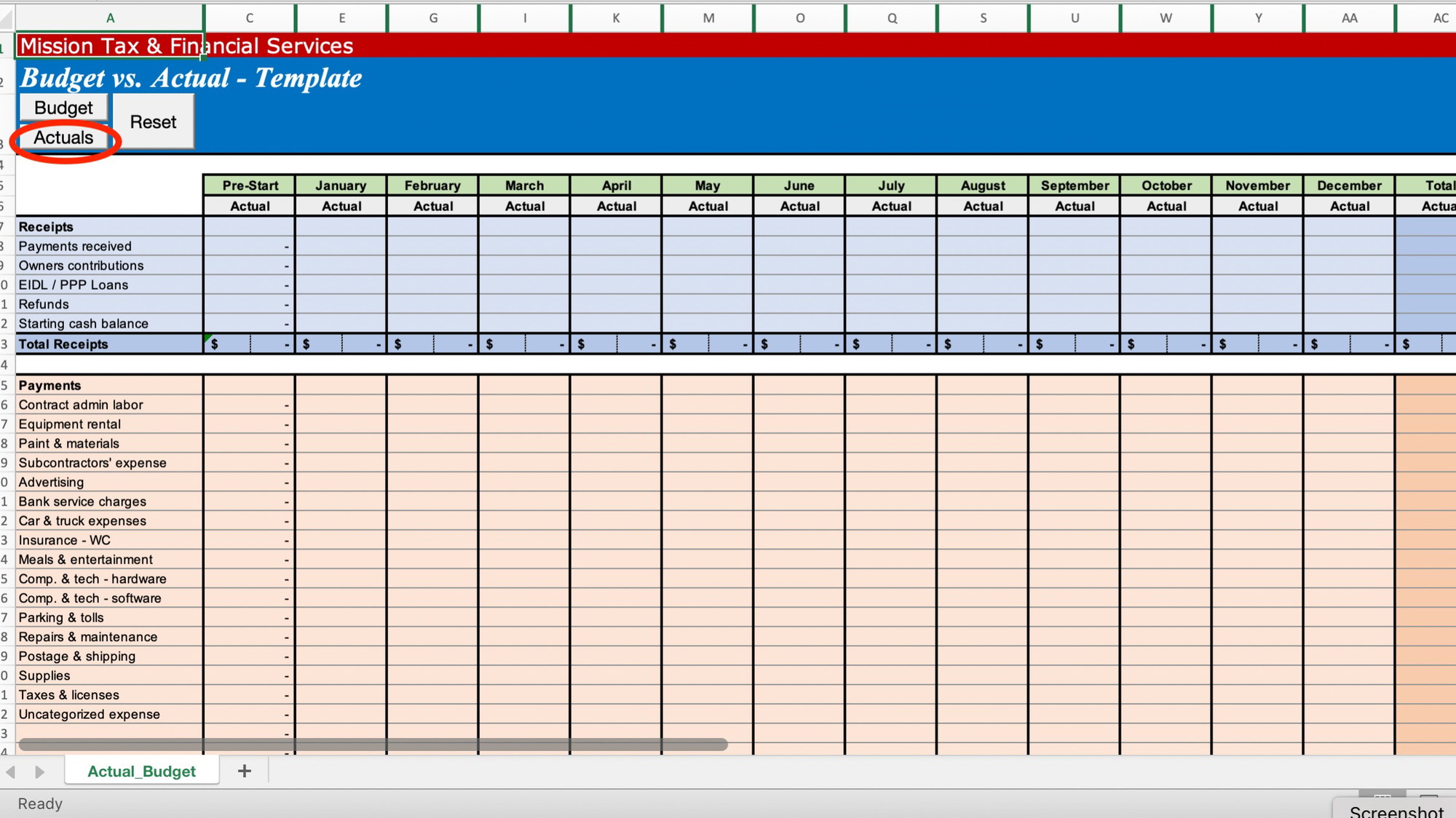

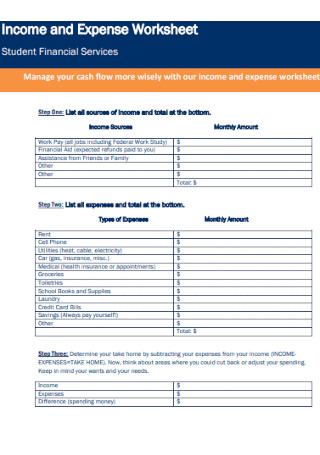

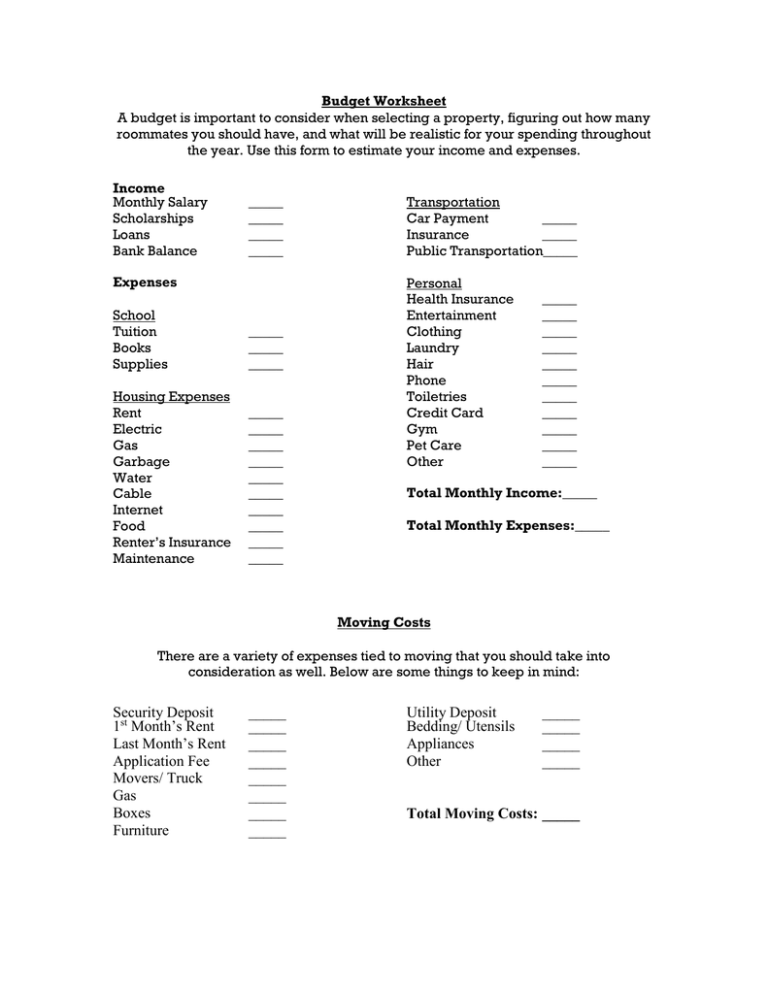

1099 Excel Template [Free Download] - Keeper Tax Whenever you have a business expense, you only need to fill out at least the first four column text boxes. If you keep a good record all year long on this worksheet you can run a simple SUMIF on the export page and boom, you have all of your expenses sorted nicely for you and ready to go come tax time!

41 trucker tax deduction worksheet - Worksheet Live The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Owner Operator Expense Spreadsheet PDF Download, federal taxes and truckers deductions list. consultant's income amp expense worksheet mer tax.

How to budget for an increasing cost of living ... Here's why: Social Security cost of living adjustment was 1.3%, yet many of the costs seniors face are rising much more quickly. From March 2020 to March 2021 the fastest rising cost was car and truck rentals which were up 31.2%. Gasoline - Prices at the pump have climbed dramatically Up 22%.

Instructions for Form 4562 (2021) | Internal Revenue Service If you are an employee deducting job-related vehicle expenses using either the standard mileage rate or actual expenses, use Form 2106, Employee Business Expenses, for this purpose. File a separate Form 4562 for each business or activity on your return for which Form 4562 is required.

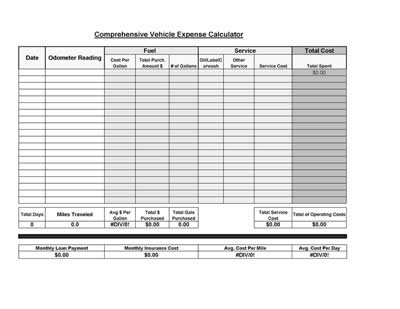

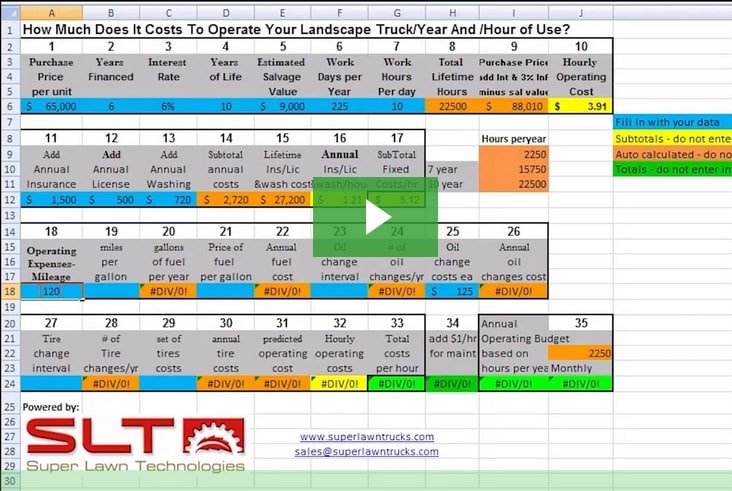

Fleet Maintenance Spreadsheet Excel & Tracking Log A fleet management spreadsheet is a great tool that provides a quick overview of the vehicles currently present and their maintenance details. With the help of a spreadsheet, you can work according to the availability of vehicles present in the fleet. Clearly minimizes the chances of unexpected downtimes. Provides a proper maintenance strategy ...

Solved: car and truck expenses worksheet says Line 51 "dep... car and truck expenses worksheet says Line 51 "depreciation allowed or allowable" and Line 52 "AMT depreciation allowed or allowable" is too large. It sounds like the business percentage may have varied from year to year. Assuming that is the case, TurboTax is NOT set to up report that.

IRS Publication 463: Travel, Entertainment, Gift, and Car ... IRS Publication 463: Travel, Entertainment, Gift, and Car Expenses explains the expenses associated with business activities that an individual taxpayer can deduct to reduce their overall taxable ...

Fill - Free fillable Form 2020: Profit or Loss From ... Method Worksheet in the instructions to figure the amount to enter on line 30 ..... 30 . 31 Net profit or (loss). ... Complete this part only if you are claiming car or truck expenses on line 9 . and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must

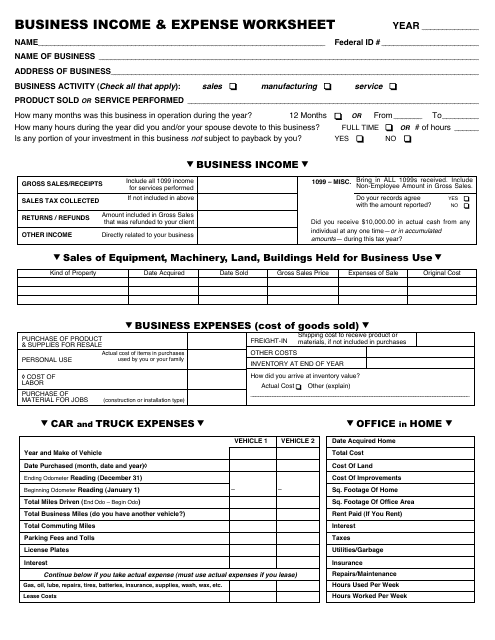

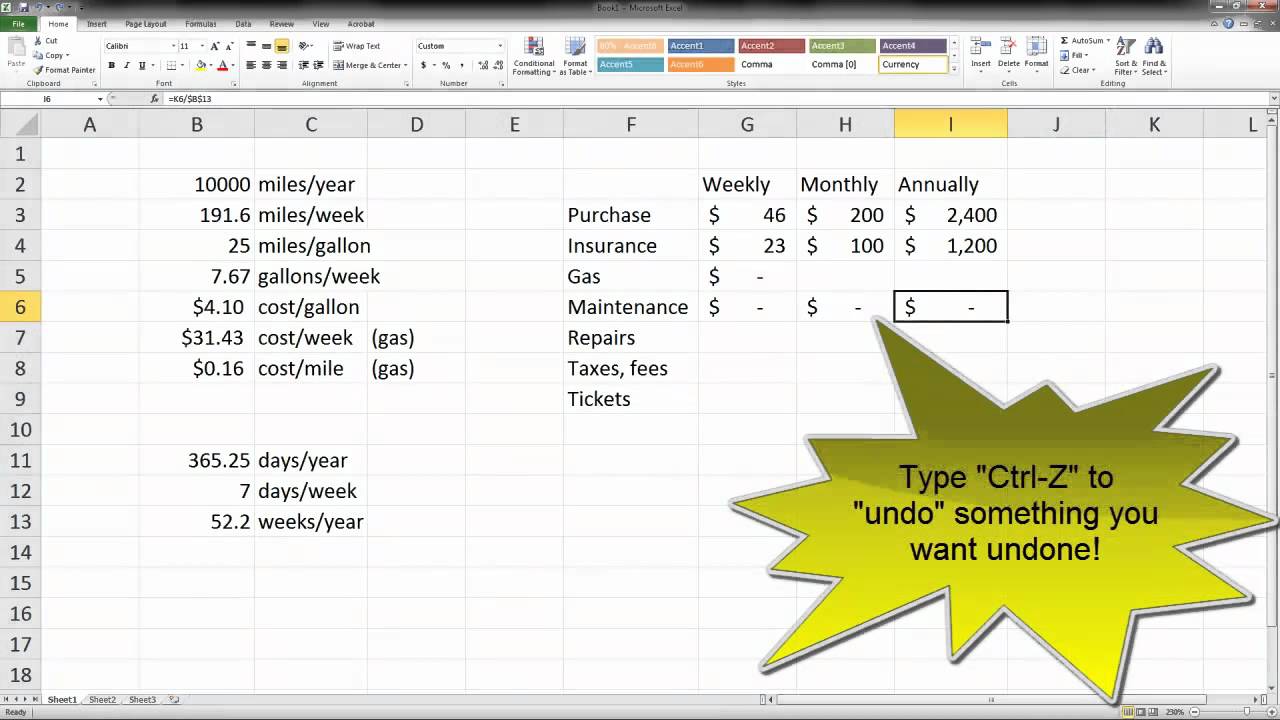

Completing the Car and Truck Expenses Worksheet in ProSeries Regarding vehicle expenses in an individual return, ProSeries has a Car and Truck Expense Worksheet. This should be used if you are claiming actual expenses or the standard mileage rate. Once you enter in the information for the vehicle, ProSeries compares what gives a better deduction for the tax return and gives you the larger deduction.

Business Use of Vehicles - TurboTax Tax Tips & Videos If you use the "actual" expenses method and the vehicle was acquired new in 2021, the maximum first-year depreciation deduction, including bonus depreciation, for an auto in 2020 is $18,200. In the example above, your depreciation on an auto would be limited to the business-use percentage of 90% times the maximum 2021 first-year maximum of ...

Schedule C and expense categories in QuickBooks Self-Employed Use this category to categorize rental and lease expenses for equipment, office space, and property rentals. This includes things like office space, computers, copiers, small business equipment, and buildings. It doesn't include vehicle rental expenses. Use the car and truck category to track those.

The Top 19 Self-Employment Tax Deductions - Bench Car and truck expenses. For some 1099 contractors, vehicle expenses can be a valuable source of deductions. If your car or truck is in your business name and used 100% for business use, then it's fully deductible.

0 Response to "43 car and truck expenses worksheet"

Post a Comment