42 sec 1031 exchange worksheet

1031 Exchange Calculator | Calculate Your Capital Gains Restart & Clear Fields Restart & Clear Fields (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case

Sec 1031 exchange worksheet

Excel 1031 Property Exchange - Business Spreadsheets 1031 Property Exchange for Excel is designed for investors, real estate brokers and facilitators allowing to: Balance equities. Evaluate boot given and received. Estimate the realized and recognized gains to calculate the transfer basis. Automatically create sample worksheets of IRS Form 8824. Perform "What if" analysis by changing the input ... A 1033 Exchange Both Section 1031 and Section 1033 of the Internal Revenue Code provide for the nonrecognition of gain when property is exchanged for qualifying replacement property. While similar in purpose, there are distinct rules separating the two which must be followed closely in order to complete a valid, fully tax-deferred exchange. 1031 Exchange with Multiple Properties [Explained A-to-Z ... You'll need to deliver the specific addresses of these properties to your 1031 Exchange Accommodator (Qualified Intermediary or QI) with the 45-day Identification Period. Holidays and weekends count so there's no next workday grace period. Finally within the 180-day deadline, closing must be completed on replacement (s).

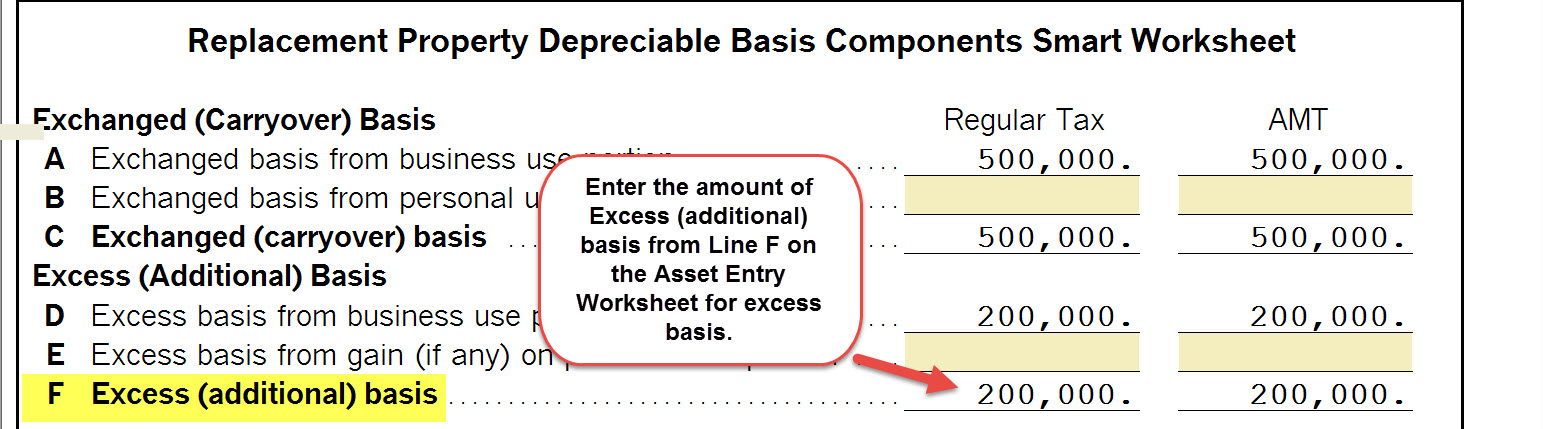

Sec 1031 exchange worksheet. 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator Using the Like-Kind Exchange Wizard in Lacerte - Intuit The easiest and most efficient way to enter a section 1031 like-kind exchange is by using the Like-Kind Exchange Wizard on the Depreciation screen. You can only do this in interactive mode. This feature isn't available in batch mode. Follow these steps to enter a like-kind exchange using the Like-Kind Exchange Wizard: Go to the Depreciation screen: Solved: 1031 exchange - Intuit Accountants Community Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Scroll down to the Dispositions section. In the Date of disposition field, enter the date the property was given up. If multiple assets were included in the trade simply enter the same Date of Disposition on each asset given up. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

1033 Exchanges - Deferring Gain on Property Lost Due to ... These are some of the basic rules, but if you are contemplating a 1033 exchange, you should investigate the details further with your tax advisor. First American Exchange is always available to answer your questions and to help you set up a tax deferred exchange, based on Internal Revenue Code Section 1031. 1031 Exchange Calculator - Penn's Grant Realty Corporation 1031 Exchange Calculator We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800. Enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. PDF §1031 Basis Allocation Worksheet - Irex §1031 BASIS ALLOCATION WORKSHEET 100% DATE:_____________, 20______, at ________________________________________________, _____________. Items left blank or un checked are not ap pli ca ble. Ref er ences to forms in cludes their equiv a lent. XLS 1031 Corporation Exchange Professionals - Qualified ... 1031 Corporation Exchange Professionals - Qualified ...

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet. 1031 Tool Kit - TM 1031 Exchange Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy. PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis. The 6 Best 1031 Exchange Companies of 2022 Strategic Property Exchanges (SPE) was founded in Ohio in 1990 and offers a full range of 1031 exchange services. It offers 1031 exchanges in all 50 states as well as overseas. It also has a boutique law firm. It looks at a 1031 exchange in a unique way: not as a single transaction, but as part of a complicated business strategy.

PDF 2019 Exchange Reporting Guide - 1031 CORP The "Tax Cuts and Jobs Act," effective January 1, 2018, repealed Section 1031 exchanges of tangible and intangible personal property assets. Reporting State Capital Gain/ Income Tax All states, except Pennsylvania, that have an incom e tax regime either follow the f ederal tax code or have adopted their own version of Section1031.

How To Record A 1031 Exchange If you've recent ly completed a 1031 like-kind exchange, you need to document your transaction for your accounting records. Although a deferred gain is an unearned revenue, it represents a future asset that counts as a liability on your balance sheet. Gains are seen as a liability until realized as an asset. It's important to get the numbers right and record your transaction accurately ...

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges ... FORM 8824 WORKSHEET Worksheet 2 Tax Deferred Exchanges Under IRC § 1031 ANALYSIS OF CASH BOOT RECEIVED OR PAID Sale of Exchange Property Sale price, Exchange Property $ 13 Less debt relief (Line 25 below) ( ) 14 Less exchange expenses paid (worksheet 3) ( ) 15 Total cash received (line 13 minus lines 14 & 15) 16 Purchase of Replacement Property

XLS Welcome - Hutchins, Canning & Company | CPA Services for ... 1031 Worksheet 5 GAIN OR LOSS REALIZED (Line 7 less line 13 Date of Sale of Property Traded Date of Settlement of New Property Received Description of New Property Received Description of Old Property Traded Date New Property to be Received was Identified Fair Market Value of the new property received List any cash you received in the ...

PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday §1031 BASIS ALLOCATION WORKSHEET 100% DATE: _____________, 20______, at _____________________________________________________, California. Items left blank or un checked are not ap pli ca ble. Ref er ences to forms in cludes their equiv a lent.

1031 Exchange Calculator - The 1031 ... - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

Exchanges Under Code Section 1031 - American Bar Association A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings. Section 1031 provides that "No gain or loss shall be recognized if property held for use in a trade or business or for investment is exchanged solely for property of like kind." The first provision of a federal tax code permitting non-recognition ...

1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value.

IRS 1031 Exchange Worksheet And Section 1031 Exchange ... IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet can be beneficial inspiration for those who seek a picture according specific categories, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all. Thank you. Download by size: Handphone Tablet Desktop (Original Size)

1031 Tax Exchange Rules: What You Need to Know A 1031 exchange is a swap of properties that are held for business or investment purposes. The properties being exchanged must be considered like-kind in the eyes of the Internal Revenue Service...

1031 Exchange with Multiple Properties [Explained A-to-Z ... You'll need to deliver the specific addresses of these properties to your 1031 Exchange Accommodator (Qualified Intermediary or QI) with the 45-day Identification Period. Holidays and weekends count so there's no next workday grace period. Finally within the 180-day deadline, closing must be completed on replacement (s).

A 1033 Exchange Both Section 1031 and Section 1033 of the Internal Revenue Code provide for the nonrecognition of gain when property is exchanged for qualifying replacement property. While similar in purpose, there are distinct rules separating the two which must be followed closely in order to complete a valid, fully tax-deferred exchange.

Excel 1031 Property Exchange - Business Spreadsheets 1031 Property Exchange for Excel is designed for investors, real estate brokers and facilitators allowing to: Balance equities. Evaluate boot given and received. Estimate the realized and recognized gains to calculate the transfer basis. Automatically create sample worksheets of IRS Form 8824. Perform "What if" analysis by changing the input ...

0 Response to "42 sec 1031 exchange worksheet"

Post a Comment