38 same day tax payment worksheet

Can I make my Federal payroll tax payments the day they're ... If you are making tax deposits using electronic funds transfer (EFT) using the Electronic Federal Tax Payment System (EFTPS), then you must submit your payments by 8 PM Eastern time the day before the deposit due date.. If your bank, however, offers same-day wire transfers for federal tax payments, then you may be able to make your deposit on the due date. fill.io › Same--Day-Taxpayer-WorksheetFill - Free fillable Same- Day Taxpayer Worksheet PDF form Same- Day Taxpayer Worksheet . On average this form takes 3 minutes to complete. The Same- Day Taxpayer Worksheet form is 2 pages long and contains: 0 signatures; 0 check-boxes; 11 other fields

PDF Electronic Federal Tax Payment System. Financial ... Same-Day Taxpayer Worksheet PAGE CUSTOMER-INITIATED PAYMENTS The Electronic Federal T ax Payment System (EFTPS) provides convenient, free ACH Debit ser vices 24/7, 365 days a year Your customers can schedule their own payments via EFTPS.gov or with the EFTPS voice response system if they have enrolled.

Same day tax payment worksheet

PDF Same-day Taxpayer Worksheet SAME-DAY TAXPAYER WORKSHEET EL Mandatory fields below are BOLD. Wires received after 5:00 p.m. ET will be rejected and returned to the financial institution. FTA does not warehouse payments for the next business day. r/tax - EFTPS payment today 4/18 or is it too late? Some ... A same-day wire instructions worksheet is available at Help & Information>Downloads. While the instructions are available here, you must contact a financial institution to make such payments. Other options may be available to very small businesses, typically those who pay less than $10,000 annually in federal taxes. Session Expired - Electronic Federal Tax Payment System Electronic Federal Tax Payment System® and EFTPS® are registered servicemarks of the U.S. Department of the Treasury's Bureau of the Fiscal Service.

Same day tax payment worksheet. EFTPS-Direct Payment Worksheet (long form) with the 720 tax payment amount entered in step #10.) You enter: $ , , . (IRS Number amount) AND "Press 2 To return to the Enter an IRS Number prompt" OR "Press the pound key (#) if there are no more IRS Numbers to report." For Tax Form CT-1 Payment: For Tax Form CT-1, you are requested to report the subcategories and amounts and the PDF Department of Taxation and Finance Instructions for Form ... Use the Amended estimated tax worksheet on page 12 of these instructions to amend your original estimate. If you are required to ... the same as shown above, the payment amounts will vary based on your income, net earnings from self-employment, deductions, additional ... Automatic 90-day extension for certain taxpayers ... Federal Tax Collection - Resources The Federal Tax-Wire Assistant is designed to assist taxpayers and financial institutions with the proper formatting of same day IRS tax Fedwires. The use of this spreadsheet is OPTIONAL. Taxpayers are not required to use this tool. Before opening the Federal Tax-Wire Assistant, close all other Excel spreadsheets. 10 Ways to Pay Your Taxes This Year | My Money | US News Making a tax payment by wire transfer requires you to fill out a same-day taxpayer worksheet and give it to the financial institution you use for the transfer. 4. Check or money order.

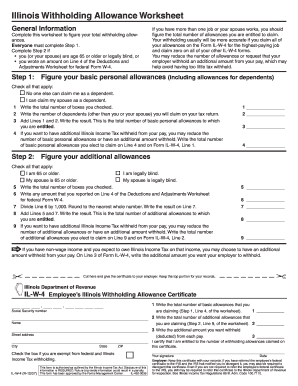

Same Day Wire Federal Tax Payments | Internal Revenue Service Download the Same-Day Taxpayer Worksheet. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook for help with formatting and processing information. Electronic Same-Day Federal Tax Payment To make a same-day federal tax payment you need to fill out the Same Day Payment Worksheet and present it to your bank. Electronic Same-Day Worksheet Things to know: Must schedule your payment before 5 p.m. ET otherwise your payment will be rejected. Errors in the worksheet will be cause for your payment to be rejected. Same Day Taxpayer Worksheet Form - Fill Out and Sign ... Follow the step-by-step instructions below to design your same day taxpayer worksheet common IRS tax type sirs: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Same-Day Taxpayer Worksheet - EFTPS SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business name)* 4 Taxpayer name: 5 Tax type:

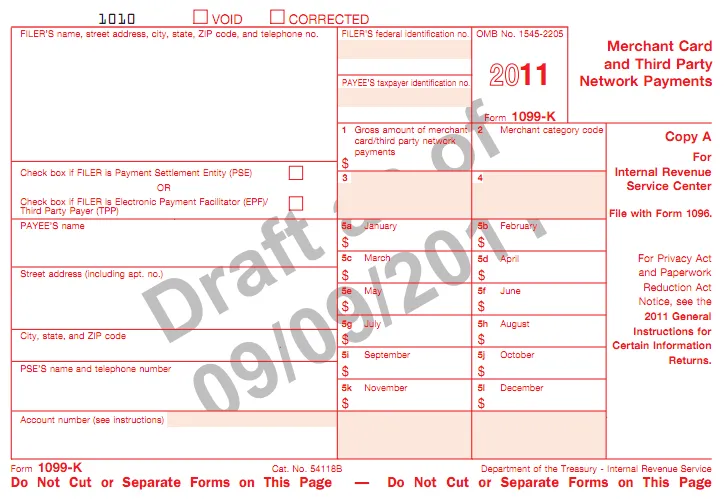

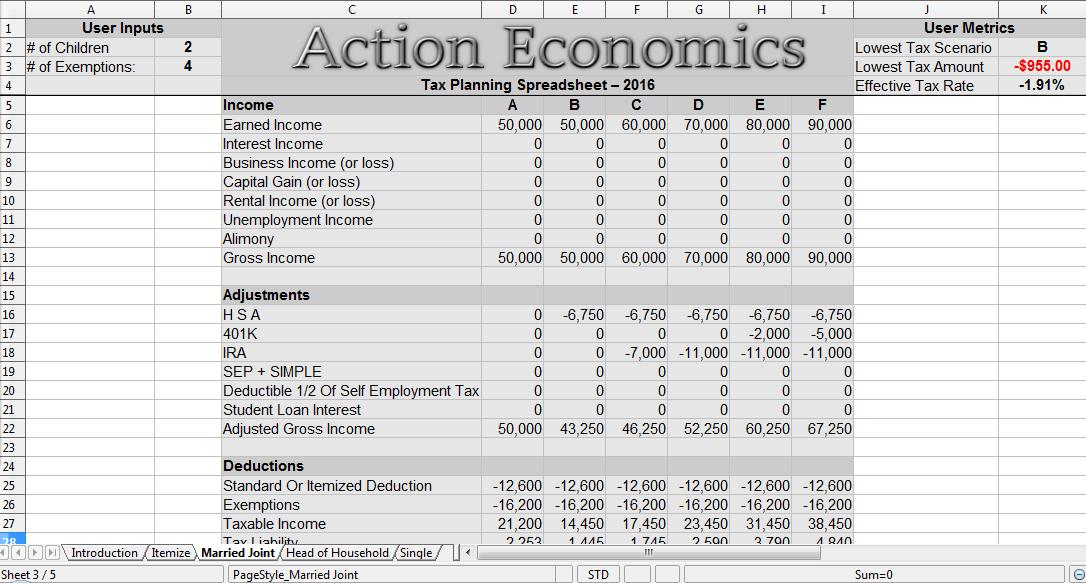

FREE Home Office Deduction Worksheet (Excel) For Taxes Users typically save $5,600 from their tax bill by using our app. Try a 14-day free trial today. ... If you pay $100 in real estate taxes and use 10% of your home for business purposes then your home office deduction in relation to your real estate taxes is $10 (10% of $100). ... At the same time, taking a look at the worksheet may help you ... IRS Payment Options: How to Pay Taxes - NerdWallet 5. Make an IRS payment with a debit card. How it works: You go to the website of one of the IRS's three independent payment processors, then provide the payment amount, your card information and ... What do I put on the Same-Day Taxpayer Worksheet u... What do I put on the Same-Day Taxpayer Worksheet under tax/month quarter for a 1040X. My preparer told me to use 10 and I did but now I'm thinking it may have. Browse ... but are you trying to make a direct payment on the IRS site for a 2019 form 1040X balance due ? 0 4 711 Reply. intertax. Returning Member October 16, 2020 1:14 ... Solved: Re: Tax Payments Worksheet: Line 15-Date filed has... Scroll down to the Tax Pymt Wks form and click on it. In my case, Line 15 was auto-filled with the date 04/15/2020, which was a date that had already had passed. Under the Edit pull-down menu of Turbotax, click on Override, which will allow you to change this date.

phd-tax.com › 12 › SameDayPaymentWorksheet-20111SAME-DAY TAXPAYER WORKSHEET - PHD Tax SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your inancial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identiication number: 3 Taxpayer name control: (the irst four letters of your business name)* 4 Taxpayer name: 5 Tax type:

Welcome To Eftps Online - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to eSign your eftps direct payment worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

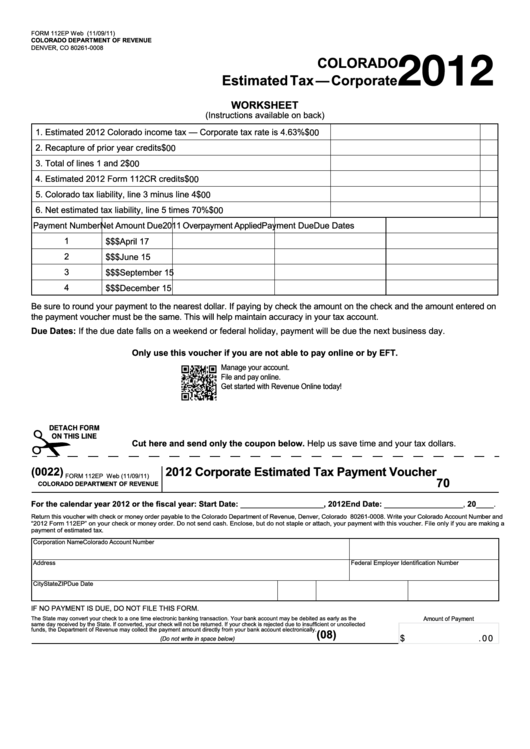

PDF FAE - Estimated Tax Payments Worksheet When to Make Payments: Quarterly payments of the estimated franchise and excise taxes are to be made as follows: Payment Due Date 1st Payment The 15th day of the 4th month of the current taxable year 2nd Payment The 15th day of the 6th month of the current taxable year 3rd Payment The 15th day of the 9th month of the current taxable year

EFTPS-Direct Payments Short Form - Fill and Sign Printable ... EFTPS-Direct Payments Worksheet Short Form Photocopy this 941 tax payment worksheet for future use. Phone Number 1-800-555-3453 Employer ID PIN Date of call / / Time of call a.m./p.m. To initiate a tax payment Press 1 Enter 3-to 6-digit tax form For Federal Tax Payment Press 1 Use this short form when you are comfortable with the voice response ...

PDF Payment Instruction Booklet - IRS tax forms 1 Gather your information, including your EIN (for business) or SSN (for individual), PIN, and tax form number. 2 Call the EFTPS Tax Payment toll-free number (available 24 hours a day, 7 days a week): 1.800.555.3453

2022 Estimated Tax Payments Deadlines, Worksheet, & Overview September 15, 2022. 4. September 1 - December 31. January 17, 2023. As with your 1040 tax return, the tax deadline is really the date that your mail to the IRS must be postmarked or paid if you are using a non-check method. If a deadline falls on a holiday or weekend, it is pushed to the next business day.

SAME-DAY TAXPAYER WORKSHEET COMMON IRS TAX ... SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identification number:

IRS Wire Transfer Instructions | Sapling The IRS asks that you fill out the Same-Day Taxpayer Worksheet and bring it to your financial institution to assist in making the transfer. You'll document your total tax payment, your taxpayer identification number, the first four letters of your business name -- if applicable -- and your name or the full business name.

TEXNET and Electronic Payment of Taxes and Fees If payments for a tax category total $10,000 or more in subsequent years, payments must continue to be made electronically. Some taxpayers may have to pay electronically for several tax types. For example, if a company pays $10,000 for both sales and use tax and franchise Tax, both taxes must be paid electronically. ... Same day settlement of ...

Hmmm…..Why Hasn't the IRS Cashed My Check Yet??? - The Tax ... To make a payment, download and complete the 'Same-Day Payment Worksheet' here (it downloads as a PDF) to take with you to make the wire. Some of you may ask, what about making international wire transfers? Well, since you asked. To start with, U.S. taxpayers who reside in the United States must of course pay their taxes in U.S. dollars.

PDF Combd PIB 2.08 Final 4PDF - e-Form RS Businesses can schedule payments up to 120 days in advance of the tax due date(s). Individuals can schedule payments up to 365 days in advance of the tax due date(s). EFTPS will schedule your tax payment instructions and your account will be debited on the tax due date(s) you indicate. You may cancel scheduled tax payment instructions up until ...

› payments › same-day-wire-federal-taxSame-Day Wire Federal Tax Payments | Internal Revenue Service Jan 12, 2022 · Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information.

Welcome to EFTPS online After this process is complete you will receive a personal identification number (PIN) via U.S. Mail in five to seven business days at your IRS address of record. Payments using this Web site or our voice response system must be scheduled by 8 p.m. ET the day before the due date to be received timely by the IRS.

Session Expired - Electronic Federal Tax Payment System Electronic Federal Tax Payment System® and EFTPS® are registered servicemarks of the U.S. Department of the Treasury's Bureau of the Fiscal Service.

0 Response to "38 same day tax payment worksheet"

Post a Comment