38 seller closing cost worksheet

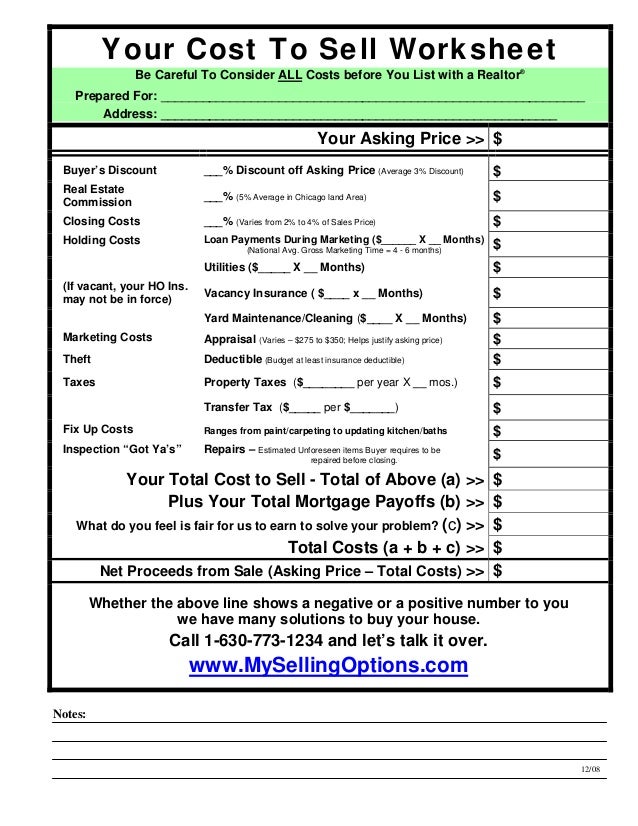

How to calculate cost per unit - AccountingTools The cost per unit is: ($30,000 Fixed costs + $50,000 variable costs) ÷ 10,000 units = $8 cost per unit. In the following month, ABC produces 5,000 units at a variable cost of $25,000 and the same fixed cost of $30,000. The cost per unit is: ($30,000 Fixed costs + $25,000 variable costs) ÷ 5,000 units = $11/unit. May 10, 2022 / Steven Bragg /. Sell | Real Estate News & Insights | realtor.com® The home was purchased for $450,000 in 2016, redesigned, and sold over the asking price of $850,000 in January 2022. May 5, 2022.

Finastra | Financial Software Solutions & Systems Banking software solutions for an open financial future. Finastra's universal banking cloud-enabled software solutions offer next-generation technology for retail banks, commercial banks, universal banks, Islamic banks, community banks and credit unions. We help you to deliver the ultimate personalized customer experience, thanks to deep data ...

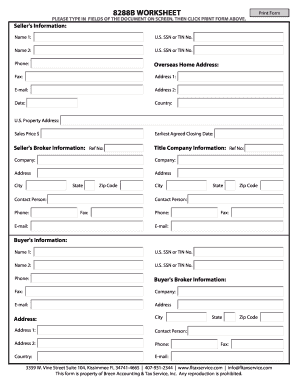

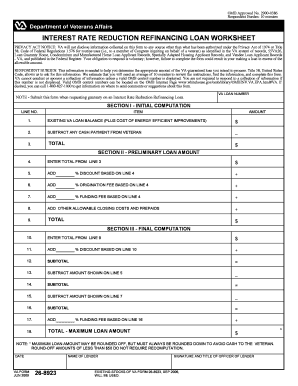

Seller closing cost worksheet

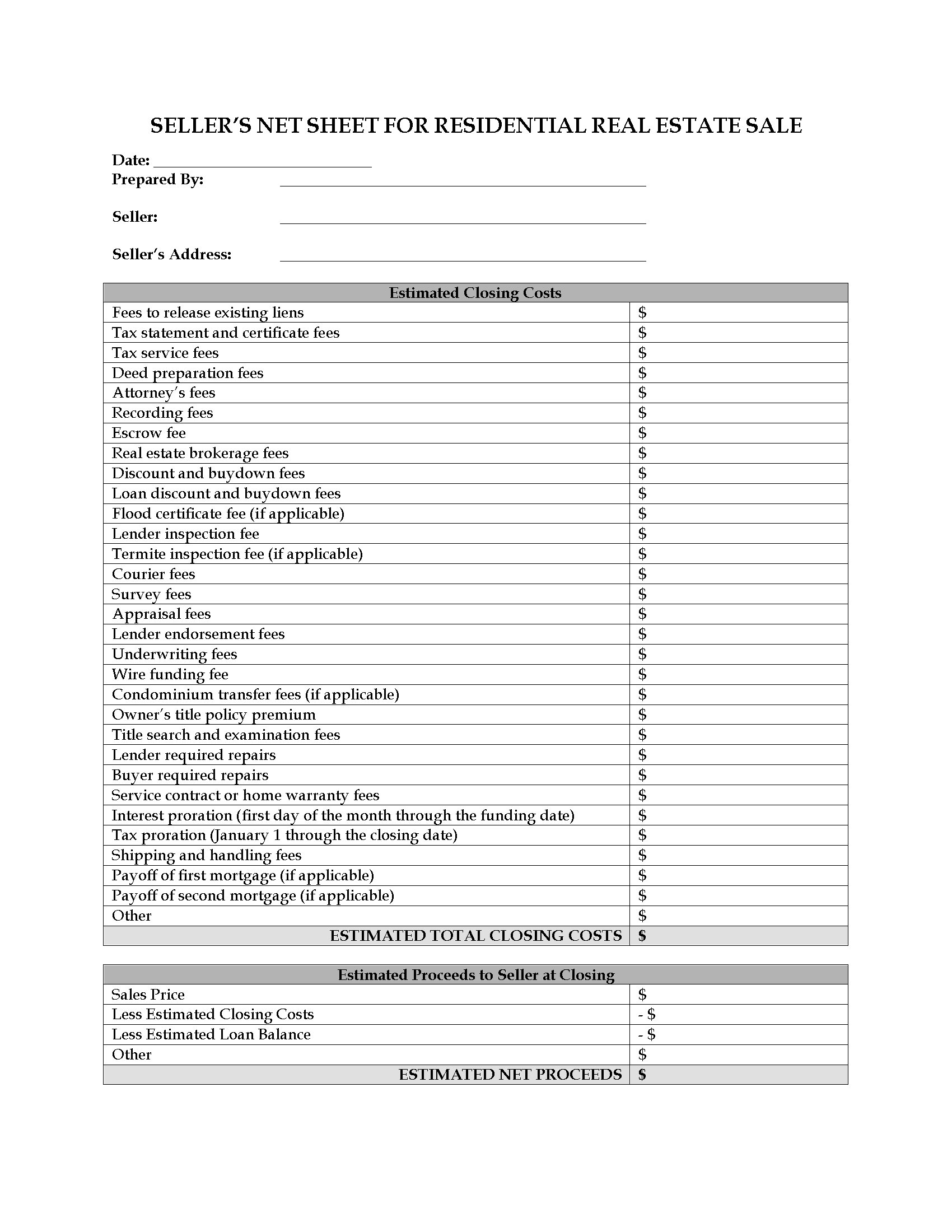

anytimeestimate.com › home-seller-costs › floridaFlorida Seller Closing Costs & Net Proceeds Calculator Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if applicable. DOR Real Estate Transfer Fee 1710. DOR posts on website final Statement of Taxes (SOT) from prior year. 2% fire dues normally paid to towns, village and cities end of May through August 1. 2% fire dues normally paid to towns, village and cities end of May through August 1. 5/27/2022 12:00 AM. themortgagereports.com › 37827 › earnest-money-checkEarnest money check, down payment and closing costs: When are ... Feb 28, 2019 · “A buyer can negotiate the seller to pay some or all of these costs,” adds Ailion. Related: Complete guide to mortgage closing costs. Closing costs are due when you sign your final loan documents.

Seller closing cost worksheet. › mortgage › closing-costsClosing Costs Calculator - Estimate Closing Costs at Bank of ... The cost of a loan to the borrower, expressed as a percentage of the loan amount and paid over a specific period of time. Unlike an interest rate, the APR factors in charges or fees (such as mortgage insurance, most closing costs, discount points and loan origination fees) to reflect the total cost of the loan. Our free bridge loan calculator can help you plan your best mortgage. BRIDGE LOAN REQUIRED. Closing Date - Purchased Property: 23-Apr-2022. Closing Date - Sold Property : 24-Apr-2022. Bridge Period: 2 days. Down Payment: Closing Costs: Prop. 19 Explained: Who's Winning, Losing or Just Plain ... - Abio With the first provisions of Prop. 19 due to take effect on Feb. 16, property owners need to know how the complex legislation impacts everyone from elderly and disabled homeowners to fire victims and first-time home buyers. Depending on who you are and what kind of property you own, Prop. 19 might save you a lot of money on your next move. › IRS-Forms › 2002Worksheet 1. Adjusted Basis of Home Sold 4 Worksheets Taxable ... Deduction Worksheet for Self-Employed..... 10 Publication 571 Worksheet 1. Maximum Amount Contributable (MAC)..... 11 Worksheet A. Cost of Incidental Life Insurance ..... 12 Worksheet B. Includible Compensation for Your Most Recent Year of Service..... 12 Worksheet C. Limit on Catch-Up

DORA HOME | Department of Regulatory Agencies The Department of Regulatory Agencies (DORA) is the state's umbrella regulatory agency, charged with managing licensing and registration for multiple professions and businesses, implementing balanced regulation for Colorado industries, and protecting consumers. Our ten divisions and over 600 employees are dedicated to preserving the integrity of the marketplace and promoting a fair and ... Fannie Mae Servicing It includes the following subparts: Contractual Obligations, Getting Started with Fannie Mae, Maintaining Fannie Mae Seller/Servicer Status, Setting Up Servicer Operations. Escrow, Taxes, Assessments, and Insurance. This part describes how to administer an escrow account to manage taxes, assessments, and insurance requirements. Current Rates - Alaska Housing Finance Corporation 6.625. 6.500. Balloon Loan 5. Up to $500,000. 6.750. 6.625. 4 Rural interest rate applies only to the initial $250,000 of the mortgage loan. Remaining loan balances are at the Taxable interest rate. 5 Balloon programs feature fixed terms of 7 or 10 years with 30-year amortizations. Will Your Home Sale Leave You With Tax Shock? - Investopedia The seller purchased the replacement within two years before or two years after the date of the sale. 1. For instance, suppose you had bought a home for $200,000 and sold it five years later for ...

Mortgage Origination Fee: The Inside Scoop | Rocket Mortgage Furthermore, lender origination fees are usually anywhere between 0.5% and 1% of the loan amount plus any mortgage points associated with your interest rate. To put an actual number to that, let's say a borrower has a $300,000 mortgage approval. The origination fee would be anywhere from $1,500 - $3,000. The difference between the periodic and perpetual ... - AccountingTools Cost of goods sold. Under the perpetual system, there are continual updates to the cost of goods sold account as each sale is made. Conversely, under the periodic inventory system, the cost of goods sold is calculated in a lump sum at the end of the accounting period, by adding total purchases to the beginning inventory and subtracting ending ... Home Page - New York State Bar Association By visiting this website, you agree and consent to the Website Terms of Use and NYSBA Privacy Policy. This website uses cookies to improve your experience. How to Invest in Real Estate | The Motley Fool Let's say you manage to buy a house for $250,000 with 20% down, or $50,000. You do another $50,000 of renovations and then list the house for $400,000. You use the $400,000 to pay off the ...

Housing Handbooks | HUD.gov / U.S. Department of Housing and Urban ... Handbook update published on October 26, 2021, and effective January 24, 2022. Handbook update published on July 20, 2021, and effective September 20, 2021. Handbook update published on April 19, 2021, and effective August 17, 2021, and March 31, 2022. Refer to ML 2021-14 for details on effective dates.

First Time Homeowner? Use these Steps to Prepare Your Finances Take the first step and call. CALL (888) 995-4673. Long before you get to sign on the dotted line — even before you start going to open houses — there are steps you can take to prepare. The process can seem daunting as a home buyer, but it is easier than you might think.

Lenders Real Estate Agents & Nonprofits | California Housing Finance Agency Loan Scenario Calculator The Single Family Division provides low interest rate home financing to low to moderate income homebuyers in California, as well as down payment and closing cost assistance. This section includes program descriptions, loan forms, interest rates, income and sales price limits and more. In addition to the information organized in the above tabs, we've also provided a ...

› seller-closing-costsClosing Costs For Seller | Closing Cost Calculator | Houzeo Get a quick, accurate estimate by using Houzeo’s closing cost calculator which allows you to estimate your seller closing costs in a few clicks! We use local tax and fee data to find your savings.

Realtor Magazine | Real Estate Tips, Trends, Data & More Realtor Magazine. Digital infrastructure and varied transportation are among factors needed to transform communities into energy-efficient, sustainable smart cities. Spring showers might cause flooding in basements, crawl spaces, and weakened foundations. Here's how to help homeowners prep. Work is underway on multiple fronts to quash bias in ...

› learn › cash-to-closeCash To Close: Breaking It Down | Rocket Mortgage Jul 06, 2020 · On the other hand, the cash to close is the total amount – including closing costs – that you’ll need to bring to your closing to complete your real estate purchase. Closing Costs. The specific closing costs you pay depend on your loan type, state, down payment and how much you borrow. A few common fees you might pay are listed below.

Returns inwards and returns outwards - AccountingTools What are Returns Inwards and Returns Outwards? Returns inwards are goods returned to the selling entity by the customer, such as for warranty claims or outright returns of goods for a credit. For the customer, this results in the following accounting transaction: A debit (reduction) of accounts payable. A credit (reduction) of purchased inventory.

NJ Division of Taxation - Sales and Use Tax Forms - State Worksheets for ST-50 (or amended ST-50) Online Filing - 3rd Quarter 2006 ONLY. Sales and Use Tax-ST-50/51: Instructions for Filing (or Amending) ST-50/51 by phone. ... Resale Certificate for Non-New Jersey Sellers: Sales and Use Tax: 2017 Mar: ST-10: Motor Vehicle Sales and Use Tax Exemption Report: Sales and Use Tax: 2006 June: ST-10-A:

› article › mortgagesStrategies for Lowering Your Closing Costs - NerdWallet The bill for closing costs is the final hurdle between home buyers and their new homes, and it can represent a surprising chunk of money. Closing fees run between 3% and 6% of the mortgage; that's ...

themortgagereports.com › 37827 › earnest-money-checkEarnest money check, down payment and closing costs: When are ... Feb 28, 2019 · “A buyer can negotiate the seller to pay some or all of these costs,” adds Ailion. Related: Complete guide to mortgage closing costs. Closing costs are due when you sign your final loan documents.

DOR Real Estate Transfer Fee 1710. DOR posts on website final Statement of Taxes (SOT) from prior year. 2% fire dues normally paid to towns, village and cities end of May through August 1. 2% fire dues normally paid to towns, village and cities end of May through August 1. 5/27/2022 12:00 AM.

anytimeestimate.com › home-seller-costs › floridaFlorida Seller Closing Costs & Net Proceeds Calculator Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if applicable.

0 Response to "38 seller closing cost worksheet"

Post a Comment