44 seller closing costs worksheet

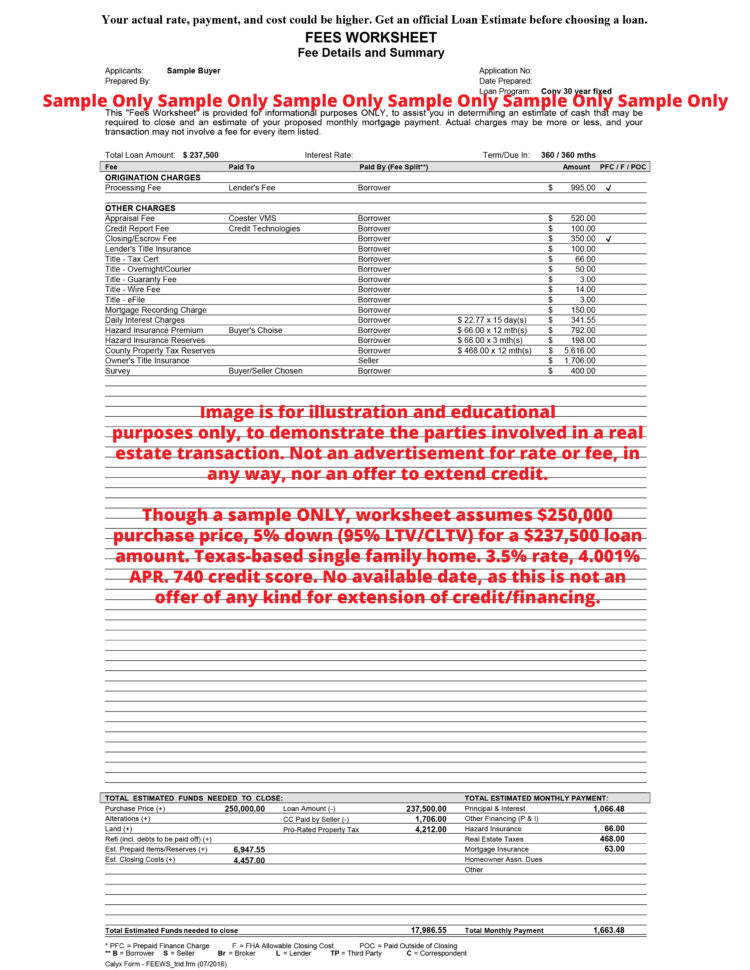

XLS Free Closing Cost Calculator - Freedom Mentor Seller Instruction - If this real estate was your principal residence, file form 2119, Sale or Exchange of Principal Residence, for any gain, with your income tax return; for other trasnsations, complete the applicable parts of form 4797, Form 6252 and/or Schedule D (Form 1040) ... Free Closing Cost Calculator Subject: Closing Costs Author ... PDF Closing Cost Estimation Worksheet - 🏡 Blue Water Mortgage TOTAL CLOSING COSTS OTHER COSTS CLOSING COSTS (approximately $150 - $400) (NH - .75% of Purchase Price, ME - .22% of Purchase Price, MA - N/A) (approximately .5% to 1% of the Loan) This "Fees Worksheet" is provided for informational purposes only, to assist you in determining an estimate of cash that may be required

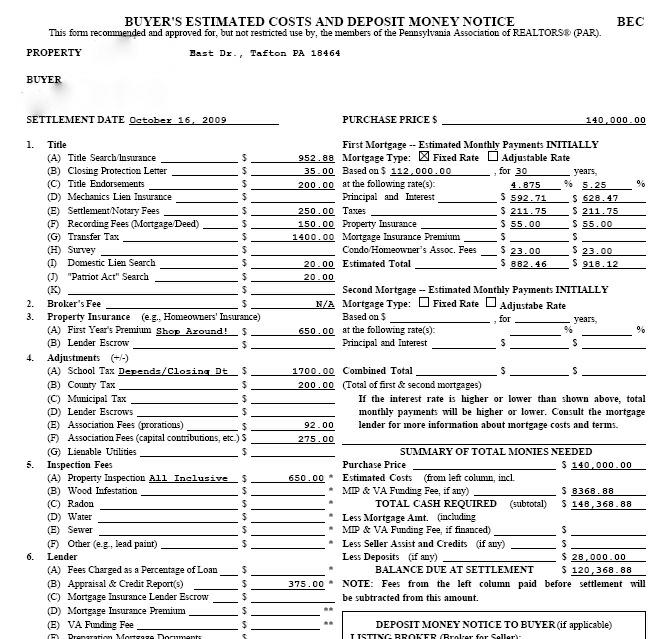

Worksheet: Track Closing Costs | Realtor Magazine BUYER COST. SELLER COST. OTHER. Down payment . Loan origination . Points paid to receive a lower interest rate . Home inspection . Appraisal . Credit report . Mortgage insurance premium . Escrow for homeowner's insurance . Property tax escrow (if paid as part of the mortgage*) Deed recording . Title insurance policy premiums . Land survey

Seller closing costs worksheet

Capital Gains Calculator - HomeGain Purchase Price $ Improvements: $ Claimed depreciation related to the business use or rental of your home: Capital Gains rolled over into your current residence: Settlement fees and closing costs (paid on purchase of original home): Sale Price $ Selling Expenses $ Federal Tax Bracket What Paperwork Is Needed to Sell a House Without a Realtor? Sep 15, 2021 · A seller’s net sheet is an organizational worksheet that will show you how much you’ll pocket from your home sale after factoring in expenses like taxes, your real estate agent’s commission (if you work with one), your remaining mortgage, and escrow fees. Typically, a home’s listing agent prepares the seller’s net sheet. Seller Closing Costs in Texas | Closing Cost Calculator | Houzeo Seller pays 8%-10% of the purchase price as closing costs in Texas. Out of this percentage, a major chunk goes to agent commissions (up to 6% of the home sale price). As the seller pays agent commissions for both parties, he has to pay more as average closing costs in Texas. The rest 2%-4% is for taxes and fees.

Seller closing costs worksheet. Multiple Offer Worksheet in Excel for Realtors [DOWNLOAD] Dec 06, 2021 · But when done right, it can be a win-win for buyer and seller. Example. Here are 3 offers. $300,000, $1000 escalation with a max $330,000. Total seller concessions are $16,850 including commissions. $320,000, no escalation clause. Total seller concessions of $10,850 including commissions. $315,000, $1000 escalation with a max $325,000. Closing Costs For Seller | Closing Cost Calculator | Houzeo If you want to know a ballpark figure of how much are the closing costs for a seller then on average, closing costs for a seller comes out to roughly 8%-10% of the property's sale price. So, if you calculate as per median U.S. home value of $276,717 (as of March 2021) then it translates to around $22,137-$27,671. › seller-orientation › sellerSELLERS ESTIMATED COSTS OF SALE WORKSHEET (P1) Inspections and obligations. Presenting your home to buyers. Showing your home. Completing the sale. Seller responsibilities. Seller estimated "Costs of Sale" worksheet (page 1) Seller estimated "Costs of Sale" worksheet (page 2) Parent's checklist. Information herein believed to be accurate but not warranted. Publication 530 (2021), Tax Information for Homeowners See Settlement or closing costs under Cost as Basis, later, for more information. Forfeited deposits, down payments, or earnest money. ... The funds you provided at or before closing, plus any points the seller paid, were at least as much as the points charged. ... (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to ...

Closing Costs For Seller | Closing Cost Calculator | Houzeo Get a quick, accurate estimate by using Houzeo’s closing cost calculator which allows you to estimate your seller closing costs in a few clicks! We use local tax and fee data to find your savings. Reviews; Buy . Homes For Sale; For Sale By Owner Homes; Sell . Flat Fee MLS ... Closing Costs Worksheet. Detailed breakdown of your costs. browardresidential.com › seller-closing-costsFlorida Seller Closing Cost Worksheet - BrowardResidential.com May 02, 2019 · What are the typical closing costs for home sellers in Florida? Here’s a list of the customary closing costs paid by Sellers in Florida real estate transactions. 1. Real Estate Commissions: 3% to the Listing Agent and 3% to the Buyer’s Agent or Selling Agent. Sometimes the listing agent is the same as the buyer’s agent. PDF Home Buyer's Closing Cost Worksheet - Allstate Cost range is $40 - 60. $ Important: You can use this worksheet to get a rough cost estimate of the typical closing, but please consult an attorney for a comprehensive estimate designed specifically for your situation. Keep in mind that some of the closing costs may be paid to either the seller or added to your mortgage. TOTAL: $ Disclaimer How Much Are Closing Costs for Sellers? | Zillow The average closing costs for a seller total roughly 8% to 10% of the sale price of the home, or about $19,000-$24,000, based on the median U.S. home value of $244,000 as of December 2019. Seller closing costs are made up of several expenses. Here's a quick breakdown of potential costs and fees: Agent commission. Transfer tax.

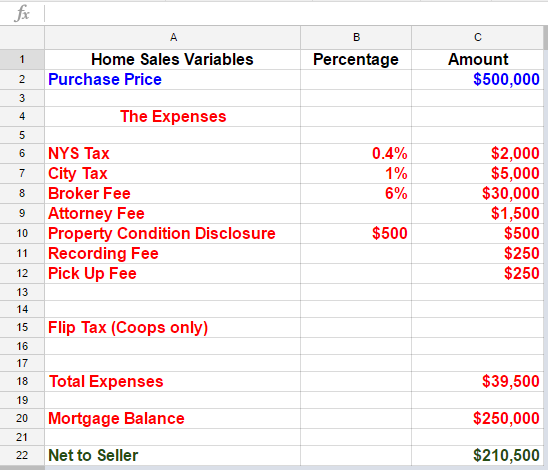

› calcs › net-sellerSeller Closing Cost Calculator Seller Closing Cost Calculator. The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. Simply enter your sales price, mortgage information & closing date and we'll estimate your totals. The actual fees, expenses & outstanding loan balance will depend on the actual closing date & other related factors. Free Seller Net Sheet - Network Closing 1-866-294-4100. to have your Title Insurance and Real Estate questions answered. The Seller Net Sheet provides you the ability to estimate a seller's net amount after closing at a specified price. This calculator takes into consideration closing cost estimates and commissions, but does not account for the payoff of a prior mortgage. Seller's Estimated Proceeds Worksheet - NYSAR Seller's Estimated Proceeds Sale Price of Property (Estimated) Less Mortgage Balance (Estimated) Less Other Encumbrances Total Projected Gross Equity Less Estimated Selling/Closing Costs Escrow Charges Document Preparation Title Charges Transfer Tax FHA, VA or Lender Discount Mortgage Pre-Payment Penalty Real Estate Taxes Appraisal Survey Termite Inspection Corrective Work Home Protection ... Closing Costs for Seller: FAQ & Calculator - Sundae Here's a worksheet breaking down some common seller closing costs and how to calculate their average costs: Cost. Average Fee. Agent commissions. Up to 6% of home sale (3% for each real estate agent) Transfer tax. $50-$5,000 (varies widely by state) Escrow fees. $500-$5,000 (split 50-50 between buyer and seller)

Closing Costs for Sellers: 5 Common Fees - Realtor.com One of the larger closing costs for sellers at settlement is the commission for the real estate agents involved in the real estate transaction. Commissions on real estate are negotiable and vary...

Florida Seller Closing Costs & Net Proceeds Calculator Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if …

PDF CLOSING COST WORKSHEET - New American Funding Use this worksheet to help estimate the extra fees. ... The tax is fixed to the house's price and is paid by the seller in some states. RECORDING FEES Fees paid to the local government to record the purchase transaction, ranges from $80 - $150. TOTAL: CLOSING COST WORKSHEET For a complete list of our state licenses, visit: www ...

Closing Cost Calculator for Sellers | Home Sale Proceeds How much are seller closing costs? Seller closing costs can range from 8% to 10% of the home selling price. On a $500,000 home, this can be between $40,000 and $50,000 in closing costs. Although this is a lot, there are several categories of expenses that can change based on location, negotiation, and specific situations.

Sellers Net Sheet Calculator - TitleSmart, Inc. Closing Fee ($275-$325) Broker Administration Fee Recording Fees ($75 - $150) State Deed Tax Seller Paid Closing Costs for Buyer County Conservation Fee Home Warranty Courier Fees/Payoff Processing ($30 per payoff) Work Orders Association Dues owing at closing Association Disclosure/Dues Letter Misc. Costs to Seller Miscellaneous Expenses 1

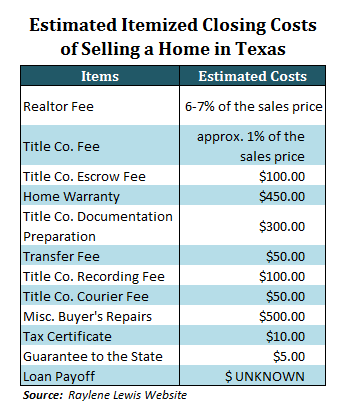

Seller's Net Sheet & Seller's Costs - MortgageMark.com The seller's closing costs will be provided by the title company. The seller's fees in Texas typically consist of: settlement closing fee for $300 (ish), document prep fee for $250 (ish), courier fee estimated at $40 (ish), tax cert for $38 (ish), recording fee for $40 (ish), and a state guarantee fee for a whopping $2.

First-Time Seller Tips: Understanding Closing Costs - Understanding closing costs and who is ...

The Beginner’s Guide to Buying Rental Properties (A Case Study) First Contact with the Seller. ... (taking the purchase price of $27,500 + closing costs of $1,375 + deferred maintenance of $2,500 = $31,375 cash required to close). ... let’s go back to the worksheet and change our financing strategy to buy this property with a mortgage.

PDF SELLER WORKSHEET - Sun Title This is an ESTIMATED WORKSHEET and is intended to approximate the net proceeds due to, or due from, the seller. The closing date, other debts payable in connection with the transaction, daily interest charges, actual mortgage pay-off amounts and other closing costs can substantially impact the amounts set forth above.

PDF SELLER CLOSING COSTS WORK SHEET - greatlakesny.com Title: Microsoft Word - SELLER CLOSING COSTS WORK SHEET.docx Author: Paulk Created Date: 3/29/2010 12:14:03 PM

Sellers Net Sheet Calculator - Independence Title Sellers Net Sheet Calculator. This tool is intended to help property owners with a reasonable estimate of closing costs and net proceeds from the sale of their property. For a more detailed estimate specific to your transaction, please contact your Independence Title Escrow Officer. Please complete all of the fields and press calculate.

Seller Closing Costs in Texas | Closing Cost Calculator | Houzeo Seller pays 8%-10% of the purchase price as closing costs in Texas. Out of this percentage, a major chunk goes to agent commissions (up to 6% of the home sale price). As the seller pays agent commissions for both parties, he has to pay more as average closing costs in Texas. The rest 2%-4% is for taxes and fees.

What Paperwork Is Needed to Sell a House Without a Realtor? Sep 15, 2021 · A seller’s net sheet is an organizational worksheet that will show you how much you’ll pocket from your home sale after factoring in expenses like taxes, your real estate agent’s commission (if you work with one), your remaining mortgage, and escrow fees. Typically, a home’s listing agent prepares the seller’s net sheet.

Capital Gains Calculator - HomeGain Purchase Price $ Improvements: $ Claimed depreciation related to the business use or rental of your home: Capital Gains rolled over into your current residence: Settlement fees and closing costs (paid on purchase of original home): Sale Price $ Selling Expenses $ Federal Tax Bracket

0 Response to "44 seller closing costs worksheet"

Post a Comment